We all know about “Sell in May and go away”, but is it too late for 2024?

Feeling a little short-changed by the Australian stock market this month? You should be. We’re down around 2% on a total return basis, that is, when you account for capital losses and add back dividends.

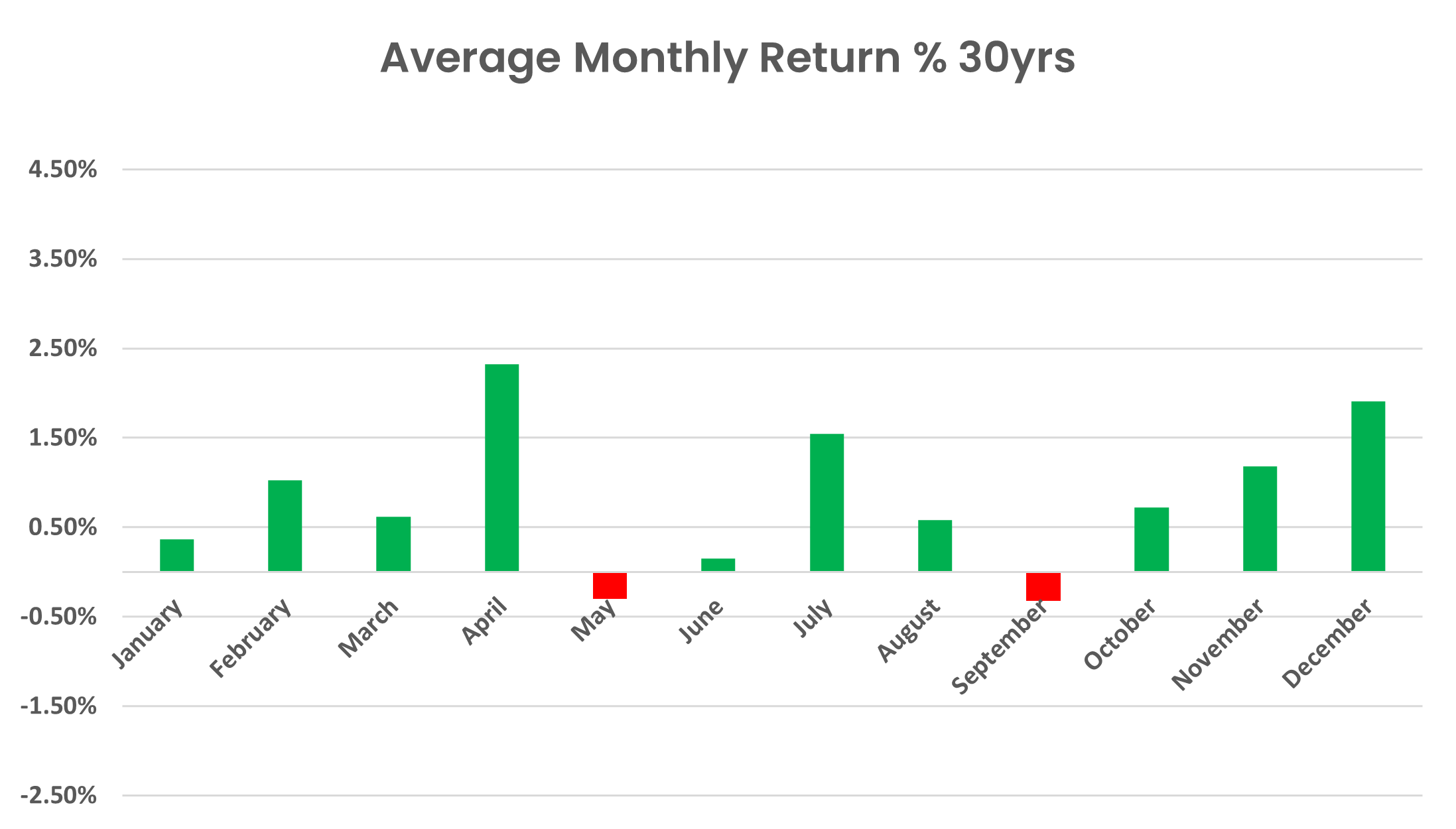

Not only is this a disappointment in terms of the absolute loss, it’s also a rip off considering April is typically one of the best and most reliable months for the Australian stock market. If we look at the monthly performance of the All Ordinaries Total Return Index (XAOA) over the last 30 years, we can see that on average April returns around 2.6% and is up 74% of the time.

This is an example of seasonal analysis. It’s a branch of technical analysis which assesses the tendency of certain assets to rise and fall in price in a consistent manner at certain times of the year.

You might think that seasonality in prices is most prevalent in commodities markets, like wheat or soybeans, where regular weather patterns can have a major impact on supply. Certainly, these markets do lend themselves well to seasonal analysis.

Interestingly, seasonality is also observed in stock markets. This is because investors tend to behave in a similar way around earnings, dividends, and at the end of quarters, and financial and calendar years. When considering stocks’ seasonality, it’s crucial to calculate their performance on a total return basis, that is, by adding back dividends.

It’s also important to use a benchmark which adequately represents a stock market. For this reason, when conducting seasonal analysis on Australian stocks, I prefer to use the XAOA. I like the fact it has 500 constituents compared to just 200 in the benchmark S&P/ASX200.

Sell in May and go away?

This is one of the oldest sayings in the stock market and it’s based upon seasonal analysis. Most of the data on seasonal analysis that is available freely on the internet relates to the S&P 500, that is, the benchmark for US stocks. I’ll let you investigate that data in your own time, but you will find that April is typically also a good month for US stocks, and May is typically a down month – hence the saying.

Seasonal data for the Australian stock market is much harder to find, and this is why I’ve been collating the data for the Australian stock market myself for nearly 20 years. You won’t see the data I publish regularly here on Market Index anywhere else!

My data shows that over the last 30 years, on average, May is indeed a down month. Its average loss of -0.30% is second only in magnitude to September’s -0.32%. In terms of reliability, over the last 30 years May has shown a gain of any magnitude 56.7% of the time (again, this is second worst to September’s reliability of 53.3%).

Probably none of this sounds all too terrifying – just -0.3%, but the data does show that May commences a relatively uncertain two month period for the Australian stock market, as well as a six month period of general underperformance. Let’s investigate.

Sure, go away, but when to come back?

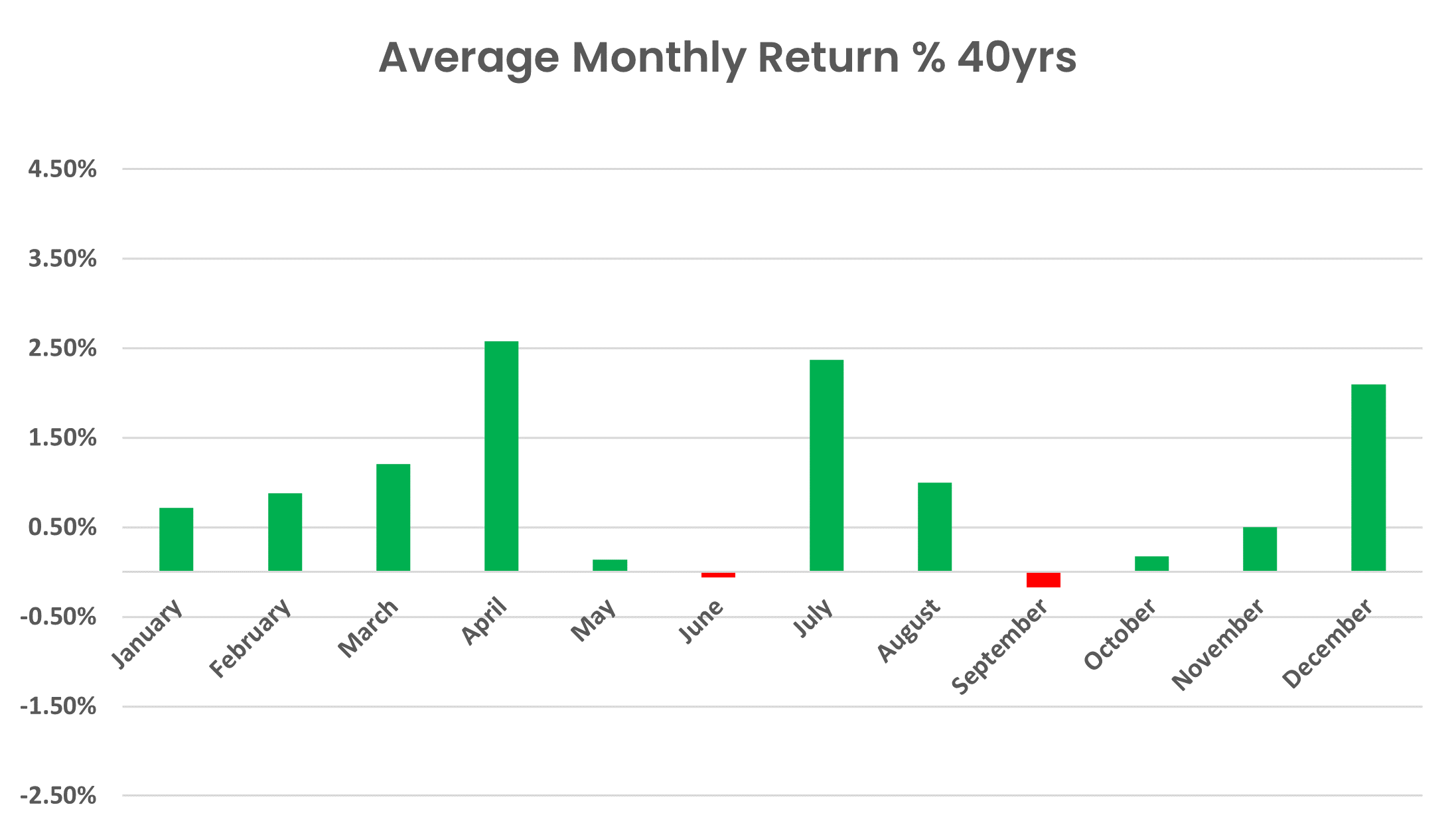

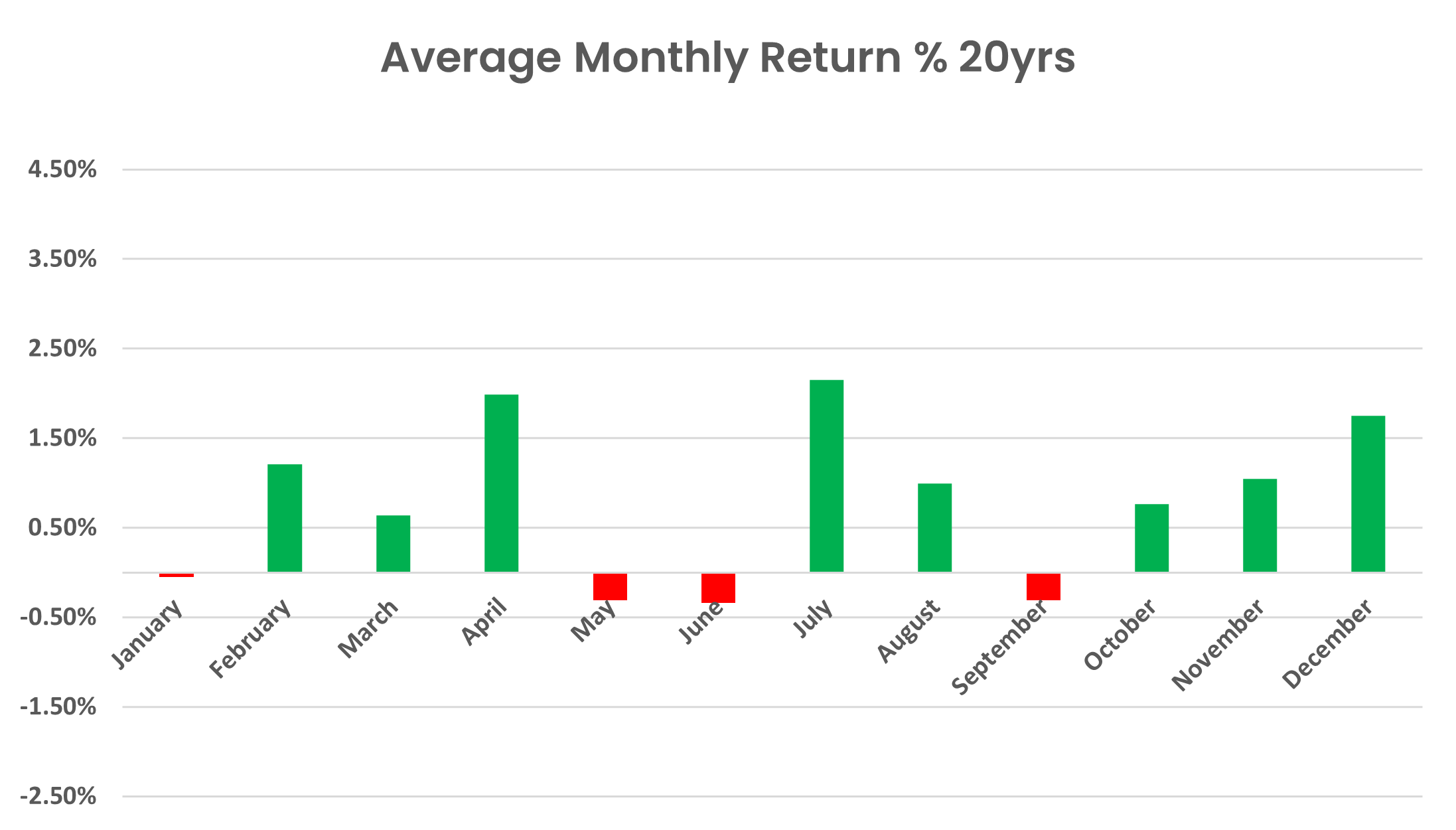

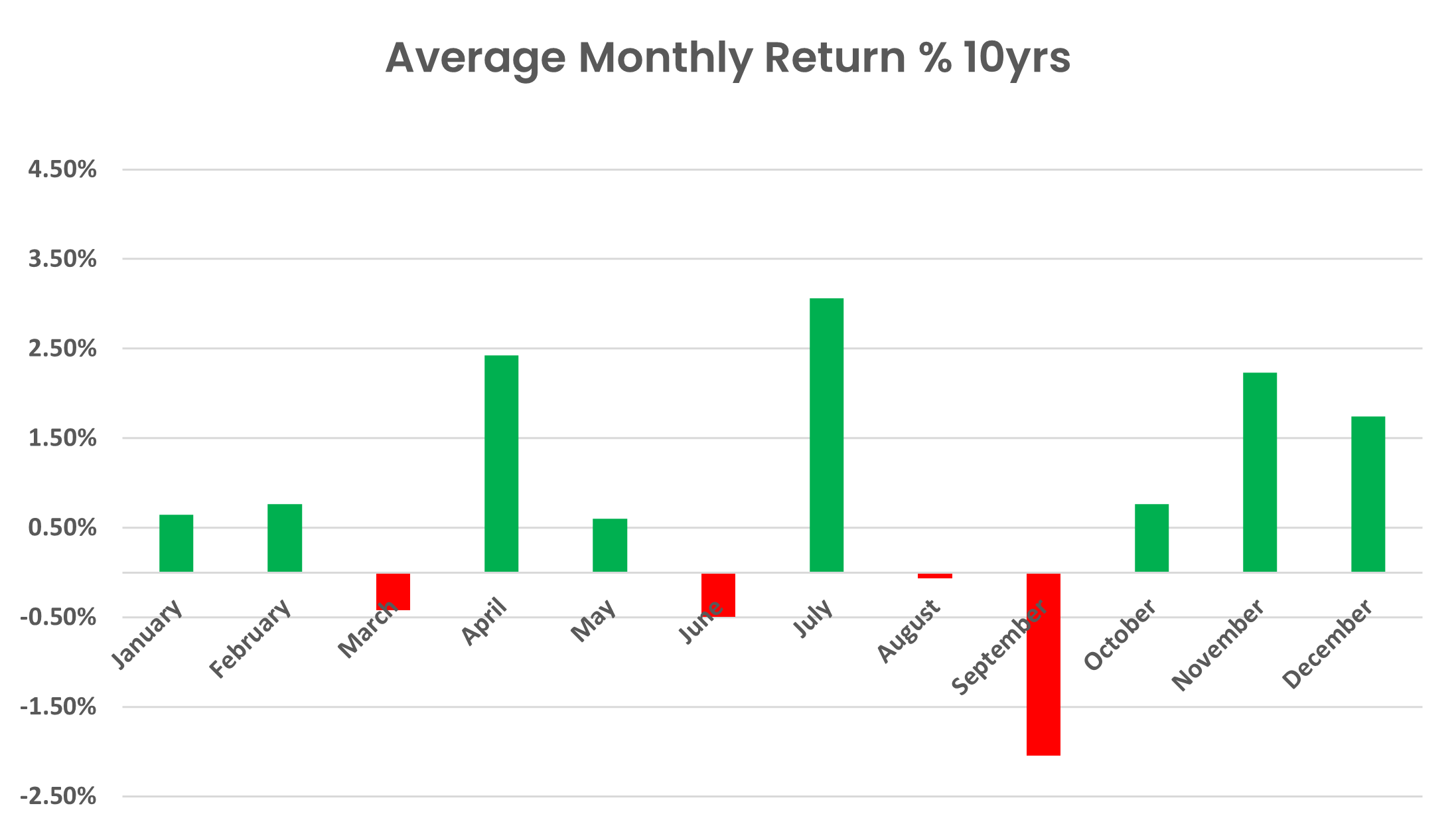

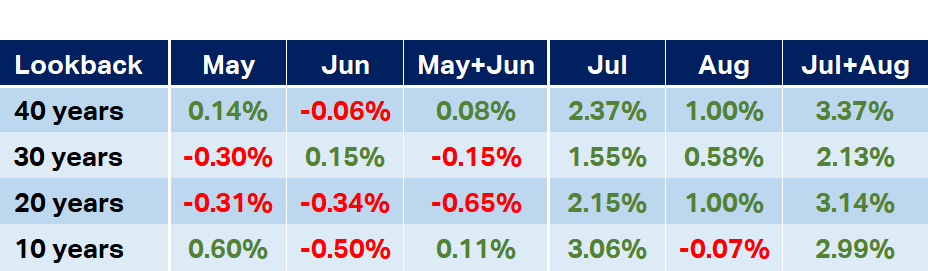

I’ve shown you the monthly seasonal chart for the XAOA over 30 years. Below, find the data for 40, 20, and 10 years.

There’s a few important points here when considering which lookback period is the best to look at.

- We don’t want to go too long, because patterns which might have been relevant in the early part of the sample may not be as relevant today, just think about how much technology has changed investing behaviour and assimilation of information over the last 40 years

- We don’t want to go too short either, ideally we have a large enough sample size to diminish the impact of outliers

- Shorter term lookback periods can be useful in identifying emerging trends

In short, there’s no hard and fast rule to which lookback period to use. However, if you find consistent trends across all lookback periods, these are likely the ones that have the best predictive ability. For the record, my personal preference is the 30-year lookback period, but I am also partial to the 20 year lookback period.

Key observations from 10-40 year lookback periods for the XAOA:

- May and June are typically underperforming months

- July and August are typically outperforming months, but August has been less consistent more recently

- September is consistently the worst month

- In all samples the period between October and April is the best time to be invested

So, if we are to answer the questions of 1. Should I sell in May? And 2. If I do, when do I buy back? Then the data suggests that selling in May is typically a useful strategy – made even more reliable by the fact that there does appear to be marked underperformance during the months of both May and June. As for when to buy back, you’ll want to target a June or July low and hold through to the August peak.

Does April influence May?

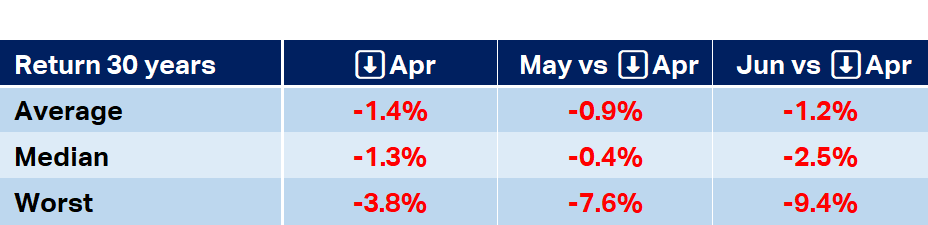

I’m a data nerd and I love my spreadsheets, so I wanted to investigate whether there were any patterns in April which potentially influenced May. Basically, is there something about April which increases the tendency of May to deliver a negative return?

Before this month, there’s only been 8 April declines for the Australian stock market in the last 30 years. April is usually so good there’s not a great deal of data to work with here! So, small sample size – pinch of salt sort of stuff – but the results are very interesting.

We’ve already established that May's 30 year average return is -0.30%, I haven’t told you yet that June’s average return over this period is +0.15%. If we consider just those 8 down Aprils, May’s average performance drops to -0.90%, and June’s plunges to -1.2%. Interestingly, the worst May (-7.6%) and worst June (-9.4%) both occurred after down Aprils.

So, based upon this small sample size, it does appear that a bearish April tends to lead to a more bearish May-June period. This could be especially relevant this year given April’s poor performance so far. To answer the question posed in the title of this article: No, if April turns out to be a stinker, the data suggests it’s not too late to sell.

Lessons from seasonality

I use seasonal analysis as a handy guide to what might happen in a particular month of the year. The words “guide” and “might” are the most important words in that last sentence. The future is unknown and even if something happened 99 times out of 100 in the markets, there’s no guarantee it will happen next time.

I believe that seasonal analysis can provide investors with greater confidence to pursue a certain strategy when they see the market is behaving in line with well entrenched seasonal patterns. Certainly, I’d want to know if I’m buying just before a period of seasonal weakness, just like the one we’re about to enter now.

This article first appeared on Market Index on Tuesday 23 April 2024.

5 topics