What's up with oil?

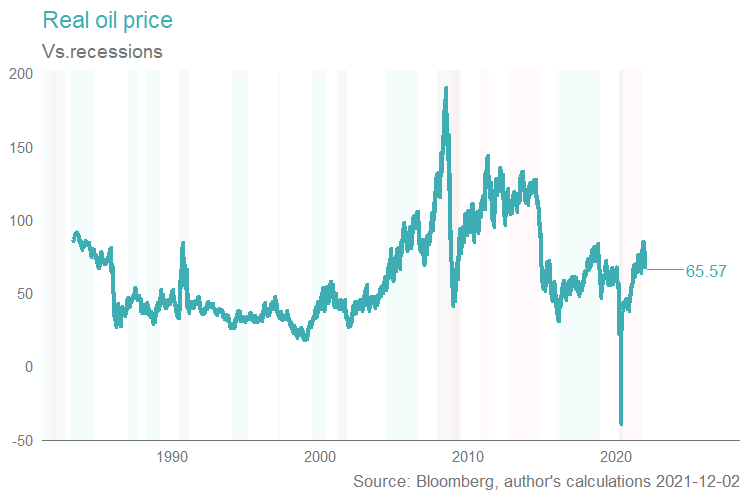

For all the excitement about oil, it is sitting around where you might expect, just by eyeballing the average of the past 21 years.

There was a supply shakeout in 2014, and a slight rise since then from modest supply discipline, and modestly higher demand.

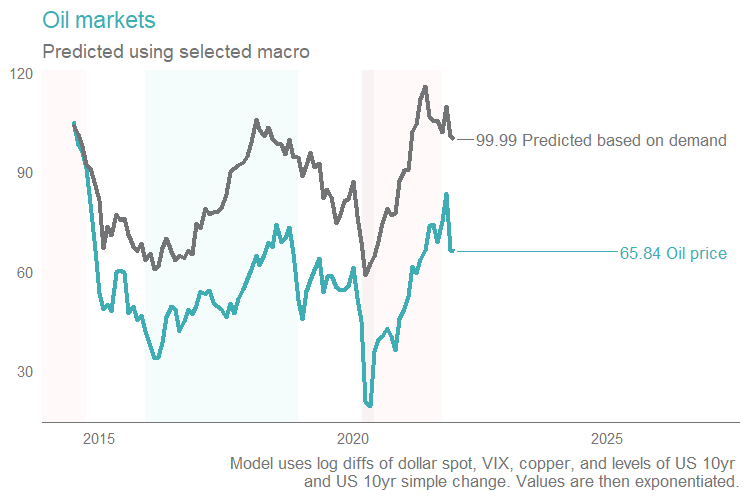

Hamilton, Ben Bernanke, and Beckworth, amongst other academics, have tabled simple oil pricing models several times over the years.

The idea is to explain the price of oil by splitting common proxies for growth which would drive demand (e.g. movements in copper, VIX, credit spreads, and changes in the 10 year treasury yields) in an econometric model, and attribute the residual (the unexplained component) to supply side movements.

The demand side co-movements give us the “predicted” value which we compare to movements in the actual price. The spread between them (getting wider, getting smaller) is the supply response.

That shows us that in 2014, a big chunk of the oil price drop was demand (~50%), and the other half was supply. That supply story was the OPEC+ response, effectively trying to drive US shale into bankruptcy. Incidentally, they're more or less succeeded, the industry went bankrupt twice in 5 years, and really everybody outside of the end consumer lost.

Such a model would also suggests that 2021 saw a material recovery in demand, which we all know was associated with the reopening/end of lockdowns.

The recent falls have been a function of some demand hit (Omicron) and some supply hits (the strategic petroleum reserve release ructions, led by the White House, China, India and others).

So what’s the point. Well, oil at $65bbl seems to be about right. Anything higher is great for producers.

$65bbl is what Woodside (ASX: WPL) use in their modelling for the newly approved Scarborough LNG project. $65bbl is also where the back end of the futures curve sits. That’s not surprising, everyone’s forecasts influence everyone else’s.

There is a worry, similar to what’s happened with the price of coal, that is worth articulating, and it works as follows.

Everyone “knows” that demand for coal will eventually decline to zero as renewables take over. That reduces the incentive to bring on new supply in the future. Perversely enough, that means, as coal reserves deplete and are not replaced, that supply can “gap down” below demand, creating huge pricing pressures.

That is what we’ve seen with coal, where prices more than tripled, and remain well above longer run averages, even though no-one believes that coal has a multi-decade future, if climate change pressures hold. That dynamic is playing out for natural gas, as well, and is leading to what’s been termed the European energy crisis.

If you are a producer, that sort of backdrop, oddly enough, can be quite appealing, and, from a portfolio perspective, we own energy stocks as a hedge against this sort of dynamic playing out.

That, and we find the valuations fairly compelling.

3 stocks mentioned