US recession risk jumps to 47.5%

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500: - 0.93%

- NASDAQ: -1.87%

- CBOE VIX - 23.11 (-3.22%)

- FTSE 100: +0.08

- STOXX 50: flat

- USD INDEX: 0.6928 (+0.04%)

- US 10YR: 2.754% (-0.97%)

- GOLD: USD1,727.44 (+0.49)

- WTI CRUDE: 95.09 (- 1.31%)

The Calendar

The Charts

The US Federal Reserve will meet this week and decide on their next interest rate move. There’s a broad expectation that Jerome Powell will hand down a further 75 basis point hike in his efforts to get inflation under control.

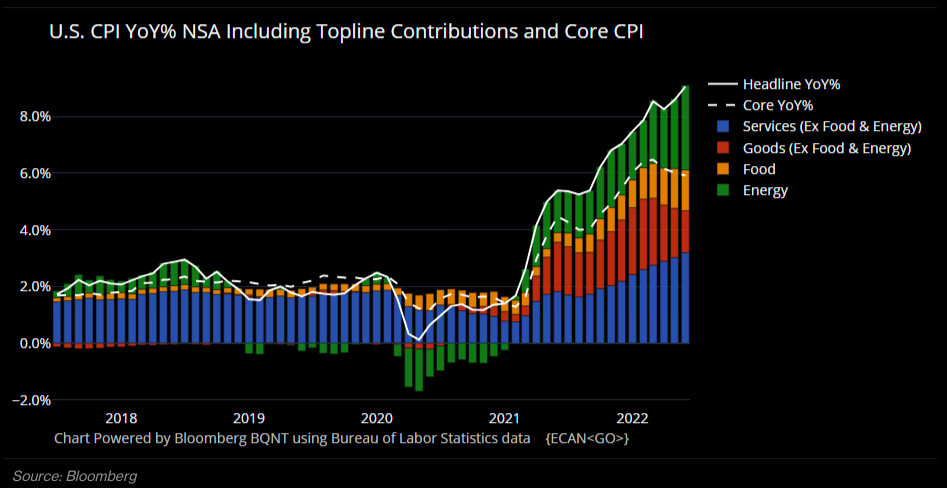

This chart shows just how aggressively inflation has risen over the past 12 months and Powell has said stabilising prices is a greater concern than pushing the Us economy into recession.

On that point a Bloomberg monthly survey of economists placed a 47.5% chance that the US will enter recession in the next 12 months. That figure is up from 30% in June when the survey was last conducted.

Perhaps they are taking their cue from the US economy, where some signs of slowing are starting to emerge. Jobless claims have hit their highest level since November with 251,000 initial unemployment claims coming in above expectations.

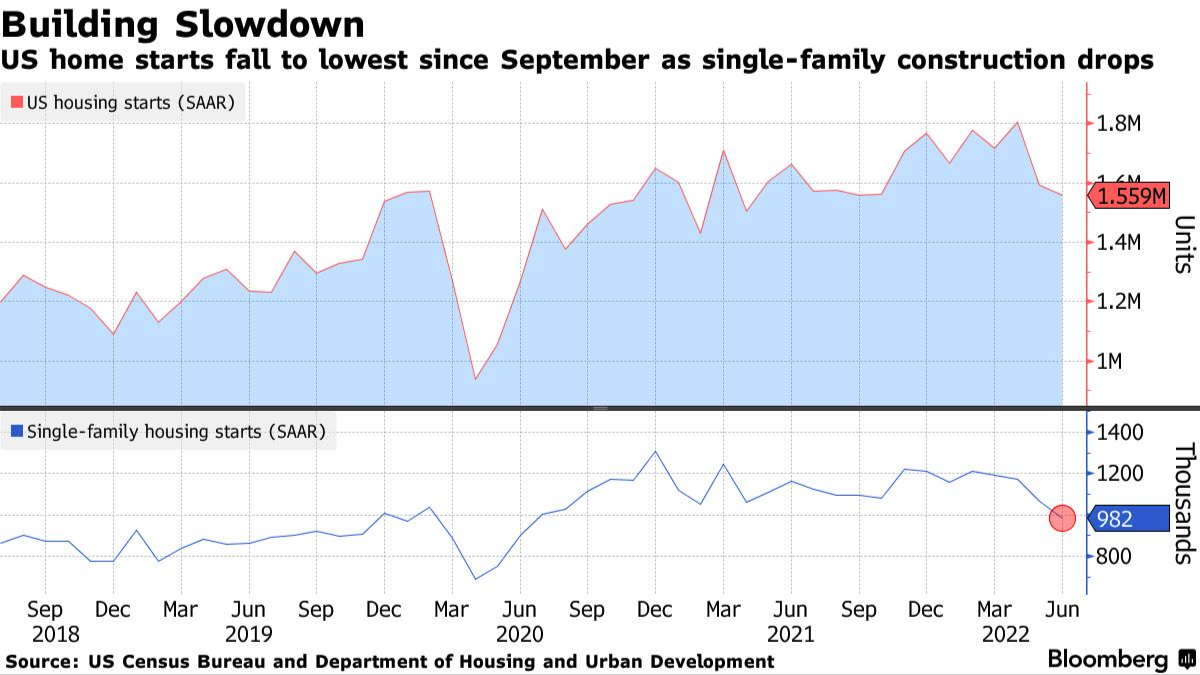

There are also some signs of cooling in the US housing market with single-family housing now falling.

Of course, all of this information is well known by the market, and it is interesting to note that the yield in the US 10-year bond is steadily declining. After peaking just shy of 3.5% in mid-June the yield dropped nearly 20%. Perhaps, investors are now looking through to the other side of the rate hiking cycle?

Related Links

Rate hikes: (VIEW LINK)

Recession survey: (VIEW LINK)

Housing market: (VIEW LINK)

Stocks to watch

If you haven’t yet had a chance to read the lead story in today’s Trending on Livewire email then I recommend you add it to the list. FNArena’s Rudi Filapek-Vandyk has suggested that we could be in Phase One of the recovery from the recent market sell-off.

That is a contentious issue and Livewire’s Ally Selby recently penned a great article looking at Signs of the bottom. The comments section is particularly telling as there remains a clear divide between those who think that markets have further to fall and those that believe the worst may be over.

.jpg)

One area, however, where there does appear to be consensus is in the universes of Real Estate Investment Trusts on the ASX.

Rudi notes that just about every sector analyst has conducted a general review of the sector over the past two months, and not one has drawn a different conclusion to most ASX-listed REITs seeming undervalued.

These are some of the key takeaways:

- Goodman Group (ASX:GMG) - lower risk, lower distributions

- Charter Hall (ASX:CHC) + Qualitas (ASX:QAL) - potentially higher returns and higher distributions

- HomeCo Healthcare & Wellness REIT (ASX:HCW), HomeCo Daily Needs REIT (ASX:HDN) and Charter Hall Retail REIT (ASX:CQR) - look well-undervalued.

Today's report was written by James Marlay

GET THE WRAP

We're trying something new around here - a daily market preview with a fun twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

2 topics

6 stocks mentioned