Value, growth and dividends. Finding the best big cap opportunities

Ahead of the upcoming Pinnacle 2020 Virtual Summit, we asked three Australian Large Cap equities managers to share a chart from their presentation and explain its importance.

For Firetrail Investment’s Blake Henricks it’s all about identifying opportunities as market short-termism makes holding to fundamental investment principles more important than ever. Plato Investment Management’s Dr Don Hamson makes the case for the future health of dividend income, identifying the sectors most affected and where the next dividend bonanza will come from. Finally, Solaris Investment Management’s Michael Bell expects a moderation in the performance of Growth companies but still sees many opportunities for outperformance within the sector. With yields on cash products at historical lows and an index full of dividend traps, the case for active management has never been stronger.

New normal, old fundamentals: Why fear & greed still create opportunity

Blake Henricks, Deputy MD and Portfolio Manager, Firetrail Investments

COVID-19 has created uncertainty and change across the investment landscape. Existing trends such as lower rates and the shift to an online economy have accelerated. Some are questioning when, if ever, people will travel again. For landlords the question is whether WFH (Working from Home) becomes TNN (The New Normal).

But what hasn’t changed are the fundamental principles of the long-term investor. Firstly, every company has a price. A company is worth the present value of its future cashflows. What you pay for a company today is the most important variable as to whether your purchase is a good investment in the future. Secondly, fear and greed create opportunities.

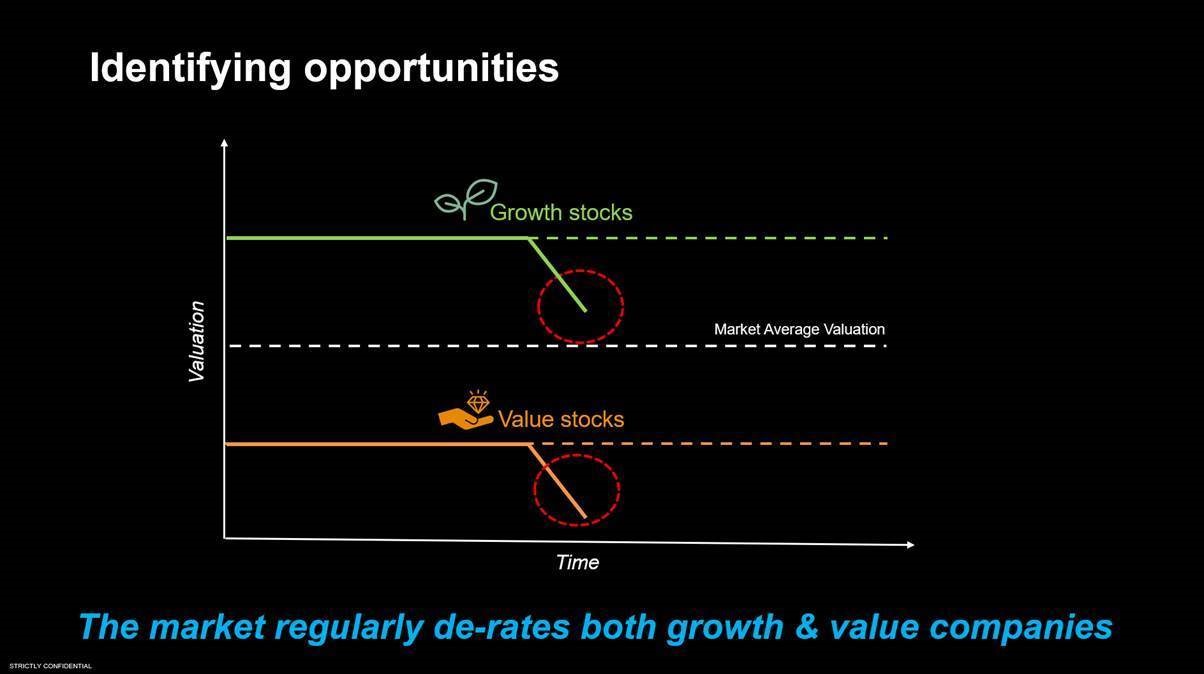

There are countless examples through history where fear or greed have ruled the day in markets. For the fundamental investor, human psychology and short-termism can create long-term opportunities.

The slide we want to share ahead of the Pinnacle Summit reinforces an outcome of these fundamental principles many seem to be forgetting. That is, growth and value companies are occasionally sold down to very attractive levels due to near term headwinds. For a high conviction fundamental investor, short-termism remains our friend. Please register to watch my Summit presentation, in which I’ll be discussing Firetrail’s approach to identifying opportunities and two of our best investment ideas (value and growth) in the Firetrail Australian High Conviction Fund today.

Click on the image to enlarge

Dividends are dead, long live dividends!

Dr Don Hamson, Managing Director, Plato Investment Management

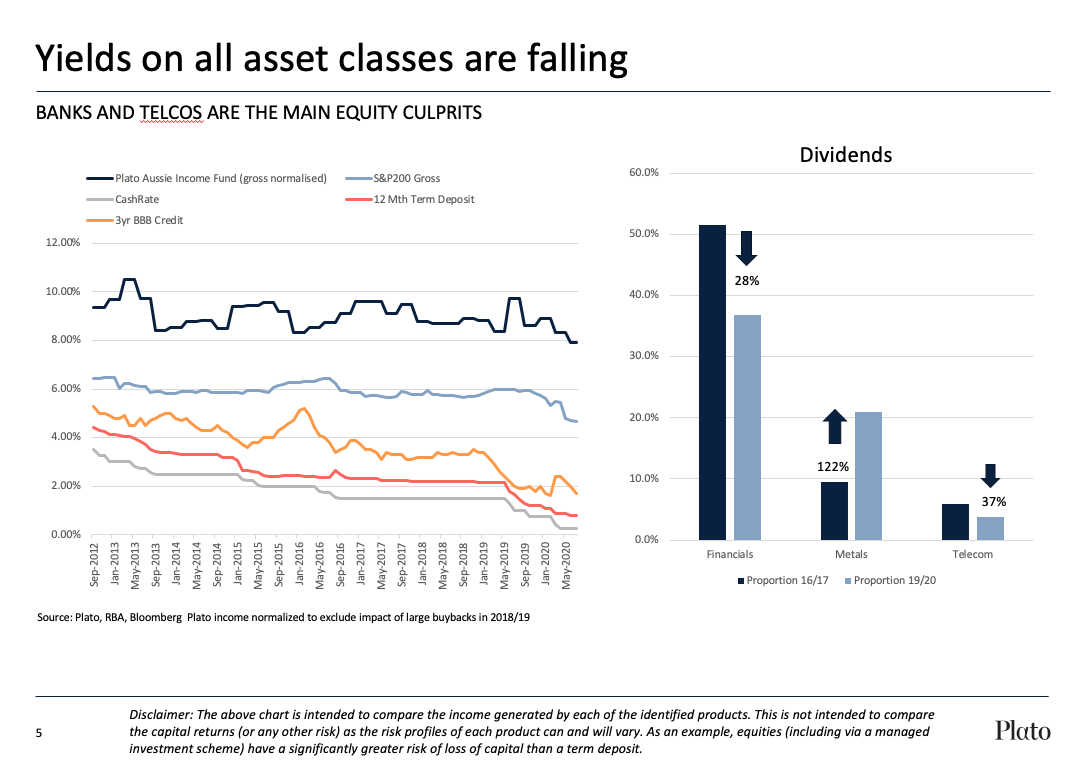

For income investors, the times they are a-changing and we feel this slide highlights some crucial implications for income investors. Investment yields have fallen rapidly across various asset classes. Cash rates are plumbing historic lows, bringing down the yields of all interest rate investments with them. This highlights the income dilemma for retirees. Australian equity yields have also fallen but are still substantially higher than yields on safer interest-bearing assets.

Click on the image to enlarge

When we look into where the largest falls in dividends have been, the major culprits have been financials and telecommunication stocks. For a number of decades, investors, particularly retirees have relied on Australia’s ‘traditional’ dividend payers, the major banks and Telstra, to pay the bills. The data shows the proportion of market dividends coming from the Finance sector are down 28% in 2019/20 versus 2016/17. The Telecom sector is down 37% over the same period.

But looking to Metals, we’ve witnessed a new dividend bonanza – up 122% in the same period. Today (and likely the next 12 months at least) iron ore miners are the new banks and there are also sustainable dividend payers to be found in many other sectors – consumer staples, consumer discretionary and even gold to name a few.

What does this mean for investors? Despite what you may hear from some pundits, dividend income is alive and well. However, those who sit on their hands hoping for a return to the ‘old normal’ are in for a painful period. We don’t expect bank dividends to snap back quickly, and investors will likely have an even longer wait for Telstra to increase its dividends. This highlights the importance of being active. With yields on cash products at historical lows and an index full of dividend traps, the case for active management has never been stronger.

On a tear: The rise and rise of Growth companies

Michael Bell, Joint CIO, Solaris Investment Management

It was February 2020 and only a month had passed since the S&P/ASX200 eclipsed the November 2007 high. Enter COVID-19 and what took 70 weeks for the correction to bottom in 2008/09 only took a matter of five weeks in 2020.

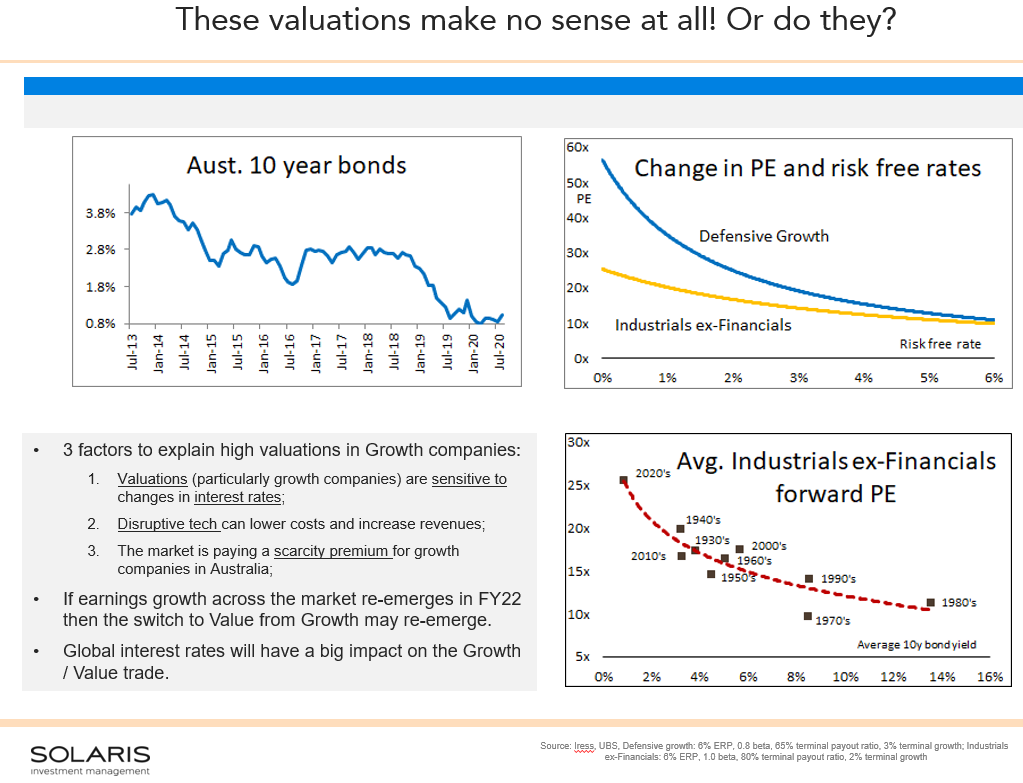

We are in a different world today. Bonds are close to 1% (2007 > 6%), and the returns on offer in all asset classes have been squeezed down materially. Governments have ensured throughout this crisis that debt markets remain open, and money is cheap. The result has been a V-shaped recovery in the share market.

Click on the image to enlarge

The top right chart shows the effect that a change in the risk-free rate has on the expected Price-earnings ratio (PE). The lower the risk-free rate, the higher the PE. Growth companies in Australia and globally have been on a tear for three reasons:

- Growth companies are more sensitive to moves in risk-free rates;

- Companies embracing disruptive technology can potentially increase revenue and reduce costs leading to higher profitability; and

- In Australia, Growth company share prices have moved even further thanks to a scarcity premium.

Growth companies have materially outperformed Value companies over most periods in the last ten years, accelerating during this crisis. Many Growth companies are trading at eye-watering valuation multiples.

Where to from here? Lower interest rates support valuations for the overall market. Pockets of the market appear significantly overvalued, particularly in some Growth companies. We expect a moderation in the performance of Growth companies as a group but still see many opportunities for outperformance within the sector. With Value companies being left behind in the rally, there are several emerging opportunities to generate outperformance.

Register for the Pinnacle 2020 Virtual Summit

In a market where herding and index hugging has become more prevalent, it can be rewarding to be different. Watch three back-to-back presentations from some of Australia’s most active and tailored Australian Large Cap equities managers during our Investment Summit. Lonsec’s Head of Investment Consulting, Veronica Klaus, will host a Q&A session and panel discussion following the presentations.

You can register for the session here, or view the entire event calendar here

Important Information: Please be advised that the Pinnacle 2020 Virtual Summit is designed for sophisticated investors only

4 topics

3 contributors mentioned