Why Zillow's move out of iBuying is cause for celebration

In July this year I wrote “Zillow — could it be a 10-bagger?”. I presented an in-depth look at the US real estate market and the opportunity Zillow had to digitise home-buying, otherwise known as iBuying.

Zillow’s largest and most profitable business is its internet, media and technology (IMT) segment, which incorporates two real estate listings websites, Zillow and Trulia, which control more than 67% of the US market.

The company entered the iBuying business in 2018, launching Zillow Offers with the ambition to streamline the buying process by reducing typical impediments like time and cost.

Zillow ramped the business quickly and delivered US$2.6 billion in revenue in the first three quarters of 2021. The iBuying service was highly valued by potential vendors who flocked to Zillow and its peers to take advantage of its ease and convenience.

In the Livewire article I commented:

"Zillow’s large database of 135m+ homes provides an informational edge. More data allows Zillow to perfect its proprietary pricing models to offer more accurate prices for sellers and buyers while ensuring a profitable business model for Zillow. The business benefits from scale as it relies on the law of large numbers to provide a stable win rate over time, which the company calls its contribution margin."

On the Q1 2021 earnings call in May, CFO Allen Parker was optimistic for the future of Zillow Offers, sharing its success and reporting revenue that exceeded the high end of their outlook.

"Growth in Zillow Offers continued to reaccelerate in Q1," Parker said. "We reported home segment revenue of US$704 million, which exceeded the high-end of our outlook with 1,965 home sales. Resale velocity was above our expectations. In Q1, we sold 128% of the beginning inventory of 1,531 homes was contributed to inventory decline at the end of Q1 to 1,422 homes."

His commentary vindicated the business case but, in retrospect, also provided the first indication the pricing algorithm required serious fine-tuning. Purchases were not keeping pace with price appreciation and Zillow was failing to acquire homes at the pace expected.

“Purchases increased to 1,856 homes in the quarter from 1,789 homes purchased in Q4, but not quite at the pace we planned as we continued to work on refining our models to catch up with the rapid acceleration in home price appreciation" - CFO Allen Parker

On the Q2 earnings call in August, CEO Rich Barton remained confident pricing trends would normalise, but made the following observation about the pricing models.

"As we discussed last quarter, we recognised that our Zillow Offers unit economics are above our plus or minus 200 basis point guardrails as we build and scale the business, a trend that continued in Q2 despite our efforts.

We expect these unit economic trends to normalise over time as we iterate, continue to learn and as home price appreciation inevitably slows. We’ve been testing pricing elasticity in this hot housing market, and we saw rapid conversion gain throughout the quarter as we improved our offer strength. We believe these tests will serve as well across future market conditions as we strive to be a market maker across housing cycles. - CEO Rich Barton

As the pricing algorithms were adjusted, the conversion rate increased, and Zillow acquired more properties. However, house price volatility meant the plus or minus 2% guardrails were regularly being broken.

The volatility significantly exceeded management’s expectations and by Q3 2021 they were concerned. The unit economics once considered acceptable were now operating significantly outside expectations.

“We have been unable to accurately forecast future home prices at different times in both directions by much more than we modeled as possible, with Zillow Offers unit economics on a quarterly basis swinging from plus 576 basis points in Q2 to an expected minus 500 to minus 700 basis points in Q4,"

Put simply, our observed error rate has been far more volatile than we ever expected possible and makes us look far more like a leveraged housing trader than the market maker we set out to be.” - CEO Rich Barton

In addition to model risk, Zillow was disenfranchising customers. Only 10% of potential vendors were able to secure an offer they were happy with, meaning 90% were walking away disappointed.

"We’ve been able to convert only about 10% of the serious sellers who ask for a Zillow Offer, and we have tended to disappoint the roughly 90% who didn’t sell through us.

Given our hard-earned position at the top of the seller funnel with 220 million-plus average monthly unique users and the popularity of the Zestimate, there are better, broader, less risky, more brand-aligned ways of enabling all of our customers who want to move." - CEO Rich Barton

At the Q3 earnings call in November, Zillow’s management announced the decision to exit the iBuying business. While disappointing, we believe it is the correct move.

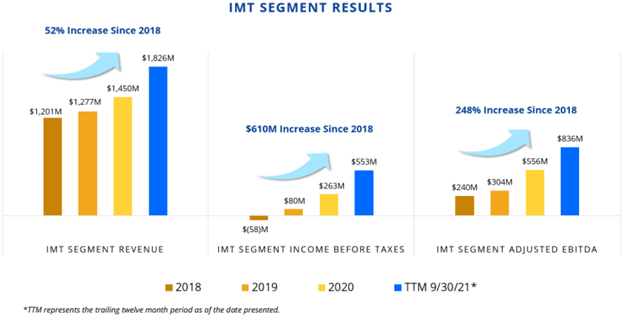

Failure of the Zillow Offers business may have jeopardised the IMT segment, which is the golden goose earning around $800m in EBITDA in 2021.

As investors, we are always happy when management makes hard decisions in the best long term interest of shareholders. This is one of the benefits of investing in a founder-led businesses, evoking the line by Jack Lang:

''Always back the horse named self-interest, son. It'll be the only one trying.''

We removed the potential upside from the Zillow Offers business from our model. However, we continue to like Zillow’s IMT segment and believe there is a significant opportunity to grow both the top line and EBITDA over the long term.

In my July article I included a chart showing the margins of two global peers, Rightmove and Realestate.com.au with the opportunity for Zillow’s margins over time.

This is reflected in the Q3 letter to shareholders, released in November, which stated:

"IMT segment income before taxes for the trailing 12 months as of the end of Q3 has grown more than $600 million when compared to the full year 2018, and adjusted EBITDA has grown nearly $600 million or 248% over the same period."

On December 2 the company reported progress on the wind-down of Zillow Offers and divestment of their inventory.

"Zillow Group today announced it has made significant progress in winding down Zillow Offers inventory and has sold, is under contract to sell or has reached agreement on disposition terms for more than 50% of the homes it expected to resell during the entire wind-down process. Zillow Group's board of directors has also authorised the repurchase of up to US$750 million of its Class A common stock, Class C capital stock or a combination of both."

We are pleased with the buyback proposal, and the company is currently trading materially below our internal estimate of its intrinsic value.

Investing can only be done one way: looking forward. The price decline has increased our modelled internal rate of return and de-risked the investment. Zillow’s leading market position and brand equity provide us with confidence management will continue to drive higher revenues and profitability over the long term. Despite this misstep, our conviction in Zillow endures.

As a concentrated manager, we will inevitably have our share of disappointments. Each time it occurs, we endeavour to identify an investment lesson and build this into our process.

This helps to ensure that, over time, our portfolio of investments continues to provide attractive risk-adjusted returns for our clients.

1 topic