What's been behind the bitcoin rally?

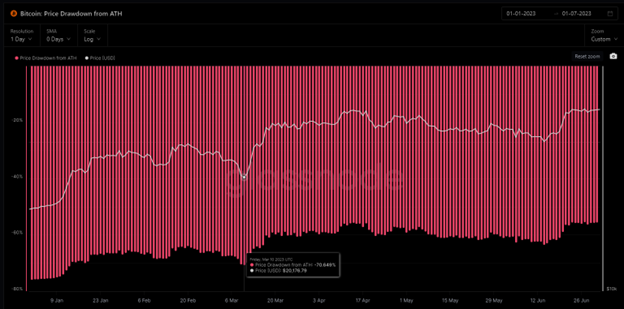

Midway through the year (as of 1 July), Bitcoin has been the best performing asset class with an 83% return over that period. However, it hasn’t been a slow and steady increase. History shows that the price of bitcoin is very volatile and moves quickly.

There have been a few big stories that have moved the dial both ways. Let’s examine what happened during the first six months of 2023.

Heading into January, the price of bitcoin was just under US$17K, slightly above the lows it fell to following the FTX hangover back in November 2022. However, a strong rally into late February, with only a small pullback in-between, caused the price to move higher to almost US$25K. Driving the price was positive macro news that inflation may be settling down and an expectation at the time that the Federal Reserve may raise rates by just 25 basis points at its February meeting – slowing from the 50 basis point hikes in December 2022.

Source: Glassnode. Past performance is not indicative of future performance.

Banks start to fail

In March, US regional banks started collapsing over the course of a few weeks. Silicon Valley Bank was the first to go. Then Silvergate Bank, known as ‘the bank for crypto companies’, announced that it was delaying the filing of its annual report due to questions from its auditors, in addition to experiencing operational issues. Within a few days, Silvergate announced that it would wind down operations and liquidate. Signature Bank also shut down after depositors withdrew large sums of money, making it the third biggest failure in US history, behind Silicon Valley Bank and Washington Mutual. Finally, Switzerland’s Credit Suisse bank collapsed and was purchased by UBS.

Panic spread across equity and crypto markets, pushing prices lower as several crypto companies continued to struggle, and the price of bitcoin fell from close to US$25K back down to just above US$20K. Ironically, as more and more banks started to announce failures, the bitcoin price started to rally.

Bitcoin was created as a response to the 2008 Global Financial Crisis (GFC). The pseudonymous creator(s) Satoshi Nakamoto encoded a message in the first block of bitcoin ever mined, giving us a clue to the problem it was seeking to solve. Nakamoto wrote: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks1.” Satoshi Nakamoto had the idea of disintermediating the banks from financial transactions and a fiat system that accords special protections to favored people and industries, with Bitcoin having a ‘sound money’ philosophy. Bitcoin was envisioned as a currency that could provide a secure, transparent, and censorship-resistant alternative to traditional forms of money.

The crypto market may have been seeing parallels between the banking failures in March and the events during the GFC. The bitcoin price rallied on speculation that stress among global banks could again open people’s eyes to bitcoin’s censorship-resistant, intermediary-free qualities.

The price of Bitcoin jumped over 40% to US$30K from the lows of March.

Source: Glassnode. Past performance is not indicative of future performance.

SEC attacks

Following lawsuits announced in June by the US Securities and Exchange Commission (SEC) on the largest and most popular crypto exchanges, bitcoin’s price fell to under US$25K. First, Binance was hit with 13 charges relating to violations of US securities laws.

According to the SEC press release, “Through thirteen charges, we allege that Zhao and Binance entities engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law,” Gary Gensler, SEC Chair, detailed. “As alleged, Zhao and Binance misled investors about their risk controls and corrupted trading volumes while actively concealing who was operating the platform, the manipulative trading of its affiliated market maker, and even where and with whom investor funds and crypto assets were custodied.” The charges also included allegations regarding the unregistered offer and sale of 12 crypto tokens that the SEC alleges are securities2.

Less than 24 hours after announcing its charges against Binance, the SEC announced it was also charging Coinbase for “operating its crypto asset trading platform as an unregistered national securities exchange, broker, and clearing agency,” as well as selling unregistered securities “in connection with its staking-as-a-service program”3.

The CEO of Coinbase, Brian Armstrong tweeted: “Regarding the SEC complaint against us today, we’re proud to represent the industry in court to finally get some clarity around crypto rules.” The Coinbase executive proceeded to outline several factors affecting his exchange’s alleged securities law violations. He detailed, “There is no path to ‘come in and register’ — we tried, repeatedly — so we don’t list securities. We reject the vast majority of assets we review”4.

Institutions still interested in cryptocurrencies

Shortly after the lawsuits against Binance and Coinbase by the SEC, BlackRock, the world’s largest asset manager, surprised markets by filing an application with the SEC for a spot bitcoin ETF with Coinbase as its custodial partner. Given the recent lawsuits on high profile crypto exchanges, the scrutiny of various tokens, and the uncertainty of crypto regulation in the US, the timing seemed odd.

However, BlackRock’s involvement appears to have been positive for bitcoin and the rest of the crypto market. Bloomberg ETF analyst Eric Bulchanis noted that, out of 575 ETF applications, BlackRock has only been denied once5. Other large institutions have followed suit, with WisdomTree, Invesco, Fidelity, and a few others refiling spot bitcoin applications after having been rejected previously.

On 26 June, EDX Markets, a crypto exchange owned by some of the biggest names in the industry, went live. EDX’s shareholders include Charles Schwab, Fidelity Digital Assets, and Citadel Securities. The key difference for EDX is that it uses a non-custodial model designed to mitigate conflicts of interest, similar to how trades are executed on the New York Stock Exchange or the Nasdaq.

EDX Markets CEO Jamil Nazarali wrote on LinkedIn, “I am proud to announce that EDX Markets (EDX) has successfully launched our digital asset market and completed an investment round with new equity partners. EDX’s official launch allows our outstanding team to bring to crypto the same values and standards of competition, transparency, fairness and safety that investors in traditional assets expect and enjoy”6.

The renewed institutional interest from traditional finance players into crypto has helped raise the price from US$25K to just above US$31K (as of [date]), its highest level since April.

The first six months of 2023 have proven once again that crypto remains very volatile, that the price can move quickly, and that it is anything but boring. It will be interesting to see what the next six months holds for bitcoin and the rest of the crypto industry.

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio.

References

1 topic

1 stock mentioned