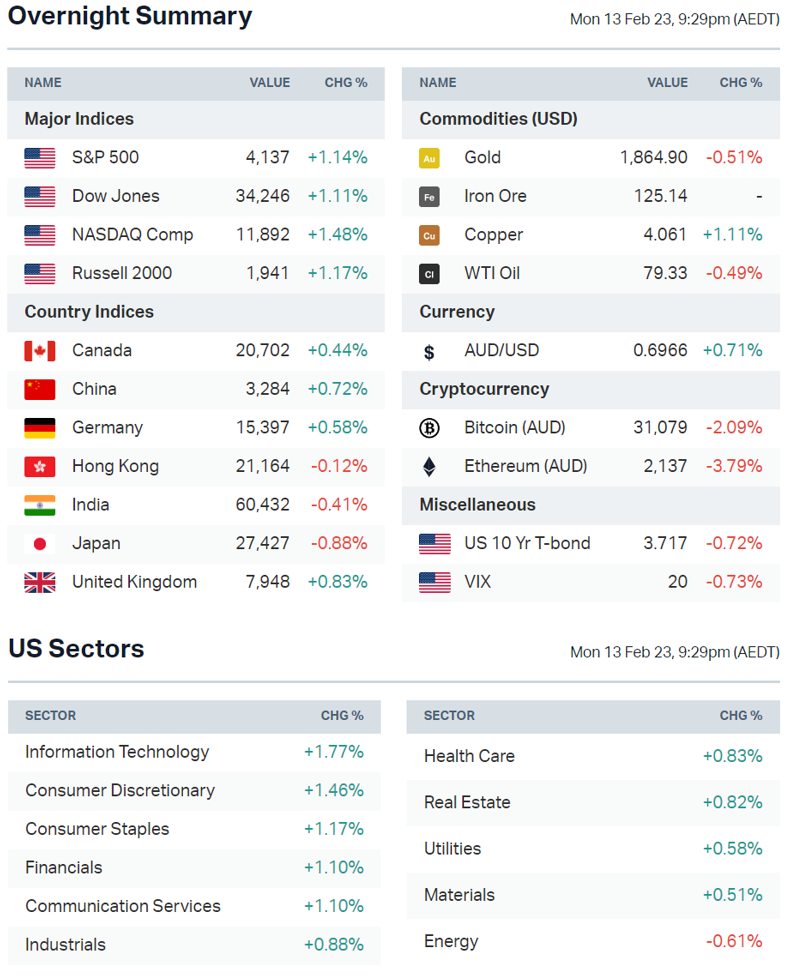

US stocks rise ahead of all-important inflation report, ASX futures higher

ASX 200 futures are trading 49 points higher, up 0.66% as of 8:20 am AEDT.

US stocks were higher in an uneventful overnight session, markets in wait-and-see mode for January CPI data out tomorrow, Meta and Twilio set for another round of layoffs, bond yields are trying to breakout of downtrends and a preview for tomorrow's inflation print.

Let's dive in.

S&P 500 Session Chart

MARKETS

- Major US benchmarks higher in an uneventful session ahead of the all-important January CPI data due tomorrow morning

- Weak Q4 earnings has analysts concerned about an earnings recession ahead (Reuters)

- Fed Governor Bowman says more rate hikes needed to bring inflation back down to 2% (Reuters)

STOCKS

- Meta is planning another round of layoffs after more than 11,000 employees were let go in November (FT)

- Ford to collaborate with a Chinese firm on a $3.5bn EV battery plant (CNBC)

- Twilio to layoff 17% of its workforce after cutting 11% in September (Bloomberg)

- Tesla shareholder Gerber plans to run for the Tesla Board (Bloomberg)

ECONOMY

- Deflationary path may not be a straight path down (Axios)

- Eurozone inflation seen lingering above ECB target until 2025 (Bloomberg)

- UK firms plan biggest pay rises since 2012 due to staffing shortages (Reuters)

- UK wage and inflation data set to fuel further BoE hikes (Bloomberg)

Deeper Dive

Talking Technicals: Bond yields

The US 10-year Treasury yield has rallied 38 bps from February lows and trying to break its downtrend line as Fed policymakers see rates staying higher for longer as well as tight labour market numbers.

Yields tumbled in January, in parallel with the the massive bounce for equity markets. So what happens when it starts teasing at a breakout?

ASX Sectors to Watch

It was a little bit of an opposite day (compared to Monday) on Wall Street. Risk and growth-y sectors like Tech and Discretionary led to the upside while Energy was the only sector that finished in negative territory (+3.9% yesterday).

Our ETF list was mixed. Sectors like Cloud, Jets, Steel, Copper and Rare Earths all broadly topped out in late January. They all bounced 1-2% overnight, representing one of the first meaningful green days since recent highs.

Overall, the narrative today will be centered around how markets are in wait-and-see mode ahead of the all-important US inflation print. Is that a light at the end of the inflation tunnel or a freight train?

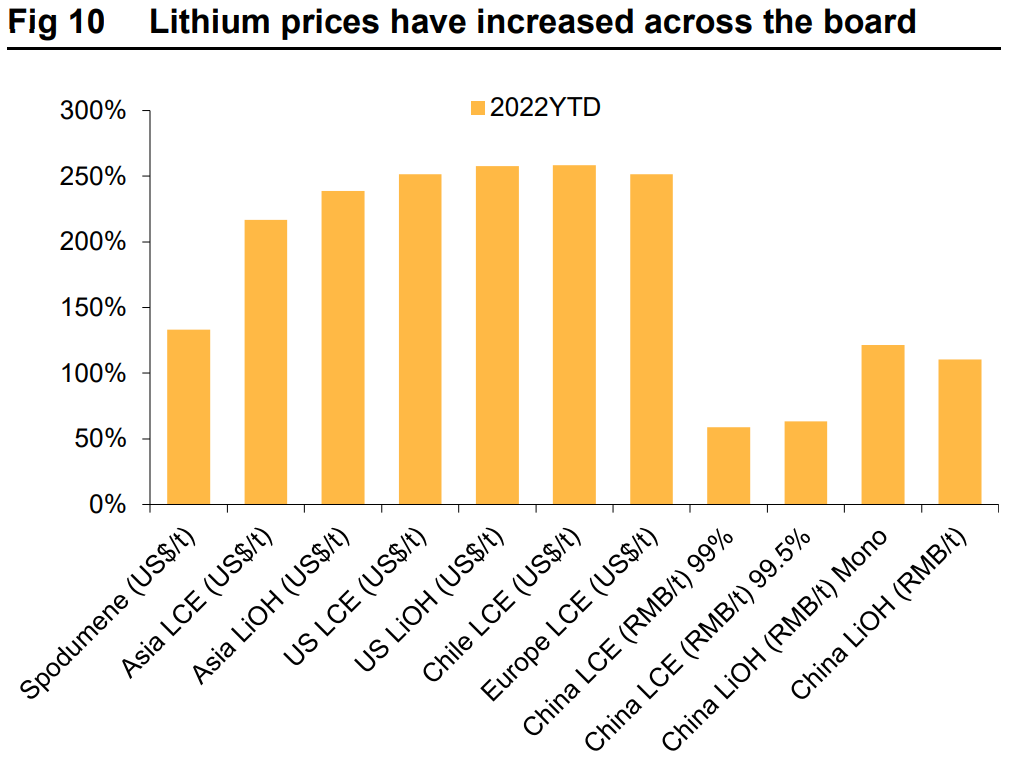

Macro: US inflation revisions

The US inflation print on Thursday early morning AEDT will be the key focus for global markets this week. Prices probably climbed again last month, just as the Bureau of Labor Statistics reveals inflation actually increased (rather than decreased) in December.

- CPI actually rose 0.1% in December (seasonally adjusted basis) from November versus the instant read of a 0.1% decline

- Economists are expecting a 0.5% month-on-month rise in headline inflation during January

- Core inflation is expected to rise 0.4%, its second increase in a row

- If the core inflation forecast is borne out, it would take the year-on-year figure to around 5.5% (still nearly triple the central bank’s target)

All survey data provided by Bloomberg, who regularly surveys tens of economists on Wall Street for their thoughts on where economic data is tracking.

And in related news that won’t be great for the Biden administration, a Gallup poll released Wednesday showed 50% of respondents describing their personal financial situations as worse than a year ago — the highest share since 2009. That’s not great news for a President who needs more to go right if he wants a shot at winning a second full term.

Looking back at how the S&P 500 performed on inflation print days in 2022:

- -1.16% was the average move when inflation was hotter-than-expected (8 times)

- +0.78% when it was in-line with expectations (2 times)

- +3.84% when it was cooler-than-expected (2 times)

Broker Watch

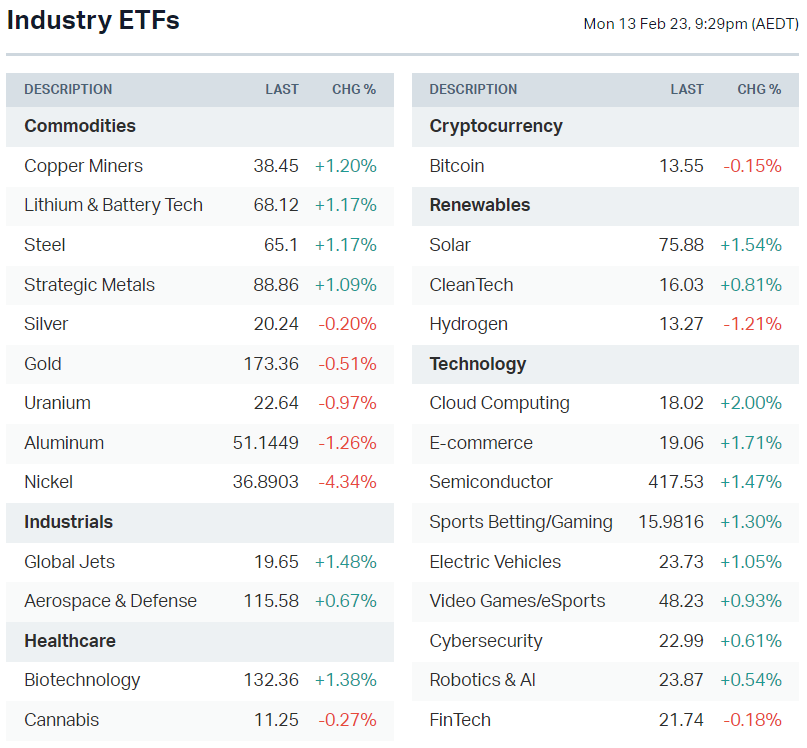

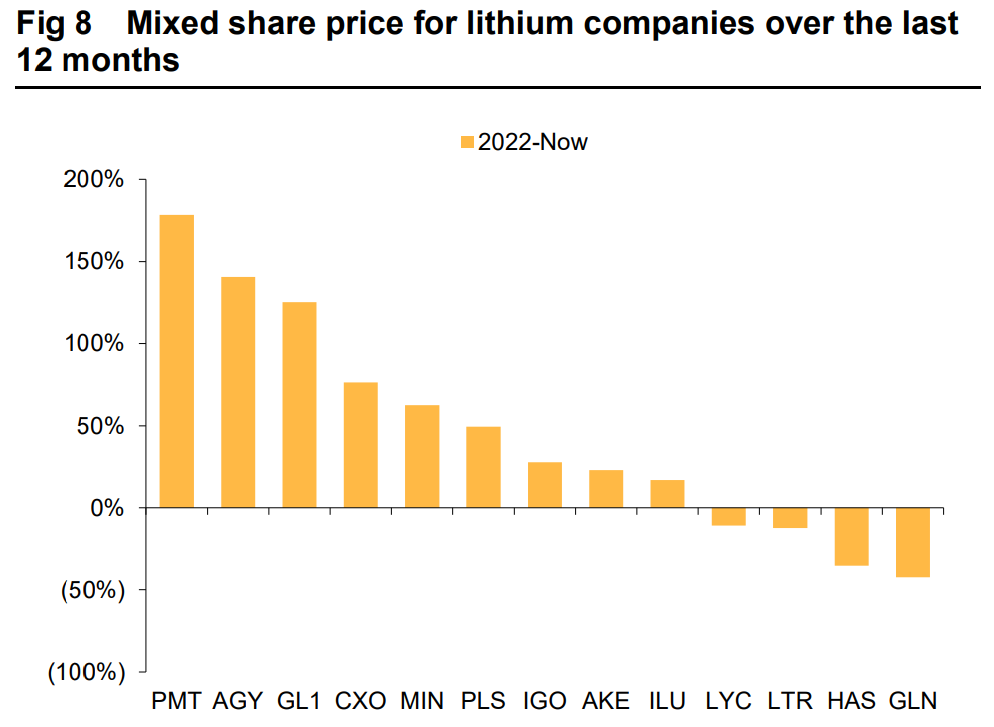

Macquarie is out with its earnings season preview for the lithium miners. Despite being at the relatively lofty end of the lithium forecast game, its previews for the actual miners’ earnings themselves are rather soft. Here’s the breakdown:

- Mineral Resources (ASX: MIN)’s earnings consensus for 1HFY23 has a wide range, and Macquarie is at the low-end of the brokers with a forecast profit of $448 million. The analysts consensus is well over $600 million.

- Pilbara Minerals (ASX: PLS) earnings forecast is for $1.21 billion, essentially in line with the consensus forecast.

- Allkem (ASX: AKE) is also at the low-end of consensus forecasts, tracking at $223 million.

- Iluka (ASX: ILU) is the only company with a better-than-consensus forecast. The broker expects its earnings to be $321 million, higher than the $252 million consensus.

- Note: IGO and Lynas already released their earnings in late January. The latter of which has been covered by Glenn Freeman at Livewire Market

Mixed fortunes: Spodumene prices more than doubled last year but it’s not always flown through to the lithium miners’ share prices.

Source: Macquarie Research

Quick Bites

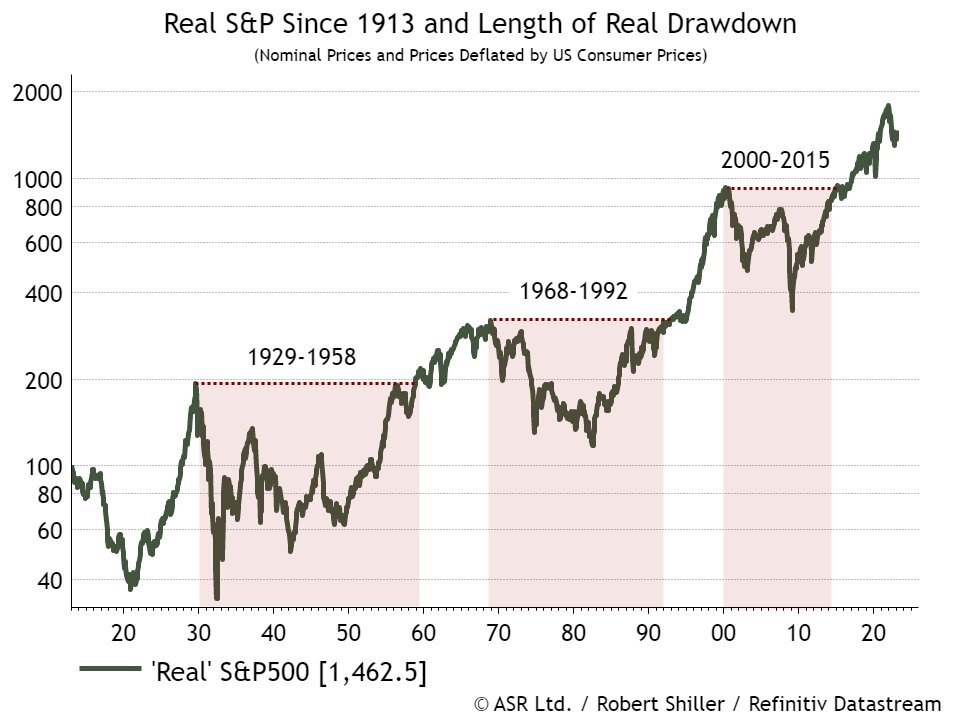

Real S&P 500 returns: During periods of high inflation, real S&P 500 returns took over a decade to break above previous highs.

.jpeg)

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Suncorp (SUN) – $0.33, QV Equities (QVE) – $0.013

- Dividends paid: Charter Hall Long Wale REIT (CLW) – $0.07,

- Listing: None

Economic calendar (AEDT):

- 10:30 am: Australia Consumer Confidence

- 11:30 am: Australia Business Confidence

- 6:00 pm: UK Unemployment Rate

- 12:30 am: US Inflation Rate

Today's Morning Wrap was written by Kerry Sun and Hans Lee.

2 contributors mentioned