Two Credit Suisse upgrades and two Citi downgrades

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

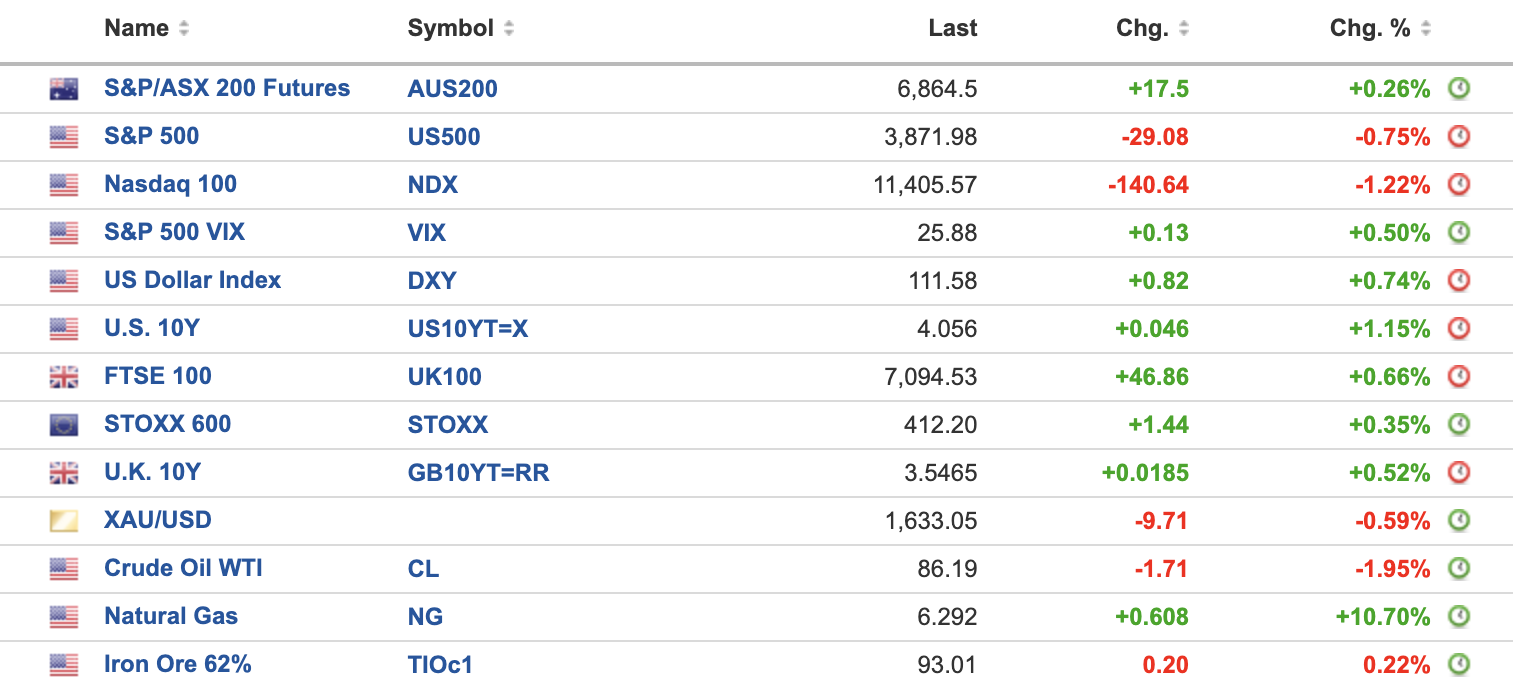

MARKETS WRAP

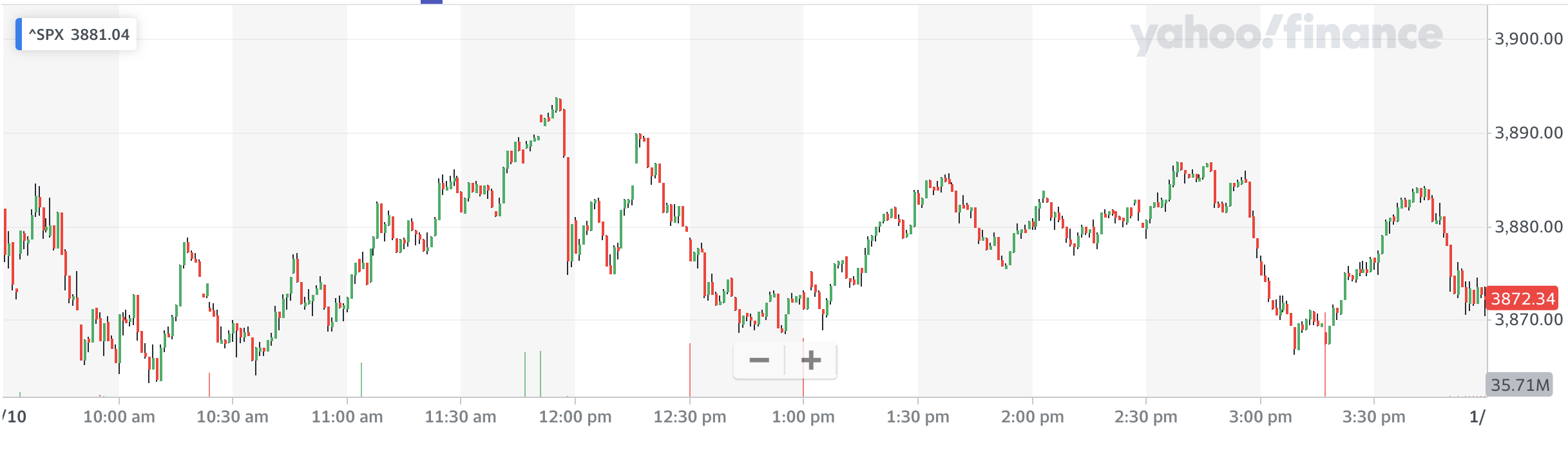

S&P 500 TECHNICALS

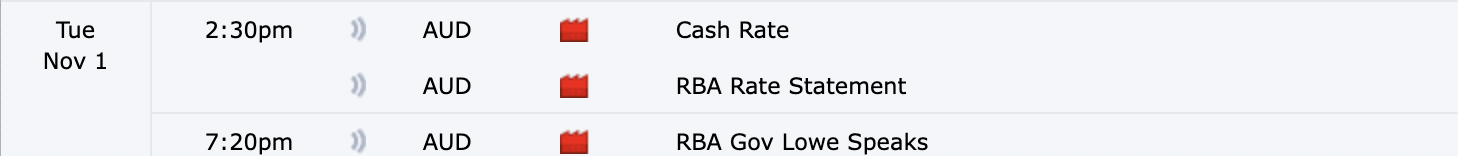

THE CALENDAR

All roads lead back to the RBA today as it prepares to hike rates (again). Will it hike by 25 basis points, as the consensus suggests? Or will they hike by 50 basis points, following the calls of Westpac's Bill Evans? All the economists' commentary suggests this call is actually borderline. CBA's Gareth Aird and Nomura's Andrew Ticehurst are both backing a 25 basis point hike, but believe there is a "40%" chance of a 50 basis point hike.

I suspect more than a few people will have one hand on the trade button and one eye on the Melbourne Cup come 2:30 pm.

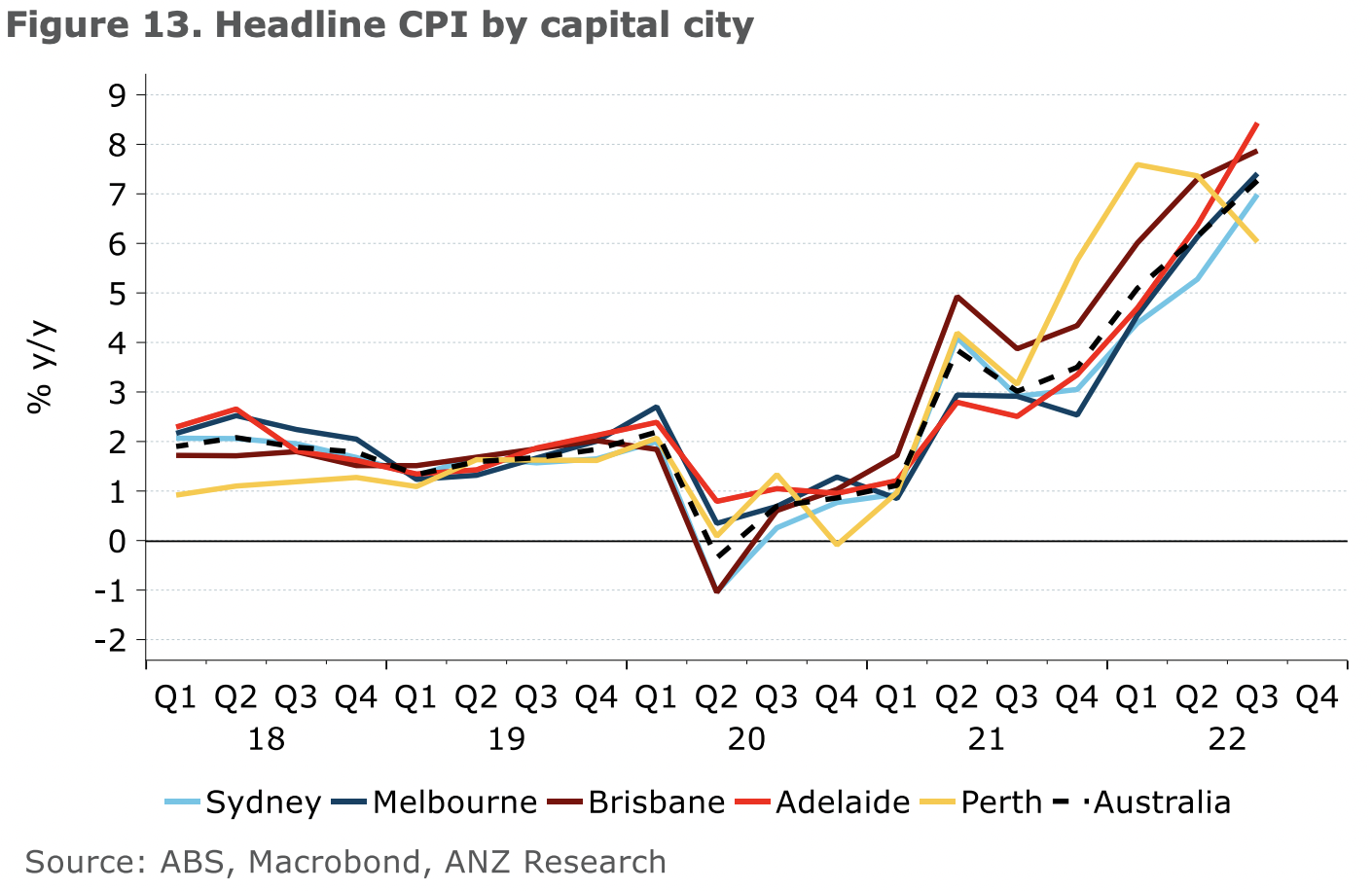

THE CHART

Given today is RBA day, I thought we'd discuss why many economists have added extra hikes to their forecasts and models. (Or in Bill Evans at Westpac's case, argued today's hike should be 50 basis points rather than the consensus 25.)

This chart is from ANZ Research. Rather than explain inflation by its various sub-categories (which is what economists normally do), I've decided to show you inflation by major city. The chart demonstrates that inflation has been marching higher and is not likely to come down anytime soon in any major city in Australia. The only case where that has happened so far is in Perth.

If the Reserve Bank was to lift rates by only 25 basis points instead of 50, it'll sure be hoping Perth is the leading indicator rather than an aberration.

STOCKS TO WATCH

Two brokers are in focus today with moves on three different stocks.

Iluka Resources (ASX: ILU)

Citi expects September zircon, rutile, and synthetic pricing to be at its peak for the current cycle and expects earnings to have done so as well. Now a neutral, rather than a buy - and the price target is reduced by nearly $3 to $9.50/share.

The opposite is true at Credit Suisse, where analysts have actually raised their forecasts on zircon pricing over the coming six months to US$2000/tonne. As a result, the stock is now an outperform instead of a neutral. Interestingly, the price target remains unchanged.

Qube (ASX: QUB)

High volumes, margin improvements, and guidance maintenance in this environment gets a tick from Credit Suisse. The stock is now outperforming rated with a $2.90 price target.

ResMed (ASX: RMD)

Following its latest earnings result, Citi anticipates a more gradual gross margin recovery impacted by supply chains and the strong US Dollar. If Philips (its main competitor) also gets to return to the market, it could cut RMD's earnings and end what has been a quiet monopoly for the company. Now a neutral instead of a buy, with a price target of $37.50/share.

TODAY'S TOP READ

Brazil’s Luiz Inácio Lula da Silva Wins Presidential Election (WSJ): He's back and back again. "Lula" (as he is often referred to in the international press) has beaten Jair Bolsonaro to retake the top job in Brazil. Brazil is not the most discussed country in financial markets. But it is interesting to note that when Bolsonaro placed second in the first runoff of this race, the Brazilian stock market actually had its best day since 2020. I guess you now know who the traders were backing.

Hans Lee wrote today's report.

GET THE WRAP

If you've enjoyed this edition, hit follow on this profile to know when we post new content, and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

3 topics

3 stocks mentioned

1 contributor mentioned