To see the future - Look West!

East Coasters can learn a lot by looking West - the home of the Boom & Bust! Because West Australia's economy is typically driven by the mining sector, it is very cyclical in nature. When iron ore and commodity prices crashed around 2012, so too did the WA economy.

As you can see, during this downturn unemployment started to rise and our economy went into free fall. Businesses closed, property prices fell and overall spending declined in these recessionary type conditions.

This was a big change from the boom years. When property prices were increasing rapidly and people enjoyed accelerating wealth. Many of the conditions that were experienced in WA during our boom, were replicated on the East Coast of Australia during the well-publicised housing boom. A boom that is now being publicised as over. So what's next?

Well looking at the impact of the commodity bust in WA on businesses, many lessons can be learned. But we will focus on Child Care & occupancy rates for the purpose of this article.

As the economy in WA slowed, it saw rising unemployment and stagnant/falling wages. This resulted in a significant tightening of the purse strings by West Australians.

During the boom times and strong employment, West Australians flocked into businesses such as Child Care as demand for these services was very strong. With high occupancy rates and great returns on investment, they were highly sought after (we know a few people who owned such assets). As a result, new facilities were built as more investors flocked into the sector spurred on by the great cash flow these investments made. This expansion and increasing competition, like any commodity eventually caused an oversupply.

Then, when the economy faltered in the post-boom period, the demand for these services began to fall as unemployment started to rise. This, along with a glut of supply caused the occupancy levels to fall. As a result, the once strong cash flows turned into a battle to stay in operation (like many businesses in WA during the time). As a result, many of the centres increased their prices in order to recover their operating expenses causing outrage in the community.

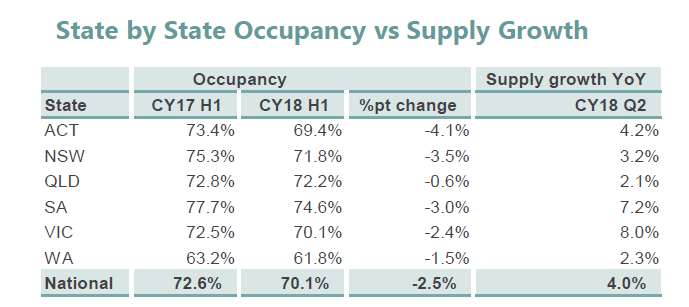

Looking specifically at G8 Education (GEM AU) it is clear this slow down in WA has still been an issue. As you can see the occupancy rate in WA is tracking at 61.8%. Far lower than the other states who enjoy occupancy around 10% higher.

However, these low occupancy rates were not always the case. So while G8 recently said their occupancy was improving, it is unlikely this is going to be a new long term trend if economic conditions continue to worsen on the East Coast.

If G8 saw occupancy levels fall towards the 60% range on the East Coast, this could have a material impact on their ability to service their debt. With a study from Childcare Alliance citing "that most centres require a 60-70% occupancy to breakeven" a material fall in occupancy may start to impact their operating cash flows.

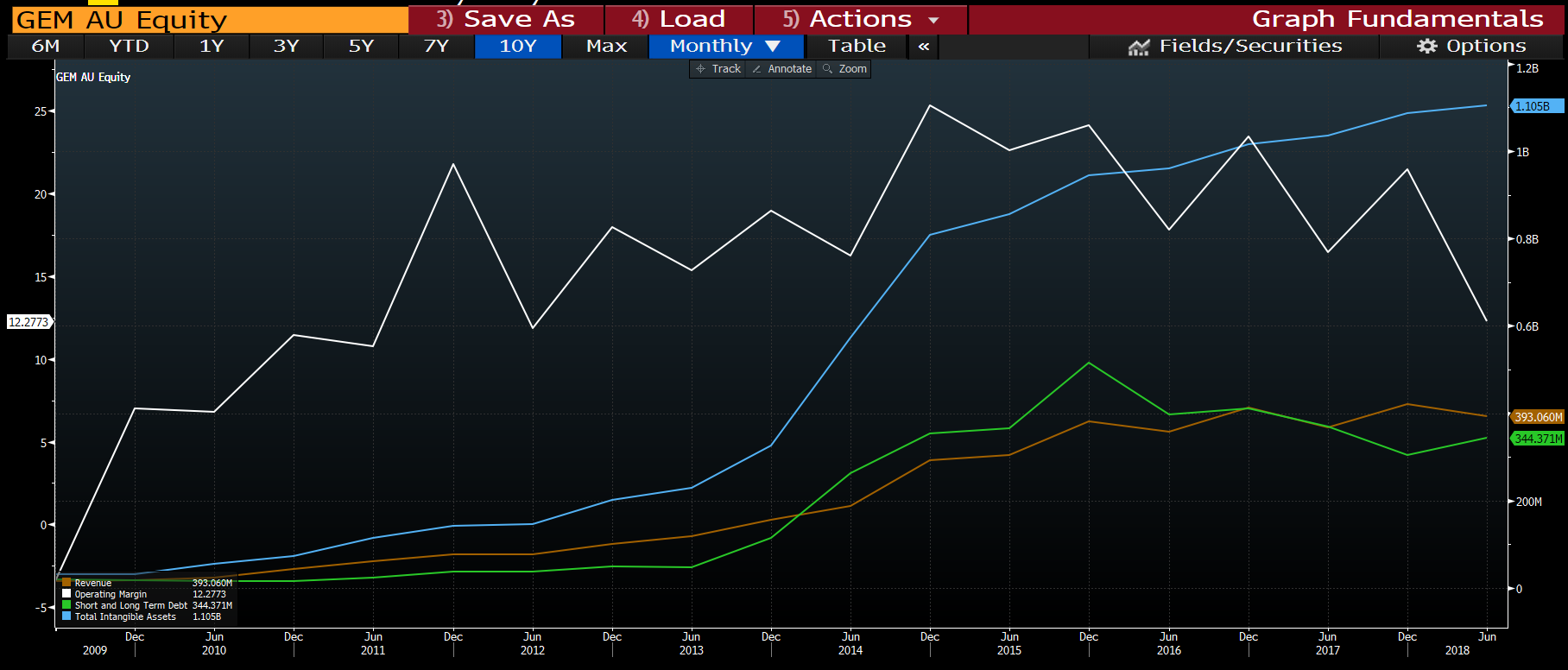

When times were good and occupancy high, G8 went on an acquisition spree, growing for growth and arguably paying a little too much for some assets. With over $1 billion of goodwill on the balance sheet. Should economic conditions worsen on the East Coast, the company could be forced into writing down the value of many of these centers.

With falling operating margins, revenue and high levels of debt. We believe that if the East Coast starts to replicate the economic conditions WA experienced post-boom, that G8, might not look too "Gr8".

Disclosure: This is general advice only and does not take into account your personal financial situation. The Progressive Global Fund holds a short position in G8 Education.

3 topics

1 stock mentioned