Three reasons we continue to like Woolworths

In recent months, The Montgomery Fund has accumulated a significant position in Woolworths – it’s now one our largest positions. And we remain positive on the outlook for the company over the medium term, even after the recent rally in its share price.

Our original investment thesis was predicated on the following:

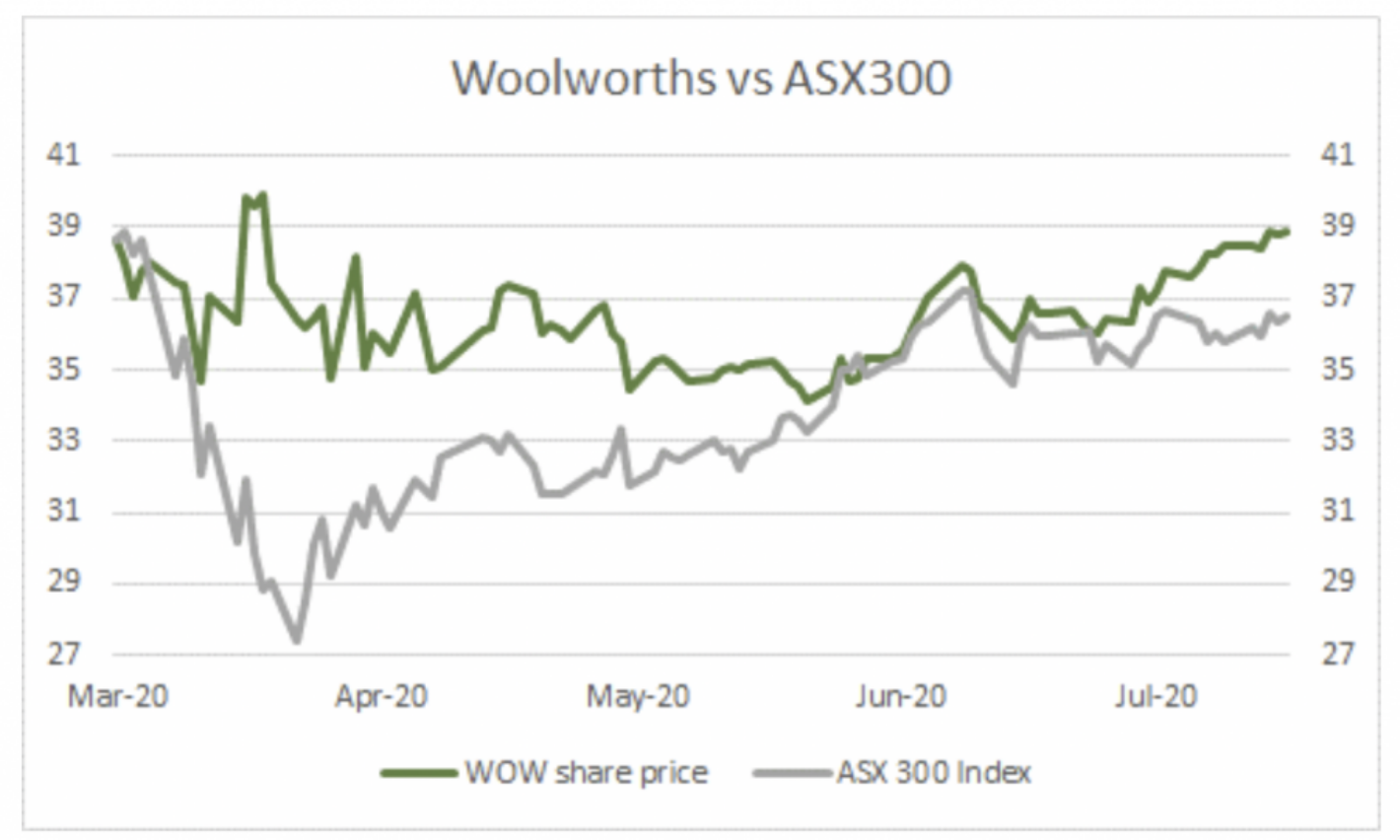

The share price had come under pressure due to rotation into re-opening trade and disclosure of COVID-related costs.

Over March, the Woolworths share price was very resilient to the sell-off seen in other parts of the market as investors flocked to the relative safety of supermarkets amidst scenes of panic buying and hoarding in a world of uncertainty.

However, as the market recovery took hold over April and May, the shares underperformed significantly as the price fell around 15 per cent even as the broader market rallied by more than 15 per cent over the same time frame as investors chased the “reopening trade.”

Source: Bloomberg

During this time, the stock was further penalised due to the disclosure of significant COVID-19 related costs, which eroded any positive earnings leverage from the spike up in sales.

Potential beneficiary of re-rotation trade

While the investment market largely shrugged off the implications of a second wave over these months, we felt the Woolworths share price had reached a level where the stock was attractive – both in terms of its defensive but growing yield, but also relative to the broader market.

There was the additional potential tailwind of being the beneficiary of a rotation trade back into defensive consumer staples businesses should rolling lock-downs recommence (impacting both market sentiment and supporting WOW’s earnings), or any uncertainty in the shape of the economic recovery – especially in terms of the uncertain outlook for corporate profitability.

Looking ahead, we remain positive on the outlook for Woolworths for three reasons:

1). Defensive but growing yield

Woolworths has a defensive but growing yield as the business is leveraged to population growth, while also being a beneficiary of any food inflation should this materialise as a result of supply chain disruption and / or as an unwanted by-product of unprecedented fiscal and monetary support.

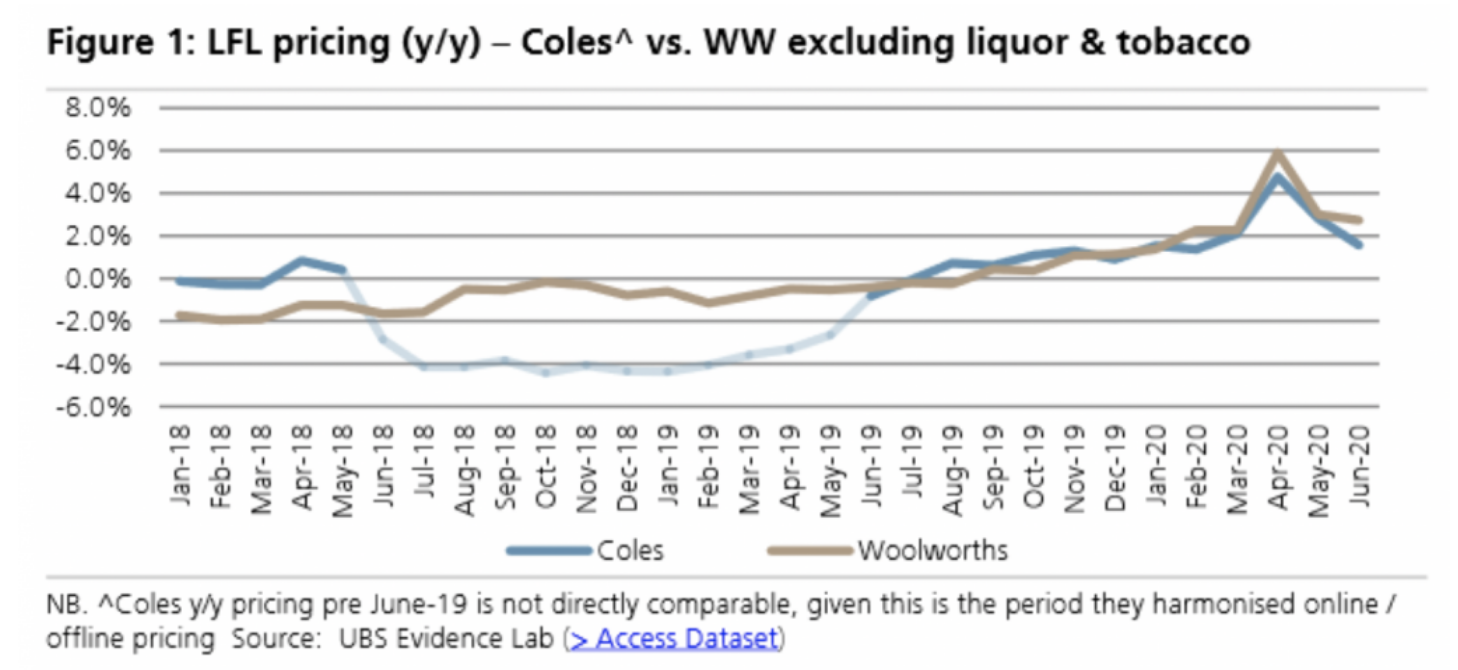

For example, the chart below from UBS shows a strong period of average inflation of around 3.5 per cent in JunQ20, after posting 1.8 per cent in MarQ20 due to removal / reduction of promotions during April and May – largely driven by inflation in fresh products.

Source: UBS

While supplier expectations are for inflation to slow, this is coming off a period of strong growth. We expect the industry to remain rational – especially with most recent threat Kaufland announcing its exit before commencing in January, and COVID-19 providing challenges to the operating environment.

2). Winning market share from loyalty program

Industry feedback suggests Woolworths remains well placed to win market share in the supermarket space – with superior service and loyalty programs often cited as key reasons of the driver.

Targeted marketing should help the company to continue building on its lead in the medium term, even as growth in 2021 slows as a result of the spike experienced in FY20.

Finally, Big W stands to be a direct beneficiary of a reduction in the Target footprint as announced by Wesfarmers in June.

3). Earnings recovery from Hotels as economy emerges from COVID-19 restrictions

One business often overlooked in the broader Woolworths Group is the Hotels division. The division – which is currently loss making given COVID-19 restrictions – should return to profitability over time, driving an uplift of approximately 5 per cent in medium term earnings for the Group. This helps to offset any slowdown in grocery spend resulting from a return to restaurants over time.

Get investment insights from industry leaders

Liked this wire? Hit the follow button below to get notified every time I post a wire. Not a Livewire Member? Sign up for free today to get inside access to investment ideas and strategies from Australia’s leading investors.

3 topics

1 stock mentioned