What’s the Fed to do?

.png)

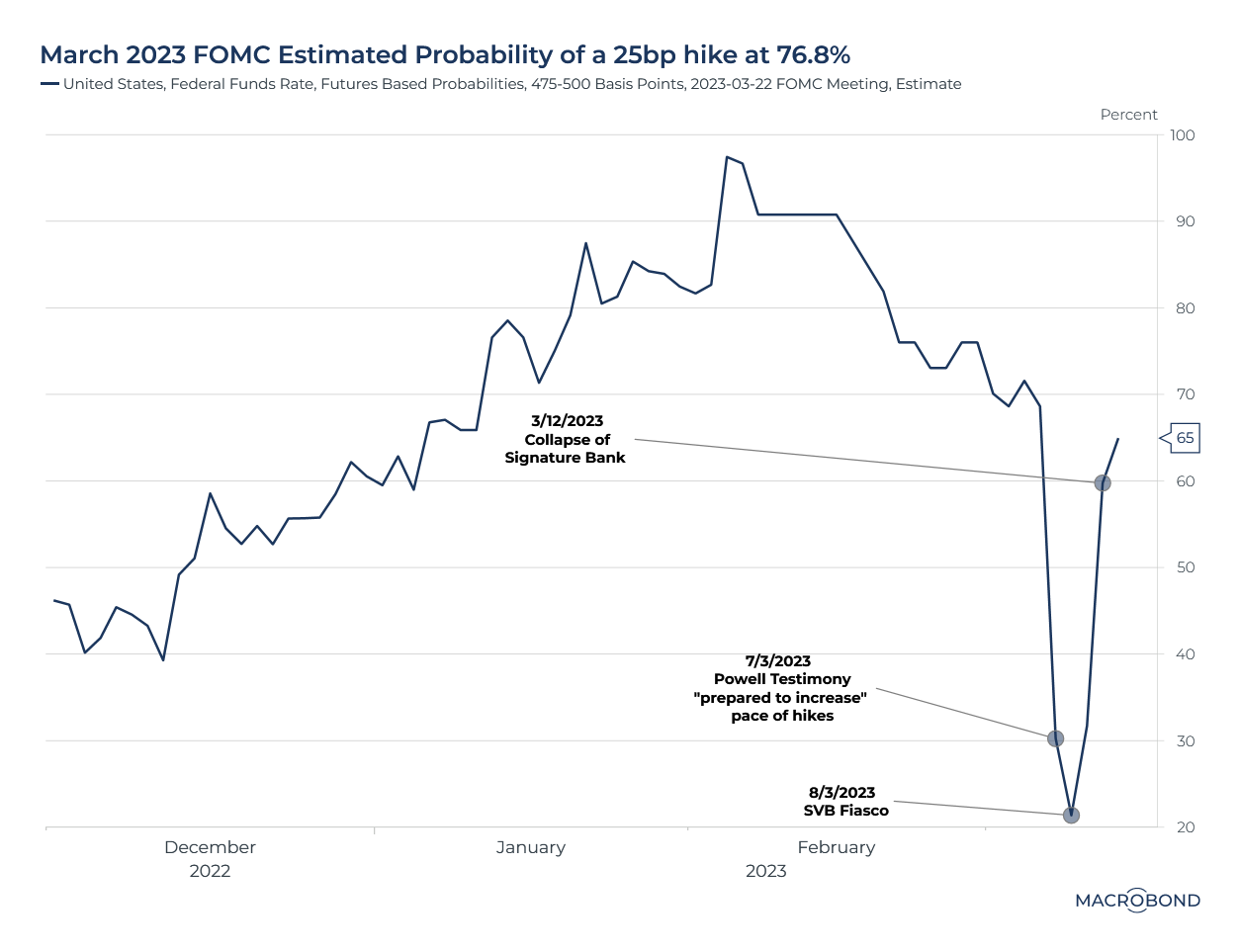

It’s a different world to just one week ago - markets were predicting a 50bp hike after the hawkish testimony of Fed chair Powell before congress last week. Fast forward 6 days, the expectations of a 25bp have now spiked to over 70% amid the turmoil related to SVB and the US regional banking sector.

A timeline of SVB’s Collapse against FOMC Estimated Probability of a 25bp hike

The Fed now finds itself caught between a rock and a hard place. Should it proceed as the market expects and slow the pace of hikes to avoid contagion in the banking sector. Or should it raise rates and risk higher inflation for longer and potentially higher terminal rates

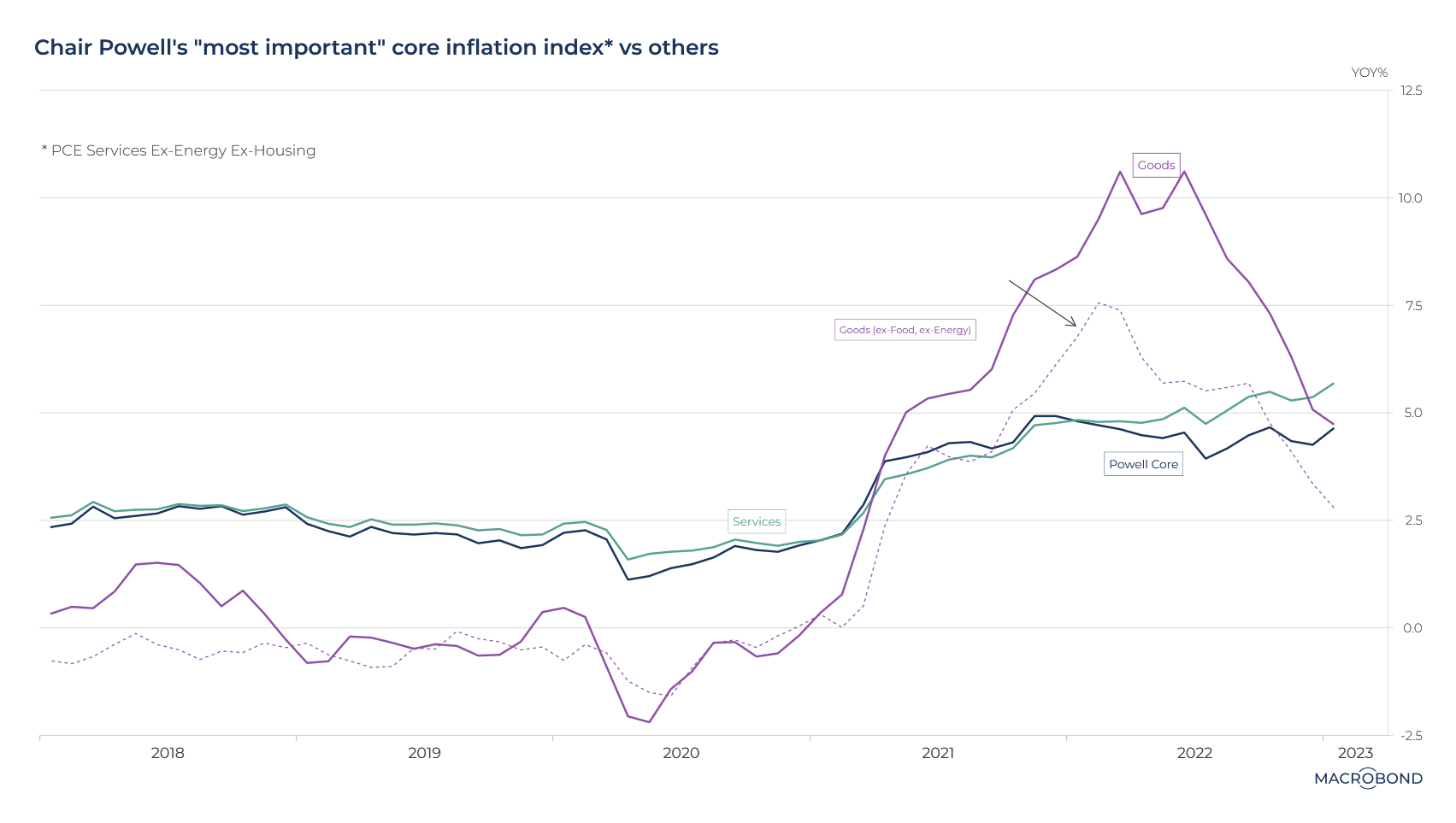

Powell’s “Most Important” Core Inflation Index

Jerome Powell has indicated he is closely monitoring services inflation (PCE services ex energy and housing) as the canary in the policy coalmine. As goods are expecting to pull back with improving supply chain bottlenecks and lowering freight rates. And this is where the trouble comes:

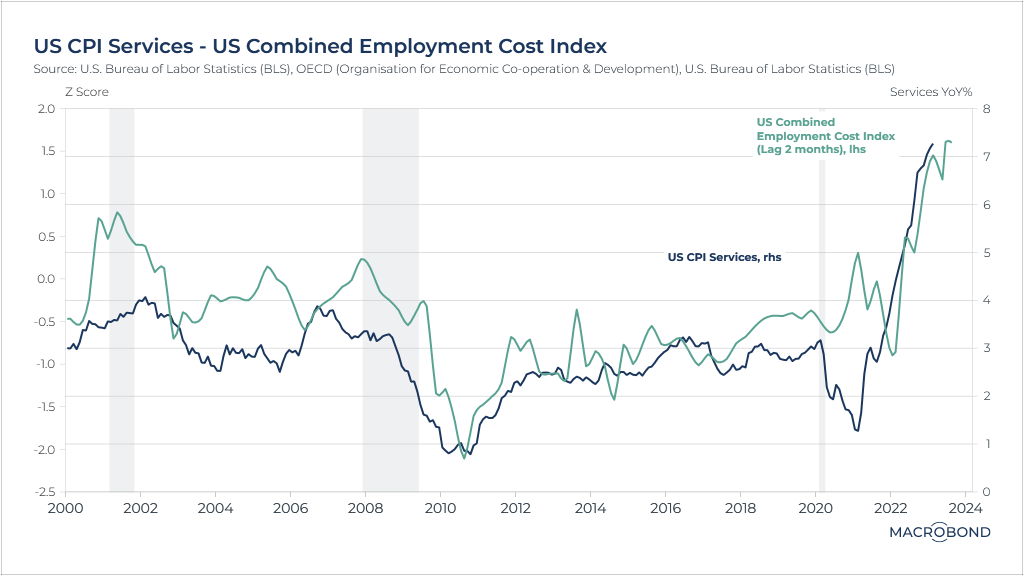

All signs point to sustained services inflation

Based on the composite of BLS and OECD Employment Cost data, which leads Services inflation by 2 months with a 0.8 correlation, we are looking at a higher or at least sustained inflation print on the services side.

Should Jerome stick to it and risk a banking crisis? Or should he pause and risk higher terminal inflation and rates? I’m just glad that I’m only writing this article and not making the decision. If the Fed does choose to stay the course, as the data above indicates it should, then we may see further market displeasure tomorrow.

3 topics

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

Expertise

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

.png)