What happened to the China reopening trade?

Stories are great. Whether it’s through books, movies, TV series or podcasts from comedy or action to documentaries and autobiographies we love getting hooked into an entertaining narrative. In our opinion, it’s great for downtime but not so great when it comes to investing.

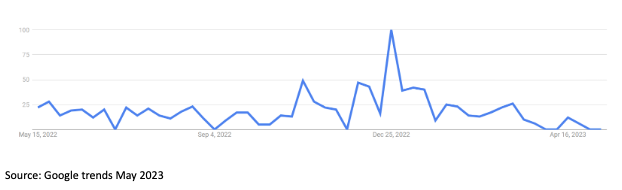

Narrative investing is all about crowding onto a trend and can be a powerful force for moving share prices. One recent example is the “China Reopening” trade. After years of highly restrictive COVID lockdowns, China began communicating a relaxation of policies. Armed with the playbook and the experience seen across the West, investors began loading up on perceived beneficiaries. Given how important China continues to be to global growth, everything from commodities to consumer stocks and even more broadly the China indexes were targeted to gain exposure.

As the narrative peaked, many of these beneficiaries rallied very hard pushing valuations to quite high levels. Unfortunately (for now anyway) it appears that many of these prices peaked around the same time as the narrative with a significant amount of any benefit priced in ahead of time.

Fig. 1 Google search trends for “China reopen” peaked in Jan

Like always, the devil is in the detail and the reality has been a lot more nuanced than the simple narrative. Brent oil peaked at around $86 in January and is now trading around $74. Iron ore rallied to around $113 and is now trading closer to $100. Copper peaked around $425 and is now trading back around $360. The broader China CSI300 index peaked at 4200 and is currently back to around 3950. China infant formula names have been soft, downgrading expectations as they cycle the significant inventory stocking that was done during lockdowns.

It hasn’t all been disappointing though. The main beneficiary appears to have been European luxury goods providers as China’s high-end consumers started spending again. Stocks like LVMH (up over 10% since Jan) and Burberry (up around 8% since Jan) had low expectations and the results have come in far stronger.

Interestingly, data released this week from China has told a different story than investors expected. CPI eased further and PPI deflation intensified. Credit growth slowed despite cycling a low base with growth in household loans a key drag. Housing and environmental policies appear to be the key drivers of heavy industry rather than a simple reopening story. China-listed property stocks are yet to recover from the crisis culminating in a number of high-profile defaults and restructures as policies to rein in debt and reduce risks in the property market.

In our view, investing in narratives with no fundamental compass is far too difficult. We prefer a fundamental framework to invest with conviction. For example, were the valuations discounting the lack of China activity into perpetuity or was the recovery already priced? What do you do now if you bought at the highs at peak narrative, buy more or sell now they are down? Was the smart money selling into this strength?

We no doubt will have themes across our portfolio but this is the result of where we see the greatest asymmetry or returns skewed in our favour (smallest downside and largest upside) as opposed to the latest story or thematic across the market. As independent thinkers, we often find ourselves on the other side of overcrowding. Over time we believe a well-researched and executed fundamental process results in strong risk-adjusted returns. We discussed looking through the noise and our investment process more broadly in a recent article here.

What do you think are the dominant narratives in the market at the moment? Are those thematics priced in?

3 topics