Underrated ASX agriculture stocks prove they are modern businesses (not just listed farms)

In the past, ASX agricultural stocks have probably deserved the blanket assumptions placed on them by analysts and the market.

But this week’s earnings results from Elders (ASX: ELD), GrainCorp (ASX: GNC), Australian Agriculture (ASX: AAC), and Nufarm (ASX: NUF) not only significantly beat market expectations. They also proved that Aussie Ag stocks have come a long way as businesses and are perhaps unfairly tarnished with their sins of the past

Around 15 months ago (May 2022 earnings), the market called the agricultural sector peak and savagely sold down the sector declaring that things couldn’t get any better for agricultural conditions. Therefore, these companies were headed for disaster.

Before 10 years ago, this was a fair assumption. The “boom and bust” cycle of ASX-listed agriculture companies was at the mercy of the weather and commodity prices. While an element of this remains true, if you dig deeper into the investor presentations of these names, you might be pleasantly surprised to see the work these companies have done to smooth that risk.

On closer inspection, many of the players are far from being one-dimensional. They boast diversified operations and resilient strategies - making a mockery of the simplistic “old world” view of these businesses.

Market Misconception and Context

The decline in stock values for Elders, GrainCorp, and Nufarm is largely due to the market's apprehension around uncontrollable factors like weather. Investors braced for extended dry spells, in turn, expecting significant hits to crop yields and corporate profitability. This reaction, however, is increasingly looking too simplistic and giving too much emphasis on farming conditions and not enough focus on the businesses.

The market reaction to the “official announcement of El Niño is a great example. El Niño’s impact is not only varied but also often less severe than feared. Yet old habits die hard, and like sheep (pun intended), investors sold off Ag stocks, dismissing these companies' “new world” scope and diversification extends beyond mere crop production, encompassing a diverse range of activities and products from agency services, real estate, financials services, insurance, processing, digital and AgTech.

Add to this the advancement of processing methods, improvement of supply chains, and application of technology to increase efficiency and lower costs and you are starting to see a modern business, not just a listed farm.

This Weeks Results

Elders (ASX: ELD): Diversification as a Pillar of Stability

Elders, a venerable name in Australian agriculture, demonstrates a commendable blend of resilience and strategic foresight. Despite prevailing concerns about El Niño's impact, Elders' recent financial outcomes are a testament to their strategic acumen.

Over the last eight years, the company has reported only a few less-than-ideal earnings, underscoring the efficacy of its 8-point plan. This plan has been instrumental in stabilising earnings and diminishing dependence on unpredictable weather patterns.

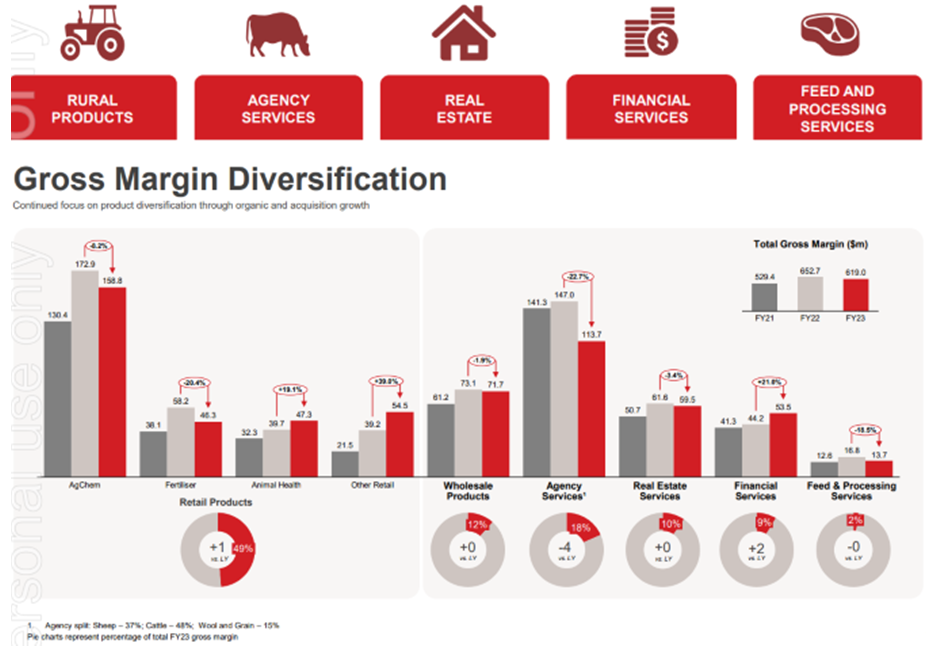

Elders’ business diversification spans retail and wholesale products, real estate, and financial services. This multifaceted approach has created a robust cushion against climate-related uncertainties.

The recent financial results, including an underlying EBIT of $170.8 million and an EPS that surpassed analyst expectations, reflect a well-executed strategy, enabling them to effectively navigate through challenging market conditions. Elders' adaptability and potential for sustained growth are rooted in this strategic diversification, positioning them well for future market dynamics.

GrainCorp (ASX: GNC): Consistency Amidst Volatility

GrainCorp's journey through the turbulent agricultural market highlights its steadfastness and strategic agility. The recent financial year saw a decline in their EBITDA and NPAT compared to the previous year, yet these figures met market predictions, showcasing their consistent operational performance amidst market variations.

GrainCorp's resilience stems from its diverse operational spectrum, spanning agribusiness to processing sectors. The company has adeptly capitalised on global demand for Australian grain, achieving record oilseed crush volumes. This adaptability is further enhanced by their strategic investments, including ventures in new oilseed crush plants, underlining a commitment to sustainable growth.

The substantial dividend payout for the year, notably higher than forecasts, signals a robust financial condition and a strong commitment to shareholder returns. These factors collectively demonstrate GrainCorp's ability to proficiently navigate market fluctuations, backed by resilient strategies and a forward-looking growth mindset.

Nufarm (ASX: NUF): Innovating for Future Growth

Nufarm is perhaps one of the best examples of simplistic selling, falling 40% from its peak on worries about deteriorating agricultural conditions in Australia due to El Niño. This is because it completely overlooks that around half of Nufarm’s business is based in the USA, a direct beneficiary of the weather pattern.

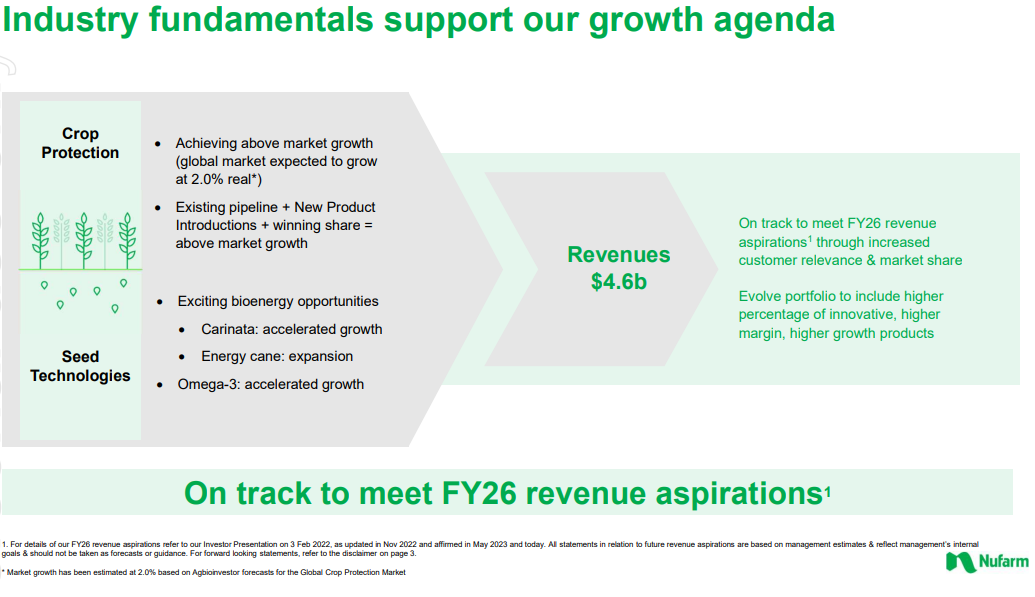

Nufarm's approach to the dynamic agricultural market is marked by innovative practices and a vision for growth. Despite a modest downturn in their latest financial reports, the company is steadfast in its growth trajectory, underpinned by strategic shifts and seed technology advancements.

Over recent years, Nufarm has transformed its crop protection business, setting a strong foundation for consistent earnings above $400 million annually. This robust performance is further augmented by their burgeoning seeds division, poised to become a significant growth driver.

Greg Hunt, Nufarm’s CEO, maintains an optimistic outlook, projecting growth in the second half of fiscal 2024 and aligning with their FY26 revenue targets. This forward-looking strategy, coupled with a focus on seed technology innovation, positions Nufarm favourably to not only navigate current market challenges but also to harness future growth opportunities, marking them as a resilient and progressive player in the agricultural sector.

In Summary

The “boom and bust” mentality of Australia’s Ag companies is likely to be replaced by “ebb and flow” as the whole industry, not just these companies adopt a smarter way to do business and not just be farmers.

Founded by Investors for Investors

MPC Markets' mission is to empower every investor with the knowledge, tools, and guidance necessary to unlock their financial potential. Find out more.

3 topics

4 stocks mentioned