Why China equities warrant a look in

Over the last two-odd years there has been a lot of discussion about an allocation to China in a portfolio and recently this talk has shifted as to whether China is investable or not. Investors that ignore China do so at their own peril, despite China becoming the largest economy into the rest of the century; being positioned differently from other developed market economies therefore providing diversification benefits; and being Australia’s largest trading partner.

Putting geopolitical concerns aside, China equities we think, warrants an investment allocation. China is about to join the rest of the re-opened world, with Shanghai and the other major cities emerging from COVID lockdowns. China’s central bank and government are supporting economic activity, evidenced by a sharp rise in China’s credit impulse. The recent price action too presents a compelling reason to consider an entry opportunity for investors.

Beijing and Shanghai are reopening

China’s worst COVID-19 outbreak is ending, with cases continuing to fall, all major cities loosening restrictions and daily life mostly returning to normal.

Figure 1: China's largest outbreak in more than two years looks to be under control

Source: Variflight

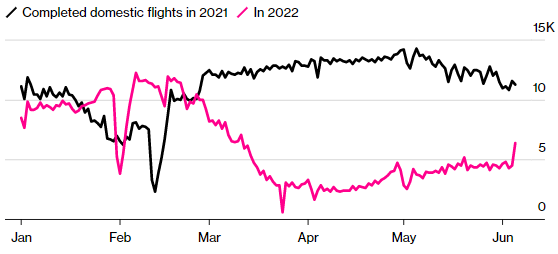

Figure 2: Air travel in China

rebounded as cities reopened

Source: Variflight

Markets reacted accordingly so far in the first seven days of the month with the “New Economy” sectors up over 3%, as shown by the MarketGrader China New Economy Index. Should the China market react to re-openings as they have in other markets, analysts expect a ‘strong rebound’. Global supply pressure is expected to ease with China’s reopening.

China equity market is also responding to positive policies

China’s tech stocks jumped last week as the government’s latest batch of new game approvals bolstered bets that the industry’s business outlook is on the mend.

China’s entertainment regulator on Tuesday approved licenses for 60 new games. Many investors see this as a flag toward policy normalisation following Beijing’s wide-ranging tech crackdown in 2021. CNEW holdings G-BITs, Kingnet, Shenzhen Shengxunda and 37 Interactive all rose in excess of 1.8% following the approvals even though none are directly involved in the 60 ratified games.

While the regulatory overhang for China and the China tech sector will weigh on investor’s minds, China has been working for many years to open its equity market for offshore investors. Chinese authorities worked hard to ensure its A-share market was included in MSCI and FTSE indices by satisfying stringent liquidity and accessibility criteria. We think China A-Shares are investable and the government will be working with industry as policy makers stimulate the domestic economy.

The importance of China

Overall, we remain optimistic about China, given the mainland’s strong fundamentals. China will soon become the world’s biggest economy and it will be China’s younger, urbanising demographic that will drive economic growth as the economy re-opens.

A-share companies in the consumer, healthcare, and technology-related sectors, which source the bulk of their profits and revenues from the domestic market, look to be well placed to benefit from the economic expansion and government and central bank attempts to kick-start growth.

Stepping back, one of the reasons investors diversifying globally is to gain exposure to different economic cycles than those being experienced domestically. With much of the developed world facing higher inflation, higher rates and governments with historically high levels of debt, China’s economy has different economic fundamentals. China still has ‘dry powder’ to stimulate its economy. Its central bank is working hard to create lending and growth in China, unlike much of the rest of the world, is expected to be positive in the seconds half of 2022.

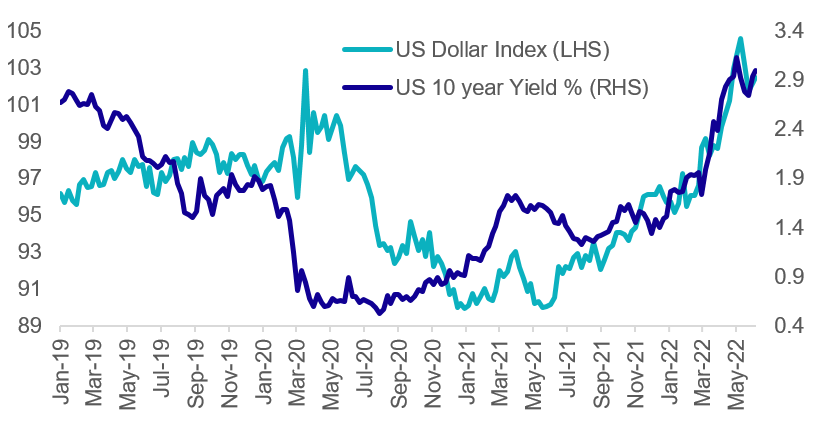

Recently, US dollar and treasury yields have pulled back from recent highs, which is good news for China, as dollar strength has been part of the tightening conditions. The other positive for China, and the rest of Asia, is the improvement in China’s credit impulse.

Figure 3: US dollar Index and US 10 year yields (%) have pulled from highs in May

Source: Bloomberg

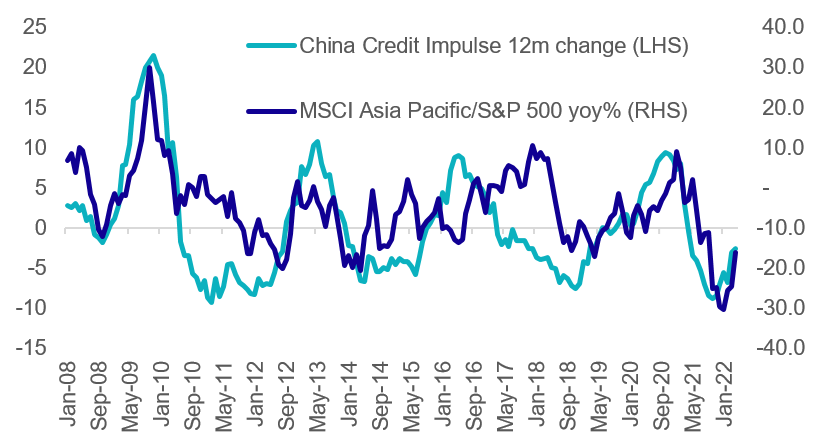

Figure 4: China’s credit impulse rising good for Asia equities

Source: Bloomberg

The credit impulse is expected to continue to rise as China’s Central Bank is urging lenders to boost loans. During the past week China’s Central Bank also said it would support lenders to lower financing costs, as well as stepping up help for small businesses in order to stabilise the economy and jobs.

China is Australia’s largest trading partner, and while recent tensions between the governments have been in the news investors, irrespective of the geopolitical views, that do not have a China exposure do so at their own peril, we think.

As a diversifier and a growth allocation China equities, we think, warrants consideration.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

5 topics