What Mattered Today; Banks under the pump

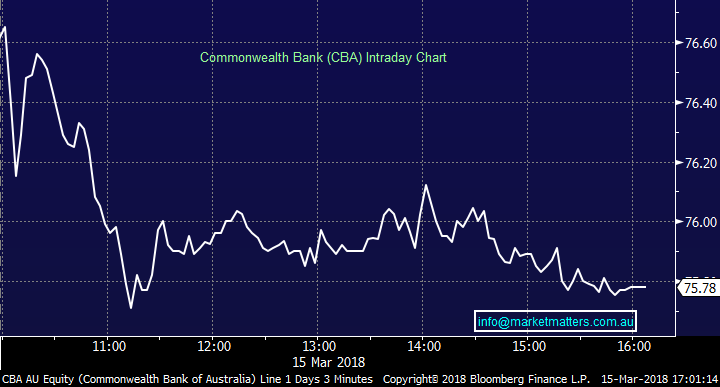

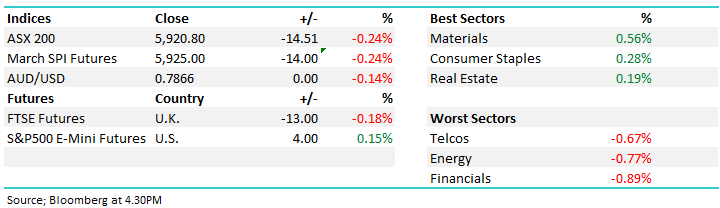

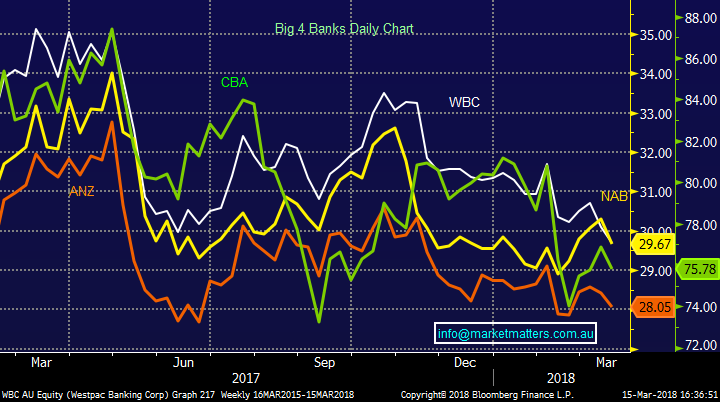

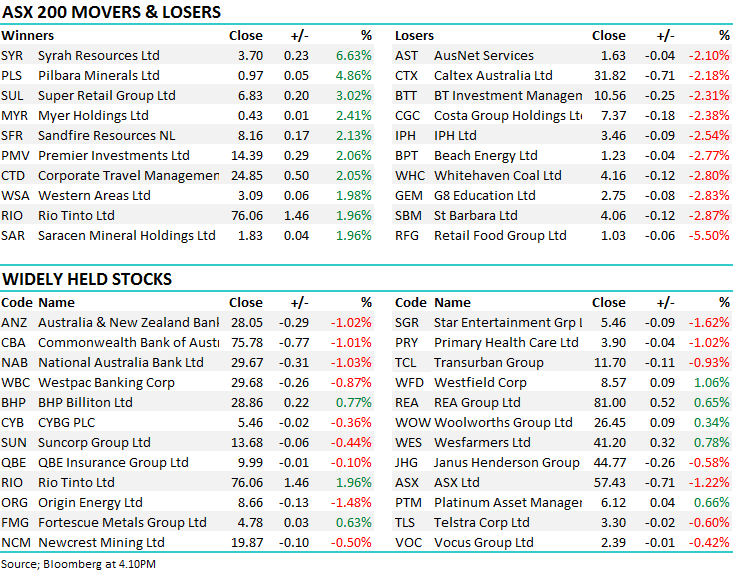

Financial stocks were the cause of pretty much all of the pain on the ASX today with the banking enquiry focussing on CBA – some extraordinary headlines making their way into the press which was also the case yesterday when NAB was in the hot seat – the BIG 4 banks taking -18points from the index with Commonwealth Bank down 1 per cent to $75.78, Westpac off by 0.9 per cent at $29.68, ANZ down 1 per cent to $28.05 and NAB down 1 per cent at $29.67.

It was a weak lead from overseas markets combined with a big index options expiry this morning that created some big large on open – CBA for instance opened at $77 only to see it trade around $76 over the next 15 mins – they them chopped around the lows for much of the day…

Commonwealth Bank (CBA) Chart

We also had news breaking during our session that weighed on US Futures early on with the European Commission looking to fire back at US Tariffs under a plan the European Commission is considering, according to a report by the Financial - according to a draft report seen by the FT, a "digital tax" would be assessed against companies' revenues rather than profits. The tax, which the FT said was likely to be set at 3%, would apply to tech companies with more than 100,000 users in Europe, and cover everything from ad revenue to subscription fees and everything in between. The tax, which may be announced next week in Brussels, is estimated to raise about 5 billion euros a year, the FT reckon. Fight fire with fire and ultimately you get the basis for a trade war – hence US Futures were sold down early and our market followed before our post lunch recovery.

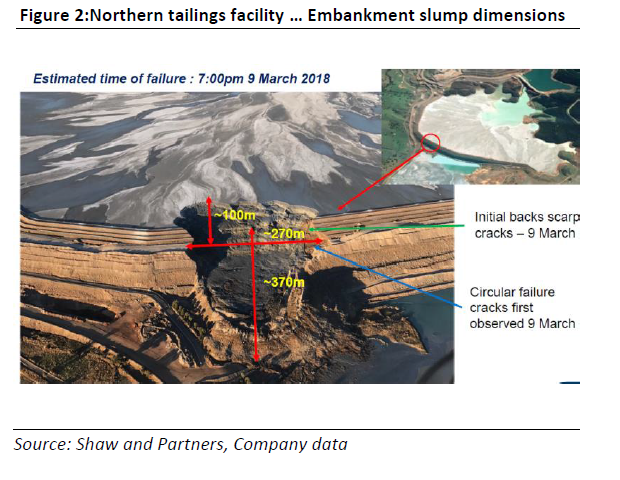

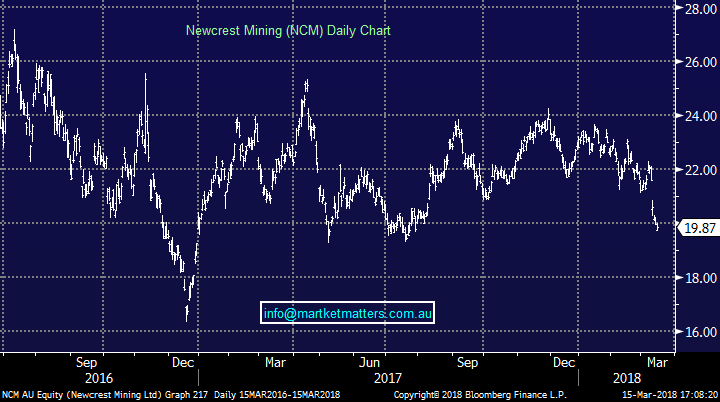

On the flipside, the Material stocks were reasonably well bid throughout the day with BHP and RIO copping some love…NCM on the other hand had another down day courtesy of their tailings dam breach earlier in the week. More on that later.

Overall, the index lost -14pts or -0.24% with the index settling at 5920 – Financials providing the biggest weight on the mkt.

As we suggested in the AM report today, in our opinion US stocks feel like they are slowly changing their tune as they embrace potential market negatives daily as opposed interpreting it as good news. We’ve been looking for US stocks to experience choppy consolidation around current levels before pushing to fresh highs into May and this is undoubtedly what the market is giving us at present. It’s very important for us to clarify our investing position moving forward:

· MM is currently a seller of strength in stocks, not a buyer of weakness.

Following yesterday’s close by the ASX200 below 5950 we are now short-term neutral local stocks needing a close back above 6030 to switch us bullish.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

1. Kidman Resources (KDR) $2.20 / 0.46%; We held KDR in the MM Platinum Portfolio and sold into today’s strength around $2.25. Clearly a ‘less liquid’ stock than some which creates some issues around selling volume however we’re now out booking a nice ~21% profit. We continue to like the sector and will be likely buyers into any weakness, with our focus now switching to Orocobe (ORE).

Kidman Resources (KDR) Chart

2. Newcrest Mining (NCM) $19.87 / -0.50%; Had a conference call today updating all about the latest at Cadia – and the call seemed to sooth some concerns and the stock bounced from the day’s lows. All in all, the company painted a better scenario than we thought they would - not perfect but not as bad as feared. That said, markets like certainty and reward it when they see it - not necessarily when it is just promised or hoped for! At this stage we’re on the sidelines and will likely remain there for some time - simply Cadia is too important for earnings + production metrics and the issue we think seems a more complicated one than is being suggested by the company.

Newcrest (NCM) Chart

Banks; a quick take on relative performance amongst the BIG 4 over the last year - clearly CBA has lost its premium to the other majors

Have a great night

James & the Market Matters Team

The above is an extract from the Market Matters afternoon Report. For a free 14 day trial of our service CLICK HERE

6 stocks mentioned