US inflation comes in hotter-than-expected, Nasdaq moves higher, ASX 200 futures flat

ASX 200 futures are trading 1 point higher, up 0.01% as of 8:20 am AEDT.

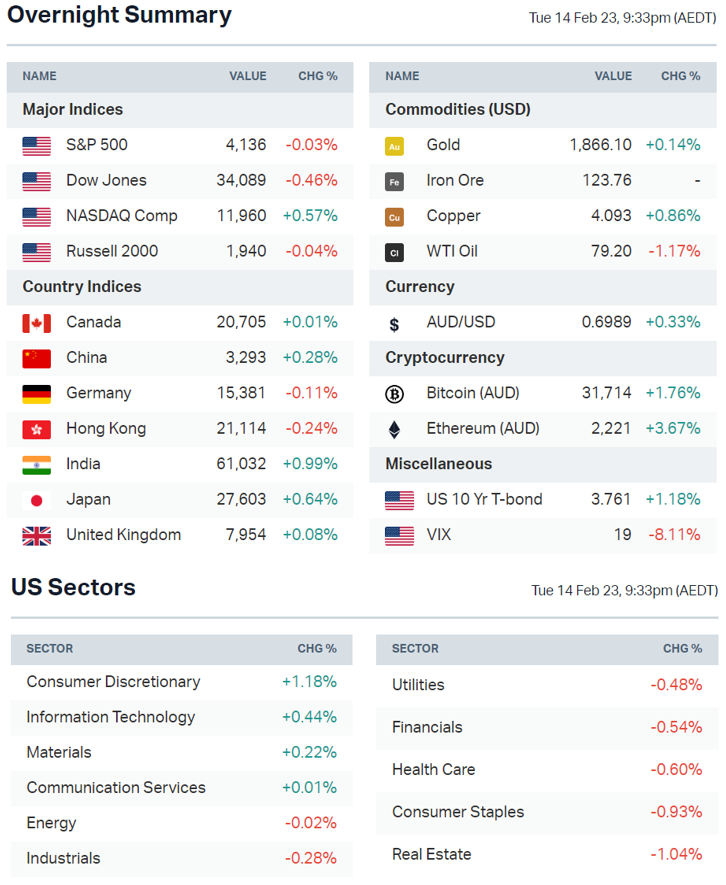

US inflation fell for a seventh consecutive month but came in ahead of analyst expectations, the S&P 500 struggled for direction and closed around breakeven, Fed funds futures are now pricing an upper terminal rate of 5.5%, the US 2-year Treasury yield jumps to a four month high and some interesting perspective about recent tech layoffs.

Let's dive in.

S&P 500 Session Chart

MARKETS

- US inflation rose 6.4% year-on-year in January from 6.5% last December but above consensus expectations of 6.2%

- US markets lacked direction but resilient nevertheless in the face of slightly above consensus CPI and hawkish Fedspeak

- Early analyst reports view the print as better than feared despite surprises in areas such as medical care, airfare and upward pressure from housing inflation

- US plans to sell 26m barrels of crude from SPR (Bloomberg)

STOCKS

- Ford plans to cut 11% of its European workforce or 3,800 jobs (FT)

- Ford pauses production of EV truck F150 on battery issues (CNBC)

- Apple's manufacturing shift to India hits stumbling blocks (FT)

EARNINGS

Only 69% of Q4 earnings have managed to beat consensus expectations, below the one-year average of 75% and five-year average of 77%.

Palantir Technologies (+20.7%): The big data analytics company reported its first profitable quarter ever of US$31 million; revenue rose 18% and customer count jumped 55%.

- "I think the biggest event in digitalisation AI is actually on the battlefield." - CEO Alex Karp

- "Overall, net dollar retention was 115%. Customer count grew 55% year-over-year and 9% quarter-over-quarter. Revenue from our existing customers continues to expand." - CFO David Glazer

ECONOMY

- BofA's February Global Fund Manager Survey notes recession odds (over the next 12 months) fell 27 percentage points to 24%, down from 77% peak in November

- Goldman Sachs, BofA CEOs see improving chance for a soft landing in the US (FT)

- India inflation hotter than expected, accelerates to 6.5% (Reuters)

- UK wages grow faster than expected fueling rate hike fears (Bloomberg)

- Container shipping costs plunge as consumer spending declines (FT)

Deeper Dive

Macro: All things CPI

Year-on-year inflation was slightly hotter-than-expected for both headline and core. Month-on-month inflation also picked up but in-line with analyst expectations.

- Headline inflation: 6.4% in January (6.5% in Dec) vs. 6.2% expected

- Core Inflation: 5.6% (5.7% in Dec) vs. 5.5% expected

We'll take a deep dive into all things CPI below.

Shelter remains sticky: The largest contributor was shelter, account for nearly half the monthly index increase. Shelter CPI rose 7.9% year-on-year, marking the highest rate of housing inflation since 1982. Shelter CPI lags behind actual prices due to the way its reported. In previous years, it significant understated actual housing inflation. But now its the opposite. For perspective, Shelter CPI is up 14.9% since the start of 2020. However, actual rents are up 20.3% and home prices are up 40%. There's a bit of catch up to do.

Closer look at core CPI: Rent accounts for 40% of core CPI and its running at around 9% annualised, according to Bespoke Invest. They also note that the other 60% of core CPI is much softer, at 1.5% annualised. This signals that the non-rent part of core looks to have normalised.

Fed funds futures: After the CPI data was announced, Fed funds futures are now pricing an upper bound terminal rate of 5.5%, up from 5.25%. The current upper bound is 4.5%. That said, the first cut is also expected to take place in December by 25 bps.

CPI outlook: "We remain optimistic that inflation can get close to 2% late in 2023, largely through flat to lower prices for shelter and a squeeze on corporate profit margins." - ING Economics

Another outlook: "Details of January CPI that were different from our forecast leave us more confident that upcoming inflation prints will remain strong. Even as shelter prices eventually start to moderate ... rebounds in components like used cars and airfares present upside risks."

Sectors to watch

Yield sensitive sectors: The US-2 year Treasury yield rallied to a four month high of 4.63% overnight (it was only 4.1% on February 2nd). Interestingly, the Real Estate sector was the worst performing S&P 500 sector, down 1.03%.

Tech: It's surprising to see Tech outperform amid a surge in bond yields. Several risk barometers such as Bitcoin (+2.0%), ARKK ETF (+2.5%) and the Nasdaq (+0.6%) all extended gains overnight. This could see some positive flow for local tech, which also bounced on Tuesday (after six day losing streak).

Copper: The Global X Copper Miners ETF rose 1.5% overnight, in-line with the uptick in copper prices. Copper is starting to find its footing after a pullback earlier this month. This follows an outsized ~15% rally between January 4 to 18.

Interesting Stuff

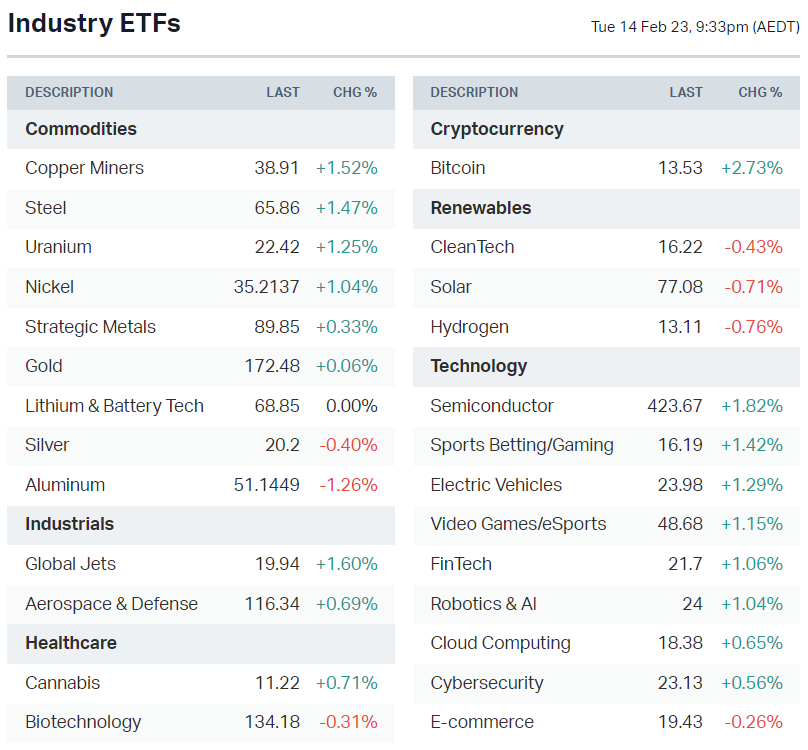

Tech layoffs vs. pandemic hiring: Tech layoff headlines are everywhere but nothing compared to the amount of people hired during the pandemic hiring frenzy.

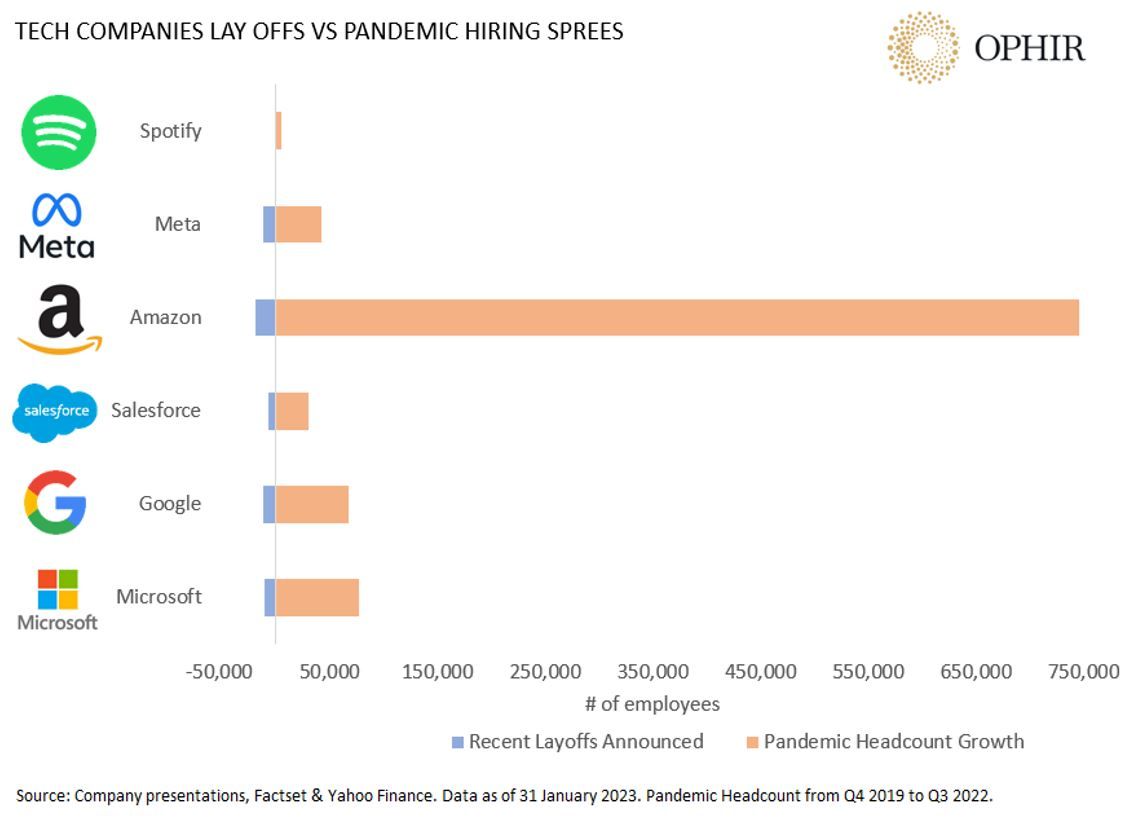

Best start to 60/40 portfolio: The traditional investment portfolio allocation of 60% to stocks and 40% to bonds is off to its best start to a year since 1991, according to BofA Research. Its up 6.8% after posting one of its worst years in history.

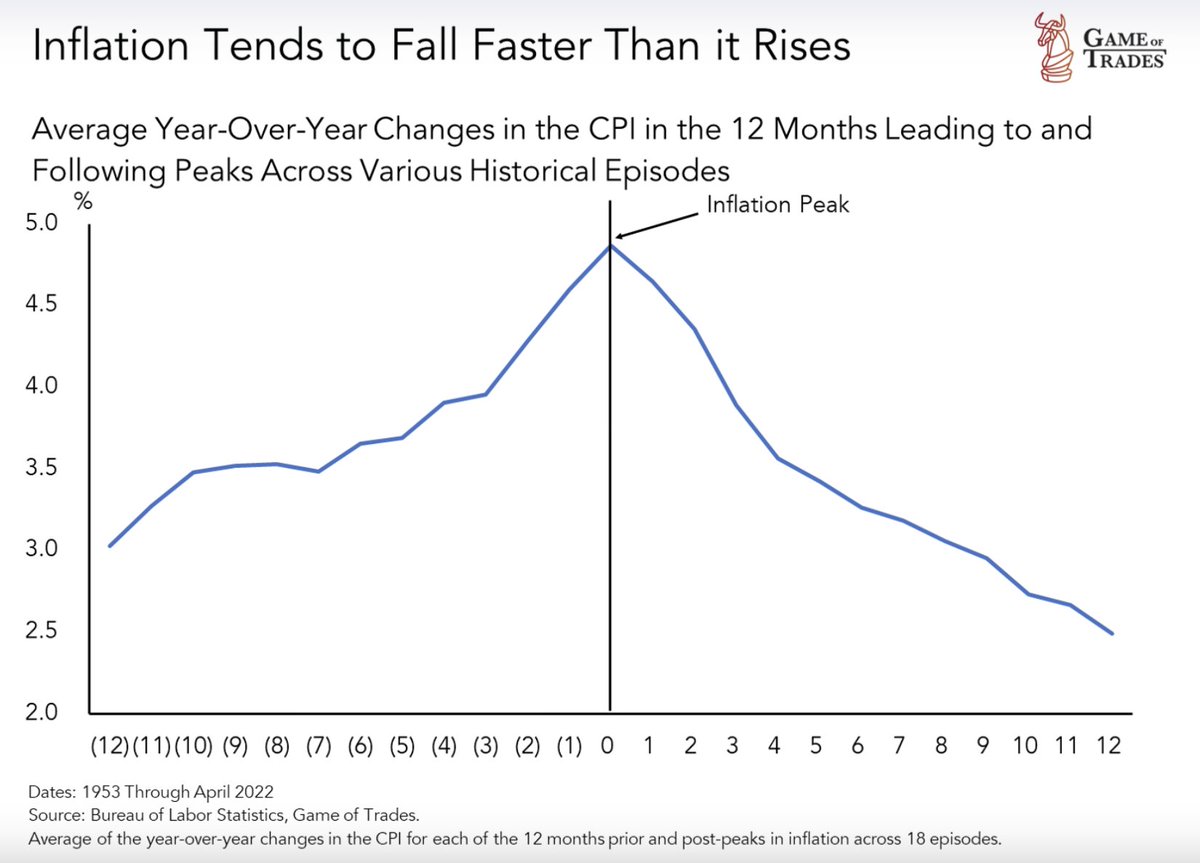

Inflation tends to fall fast: Across various historical episodes of high inflation (between 1953 and 2022), inflation tends to fall much faster than it rises once the peak is in.

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Microequities Asset Management Group (MAM) – $0.018

- Dividends paid: None

- Listing: None

Economic calendar (AEDT):

- 11:15 am: RBA Lowe Speech

- 6:00 pm: UK Inflation

- 12:30 am: US Retail Sales

Today's Morning Wrap was written by Kerry Sun.

5 topics

1 contributor mentioned