Why I am frustrated by the state of ESG II

Nobody wants to read a long wire on New Year's Day 2023. This will be a pretty short wire with a simple message that reflects my NYE Resolution. In a nutshell, I promised myself to waste no time on matters that would not help my clients, this world, or anything in it.

I do believe in the ultimate purpose, and cause of sustainable investing, but I really have come to the firm view that the industry has basically lost its compass bearings and wound up in a strange cul-de-sac of over-reliance on a battery of ill-posed ESG metrics.

As I will later show, the results of this scoring effort to rank companies on their ESG performance often wind up being a proxy for the size of the company.

The value of ESG metrics is to teach us this totally un-surprising lesson:

Larger firms can devote more human resources and management effort to meeting external regulatory and compliance demands.

Perhaps that makes them "better" in the eyes of some, but I am not persuaded that larger firms will necessarily do better in adapting their plant and process to climate change.

The spur to this observation is my own experience of regulatory overheads in small business. It can seem arbitrary, punishing, and often lacking clear merit.

Right now, I am deep into business planning for 2023, and so spent a few days last week gathering together the various due diligence documents for future business progress:

- Investment Committee Charter

- Compliance Policy

- Conflict of Interest Register

- Insider Trading Policy

- Personal Dealing Policy

- Anti-Money Laundering & Counter-Terrorism Financing Policy

- Breaches & Incidents Policy

- Dispute Resolution Policy

- Risk Management Statement

- Training Policy

- Privacy Policy

- Cybersecurity Policy

- Document Retention Policy

- Proxy Voting Policy

- Voting Records Register

- Corporate Action Policy

- Investor Suitability Statement

- Sustainable Investment Strategy

- Investment Process Statement

- Investment Management Agreement

- Investment Mandate

- Risk Management Process

- Trading & Dealing Process

That is quite a list, but it is all fine.

I have 25 years of experience as a financial market professional.

My wife, who is a partner in the business, has 25 years of experience in corporate para-legal.

Our AFSL Corporate Authorized Representative (CAR) Compliance Officer is a qualified lawyer, with similar experience across markets, and perfectly capable of assisting us to meet the long list of prerequisites to actually have a host of a chance of ever being in business.

This will surprise nobody who has any familiarity with finance.

However, do spare a thought for the fate of any corporation that must now file their responses to multiple separate questionnaires from different competing providers of ESG metrics.

If they are not to receive a down-rating on their responses to the Environmental, Social and Governance (ESG) questions, then they must complete all questionnaires as fully as possible in a timely fashion. Furthermore, if they happen to be an industrial or mining business that has significant carbon emissions, they are most unlikely to be asked any direct question that has any strong relationship to those emissions. It will be something oblique, that is a question that suits the purpose of the quiz-maker, and not the social purpose of emissions reduction.

To make my beef concrete, consider this question. If you own a gasoline-powered car, the most obvious question to ask would be this:

How many kilometers did you drive last year and what car did you drive?

There are better proxies for carbon emissions, namely actual fuel consumption and average speed of travel, which relate to the emissions profile of a working vehicle engine.

However, these would be difficult records to come by. A simple once-a-year odometer check is sufficient to approximate fuel consumption through distance travelled. There are the standard adjustments one needs to make for reduced fuel economy in city traffic as opposed to cruise travel down the highway. However, you all know the score. That is how it works.

If you gathered such data for transport, and other important industrial activities, such as the physical plant used in a mine to crush ore, industrial heat sources in a factory, or electricity consumption within a building or warehouse, you will have a close approximation to the actual carbon emissions that were associated with a given physical activity.

The natural corollary to this statement is that if you want to reduce your emissions to accomplish the same task then you need to drive less distance, more efficiently, with reduced speeds, steady speeds, and less idle time spent waiting in traffic. You could also replace plant and maybe buy a new vehicle, possibly an electric vehicle connected to a renewable grid.

There are related levers of superior performance which are relatively easy to identify in any major industrial activity that burns fossil fuels. For instance, in ocean shipping the fuel that is used per nautical mile travelled goes as the cube of the ship speed. Ergo, if you can persuade your customer to wait 10% longer for delivery, that will shave around 33% from the greenhouse gas emissions attributable to shipping each 40-foot container over that distance.

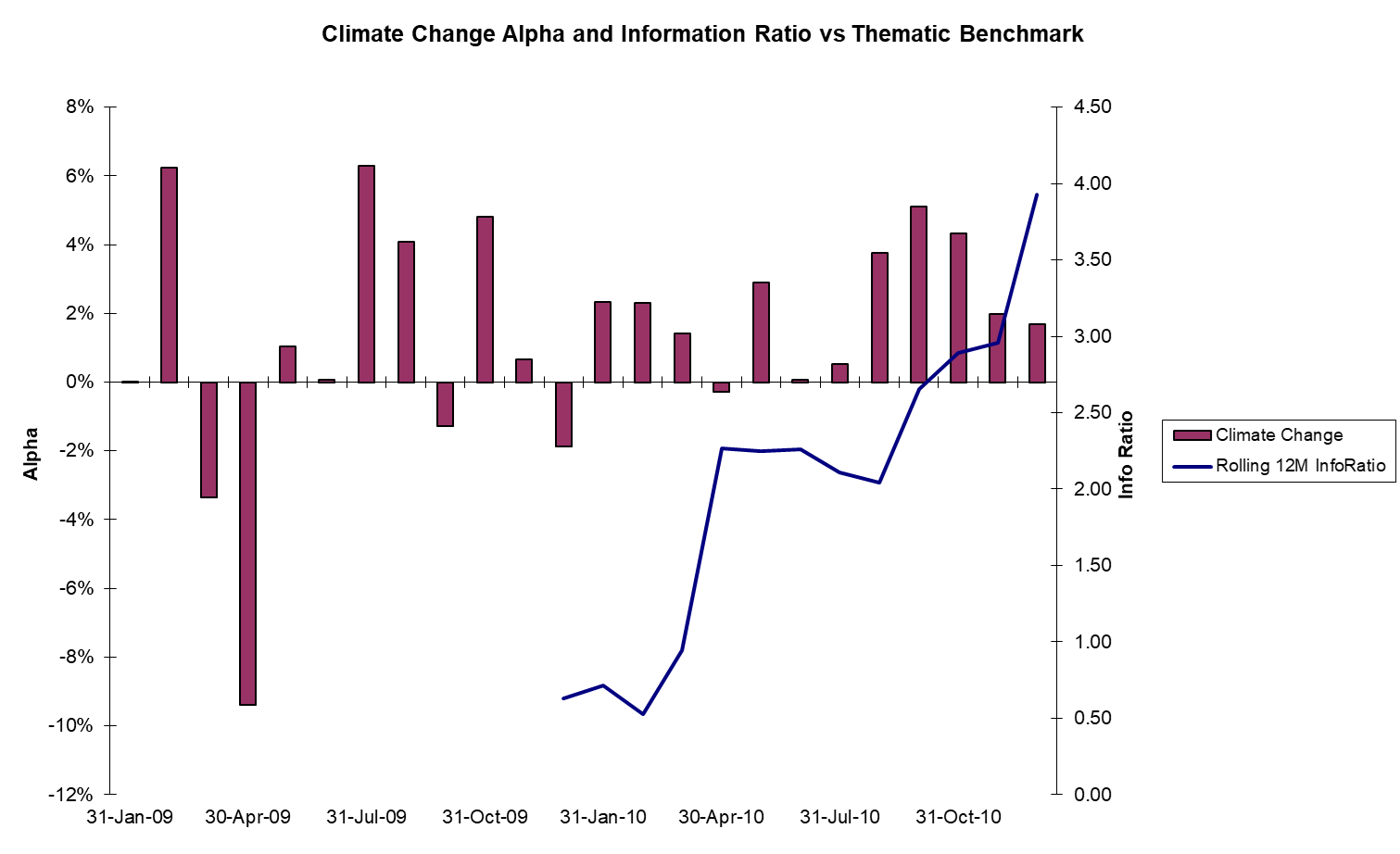

This is the kind of stuff that I used to discuss climate change mitigation with company CEOs the last time that I ran a climate change fund, which is now more than 10 years ago. That was a challenging period in markets, but I am quite proud of the success that my small team were able to achieve in managing a series of active strategies. The climate change one happened to be benchmarked against a well-known climate change benchmark that is now the subject of many a passive investment Exchange Traded Fund (ETF) strategy.

The contemporary press, especially in Australia, is fond of remarking that fund managers are not generally able to beat their benchmarks, and so passive management is to be preferred.

I can say that my team did have a torrid year in 2008 when the high level of hype associated with renewable energy collided with a major bear market. In the workout from that period, a small team of three were soon able to find value and perform well.

The final trailing information ratio of that fund (a measure of active return for unit active risk) was just less than 4. Any number over 1 is considered good for an active manager, while a number over 2 is considered exceptional. Numbers around 4 are abnormally high.

I would not expect to achieve the same results now, but I am happy to point out that we did not achieve those results through any reference to a modern ESG metric. The sort of survey-driven numbers that constitute ESG reporting today were simply not available then.

The way that we invested then is the exact same way I would invest today.

We used a version of the car mileage rule of thumb. We reasoned that those firms who could make a consistent profit by selling new capital equipment that could make the same output of something useful, like ship ton-miles travelled on the ocean, but do so with less greenhouse gas emissions, would likely experience strong growth and good business conditions.

I will freely admit that this does seem like cheating.

How could a vexing question like climate change be so simple?

Who could possibly credit positive change with a simple and durable focus?

In our minds, this strategy made good sense and we had little doubt that we could continue to find such opportunities long into the future. The real performance track record of actual live portfolio performance versus a much-vaunted passive climate change benchmark proves it.

So, why did we close the fund?

The lesson of my introduction serves to explain why. There are expensive compliance and back-office costs associated with any funds management operation. To make an actual working investment strategy work as a business you need to gather assets.

Try this one for size, with your family and your neighbours.

Explain to them that you have had a major brainwave. You are going to solve climate change by persuading everyone to junk their old car and buy a new one. Either an EV, or one that is still fossil-fuel-powered, but with better mileage.

I urge you to try that exercise and see what response you get.

However, in truth, that is all that we did to actually run a successful (in performance) climate change active funds management strategy. It worked, and we knew it worked, but when asked why we thought it worked we were honest enough to tell people the real reason we did it that way.

This turned out to be the wrong reason to give, for marketing purposes.

What I can safely say, today, is that there is now a super-abundance of ESG metrics that my research has established have essentially no correlation with investment performance. The shrewd marketer will appreciate that you can happily game the system by cherry-picking whichever set of metrics you want to select to make your portfolio look good.

Of course, I am not going to do that, but I do want to communicate this important message. While I fully support active investment strategies to combat climate change, I just made a very important New Year's resolution that I promised to keep until my dying day.

I am not going to lie about my investment strategy just to raise money.

That has never been my modus operandi in funds management.

When Australian superannuation funds asked us about our former climate change strategy, and what made it work, I told them the truthful answer that I just gave above.

They were not persuaded that this was a good answer. They wanted something else.

That is their lookout, but I am disinclined to change my story. It works. Did then. Does now. I still invest the exact same way in this space, and I am not going to change the strategy.

To close, let me leave you with one cautionary figure that speaks truth to ESG metrics.

The chart above shows the correlation between the ESG score given to all companies in the Australian S&P//ASX 200 and the size of the company as measure by the logarithm of the market capitalization. You can see that the R-squared is 29%, near enough.

That is a good correlation: Big - good on ESG metrics; Small - less good on ESG metrics!

Moral of the story: to ace the ESG-exam don't be a small-cap manager!

I think the reason is pretty darn obvious. Large firms can afford to hire large teams to answer the requisite questionnaires across however many different data vendors enter the game.

The beauty of the ESG metrics industry is that it fulfills this simple question profile:

Have you stopped beating your wife?

Answer carefully because your entire corporate reputation depends on it.

Very simple proxies for lower carbon emissions, like the head grade of your copper mine, or how many tonnes of ore you need to shift for each tonne of lithium concentrate are not considered apropos as answers to one hundred plus questions of an oblique nature.

I opened this article with a very long list of the compliance chores to be done by Tuesday to get my firm through due diligence. Smaller enterprises are expected to meet essentially the same regulatory and compliance demands as larger ones. That can be a challenge.

However, I also shared that the Jevons Global team, and our compliance officer, are highly experienced market professionals who are not fazed by the regulatory demands of this industry. We have a very simple over-arching corporate policy:

Don't LIE to clients. Admit errors when made. Fix them to benefit the client.

Needless to say, you do need reams of regulation in our industry. The unfolding story of cryptocurrency bankruptcies and malfeasance eloquently speaks to that need.

However, I do have sympathy for those public companies who struggle to fill in their ESG questionnaires when they are asked questions which I, as a professional investor, mostly disregard as pretty much irrelevant to my investment deliberations.

This is especially so for the primary mission of climate change where the ultimate determining factor for greenhouse gas emissions is plant capital equipment type and utilization efficiency.

These are actually well understood and measured engineering parameters of any well run and managed industrial organization. There is quite literally nothing new in this dimension. What we do see is better efficiency metrology through digitization of plant control equipment.

These are very important factors in the progress of any real-world company with a large carbon emissions footprint, such as an operating mine, a steel plant, a rail company, a shipping line, an airline, a road freight company, or a refrigerated goods warehouse.

A ready supply of varied ESG metrics may appear helpful to novice investors in the industrial companies' space but they are essentially useless to me. I will simply speak to management and ask them the same searching engineering physics motivated questions I always have.

I know thermodynamics well. I know that if an electric utility tells me that they will significantly alter their fuel-to-electricity conversion ratio in a thermal generating plant without changing the operating temperate to exhaust temperature ratio they are simply greenwashing.

The laws of nature are much less easily fooled than some who sit on pension fund investment committees.

In short, no professional should have to waste their time slavishly following "good form" on a set of answers to ESG questions they did not write, which have little bearing on outcomes.

That is why I made my NYE Resolution on ESG Metrics:

I am not going to lie to clients that they have any great value to my process.

Enjoy the New Year, and the opportunity that the workout from a bear market brings!

Image Credit: Donald Cooper / Licensed photo from Alamy Stock Photo

The chorus in BACCHAI by Euripides at the Olivier Theatre, National Theatre (NT), London SE1 17/05/2002 translated by Colin Teevan music: Harrison Birtwistle design: Alison Chitty lighting: Peter Mumford movement: Marie-Gabrielle Rotie director: Peter Hall

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics