US Stocks Vulnerable to Tax-Loss Selling

The US tax year is ruled off at the end of December. Typically, there is tax loss selling in US stocks in the lead up to the end of the year, followed by a relief to selling pressure once the new year arrives. Obviously, there are more losses to take in a bear market year.

In this short note, we reprise our earlier article on Which stocks are most at risk of tax-loss selling? for the Australian market, as of early June, going into the Australian tax year end.

For the detail of the method, see that earlier article, where it is explained in detail.

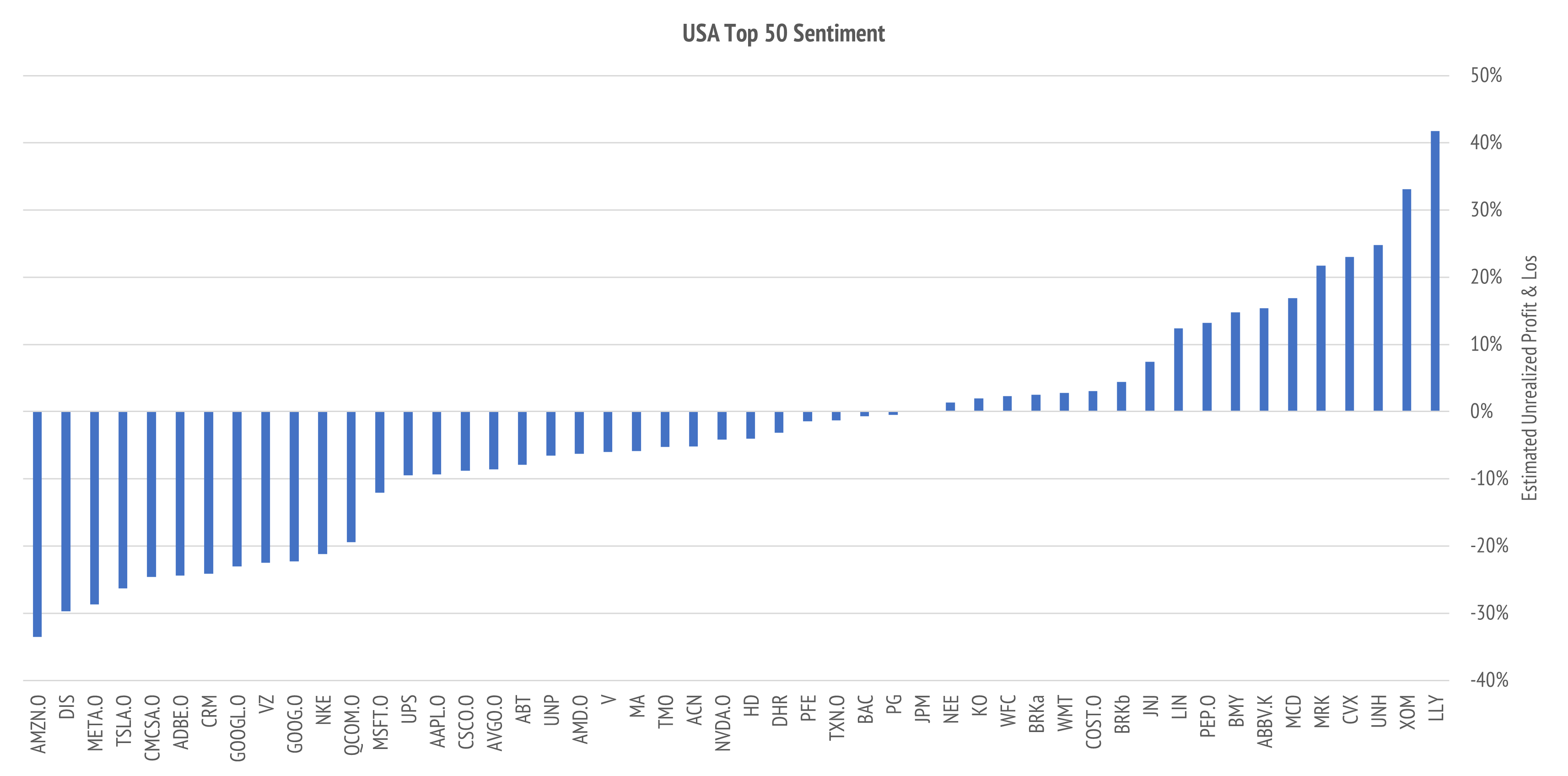

Estimated tax losses for the top 50 US stocks by market capitalization

Coming out of the recent US earnings season, our goal is to estimate which stocks have built up the largest overhang of possible tax loss selling going into the year end. The results of our study are shown at Exhibit 1. Note that we have included different lines for firms with multiple share classes, since the underlying liquidity may differ. Alphabet has two classes GOOG.O and GOOGL.O, while Berkshire Hathaway also has two classes BRKa and BRKb. These are Reuters codes, so that stocks with the suffix "O" are NASDAQ listed, while the others are NYSE listed.

A few general comments may help set the scene.

Firstly, stocks appearing to the right are significantly in profit, likely to enjoy positive investor sentiment, and unlikely to be targets for tax-loss selling. The top three positive sentiment stocks are Eli Lilly LLY, Exxon XOM, and United Health UNH. As a general comment, the pharmaceuticals, healthcare and energy sectors dominant positive sentiment

Secondly, stocks in the middle zone are around break even. This is an area to watch out for possible reversals of sentiment. We will mention two examples later, in the financials, and within semiconductors. These look to be delicately poised at the present time.

Finally, the mega-cap technology stocks and communication services dominate in the area of large unrealized losses. These are the prime candidates for tax-loss selling through year end. The worst three stocks are Amazon AMZN.O, Disney DIS, and Meta META.O.

Top Three Positive Sentiment Stocks

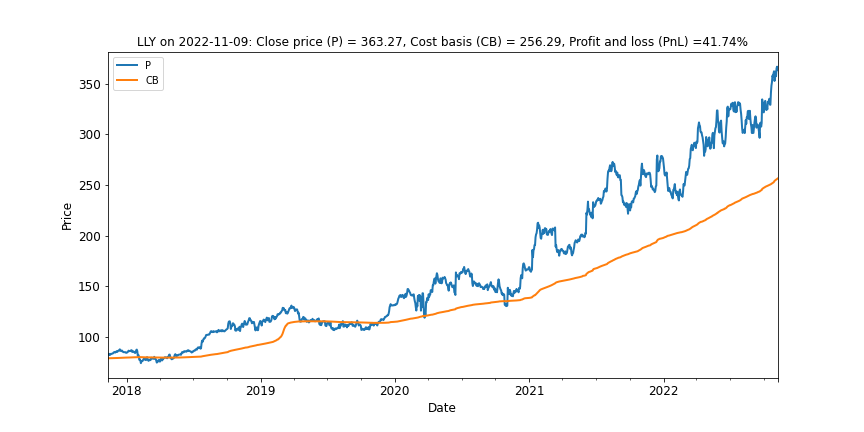

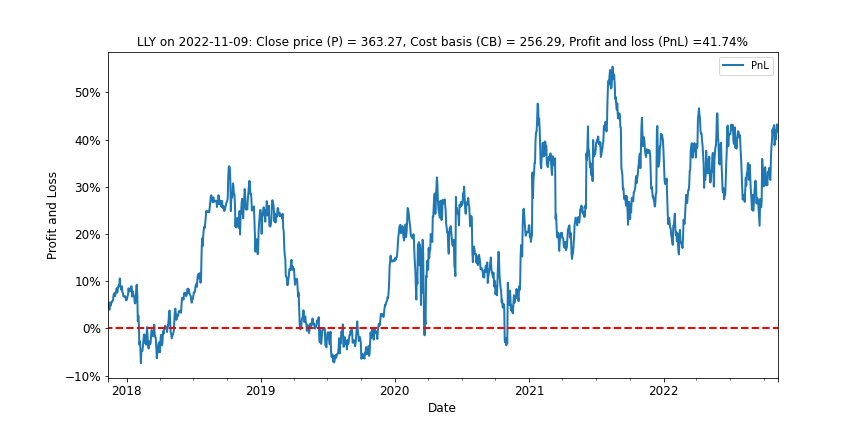

Eli Lilly LLY has been the stand-out large-cap US safe-haven in this bear market. There is little sign of any deterioration in the current positive sentiment.

The profit and loss chart remains very positive.

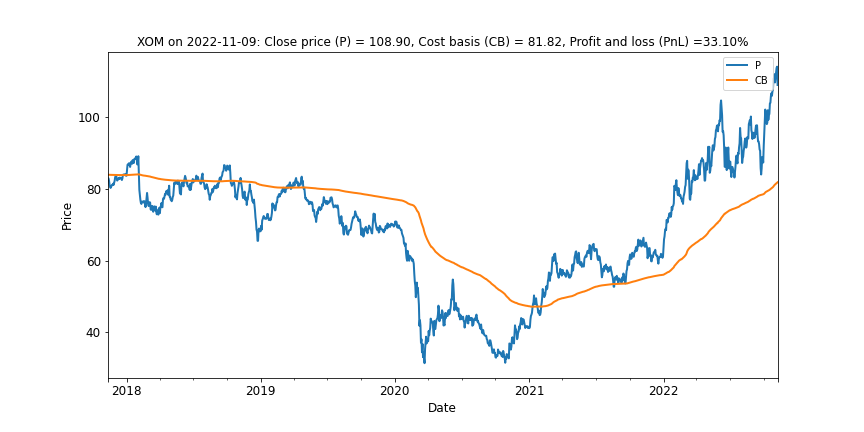

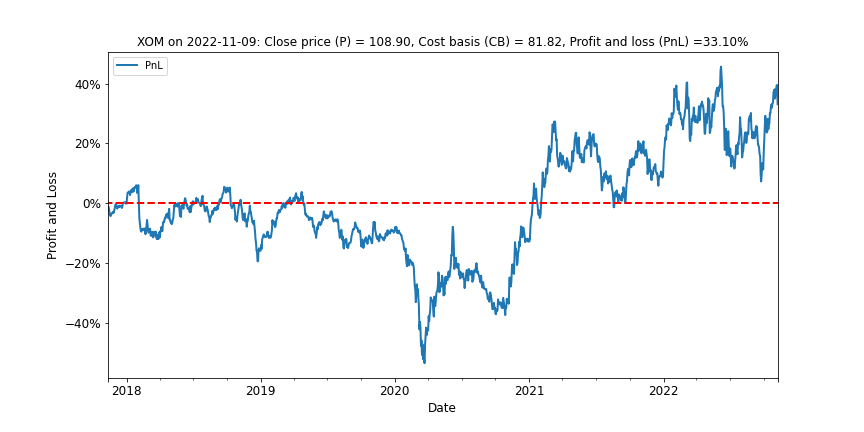

Exxon XOM has an outstanding bear market.

The unrealized profit buffer is still expanding.

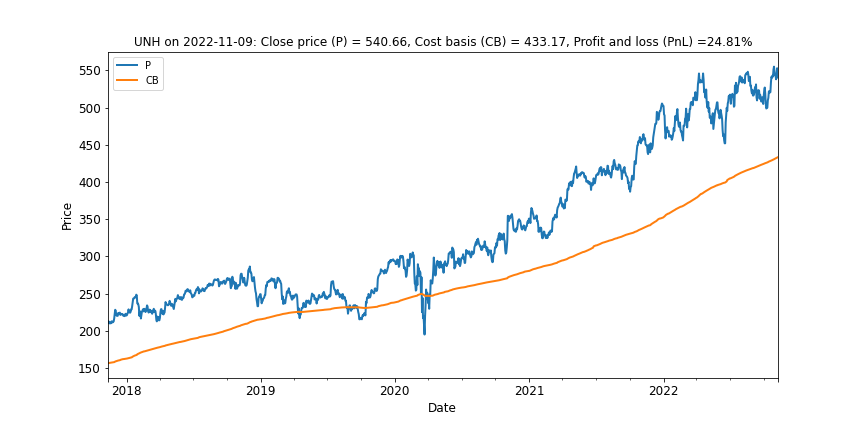

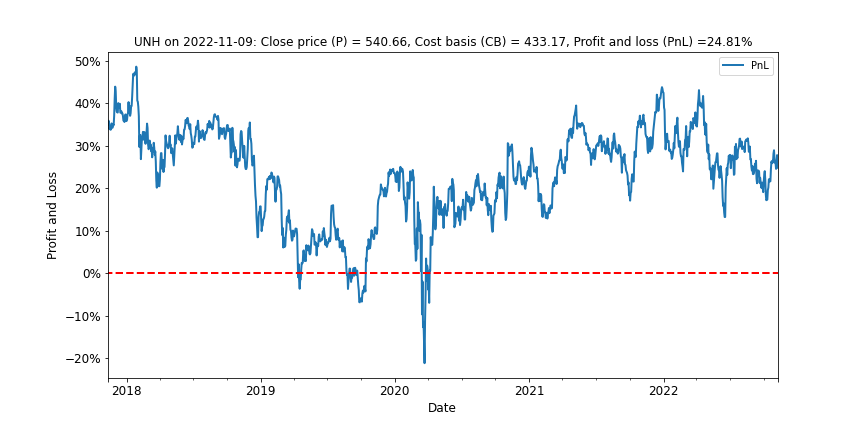

United Health UNH has been a very consistent defensive name through thick and thin.

The bullish sentiment is well-supported in the trend of unrealized profit.

Bottom Three Negative Sentiment Stocks

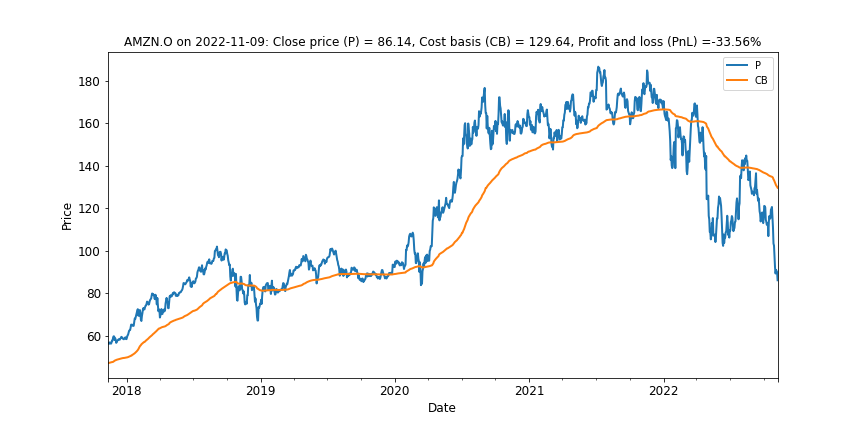

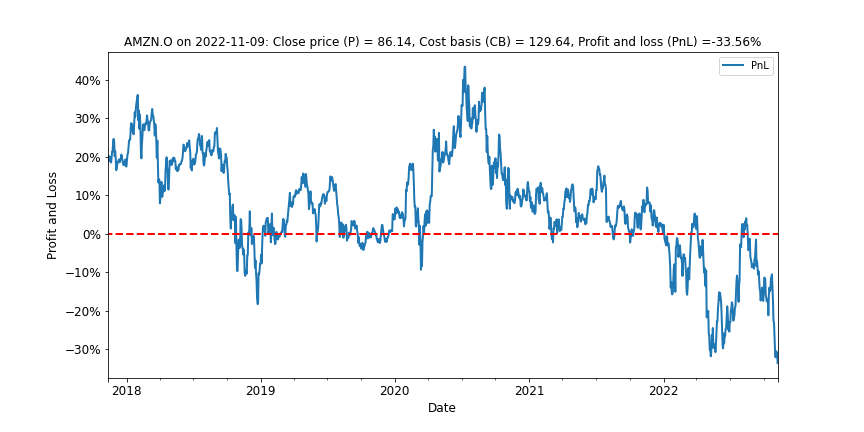

Amazon AMZN.O has been the stand-out large-cap US disappointment in this bear market, having given up over one trillion dollars of market value. Management guided lower in the recent earnings call, which led to a further sell-off. US retail has struggled with growing inventories, and Amazon has excess warehouse capacity.

The unrealized losses in Amazon have been worsening in recent weeks as the down trend resumed after a bracing rally from the mid-year lows. The market seems of have gotten overenthusiastic about the former guidance for a good September quarter.

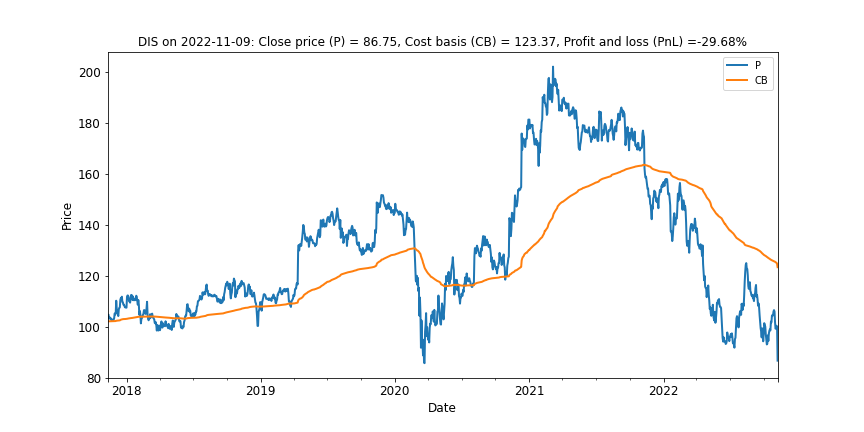

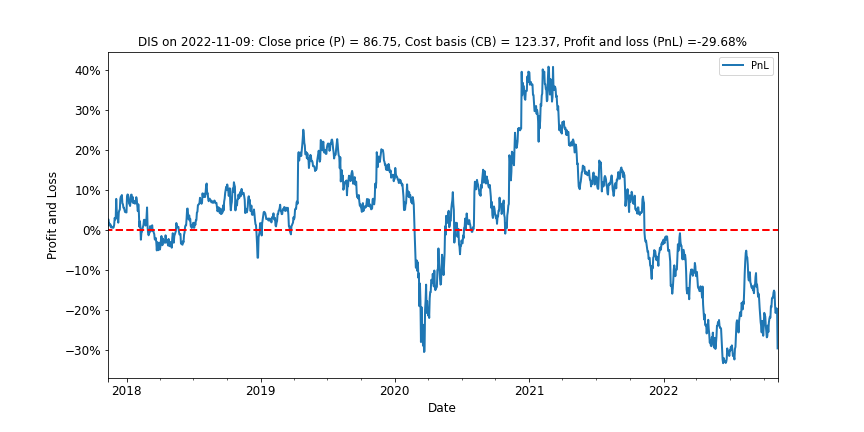

Disney DIS has recently resumed its downtrend trend and looks set to be among stocks with substantial end of year tax losses to take.

The unrealized losses did close up some after the mid-year rally but have since begun to worsen as the market began to price in a deteriorating outlook and negative currency translation effects for offshore earnings.

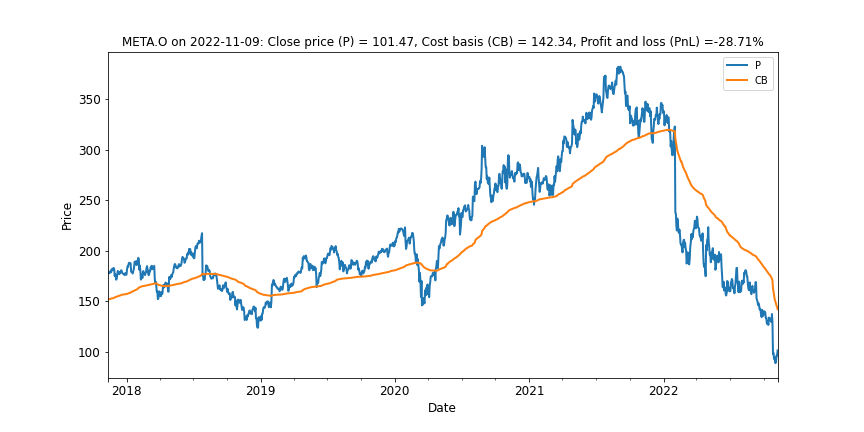

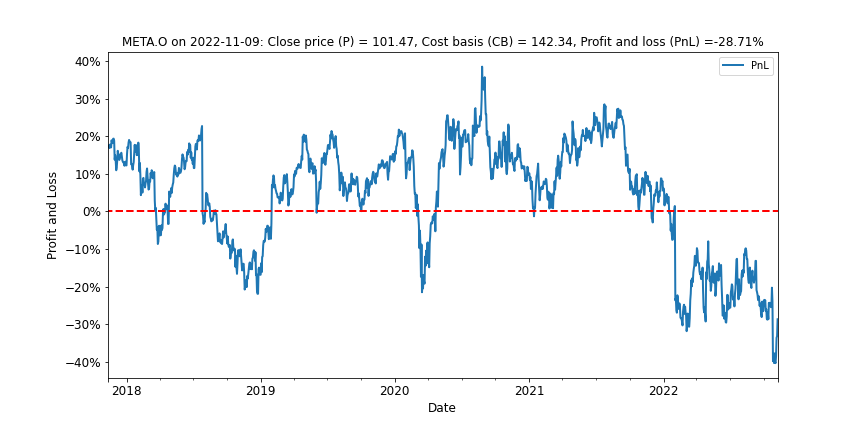

Meta META.O can do no right in its journey beyond this reality into the metaverse.

The worsening state of unrealized losses suggest that Meta will figure prominently in tax loss selling as investors seek to improve tax outcomes going into the year end.

Stocks in a finely balanced state of neutral sentiment

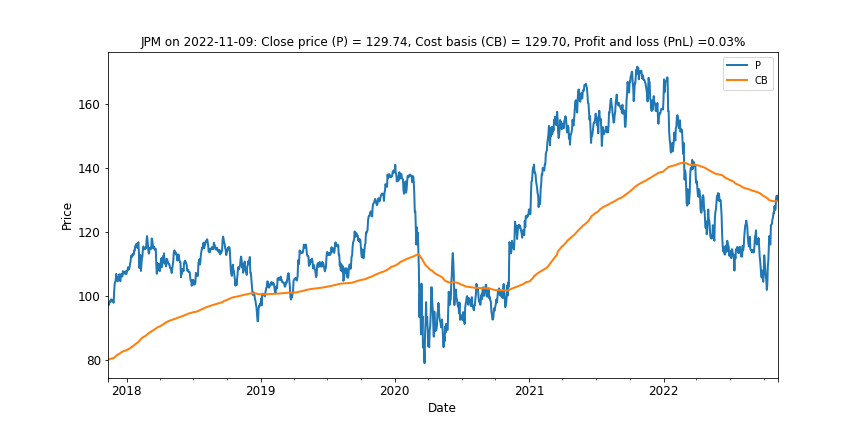

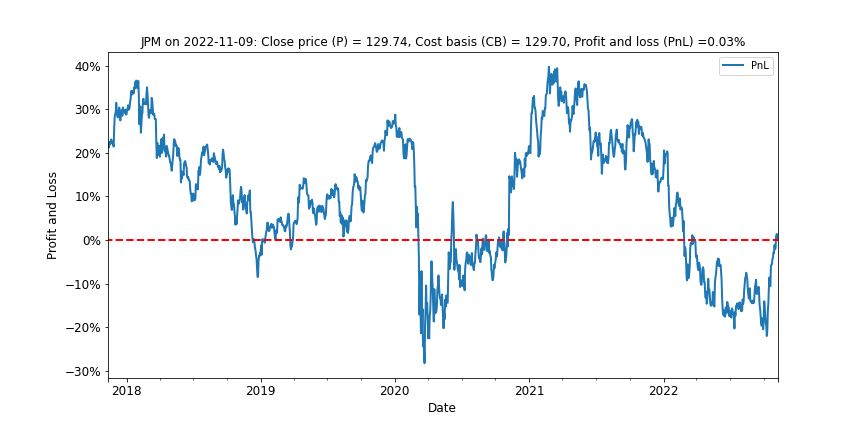

JP Morgan JPM was in a deep drawdown for most investors until the last week. This is a delicate time for US financials. Rising interest rates have improved margin in some lines of business, and credit card losses are not too bad. However, rising fixed rate mortgages will eventually pressure consumers and reduce new lending. It is a delicate time for banks.

The earlier draw-down was not very deep at around -20% loss. The situation is worth monitoring as there is some chance the Fed will begin to fade interest rate hikes.

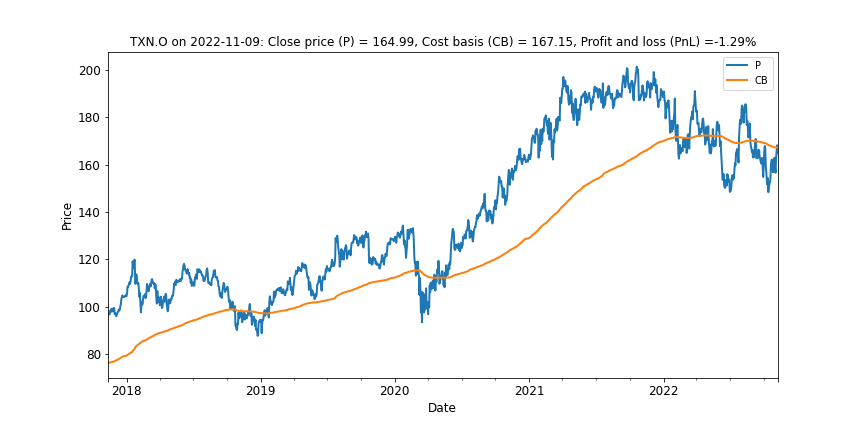

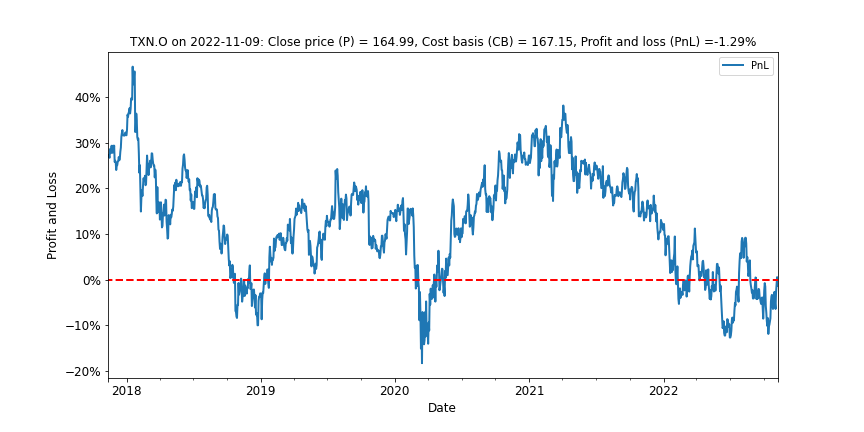

Texas Instruments TXN has performed well versus the broader semiconductor market due to the strength of automaker demand. Their chips are used in a wide variety of devices and are generally lower unit price items than are microprocessors and GPU graphics chips.

Texas Instruments looks to be having a good bear market with little portent of tax loss selling to come in December. The main factor to watch out for is any deterioration in auto demand.

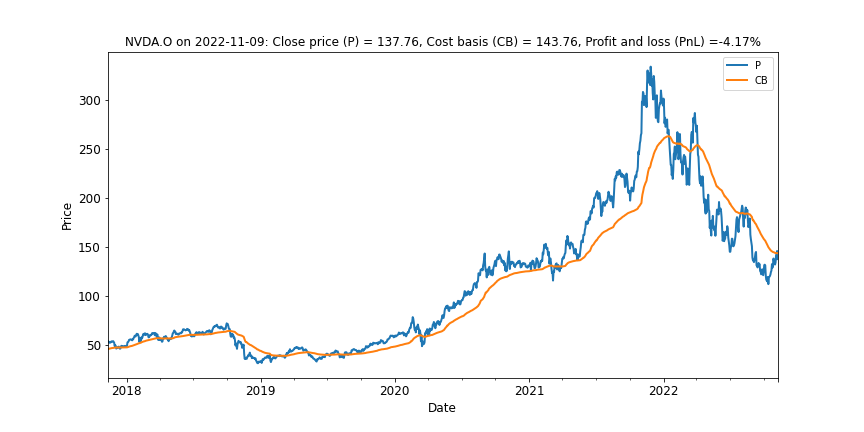

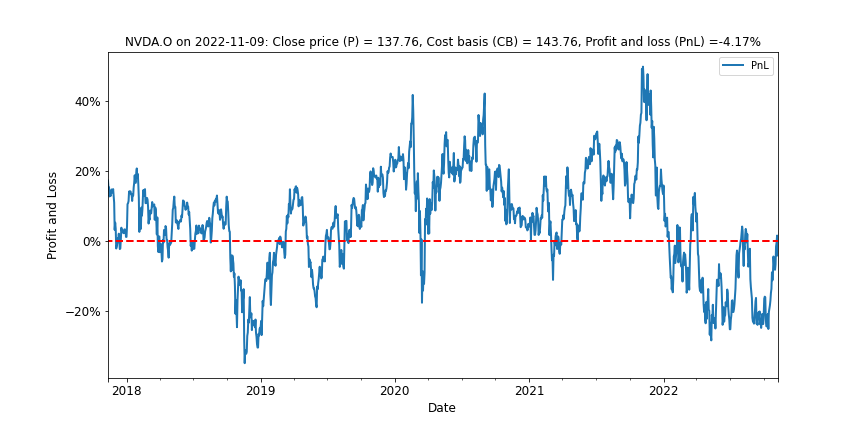

Nvidia NVDA.O is trading very near break-even, having touched that level briefly and then fallen back below. They are due to report next week, against a backdrop of reduced gamer demand for high-end graphics chips. The bright spot for Nvidia has been demand for premium GPUs used in deep learning, and other Artificial Intelligence applications.

Presently, there is no great overhang in the unrealized profit and loss. The risk for Nvidia centers on their forthcoming earnings report on 16-Nov-22. The impact of a slowdown in digital advertising may have reduced demand for GPU chips in the cloud. However, the company also has new product launches to come, and inventories to manage. There is considerable uncertainty on how these countervailing factors will play out.

Conclusion

Although Australian investors are accustomed to think of tax-loss selling as a mid-year effect, it is an end-of-year consideration for investors in North America.

The analysis of average cost basis cannot, by itself, inform us of the future direction that any particular share price may take. However, it does speak directly to current sentiment, and it can alert us to forward risks, such as the potential for tax loss selling in December.

The sectors at most risk for tax loss selling appear to be technology and communication services. The sectors at lowest risk appear to energy and healthcare.

In the middle, we find a number of financials that are delicately poised, and vulnerable to any further market shocks on inflation, interest rates and unemployment.

Those investors who take advantage of the tax-loss selling season can always wait before redeploying capital. This may be prudent given the uncertain global situation.

In relation to your own personal tax affairs, be sure to consult with a registered tax advisor concerning your own unique tax position.

Tax laws are complex, and your trading actions will alter your likely taxable income.

All pricing data is as at market close in the USA on 9-Nov-2022. Source: Refinitiv.

Photo by Kelly Sikkema on Unsplash

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

5 topics

9 stocks mentioned