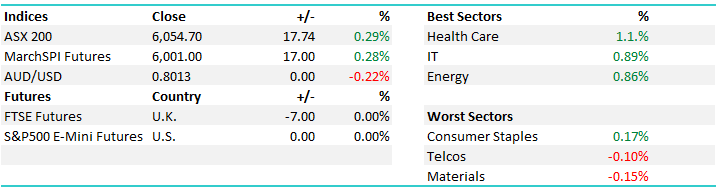

What Mattered Today: QBE continues to rally

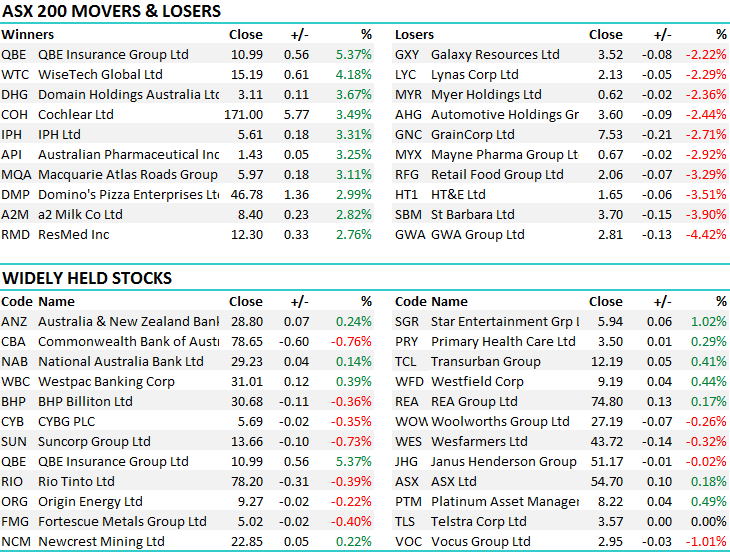

A second day of gains for the ASX with the market trading back up above 6050 following on from the positive gains yesterday. Healthcare has a good day led by strong follow up buying in Resmed while QBE was in the spotlight adding another 5.37% to trade back up around $11.

The S&P/ASX 200 index rose 17 points, or 0.3 per cent, to 6054, while the All Ordinaries climbed 18 points, or 0.3 per cent, to 6168. The Australian dollar reached US80.13.

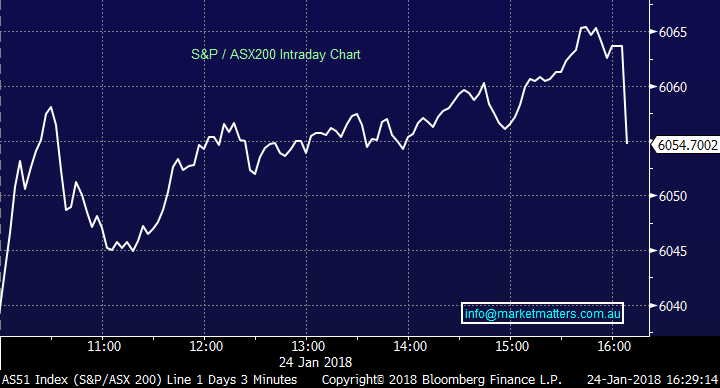

S&P/ASX 200 Intra-Day Chart

S&P/ASX 200 Daily Chart

WHAT MATTERED TODAY

1. QBE Insurance (QBE) $10.99 / +5.37%; QBE was the most improved in the top 200 today, now seemingly a far cry from the downgrade announced yesterday. Since it’s 10:11AM low yesterday of $9.86, QBE has risen a huge $1.13 / 11.5%. Today’s jump came despite 4 brokerage houses cutting their price target, however although Macquarie reduced their price target, they upgraded their outlook to outperform – which is BUY. They reckon that within QBE, there are 5 key portfolio’s that QBE should look to divest in order to simplify the business; Australia Personal, LMI, Argentina, Latin America & Asia.

Although there is a long road ahead, it seems that after years of disappointing investors the market was anticipating a much bleaker outlook from the company, but instead received some tentative signs that the worst is over. The price action over the last few days goes to show how negative the market was towards the stock, positioned against it and are now forced buyers. We hold QBE in the Platinum Portfolio.

QBE Insurance (QBE) Daily Chart

2. St Barbara (SBM) $3.70 / -3.9%; SBM appears to have run too far for its own good recently, with target prices upgraded but performance outlook downgraded. The gold miner and explorer had a stellar end to 2017 after delivering strong cash flow outcomes in August whilst ramping up production in the back end of the year. Jumping nearly 50% from October lows, analysts deemed that the run had gone too far, and doubted whether the strong numbers could continue. We have gold exposure through NCM.

St Barbara (SBM) Daily Chart

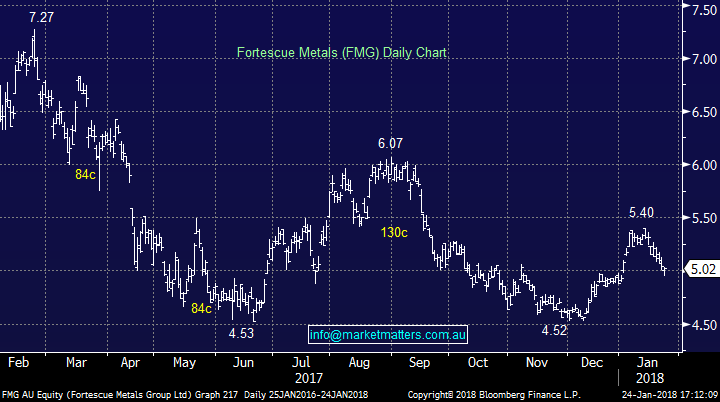

3. Fortescue (FMG) $5.02 / -0.4%; FMG fell alongside Iron Ore futures in Asian trade today. Iron Ore has taken a hit in the last few days after Barclay’s and ING warned that profitability of Chinese steel mills has been squeezed and will lead to lower demand and prices for Iron ore. In our view, the banks have jumped the gun here and iron price gains have really lagged the increase in steel prices being received by mills, as shown in the chart below. We bought FMG today below $5

Iron Ore Futures (WHITE) vs Steel Index (ORANGE) Daily Chart

Fortescue (FMG) Daily Chart

FREE TRIAL - 14-days free stock market advice - all our reports including every ASX buy & sell recommendation - CLICK HERE TO REGISTER

Have a great night

James & The Market Matters Team

3 stocks mentioned