Will inflation end with a bang?

In recent months we have been cautious about the outlook for 2023. That’s because Central Banks are fighting inflation by using higher interest rates to increase the cost of capital and drain liquidity from the economy. This will ultimately lead to slower growth.

The magnitude of monetary tightening by Central Banks globally has been staggering. In fact, it’s been on a scale most investors have never experienced. And yet, the global economy has proven to be remarkably resilient, so far.

The impacts of monetary tightening have a lag. While it’s difficult to predict what that lag will be, it can typically be somewhere between 12 and 18 months. We are currently ‘smack bang’ in the middle of the 12 to 18 month period following the first RBA rate hike.

We continue to lean toward possible shallow recessions across developed markets in the year ahead. But even if we’re wrong about history’s most anticipated recessions, economic growth will slow, including here in Australia. This will in turn weigh on the ability of ASX companies to grow their earnings.

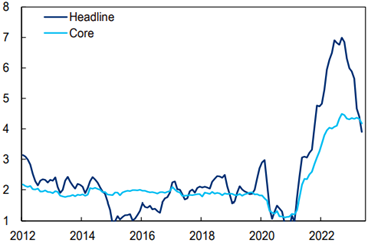

The good news is that headline inflation has peaked in most regions with the biggest contributor being the decline in energy prices. The oil price is down from $130 per barrel (just after Russia’s invasion of Ukraine) to $70 per barrel in mid-June. Unfortunately, as we expected would be the case, core inflation (which excludes more volatile food and energy costs), is proving stickier.

Global inflation (YoY %)

Services inflation remains stubbornly high

Wages make up the majority of inputs for service industries, and with labour markets in many developed markets still tight, it’s hard to see wages growth receding without the jolt of a recession. As a result, major Central Banks appear to be opting for the risk of tightening too much to avoid anchoring inflation expectations higher.

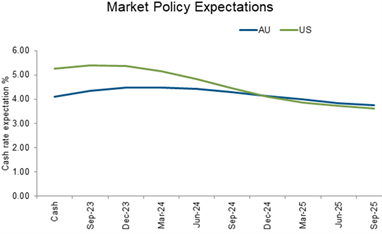

The RBA has certainly increased rates more than we had initially expected. Will they rise again? The market seems to think so. The impact of one more 25bp rate rise has already been priced in by the market.

We expect it to take time for core inflation to decline closer to target levels. Therefore, interest rates will also take time to ease. The potential for accidents however remains high.

As such we see both upside and downside risks to our economic growth expectations. If our base case is wrong, the likelihood of a severe recession seems higher than a soft landing, but we may be underestimating the likelihood of inflation declining with lower costs to economic activity than we now expect.

To conclude, stubborn core inflation, tighter financial conditions and central bankers that are slow to cut policy rates to boost growth mean distinctly sub-trend economic growth and declining company earnings.

What this means for portfolios

Against this backdrop, and with equity valuations broadly speaking hardly cheap, we remain underweight both domestic and international equities in favour of fixed income.

Within the Australian equity component, we have also been increasing the overall weighting to non-cyclical businesses like Aurizon (ASX: AZJ), CSL (ASX: CSL) and Worley (ASX: WOR) that should perform regardless of economic conditions. I further discuss the investment case of these 3 names here.

Historically, one of the best times to own fixed income has been when policymakers make their last rate hike in a tightening cycle. Recessions typically see bond yields decline which has led to us lengthening the duration (i.e. interest rate sensitivity) within the Australian fixed interest component of portfolios following the dramatic increase in bond yields over the past 2 months.

Recessions, however, also typically result in credit spreads widening, and as such we are keenly focused on risk-adjusted returns within fixed income – high yield is particularly vulnerable. We prefer high quality investment grade corporate credit where spreads better compensate us for the additional risk given generally strong balance sheets, and the yield pick-up relative to government bonds is attractive.

Learn more

Elston Asset Management's investment solutions range from a core Australian Equities Large Cap model through to full risk-based multi-asset class models. To find out more, visit our website.

3 stocks mentioned

1 fund mentioned