What soaring inflation expectations mean for portfolios

Economies are emerging from one of the largest economic downturns in modern history, even if it was only short-lived. As the recovery takes hold off a low base, near-term growth is likely to be quite strong. Those areas of the economy that have been particularly disrupted are likely to struggle to respond quickly, creating some near-term upward pressure on prices and inflation.

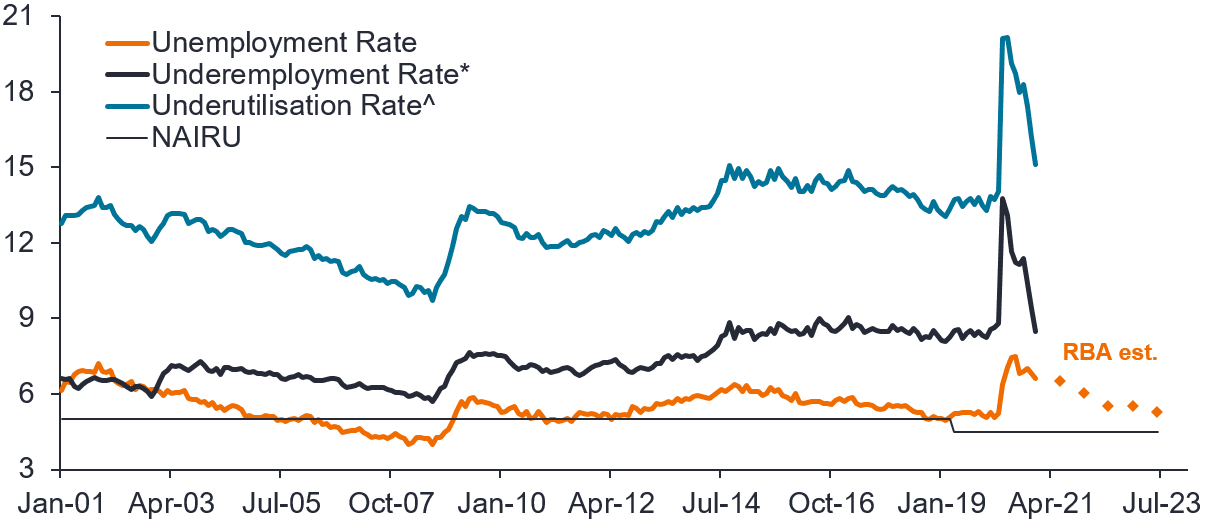

Once this initial phase of recovery passes, medium-term growth is likely to normalise, with a labour market that still has some spare capacity. This is particularly the case when viewed from an underemployment and underutilisation perspective. Spare capacity in the labour market is likely to take some time to tighten before sustainable inflation can be observed.

Chart 1: Percentage of labour force (%)

Excellent inroads have been made, but significant slack remains.

Source: ABS, RBA February 2021 Statement of Monetary Policy, Janus Henderson Investors, data to latest available. Note: *full-time workers on reduced hours for economic reasons and part time who would like and are available to work more hours. NAIRU: Non-accelerating inflation rate of unemployment.

Over the longer-term, central banks and governments (in our assessment), will err on the side of creating a slightly higher level of inflation than perhaps they’ve targeted in the past.

The primary motivation for this is twofold: First, to avoid the disinflationary trend we observed pre-COVID leading towards a ‘Japanification’ path (i.e. weak rates of growth and low inflation despite accommodative monetary and fiscal policy). Second, to be able to grow economies out of the huge sums of debt that is now present in economies by inflating it away. Rising wages, corporate revenues and tax collections all help deal with the stock of debt. A pre-condition for higher inflation to be achieved would be continuous easy monetary and loose fiscal policy for some time to come.

In short, we expect some near-term pickup in inflation but would agree with the central banks that it is likely to be transitory and some time away still until inflation more sustainably picks up.

Inflation pricing

As for the market’s ‘expectations’ for inflation, that’s a whole other dynamic – and markets rarely price perfectly or rationally. Break-even rates on inflation-linked bonds are living evidence of this phenomenon.

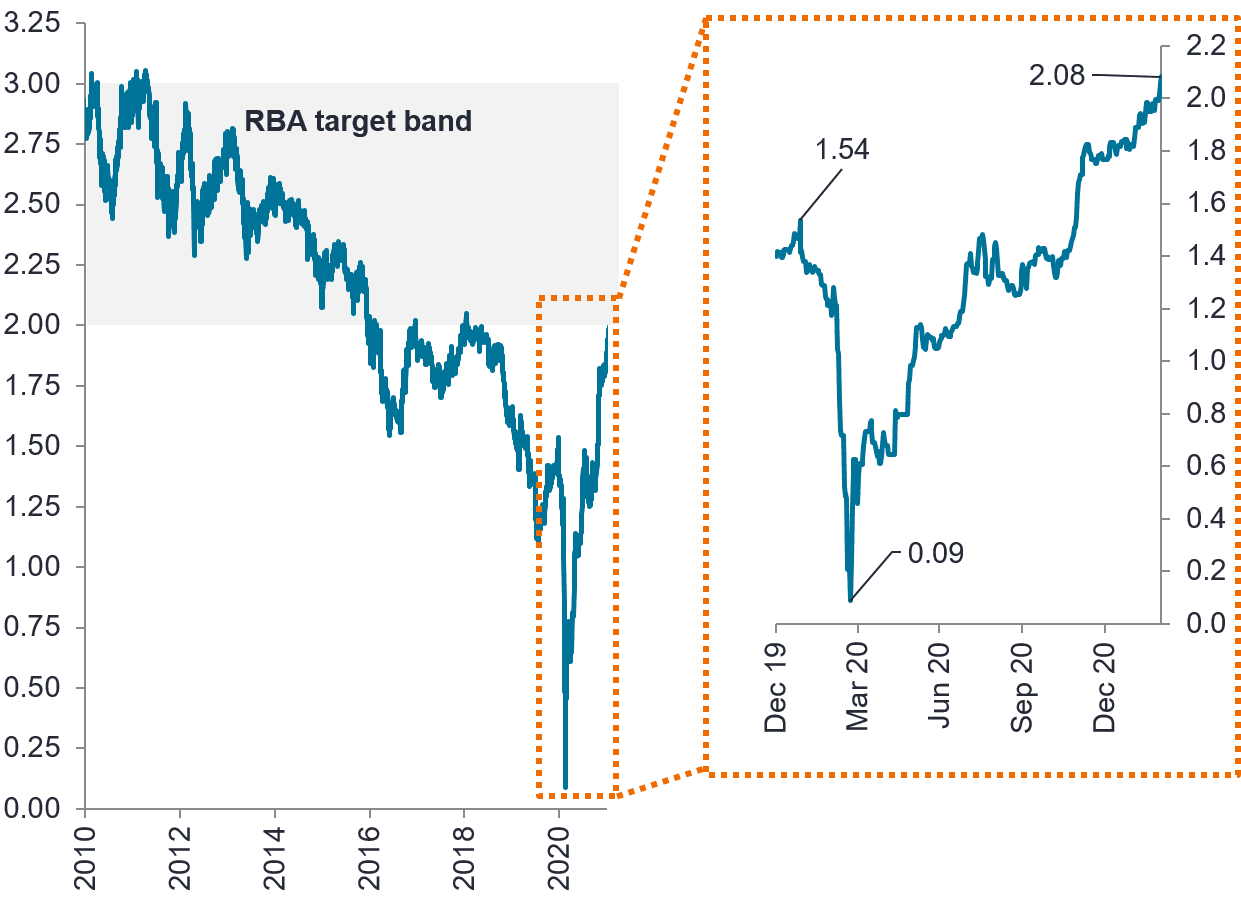

For two to three years now, break-even rates had been falling to a little below the Reserve Bank of Australia’s (RBA) target band for 10-year terms. In 2020, these rates fell close to zero, implying markets expected no inflation over a decade. Recently inflation expectations have lifted dramatically, getting into the RBA’s 2-3% target band as illustrated in Chart 2 below.

Chart 2: Australian 10-year break-even inflation expectations (%)

Long term inflation expectation now priced inside the RBA lower band

Source: Bloomberg, ABS. Australian 10-year breakeven inflation rate to 4 March 2021.

Markets can and do overshoot fundamentals, and the recent rise is a good example of this. Markets can go further towards and beyond 3% if they become frightened over policymakers over-stimulating economies.

For investors, it is the pricing of inflation that matters most. It’s valuable to buy inflation protection when others don’t want it or don’t price it in and to sell inflation protection when market participants expect high inflation outcomes (which may or may not happen).

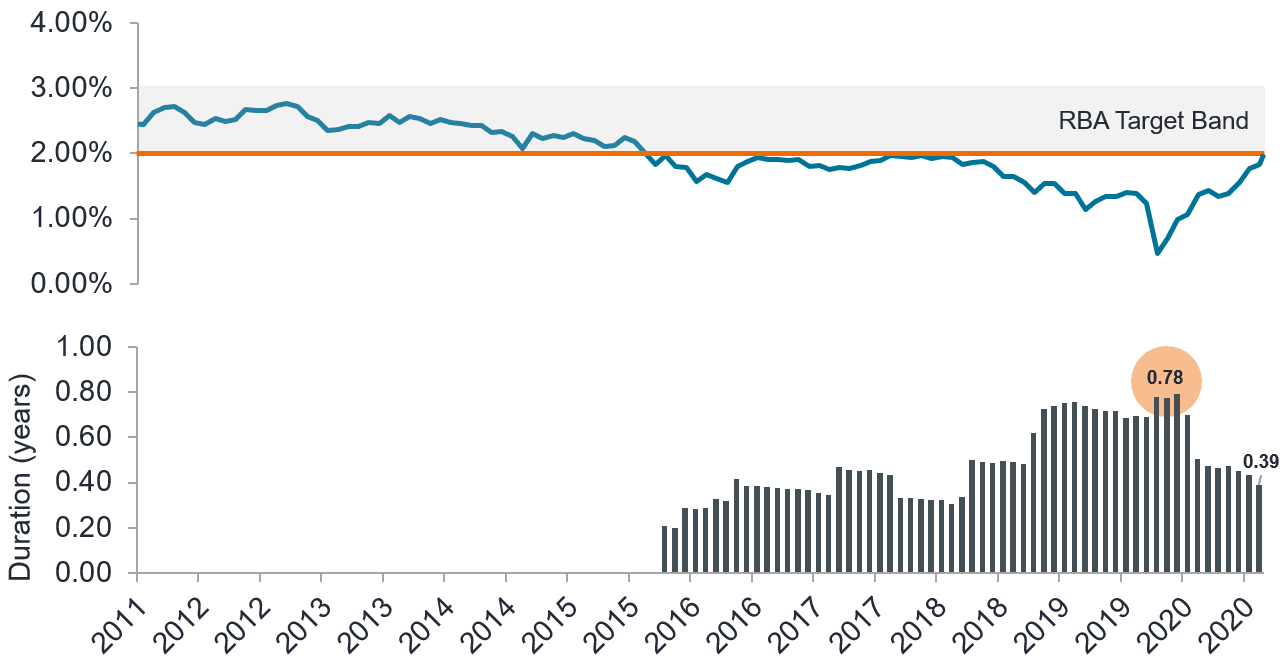

Chart 3: Australian 10-year break-even inflation rate (%) & Active inflation-linked duration (Years)

Source: Bloomberg, as at 31 January 2021. Note: Based on the Janus Henderson Australian Fixed Interest Fund – Institutional

It is on this basis that we have purchased (with a peak holding in March 2020 when inflation expectations were at their low point) a good allocation to inflation protection via inflation-linked bonds in our various portfolios. For illustrative purposes, the bottom of Chart 3 shows the peak and subsequent reduction of active inflation-linked duration in the Janus Henderson Australian Fixed Interest Fund – Institutional over time and current levels for that fund.

Learn more

Stay up to date with all our latest views but clicking the follow button below, and you'll be the first to read all our wires.

.png)

.png)