Vale David Swensen - Lessons from a pioneer of Endowment investing

Legendary but perhaps lesser-known investor David Swensen passed away earlier this month. Mr Swensen had been the CIO of the Yale University Endowment since 1985 – so over 35 years – and is credited with inventing an entirely different way of investing for institutions and specifically for Endowments.

During his tenure the Endowment at Yale grew from $1bn to over $30bn, with the value creation during this period over $45bn if all distributions paid to the University are included.

These returns far outstripped that of all other Universities and most institutional funds, many of whom were managing their portfolios on a more traditional 60/40 (equity/bonds) investment approach. Over time, many of these institutions attempted to replicate the Yale model, with varying levels of success.

Just as important as the total return generation of the Fund has been the provision of funding for the University across a variety of market environments. This funding has become increasingly critical to the University’s growth and success as the Endowment now provides one-third of the entire Yale University operating budget (as per 2020) which is a significant increase from 10% in 1985. This achievement is all the more remarkable given the massive growth in operating budgets and tuition fees in addition to the fact that the Endowment now provides financial aid for more than half of Yale’s students.

What can be learned from Swensen’s Endowment model of investing?

In many respects, investing for an Endowment has many similarities to investing in retirement. In retirement, the investment objectives are often about providing a secure income (funding housing and food, not Yale undergrads), yet also preserving and growing capital for the future.

These are very different objectives to investing in Accumulation, where simple wealth maximization – regardless of volatility or income - is often the singular purpose.

I first read David Swensen’s investment classic “Pioneering Portfolio Management” over a decade ago, little knowing at the time how relevant many of the chapters would be. At Wheelhouse we recently added a new Endowment client from my alma mater, the University of Queensland.

After re-reading Mr Swensen’s book in recent weeks, these were the three most important lessons learned for me:

- Asset Allocation

Asset allocation is the singular most important decision an investor can make, often attributing for 90-100% of typical investment returns. These decisions have proven to be far more important than manager or stock selection, or attempting to time market returns, with these ‘skillsets’ often proving to be value destructive over the long-run after taxes and trading costs are included.

Critical in the asset allocation decision is providing genuine diversification across a variety of differentiated return drivers. For example, one of the most dominant factors driving both stocks and bonds over the longer-term is the movement in interest rates, particularly secular shifts in rates. When interest rates decline, typically bonds and stocks rise. Conversely when rates rise, bonds and stocks should fall.

Due to this correlation, Swensen avoided large holdings of fixed income in particular, but also direct shareholdings. Yale’s direct US equity exposure was 2.3% in 2020, a massive outlier versus most institutional portfolios.

2. Alternatives

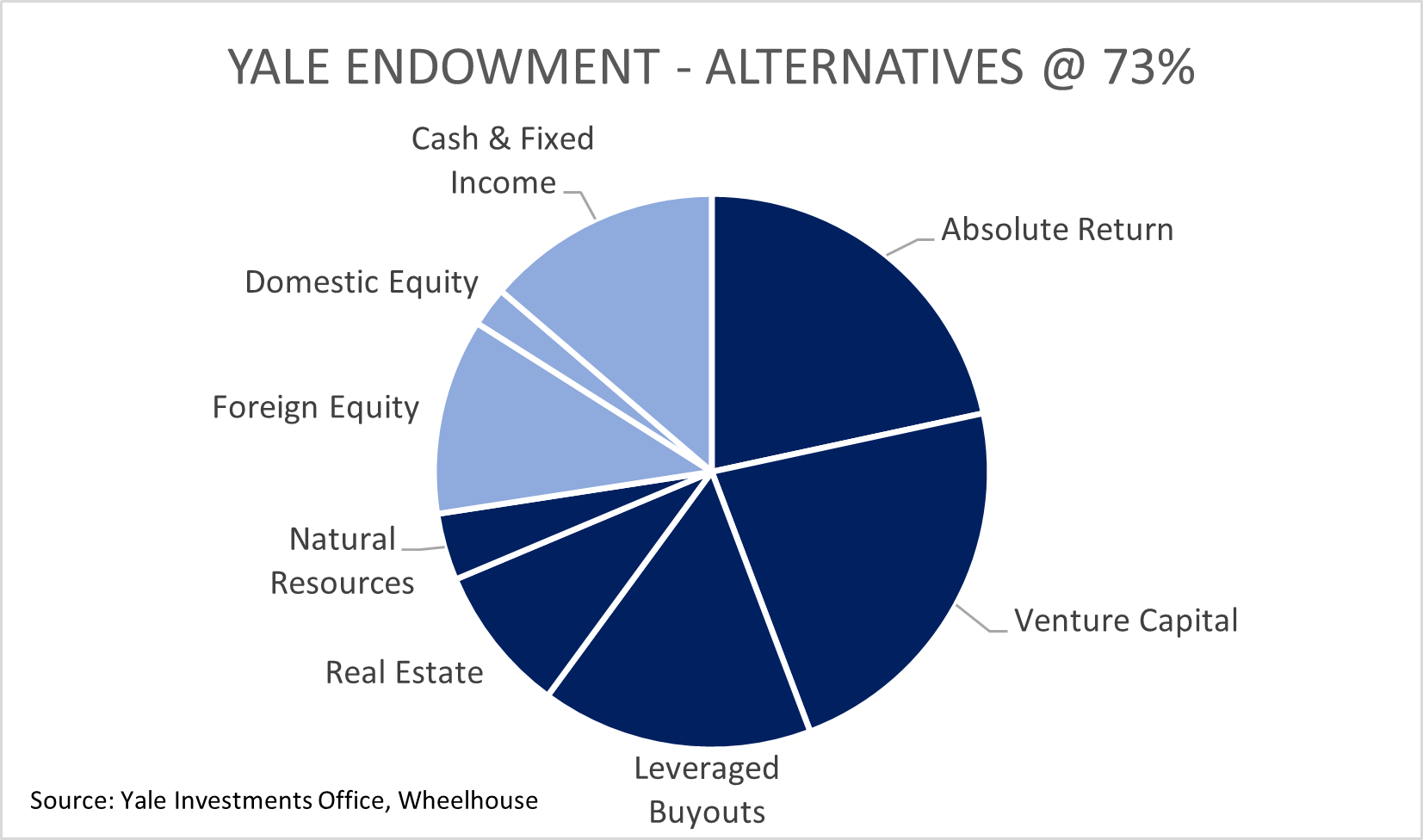

Alternatives dominate the portfolio, regularly accounting for nearly three-quarters of total Endowment assets. Most of this exposure was invested in Absolute Return strategies, Private Equity or Real Estate investments, with an overwhelming equity bias across all of these asset classes (as opposed to debt-based alternative strategies).

The large exposure of the Yale Endowment to Alternative asset classes versus more traditional equities and debt is represented below.

Swensen recognised that the only way to deliver on his dual objectives of maintaining regular funding for the university, and preserving and growing the capital base, was to have an overall equity bias within the portfolio (due to the higher expected returns of equity vs all other asset classes). However, the benefit of using Alternative strategies as opposed to owning pure equities, was to significantly diversify the underlying common return factors present in a traditional long-only equity portfolio.

For example, equity long-short, equity derivative-based strategies, or event-driven strategies all make use of different sources of return, reducing the correlation to a singular dominant equity factor such as corporate profits or interest rates.

3. Less liquid assets

Many of the asset classes invested in were far less liquid than the marketable securities held within traditional asset classes, such as stocks and bonds.

Swensen recognised that many investors were unwilling to lock up capital for multi-year periods, and as a result these investments often benefitted from an illiquidity premium which enhanced prospective returns. In an Endowment, the time horizon is genuinely infinite, meaning liquidity and access to capital can be less of an issue.

We believe this is where investing for an Endowment differs markedly from investing in Retirement. Typically, investing in Retirement requires a consideration that time-frames are shorter, and that access to capital (particularly during a crisis such as a medical emergency) can be extremely valuable. This is an important difference.

Legacy

There are a huge number of other learnings for the investment industry from David’s Swensen’s 35-year tenure at Yale. Perhaps one of his most enduring is the understanding and recognition of the unique investment objectives for an Endowment, and the need to design an investment strategy that balances the critical need for distributable cashflow or income, with the equally critical need for capital values to be preserved and grow above the rate of inflation.

Testament to his impact on the profession are the legions of Yale cadres who now manage institutional endowments globally, many of whom adopt very similar investment approaches to Yale. Andrew Golden, who runs the Princeton University endowment is quoted as saying;

“Ninety percent of good ideas on how to organize the office and develop a culture, I’ve stolen from Yale”.

Likewise, while it has been over ten years since I read Mr Swensen’s book on portfolio management, at Wheelhouse we are also perhaps a little guilty of some misappropriation of these underlying principles. Equity-like returns, delivered through alternative strategies that reduce risk, and often with absolute return characteristics.

These are the lessons that resonate with us. Vale Mr Swensen.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics