UBS: Has "Aussie exceptionalism" seen the ASX 200 run too far?

It seems hard to believe for any investor that's lived through the last few weeks of mayhem, but the ASX 200 looks set to close the month of April in the green.

Back above 8,000 points for the first time since late March, the ASX 200 has come out the other side of Trump's global tariff war relatively unscathed (so far).

The same cannot be said for most of the other major global stock indices.

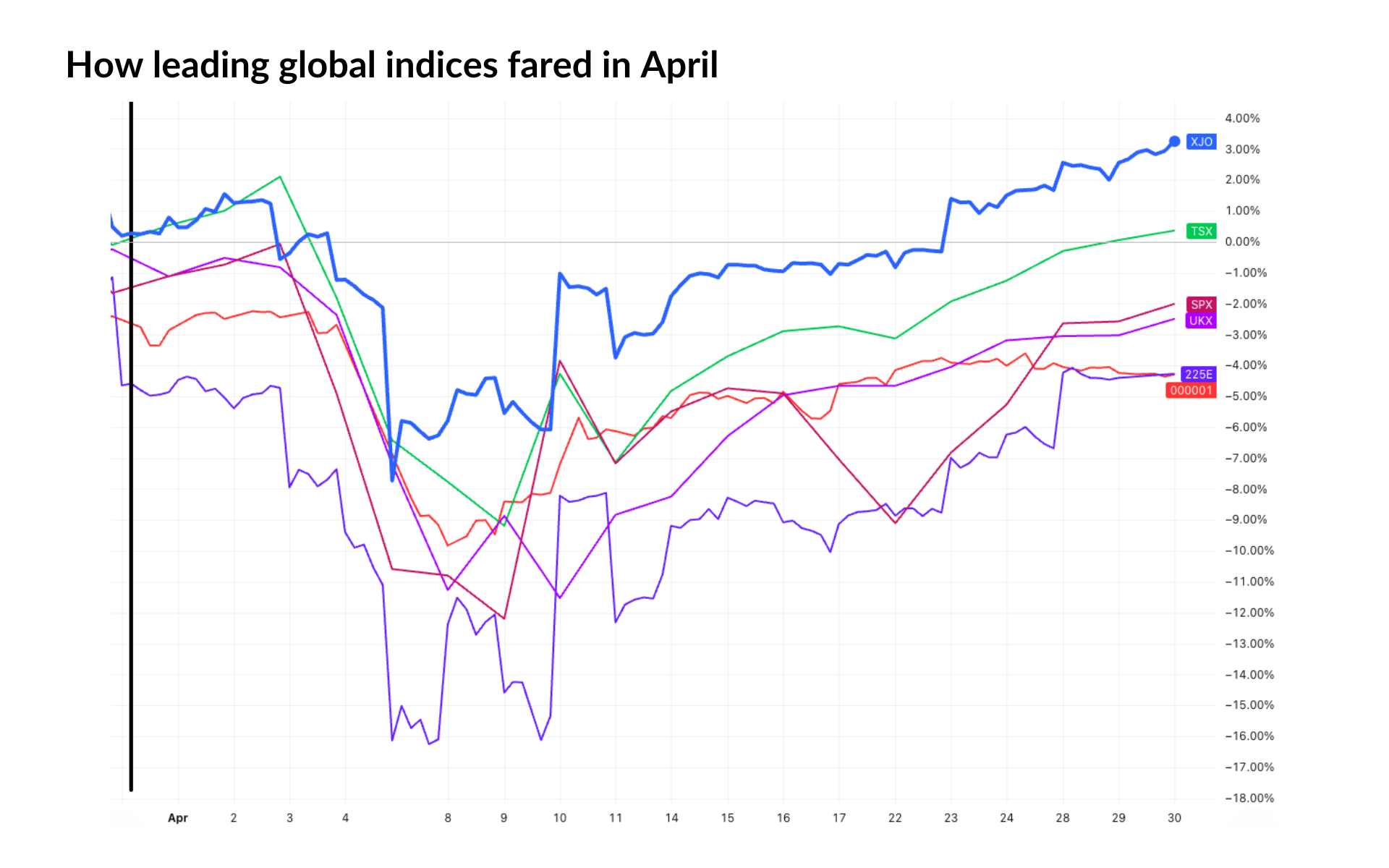

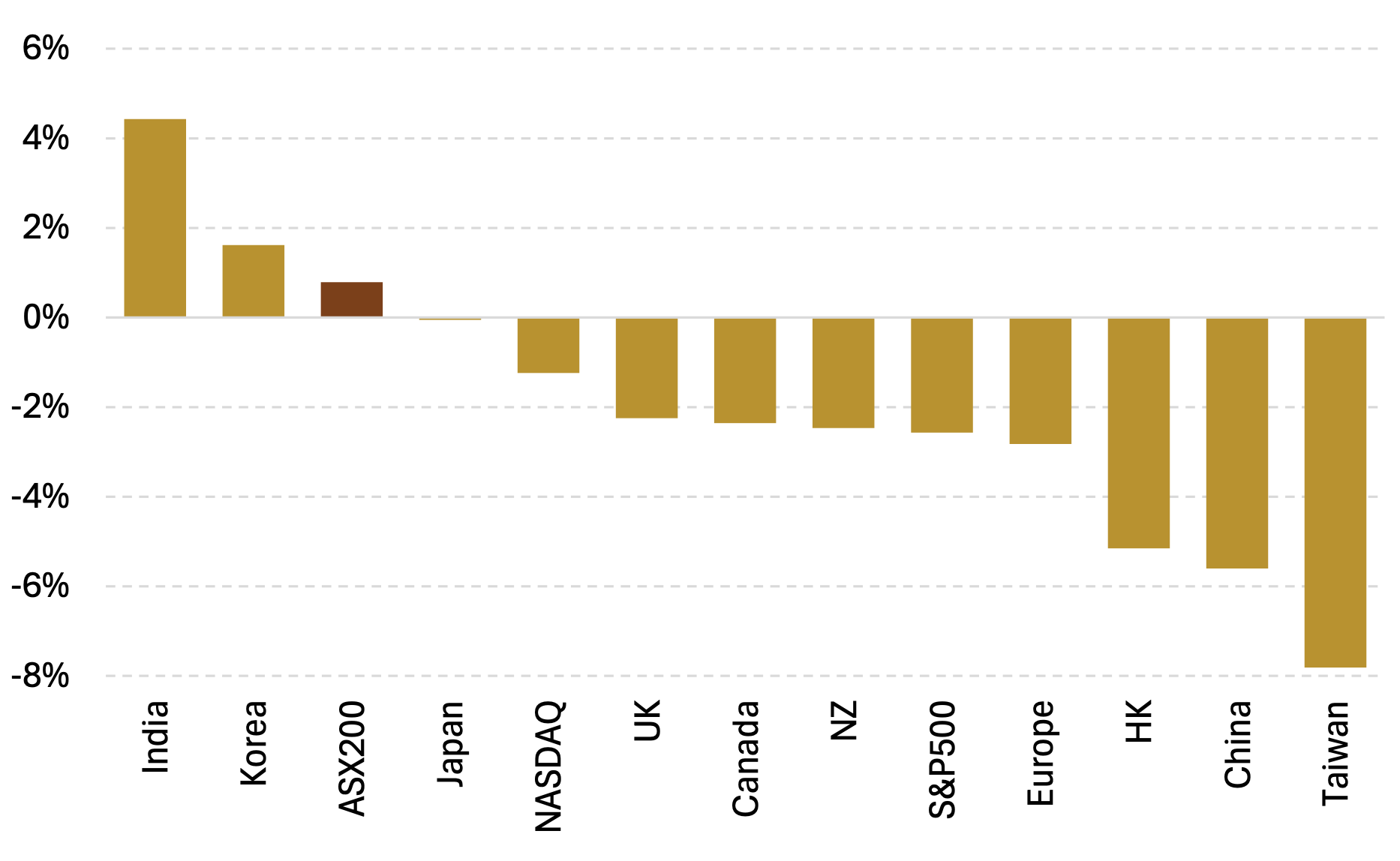

As you can see in the chart below, the leading indices of the US, UK, China, Japan and Canada are all down in April, while the ASX 200 (in blue) has surged higher.

In fact, only the Indian and Korean stock markets can boast better returns than the ASX 200 since the start of the month.

Equity markets price performance since 2nd April (Source: UBS Refinitiv) *in local currency

The lucky country?

According to UBS, there are three key reasons for this outperformance.

First is Australia's lack of a trade surplus with the US, which has protected it from the full brunt of Trump's tariffs.

Second is its ability to more easily redirect its hefty agricultural exports from the US to other economies, compared to manufactured exports.

And third is the heavy domestic revenue weighting for many of the ASX 200's largest companies.

As a result, homegrown stocks have caught the attention of overseas investors looking to limit the damage of the trade war.

"Global investors appear to have rewarded this 'Aussie exceptionalism' over recent weeks, and have begun rotating their equity holdings away from the more impacted markets towards Australia's relative safety," wrote UBS strategist Richard Schellbach in a note to clients.

It sounds like good news, but it hasn't stopped UBS sounding the warning bell on the index's near-term prospects.

Last week it reduced its year-end target on the ASX 200 to 8,150, down from 8,850.

"We are concerned that recent gains made by the Australian market have run ahead of softening underlying fundamentals," said Schellbach.

He cites two key reasons why the recovery may be the market getting ahead of itself.

"Firstly, US trade and tariff policy shifts have contributed to increased uncertainty, meaning investors should demand a higher risk premium to hold stocks," said Schellbach.

"The trajectory for corporate earnings recoveries has been damaged. We expect the upcoming period of trading updates and quarterlies from Aussie companies to be unfavourable in both tone and guidance revisions, and thus expect to see earnings downgrades from consensus analysts."

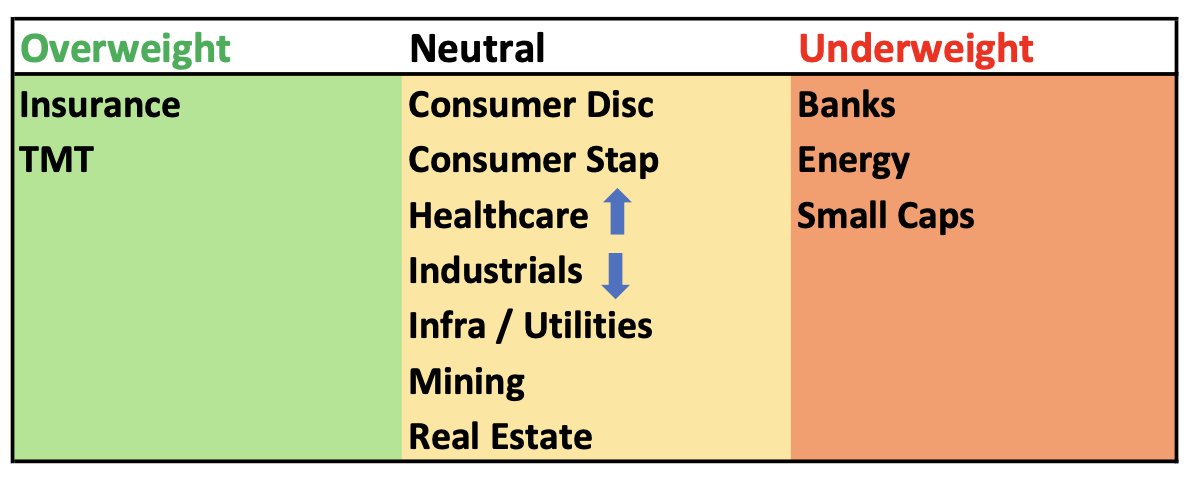

This has prompted UBS to dial back the risk and stay overweight on the sectors it believes are agnostic to the ongoing macro uncertainty, namely Insurance and Telecommunications.

It has also made two sector changes - moving Healthcare from underweight to neutral, and downgrading Industrials to neutral from overweight.

Healthcare offers the most attractive relative valuation of all stock sectors, according to UBS, with a de-rating back to 1.4x PE putting it below its long-term average of 1.6.

With its heavy exposure to the US, Industrials has been downgraded as US economic exceptionalism fades in the face of recent tariff-led developments.

UBS sector recommendations

The three stocks UBS is keen on

Despite the concern, UBS has also added three ASX companies to its "most-preferred" stock list:

#1 Steadfast (ASX: SDF)

Insurance broker Steadfast offers defensive protection and exposure to SMEs that are insulated from softening commercial insurance premiums.

It replaces AUB Group as UBS's preferred insurance broker, with its status as Australia's largest strata title insurer leaving it well-positioned to any sector-wide slowdowns.

#2 SGH (ASX: SGH)

With diversified operations and strong end-market activity in infrastructure and mining, SGH is well-positioned following the turnaround in subsidiary Boral.

The Kerry Stokes-led company took full ownership of Boral in July 2024, and also owns Coates Hire, WesTrac and Seven West Media.

#3 Technology One (ASX: TNE)

TNE boasts an impressive product offering and business moat, and less exposure to global trade and growth risks than other local companies.

Technology One replaces Car Group in the preferred list, as part of UBS's pivot towards companies with most of its revenue coming domestically.

3 topics

3 stocks mentioned