Timing a Plunge With Managed Funds

My advice has been consistent over the years: get your portfolio allocation right and let us worry about the timing. It’s fair to say it’s a piece of advice widely ignored.

I come across a lot of people who have already decided they want to invest with Forager Funds, but want to get the timing right.

If the past 12 months is anything to go by, more than a few get it wrong. We have historically seen counter-cyclical flows; investors have contributed more when performance was bad and taken money off the table when performance has been good.

From July to December last year, though, we saw strong inflows on the back of last year’s Forager International Fund (FISF) outperformance. Since January, when the one-year performance number for FISF started looking relatively bad, inflows have dried up and there have been a handful of larger redemptions.

"Get your portfolio allocation right and let us worry about the timing."

Bad client experience

It’s a relatively small amount of dollars and it is not the revenue that worries me. The Forager business has made huge strides over the past few years and I’m more confident than ever we can achieve our aspirations. I just hate it when clients have a bad experience.

And I do get it. It is easy to sit here and say investors should be patient and invest for the long term. But the first year is the one with the most uncertainty. It’s no different to us buying a stock. You never know a company until you own it and I normally get a pretty good idea about whether our thesis is right within the first 12 months of ownership. I ask a lot more questions of myself and the company in that first year than I do in the fifth. It is natural that a new investor should do the same with their fund manager.

"It is easy to sit here and say investors should be patient and invest for the long term. But the first year is the one with the most uncertainty."

So I’m going to provide a few tips on getting your first year expectations right. To be clear, I don’t have any better idea about near term outperformance than anyone else. Had markets fallen over the past year rather than rocketing upwards, our cash-laden portfolios would have outperformed rather than underperformed. But there are a few markers that help you assess the current level of opportunity in the portfolio. Here are a few little tests.

The number of ideas working out

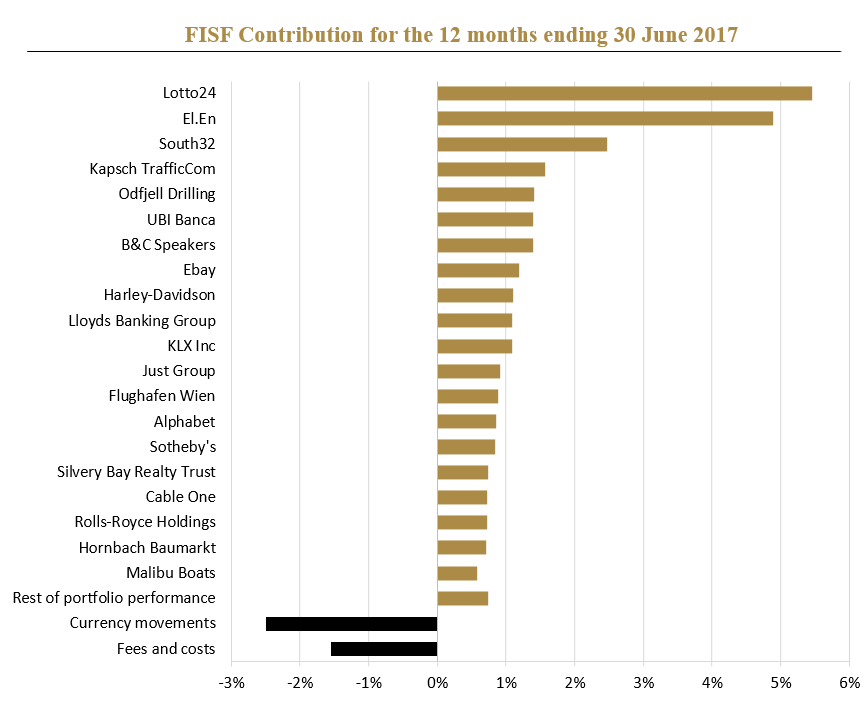

The first assessment to make is what has been happening in the recent history of the Fund. The fact that the FISF fund dramatically outperformed in the year to 30 June 17 tells you a lot. In fact, as this chart in the annual performance report showed, there was not one stock that made a meaningful negative contribution.

That should tell you something about any concentrated portfolio. It tells you a lot more when that portfolio is run by a value manager. We buy things that are unloved and trading at deep discounts to their intrinsic value. We hold them until the business shows its worth and that worth is reflected in the share price. And then we sell. When you see them all working out at once, it’s a fairly reliable sign that there are less remaining opportunities to make money than usual.

"We buy things that are unloved and trading at deep discounts to their intrinsic value."

Are they being replaced with new ideas?

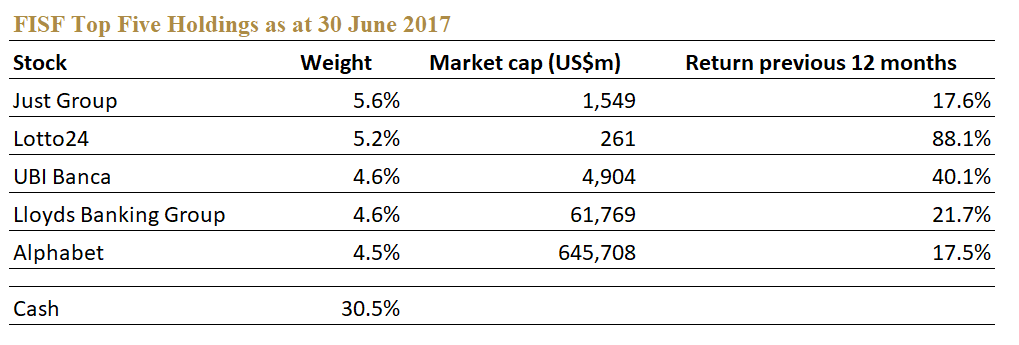

Next take a quick look at the top five holdings, read the latest quarterly and form a view about how many new ideas are turning up in the portfolio. Maturing ideas are fine if they are being replaced with new bargains. Here is the table from last year’s June quarterly report:

It doesn’t look particularly prospective. The top five holdings were large cap or up substantially over the previous 12 months. There could be plenty going on beneath those top five, of course, but the the level of cash tells you that probably wasn’t the case. And that is the next marker to look to.

Cash holdings are the best marker there is

Restricted to one marker alone, I would choose cash levels. It tells you most of what you need to know about the opportunity set in front of your fund manager. When there are lots of bargains, we won’t be holding much cash. When we aren’t finding much to buy, cash levels will rise. At 30 June last year, cash levels were north of 30%, suggesting we weren’t finding much to replace those maturing ideas with.

The cumulative impact of those three factors was bluntly summarised in last year’s annual performance report:

Past performance is no guarantee of future results, goes the standard disclaimer. One thing we can guarantee is that we’ll rarely, if ever, have a year as devoid of loss-making investments as 2016/17. That you can bank on.

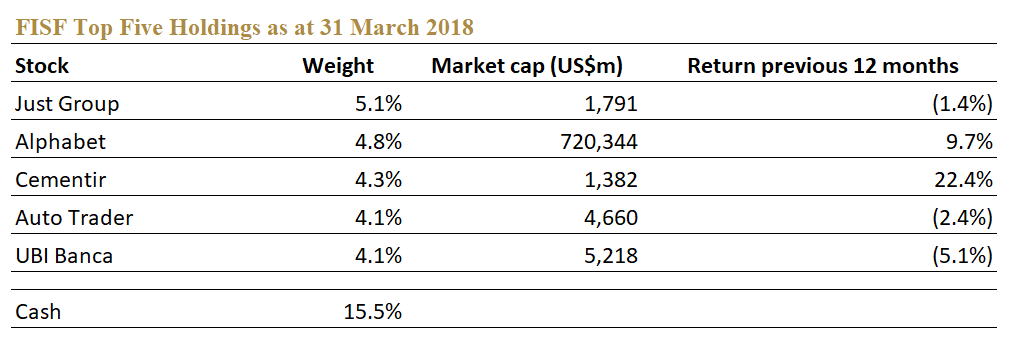

You don’t need to wait for us to tell you, though. You can look at the top holdings, new additions and most recent cash levels at any time.

Do it now and you will see that the portfolio is looking more prospective. While no one is on the Corn Flakes diet just yet, the cash weighting has fallen to 15%. There are a number of new ideas in the portfolio. We’ve been vocal about the bargains on offer in the UK. And we’ve been harping on about opportunities in oil for the past few years. With oil prices hitting multi-year highs and increasing talk of an improving market for oil services companies, you could expect the portfolio to be benefitting.

Great times ahead?

None of this necessarily means great times are ahead of us. If fact, we would welcome more meaningful market falls. It’s just looking a lot better than it was nine months ago.

Personally, I just get my money invested and leave it there. I stand by the view that very few people add value trying to get the timing right. There are solutions to buyers remorse, like dollar cost averaging. If you are going to try it, though, hopefully these few pointers help.

You can learn more about investing in the Forager International Shares Fund here.

3 topics

.jpg)

.jpg)