When money doesn't work, people stop working

Top Events

El Salvador celebrated the two year anniversary of the ‘bitcoin law’ that made bitcoin legal tender. Not only did this move put El Salvador on the map globally, but has led to a rally on their bonds that “almost defies gravity”.

The Financial Accounting Standards Board (FASB) is set to introduce new fair value accounting rules for Bitcoin and other cryptocurrencies. Previously, bitcoin price movements were treated under intangible asset accounting. Full details here for interested bean counters.

Ethereum Futures ETFs hit the market as SEC mulls next steps on the long-awaited Bitcoin Spot ETF. Meanwhile, Franklin Templeton joined the race to offer the ETF. If approved, Franklin (NYSE: BEN) plans to use Coinbase Global (NASDAQ: COIN) as custodian for the fund’s Bitcoin holdings.

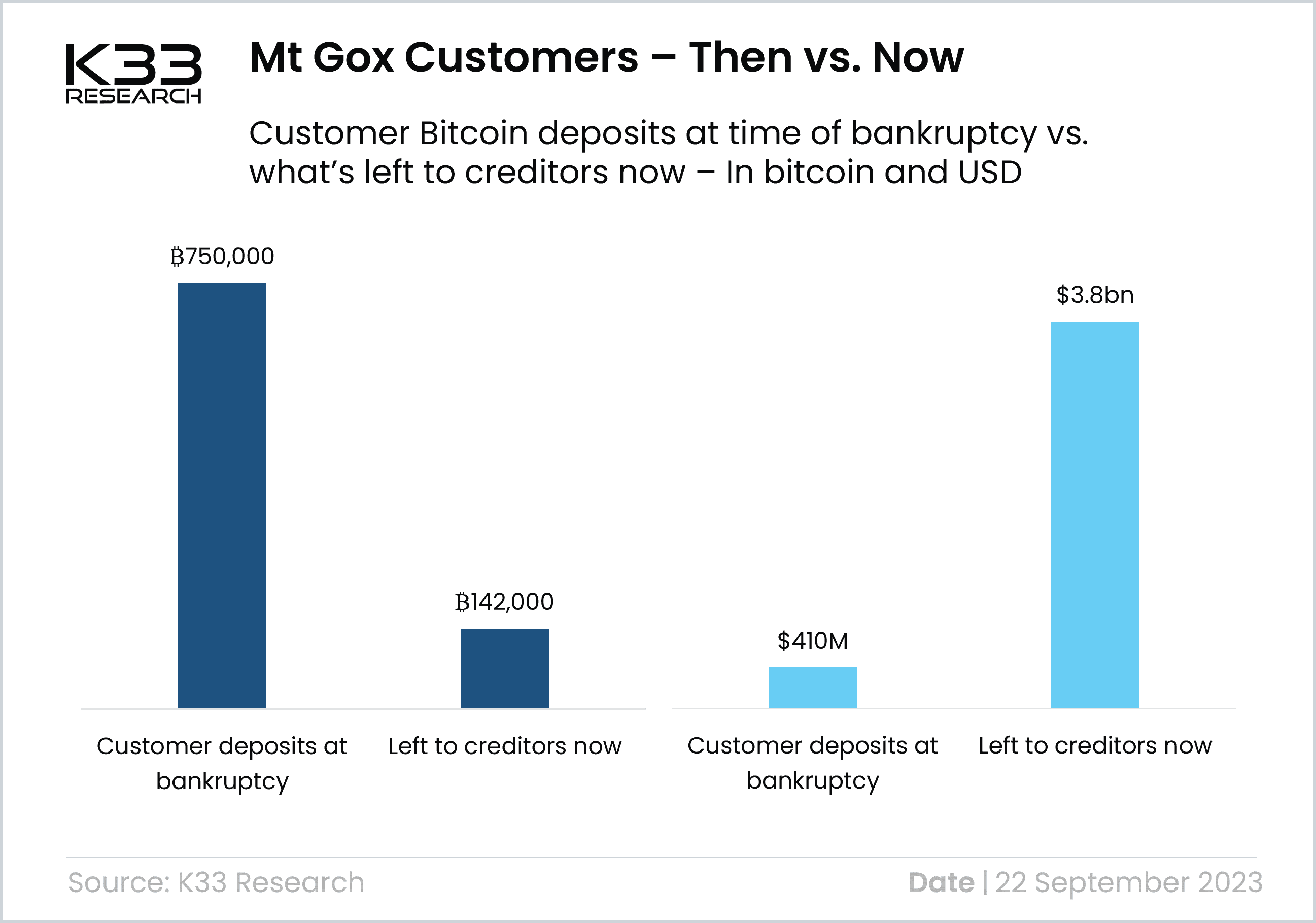

The ‘Bitcoin Unlock' deadline was extended by 12 months. Mt Gox's 127,000 creditors, primarily former exchange customers, have patiently awaited their share of the estate's assets since 2014. Currently, the trustee oversees 142,000 Bitcoin (worth $3.8 billion), 143,000 Bitcoin Cash ($30 million), and 69 billion yen ($470 million) to be distributed among the creditors.

Bitcoin held by the US government that's set to hit the market at some point in the future. Source: K33 Research

Lightning Network Updates

Coinbase plans to implement the Bitcoin Lightning Network for faster transactions amid growing competition. That follows exchanges like Bitfinex who have implemented something similar and a challenge from Jack Dorsey in July.

.png)

Bitcoin Mining

Bitcoin mining is being used to solve energy problems in rural Africa. 600 million Africans (43%) have no access to electricity. Bitcoin mining is a solution to the supply/demand mismatch in planning energy investment in these areas. This article follows our coverage of this industry development back in May.

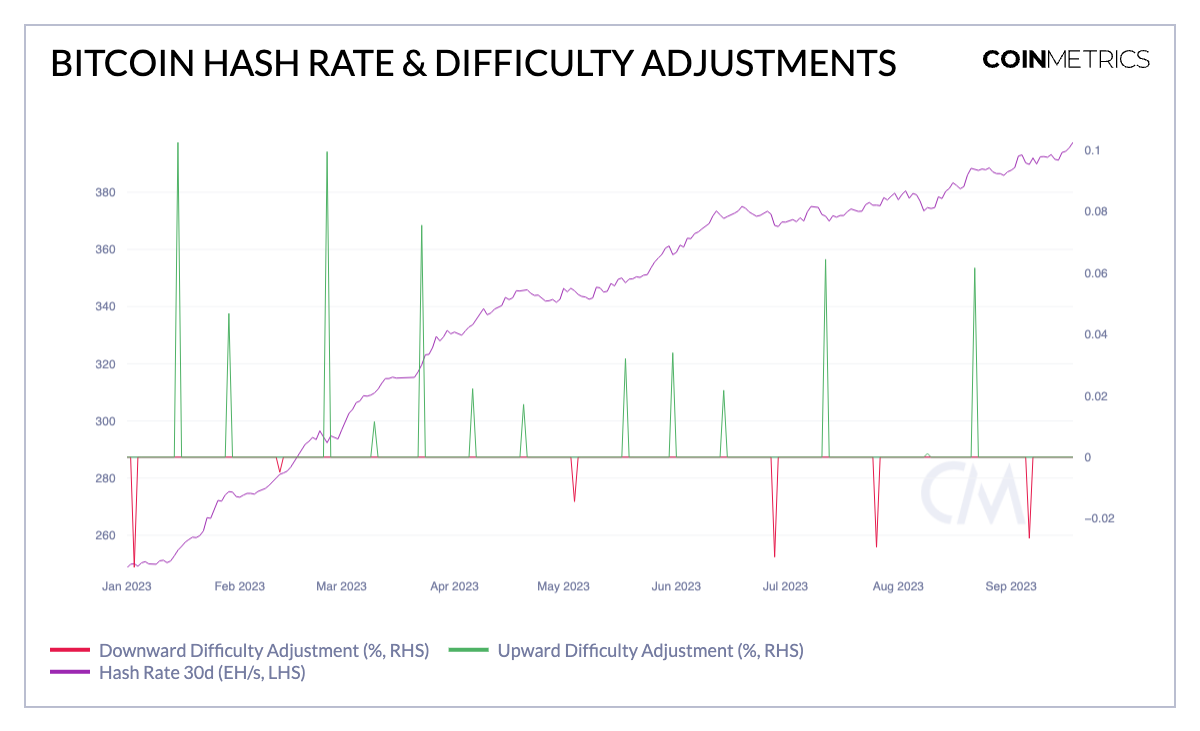

The concentration of hash rate in the hands of a few massive mining pools remains a concern for the Bitcoin community. Since January 2023, Foundry and Antpool have collectively controlled north of 50% of Bitcoin’s hashrate. This is a popular target of ire when it comes to centralisation risk.

The hashrate hit a new high of around 400 EH/s from 250 EH/s at the beginning of 2023. Source: Coin Metrics

Best Articles and Podcasts

When money doesn't work people stop working. Here’s an interesting take on the impact that high inflation has on incentives, particularly on low-wage workers.

This is a nerdy explainer of the bitcoin ‘security model’ and why the cost to attack the network simply doesn't make sense.

Macro and Politics

The competitor to CBDCs will be stablecoins as much as it will be other digital assets. For those interested there was a fascinating talk given in Singapore this week by Nic Carter of Castle Island Ventures. The parallels with the Euro-Dollar market are compelling and eventually the sheer scale of the stable coins will bring the US to heel. For now, we view them as risky.

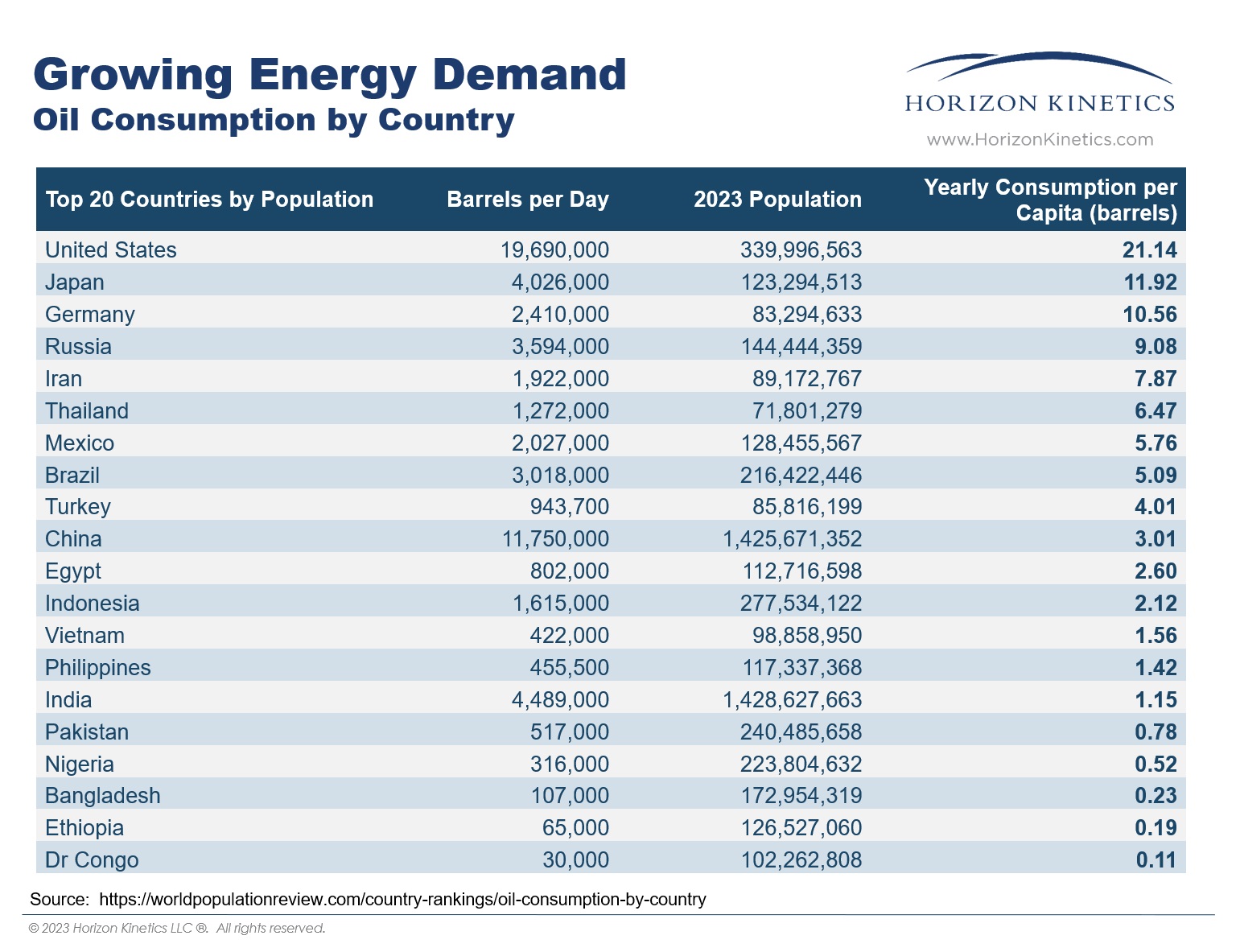

Oil consumption in the non-OECD world is rising, as those countries look to traditional fuels to drive economic development. The likely result: higher global oil demand.

Oil consumption in the developed world vs emerging nations. Source: Horizon Kinetics

Meme of the month

5 topics

3 stocks mentioned