Two things investors should watch for into 2023 and beyond

US stocks probably have some way to fall before bottoming out, and cash is a decent place to hide right now: these are a couple of the key takeaways from my recent chat with some senior local insiders at MLC Asset Management and abrdn.

In the second and final part of this series, I asked the following multi-asset managers to nominate an important chart that helps pinpoint where markets are currently. They also each highlight a market theme or signal investors shouldn’t ignore in the next 12 to 18 months.

- Anthony Golowenko, portfolio manager, MLC Asset Management’s Capital Markets Research team.

- Raf Choudhury, investment director, abrdn Asia Pacific Multi-Asset Investment Solutions.

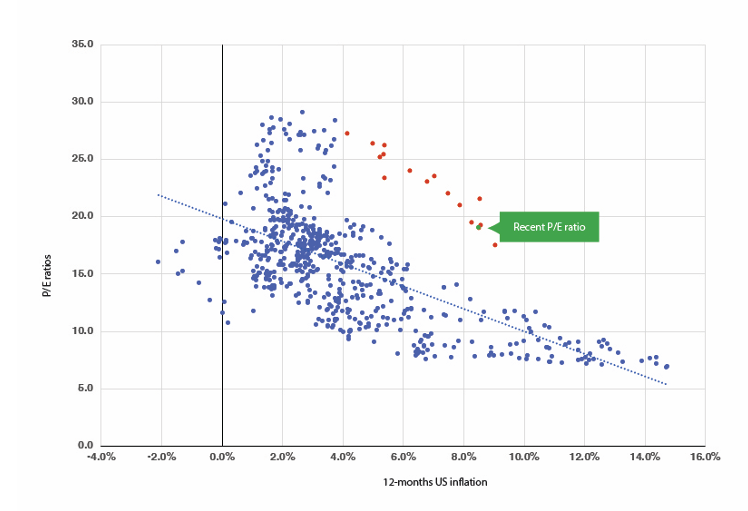

Looking first at the chart addressed by MLC’s Golowenko, he emphasises the historical context for the current pricing of companies in the US’s S&P 500. The below chart shows valuations are well beyond the levels typically seen during periods of similarly high inflation.

A 50-plus year perspective on US inflation and S&P 500 equity prices

Source: IBES via Datastream, through July 2022

“While high inflation isn’t necessarily bad for equities, generally speaking, it is bad for equity valuations,” Golowenko says.

“Considering expected US earnings growth (sales, margins) and valuations, it’s likely that ‘something’s gotta give’ in this Fed inflation-fighting adjustment period.”

The one theme you shouldn’t ignore

Golowenko points to companies that satisfy the definition of “Quality” as the single biggest theme in the year ahead. He describes these as businesses able to maintain their operations in the face of a highly volatile environment that’s likely to persist into 2023 and beyond. Among the laundry list of headwinds Golowenko cites are:

- Higher input costs

- Staff absenteeism

- Labour costs

- Energy and fuel costs

- Interest rates

- Disrupted supply chains, and

- Tightening household budgets.

In addition to the Australian equities market, the MLC Asset Management team is finding Quality companies in emerging markets. But overall, Golowenko describes its multi-asset strategy as “underexposed to global equities.”

He’s also bearish on bonds across the board and doesn’t see this view changing in the short term – at least until yields find a bottom and it becomes clearer that central bank efforts to rein in inflation are working.

Australian guvvies hold some appeal

Golowenko’s view is shared by abrdn’s Choudhury, with Australian government bonds the only fixed income exposure his team has increased more recently.

“We think yields can still move slightly higher but it’s a good time to start averaging in, although not yet the time to go all in,” he says.

With only minimal exposure to global government bonds, Choudhury finds longer-dated US T-bills more attractive than the sovereign debt issued by the European Central Bank and Bank of Japan.

Cash is king

As alluded to in part one of this series, Choudhury emphasises the fund’s cash holding is currently the largest position in the abrdn Multi-Asset Real Return Fund, with a 35% allocation.

“Over the next 12 months, and more likely through the second half of next year, we expect we will redeploy these cash reserves as more attractive opportunities and entry levels across asset classes present themselves,” Choudhury says.

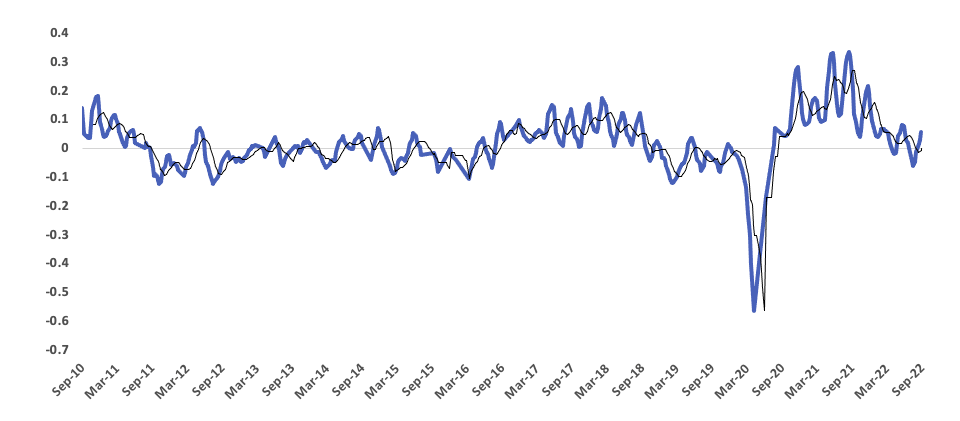

Asked to nominate a favourite chart, he provides the following, which shows declining company earnings estimates from equity analysts. In line with this, Choudhury believes average EPS could decline between 14% and 21% in the next two years.

The chart below is created by subtracting the number of upward revisions from the downward revisions and then dividing the total by the number of analyst estimates.

MSCI World Revision Ratio

Source: abrdn, Bloomberg, as of the end of August 2022

A signal you shouldn't ignore

Choudhury regards this as the most important signal for investors in the back end of calendar 2022 and into 2023. And for him, this indicates an earnings recession is almost unavoidable and that “earning estimates on the street are still too high.”

“We have started to see some downward revisions on the back of profit warnings, most recently from Fedex (NASDAQ: FDX) and Ford (NASDAQ: F) but we expect more to come,” Choudhury says.

“Expect earnings to fall and bottom out through the first half of next year as the recession takes hold.”

The wrap-up

Choudhury believes it’s a matter of when, not if, the US slips into a recession – so for his team, risk assets are off the table.

MLC’s Golowenko is arguably more sanguine in his outlook, not quite regarding a recession as inevitable. But he does say that “something’s gotta give” with regard to the strength of US companies’ earnings growth versus their stock valuations in the current context of the Fed’s ongoing struggle with inflation.

With this in mind, both multi-asset managers are bearish on stocks more broadly but Golowenko sees limited opportunities in Australian large- and mid-caps and some emerging markets. On the other hand, abrdn’s Choudhury has shifted to cash in a big way while awaiting stock-buying opportunities.

Both are bearish on corporate bonds – particularly lower-quality high-yield debt – while Golowenko is “constructive” in his view on Alternatives, particularly some parts of shorter-term private debt.

Catch the rest of this series

Make sure you "FOLLOW" my profile to find the first part of this series. In part one, our contributors discussed their current portfolio positioning and their 12-month outlook for multi-asset markets.

5 topics

2 stocks mentioned

2 contributors mentioned