The release of global PMI indicators recently indicated that global growth is ticking up and broadening out around the world, after being dominated by the US in 2023. Stronger global growth (as well as other factors like geopolitical concerns) are lifting commodity prices, which is causing renewed concern about the inflation outlook and leading to financial markets pushing back expectations for rate cuts.

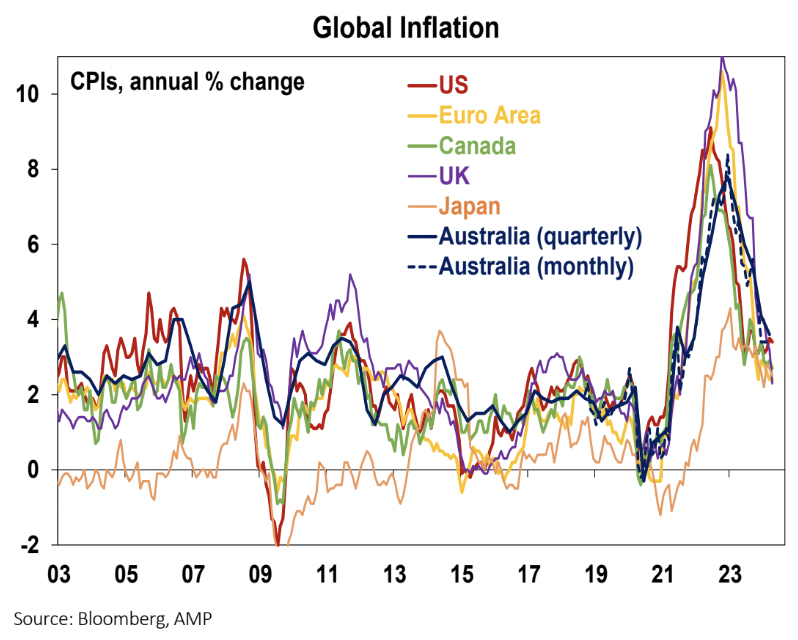

Global headline inflation has fallen significantly from its 2022 highs (see the chart below) and is running between 2.5%-3.5% across major economies. But, core inflation is still too high, and has been slower to decline. In this wire, we look at the impact of stronger global growth on the trajectory for inflation.

Global growth and commodity prices

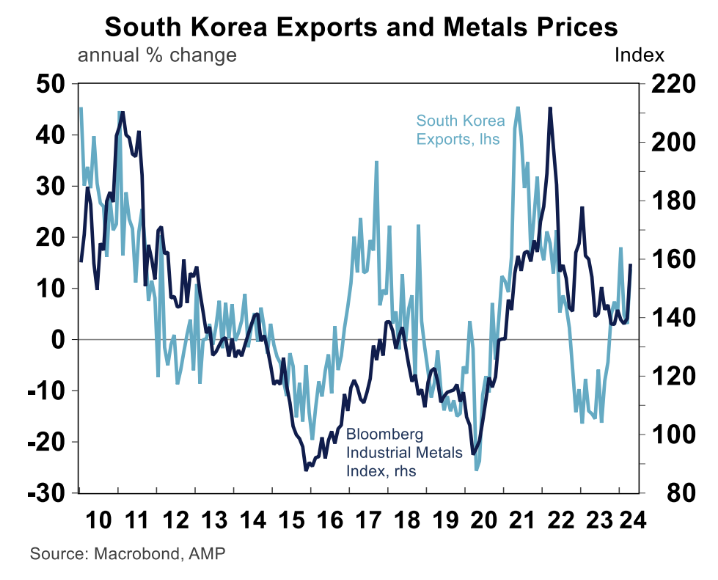

The uptick in global growth is one explanation for the increase in commodity prices, through the associated lift in demand, particularly for heavy industries. South Korean exports are often considered a bellwether for global growth (because of the high share of semiconductors, chips and motor vehicles and accessories) and during early 2024, have been increasing.

This has occurred alongside a pickup in industrial metals prices (see next chart).

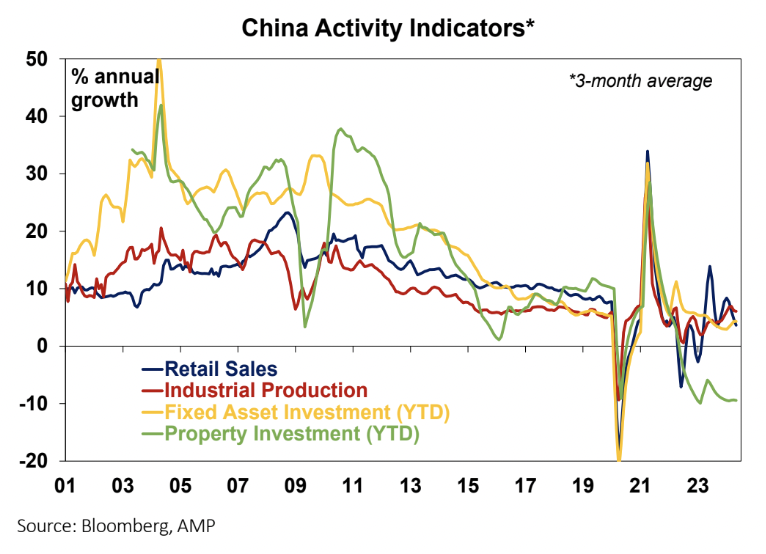

Despite a lot of negative headlines and concerns around Chinese GDP growth (particularly about the property sector), industrial production has held up in China (see the chart below), and industrial metals demand from China accounts for around 40-60% of global industrial metals demand. This reflects the strong growth in areas like solar panels, electric cars, aeroplanes, and infrastructure construction.

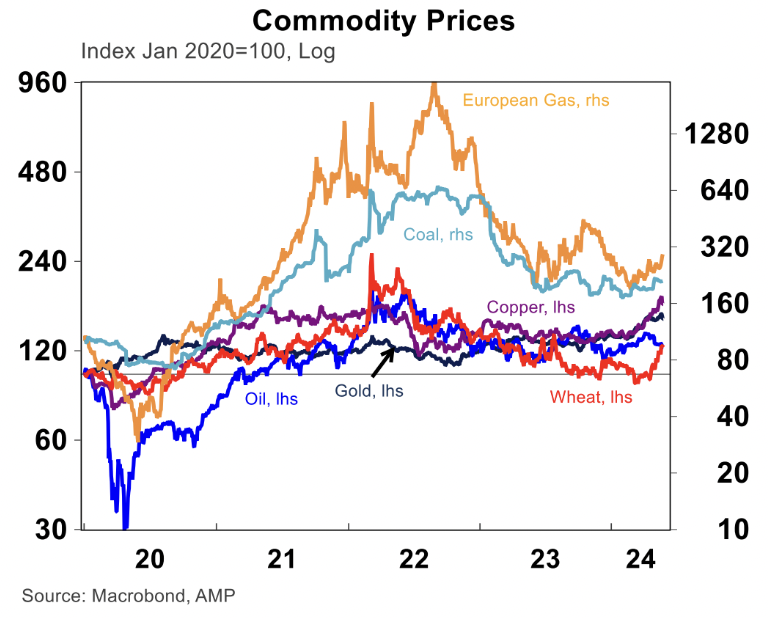

The lift in metals prices has occurred in copper (around a record high), gold (around a record high), aluminium, nickel and silver. But, other commodity markets have also seen a lift, including gas, corn and wheat (due to poorer Russian crop prospects). Oil prices are around US$80/barrel, down from their highs of around US$90/barrel in early April.

Other explanations for the rise in commodity price include a heightened geopolitical climate (with increasing threats in the Middle East) which usually lifts gold prices (typically seen as a safe haven), central banks buying gold or selling out of US treasuries and purchasing gold and expectations for lower interest rates through this year which decreases the opportunity cost of holding gold and also boosting growth prospects in the future.

Commodity prices and inflation

The broad fall across commodity prices in 2023 led to lower goods prices and helped to reduce inflation. So, if the recent uptick in commodity prices is sustained, it is an upside risk for inflation, as raw materials are used in production for many items, especially food.

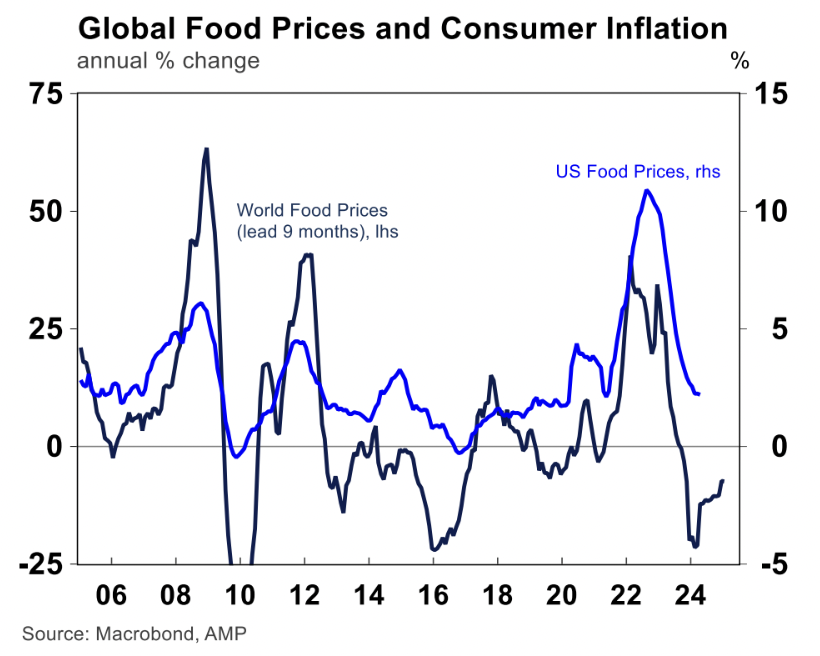

US food inflation has remained elevated (see the chart below) despite a steep fall in world food prices (although the chart below indicates that food prices should fall further).

However, the current economic backdrop is quite different to 2022. Across major economies like the US and Australia, multiple rate hikes have weakened the consumer. This is particularly evident in Australia with the faster cash flow transmission from the interest rate set by the central bank to the outstanding mortgage rate paid by households, with consumers drawing down on their accumulated savings.

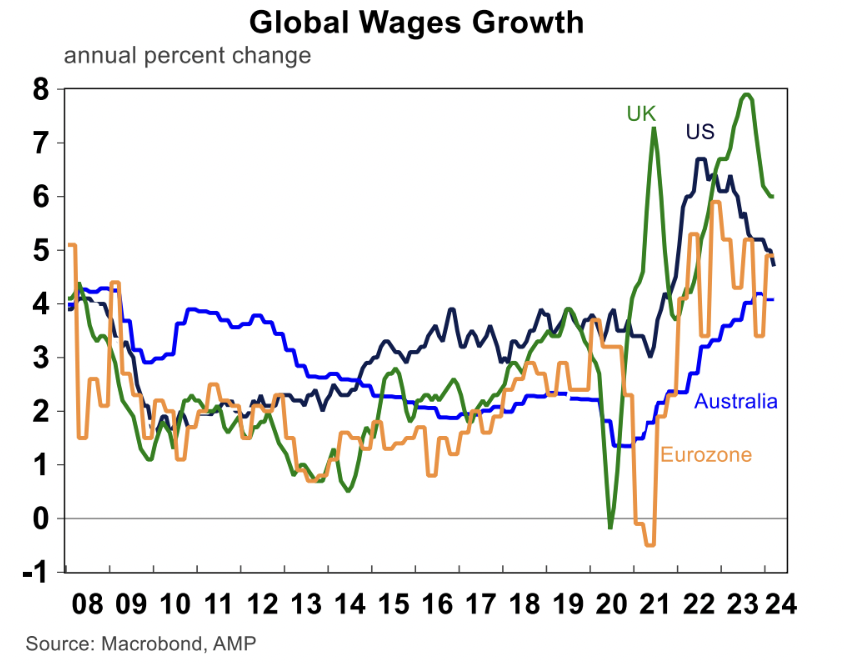

As a result, even if producer prices rise due to higher raw materials, they may not be able to pass on these prices as easily to consumers. As well, wage growth is slowing around the world (see the next chart) and should offset any potential rise in inflation as a result of higher commodity prices.

Lower wage growth is needed to reduce services inflation. However, wage growth still needs to decline further to be back to around 3-3.5%, to be closer in line with central bank inflation targets.

Implications for investors

We have been expecting inflation to decline further in 2024. The lift in commodity prices is an upside risk to our inflation projections but it’s too soon to be certain that higher raw materials prices will be sustained or passed on to consumers. Global growth improved in early 2024, but the US economy is weakening, China still faces many issues in its property sector and many advanced economies are being negatively impacted by high interest rates.

So, the stronger growth backdrop since the start of the year probably doesn’t have much further to rise. We see the current macroeconomic environment as being quite different to 2021/22.

In the immediate post-COVID period, producers were able to pass on higher raw materials prices to consumers because consumer demand was strong. But now, growth is softer and consumers are in a weaker position after numerous rate hikes and the draw-down on their accumulated savings.

As a result, we expect that there is further downside to inflation and we expect most major central banks to be cutting interest rates by the end of the year.

However, the slow progress in reducing services inflation means that any rate cuts will be minimal and central banks will be slow to unwind previous interest rate increases (unless there is a growth downturn or a recession!).

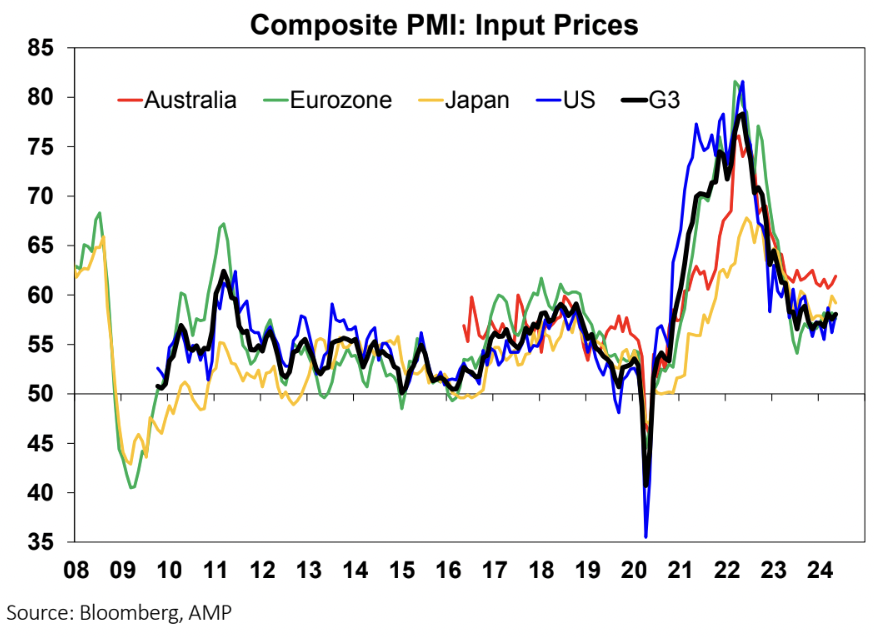

Something for investors to watch are the price indicators in the PMI surveys which are a good leading indicator for inflation. Input prices have mostly been stable in recent months, but it would be good to see some further downside from here.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire