Why Citi believes oil bulls may be left disappointed

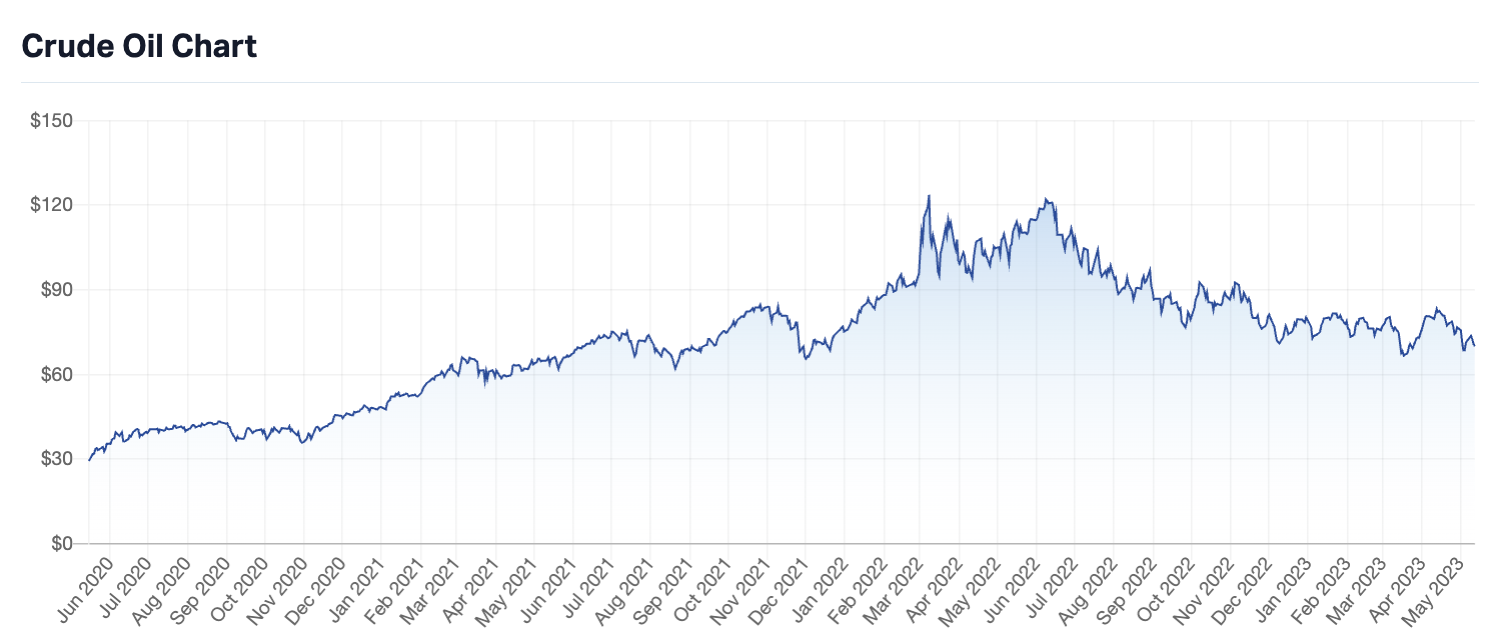

It’s been a long and painful 12 months for oil bulls. After the Brent crude price peaked in June 2022, it’s been one-way traffic. And one of Wall Street’s most respected energy analysts doesn’t think there will be any more good news on the immediate horizon.

Citigroup’s Global Head of Commodity Research, Ed Morse, believes crude oil may not climb beyond US$82/barrel for the rest of the year - and isn’t ruling out a year-end price of below US$80/barrel.

In this piece, I’ll summarise his thinking and provide some local perspective from Citi’s Australian energy analysts.

Welcome to the stabilisation period

You would think that recent headlines around the oil market would actually boost the price. Most recently, the OPEC+ cartel announced a production cut to 1.2 million barrels per day. So far this year, the total production cuts from OPEC+ have amounted to 3.66 million barrels per day with more not being ruled out.

But hopes for a boost in demand is likely to evaporate, as Morse explains:

“We foresee neither a turning point in demand growth to the upside nor to inadequate supply from non-OPEC. If anything, the chances are that demand will continue to underperform expectations through the year just as demand has disappointed globally year-to-date.”

Lots of factors will weigh on the oil price including weaker than expected global economic growth. The narrative around bullish demand in China could also be easily usurped.

“Chinese data on demand appears potentially misleading, with mobility data reflecting a freedom and desire to travel around the Labor Day holiday, but accompanied by weaker manufacturing and industrial activity, and faltering annual GDP growth quarter after quarter following an initial re-opening surge.”

The structural point of view

Morse also argues there is a “double normalisation” playing out in the oil markets, all leading to a redefined “normal” for oil markets.

1. Forward curves are flattening, implying that the inflation in costs in the oil patch is (or was) coming to an end, and

2. Prices reflecting more of a new average price for markets as new supply lines and associated freight rates normalise.

Citi’s view on ASX energy stocks

Citi upgraded Woodside Energy (ASX: WDS) to NEUTRAL from sell last Friday, but did note it has some serious concerns about the company’s flagship gas project.

“Woodside believes the regulatory risk in Australia isn’t necessarily worse than other parts of the world and may not be an impediment to investment. We are not yet convinced by this argument as most joint ventures we speak to seem to be reducing CAPEX budgets.”

The current price target of WDS is $32/share. Rival broker Macquarie also has a NEUTRAL rating but it recently decreased its exposure to the stock.

Citi is a little more positive on Santos (ASX: STO), despite also having a NEUTRAL rating attached to it.

“We continue to believe STO is efficiently priced by the market, where the market has adequately reflected most risks facing the assets into the cost of equity.”

What do the fundies think?

Talking to our own Glenn Freeman, Martin Currie’s Michael Slack argued recently there is still more upside to come for Woodside.

“I think there’s still some good upside in Woodside. The other thing that will bear out over time, now that the merger with BHP petroleum is complete, is the pipeline of opportunities for WDS. Not only will it have access to its own pipeline of strong future gas markets – and we like gas as a transition fuel – BHP has contributed a lot to that pipeline, which will now get the focus of a dedicated energy company.”

On Santos, Stefan Hansen of Tyndall AM was most impressed by their most recent results particularly around free cash flow and better-than-expected dividends. But don’t jump for joy too quickly.

“Despite the high energy prices of last year, there were some government intervention issues and regulatory issues with the offshore regulator around the Barossa project. That will continue to weigh on the stock, but we expect that to get resolved over this year. And then the delivery of these projects really is the key value driver in our view for Santos.”

3 topics

2 stocks mentioned

2 contributors mentioned