Why R&D masks earnings & value in today's mega-techs

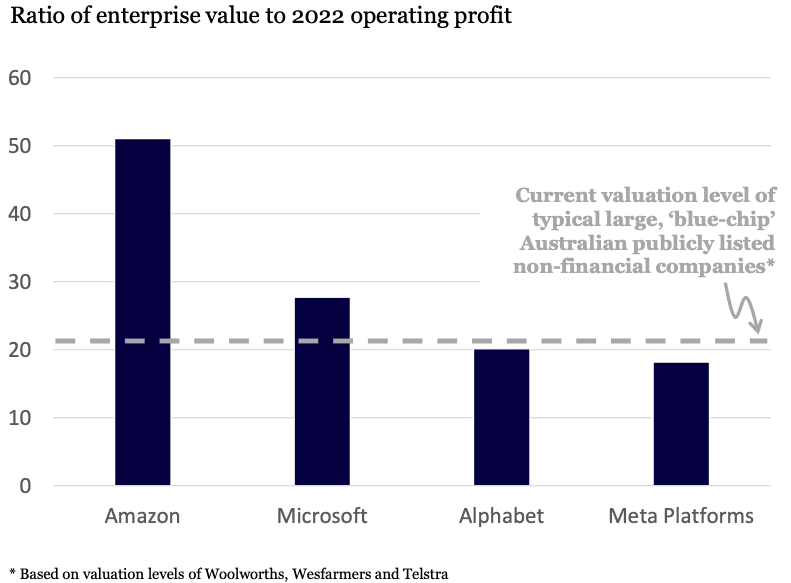

In the eyes of many investors, today’s mega-techs – Amazon, Microsoft and Alphabet, for example – are way overvalued. A cursory glance at the valuations of the North American majors suggests they are more expensive, say, than most of the big non-financial ASX-listed companies. You need to pay a higher multiple of next year’s operating profit for these tech giants.

Valuation multiples of US mega-techs

Source: Bloomberg

But investors are missing something vital: the massive sums the mega techs are spending each year on research and development (R&D) is masking their true earnings power and valuation.

Rather than expensive growth stocks, mega-techs are cheap value stocks.

Today’s mega-techs might appear expensive because they expense R&D. But R&D is really an investment that yields high-probability future returns. That means the mega tech’s reported earnings today – and therefore their apparent valuations – are understated.

Not all expenses are created equal

When a business reports its operating profits, it wants to give investors a picture of the revenues generated, less the costs incurred to generate those specific revenues. For most expenses, such as ‘cost of goods sold’ (that is, the direct costs incurred to create a product or service which has been sold) there is a clear link between the cost and revenue.

But for R&D, the link between cost and revenue is less clear.

Under US accounting rules, if a company spends money on R&D the costs are immediately and fully ‘expensed’ today (that is, today’s profits are reduced by that full amount) because it is uncertain whether the company will derive any future economic benefits from said R&D.

This convention is very conservative and the implicit meaning of R&D expense in the US is that a company will not realise any future economic benefits. But for many businesses – particularly those with powerful market positions, scale, and data advantages – R&D does often lead to huge future economic benefits in the form of massive cash flows, profits and more entrenched market positions.

So, for businesses like the mega techs, R&D is an ‘investment’, not an expense. And by implication, their earnings power is understated.

Successful R&D drives and hides value

Not all R&D will drive long-term value. Lots of R&D is speculative – it has a low probability of success, but, if successful, will generate high returns. That’s the case in fields such as drug discovery or prospecting for natural resources. Most dollars spent on these endeavours will not yield future economic benefits and, therefore, it is right that companies should expense those dollars when they are incurred.

But when Microsoft spends dollars to create its communications platform Teams, or when Alphabet spends to create its specialised machine learning tensor processing unit (TPU) chip, or when Amazon creates Alexa – the probability of future economic benefits is extremely high. That’s because these businesses already own large, privileged, connected ecosystems of customers and developers.

What is unusual about today’s mega-tech leaders is that they are choosing to spend to innovate, rather than drastically boost their short-term earnings by holding down R&D spend.

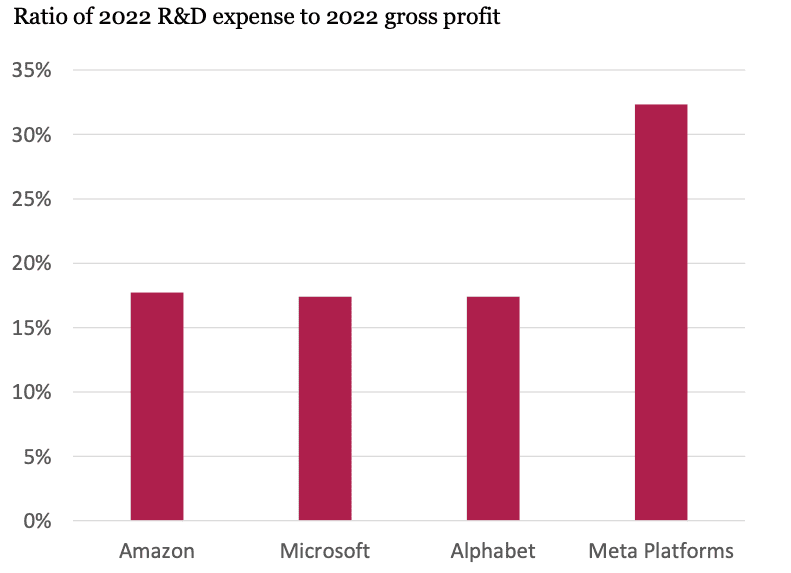

This year, Amazon and Meta Platforms will spend around US$40 billion on R&D. Alphabet will spend around US$30 billion and Microsoft more than US$20 billion. As a percentage of gross profits, this spending ranges from 17% up to an extraordinary 32% for Meta.

US Mega-techs: R&D intensity

We believe there is a high probability this enormous spending will lead to future economic benefits for these businesses. The expensing of the billions in R&D spending this year is therefore way too conservative and the mega tech’s earnings power is materially higher than it looks. And if this is so, then today’s valuation multiples are too high.

These businesses are much cheaper than many investors think!

A bigger investment opportunity than many appreciate

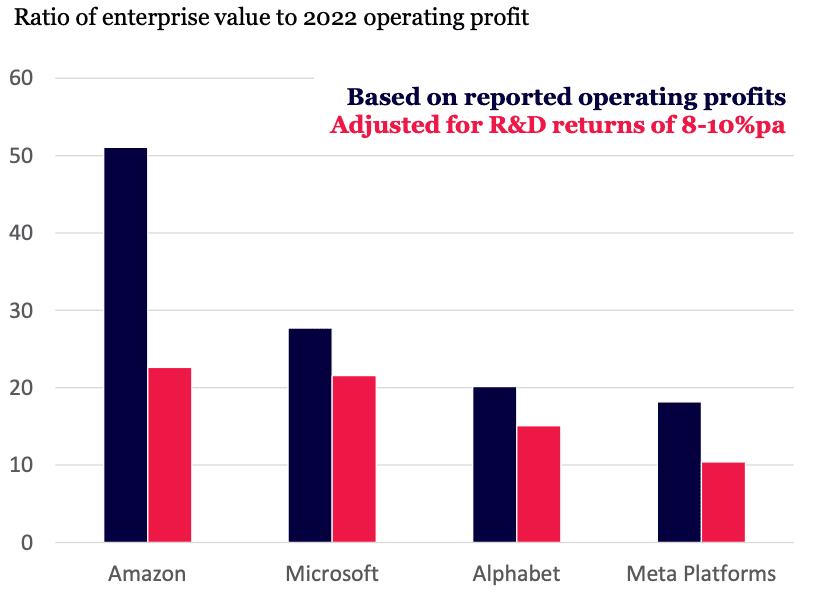

Here is a thought experiment. Imagine if the R&D spent by these American mega-techs earned an average effective return of, say, 8-10% per annum – which hardly sounds unreasonable and is certainly the absolute minimum hurdle needed by management teams to approve internal budgets.

If this were true, then we estimate Amazon’s ‘true’ valuation multiple would more than halve to just over 20x operating profit. Alphabet’s would be 15x and Meta’s would be just 10x. If the return on R&D was higher still, then these valuation multiples would reduce even further.

Valuation multiples of US mega-techs

Investors today have an unusual opportunity. Many investors are wrongly thinking that some of the world’s most well-positioned and advantaged technology businesses are ‘expensive’.

But, to a large extent, that is being driven by the big R&D spending, which is depressing their perceived earnings power today in favour of higher earnings power in the future.

The message for investors is clear: cursory valuation analysis can often lead to false conclusions.

Yes, at first glance, most of America’s large mega-techs ‘screen’ as expensive.

But when you consider the true value of the very significant R&D expenses that are depressing reported earnings, it’s not hard to imagine this R&D leading to substantial future benefits in artificial intelligence, the internet of things and the ‘metaverse’, for example.

The true earnings power of these businesses is hidden today. And, therefore, these businesses are much cheaper – and much greater investment opportunities – than many appreciate today.

Note: Montaka is invested in Meta & Amazon

Compound your wealth over the long-term

Montaka Global Investments provides investors with the opportunity to compound wealth over the long term through disciplined global investment strategies and a sophisticated approach to risk management. Get in touch with us through the 'CONTACT' button below.

5 topics