What’s going on with the CSL share price?

The Aussie mega-cap (and formerly government-owned company, which was known as Commonwealth Serum Laboratories when established in 1916), CSL Limited (ASX: CSL) occupies a huge place in the Australian market.

One of the three biggest companies on the ASX, with a current market cap of more than $136 billion, it’s also one of the most widely held stocks. This scale means CSL draws a huge amount of attention, both positive and negative.

A recent tweet from FNArena’s Rudi Filapek-Vandyck, a prolific Livewire contributor, spurred us to delve into the detail of what’s going on at the best-known Aussie biotech firm.

Bears versus bulls

Why are some investors critical of CSL’s performance during recent years? The share price is currently down -3.9% on the same period three years earlier and is -15% below its early 2020 level.

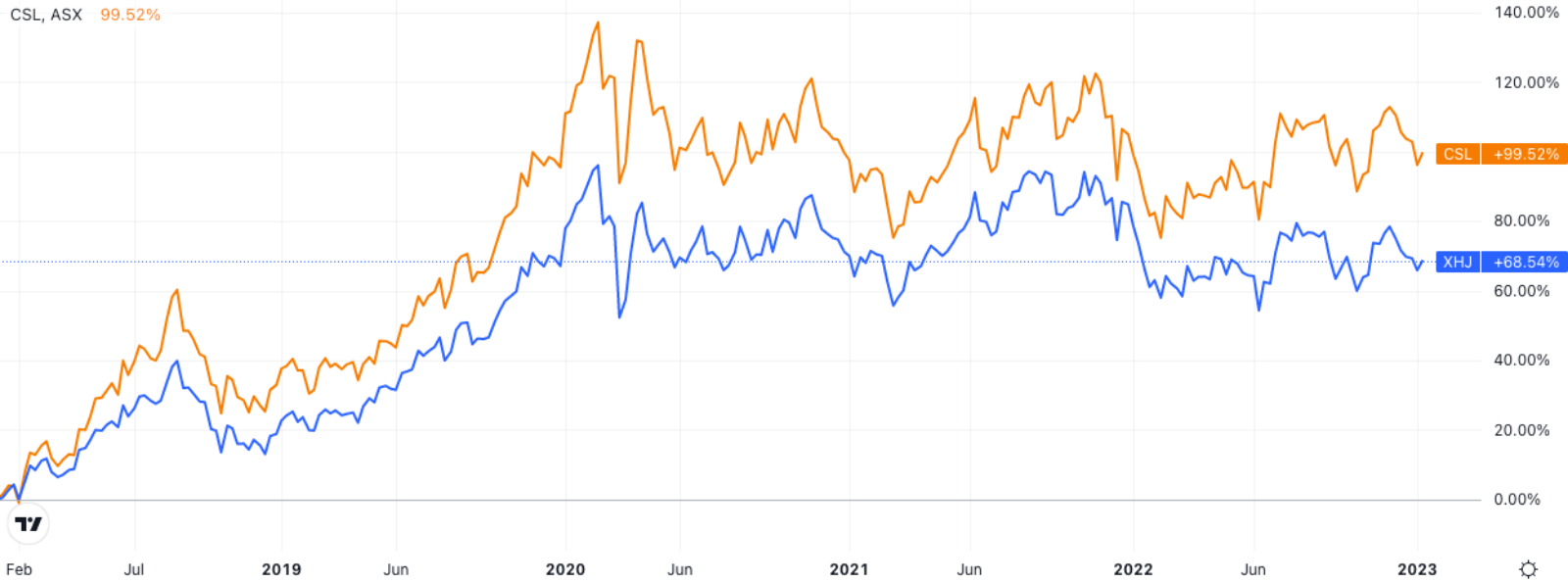

Then again, CSL’s stock price has risen 3.4% in the last 12 months – in a period where the S&P/ASX 200 Health Care and S&P/ASX 200 indices were off by -2% and -0.4%. And over five years, CSL stock has gained by just under 100% - that’s around 30% ahead of the ASX 200 Health Care index over this period and a 75% beat versus the ASX 200.

Looking at the business model – CSL’s biggest money spinner is its world-leading plasma collection network which spans the US, Europe, and China – things could have been much worse during the pandemic.

Stuart Welch, portfolio manager at Alphinity Investment Management, discussed this period during a recent chat about CSL and the ASX healthcare sector more broadly.

“During COVID, people were terrified of going to plasma collection centres so were staying away,” he says.

5-year share price movement of S&P/ASX 200 Health Care Index vs CSL Limited

.png)

This was the primary reason that CSL’s plasma collection volumes fell between 30% and 50% during the pandemic, alongside others including the US government stimulus – which meant people who previously relied on the money from donating plasma were less incentivised because of the stimulus cheques they were receiving.

What's happening at CSL now?

FNArena’s Filapek-Vandyck also referred to a competitor that’s a potential concern weighing on investors. At the end of last year, global immunology company argenx SE (NASDAQ: ARGX) received US FDA approval for a drug to treat a condition known as myasthenia gravis.

The potential size of the addressable market for this drug is only about 5% of that of immunoglobulin usage.

The drug can also be used to treat a condition called CIDP, for which patients use around 24% of immunoglobulin on a global basis. This is being tested in an upcoming phase 3 trial due to report in mid-2023. If the drug works in the treatment of CIDP, it remains unclear what proportion of patients would be treatable. But Alphinity’s Welch says most expect it will only be able to treat a subset of the patients suffering from the autoimmune condition. Most would likely assume, if it is successful, it will only work in between 20% and 30% of cases.

Another point raised in the above tweet was a potential shifting of sentiment toward the healthcare sector more broadly.

“It depends on what timeframe you’re looking at, but the fundamentals of the sector haven’t been too flash over the last 12 months,” Welch says.

He points here to the weaker earnings momentum. In most cases, the reasons for this were specific to individual healthcare companies.

Some other broader influences on the sector include rising interest rates, which affect the valuations of the typically longer-duration growth companies in healthcare.

"The sector is somewhat expensive given share prices were bid up when interest rates were very low," Welch says.

Currency movements have also had a big impact, especially among those companies with large European operations as the Euro weakened against most other currencies for much of 2022 - though this process is reversing now.

In the case of CSL, there’s another reason its earnings are likely to look weaker in 2023.

Drugmakers and medical device companies are renowned for the long timeframes involved in receiving regulatory approval from the likes of the US Food and Drug Administration and the Australian Therapeutic Goods Administration. This affects all companies, but there’s another kicker for CSL.

As Welch points out, there’s a lag in the time between when blood plasma is collected and when it is ultimately processed. As he describes it: “Even though plasma volumes are picking up, it takes between seven and nine months for plasma to go through the sausage factory and come out the other side as product.”

“Despite recent strength in plasma collection volumes, this will not appear immediately, although the case for earnings in outer years is certainly improving as those collections come back,” Welch adds.

How China, miners impact healthcare stocks

Welch alludes to the influence that institutional portfolio positioning has had on valuations within the Australian healthcare sector. The strength of iron ore and other commodity prices, which have picked up recently as China has reversed its zero COVID policy.

“The Chinese government clearly seems intent on riding out the worst of these reopening issues, with a pretty clear intent to stimulate the economy,” he says.

“For example, we’ve seen Chinese officials saying regions should give powerful financing support to infrastructure projects.”

What does this mean for the healthcare sector?

As Welch explains, it’s an issue of portfolio positioning, as portfolio managers are forced to chase the return potential and increase their allocation toward resources.

“That money has to come from somewhere,” he says while emphasising that company fundamentals are what determines these decisions over the longer term.

"I wouldn’t say CSL is particularly vulnerable, but it could possibly be one of the funding sources for people reallocating money to resources. This is a much more recent phenomenon," says Welch.

Perhaps the clearest demonstration of Welch's conviction in the company lies in his team's portfolio positioning.

On the sector overall, his team remains underweight to healthcare - though it's less underweight now than it was a few months ago.

When he appeared on Livewire's Buy Hold Sell last October, Welch described CSL as a prominent COVID recovery story.

"But we're overweight CSL as the longer-term outlook continues to strengthen as new products get approved, plasma collections improve, and the outlook for margins looks positive given higher volumes, decent pricing and solid cost management," he says.

Never miss an insight

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors. And while I ask the questions of some of Australia’s best strategists, economists and portfolio managers, if you’ve questions of your own, flick me an email on content@livewiremarkets.com.

2 topics

2 stocks mentioned

2 contributors mentioned