Wiping $1.5 trillion off house prices will force RBA to pause after 100-150 basis points of rate hikes

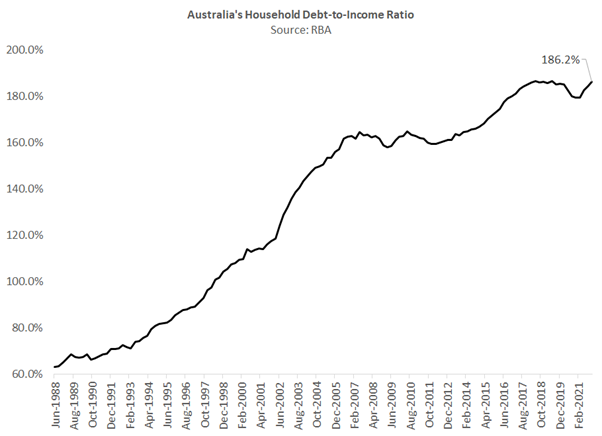

The RBA has a long history of getting the Aussie housing market's reactions to its cash rate changes horribly wrong, which is surprising given how easy the housing cycle is to forecast. Crucially for investors, this interest rate cycle will be heavily influenced by the direction of Aussie house prices, which have never been more inflated after years of cheap money. This will be accentuated by two facts: (1) that hundreds of billions of dollars of cheap fixed-rate loans will transition to much more costly variable rate products in the next 2 years, amplifying the impact of the RBA's hikes; and (2) that households are generally much more sensitive to interest rate changes than they have ever been before. Specifically, Australia's household debt-to-income ratio is sitting around 186%, in line with its all-time highs. We project that the RBA will likely be forced--if it acts prudently--to pause its monetary policy tightening process after the first 100-150bps of cash rate hikes (banks will pass on more in the form of even larger mortgage rate increases) as a result of the commencement of a record 15% to 25% decline in Aussie home values. This is something we forecast way back in October last year.

Given the total value of residential real estate in Australia is currently worth $9.9 trillion, we are talking about the RBA inflicting losses on households worth some $1.5 trillion assuming just a 15% draw-down in national home values, which is at the lower-end of our expected range.

The precise size of the additional out-of-cycle hikes we will see from banks is not known, but their funding costs are soaring, and they have already aggressively repriced 3-year, fixed-rate home loans from 1.98% only 12 months ago to 4.5% today. Non-bank lenders are similarly wearing an overdue repricing in their cost of funding via a steady increase in the credit spreads investors require when they underwrite non-banks by investing in their residential mortgage-backed securities (RMBS).

A history of housing misses

As the RBA's governor Phil Lowe noted himself yesterday, Martin Place has had some embarrassing forecast misses, which need to be rectified. The apparent infusion of humility in this respect will certainly help. We have previously noted that the RBA has had some outstanding housing market models at their fingertips, which we have refined and used ourselves. For some reason Martin Place has historically seemed insouciant to the insights rendered by this analysis, which helps explain the 2012-17 and 2020-22 booms, although it did unfurl the famous Saunders-Tulip model for the first time in the latest Financial Stability Review. Specifically, the RBA remarked:

Estimates using a model of the housing market that takes into account historical relationships between interest rates and both demand and supply factors suggest that a 200 basis point increase in interest rates from current levels would lower real housing prices by around 15 per cent over a two-year period, relative to the baseline model projection in the absence of an interest rate shock.

Despite the fact that the housing market is--in the RBA's own words--a core part of the monetary policy transmission mechanism, Martin Place has struggled to divine its destiny. This raises the spectre of a potential policy error if the RBA again misjudges the direction of what is Aussie households' single most important investment.

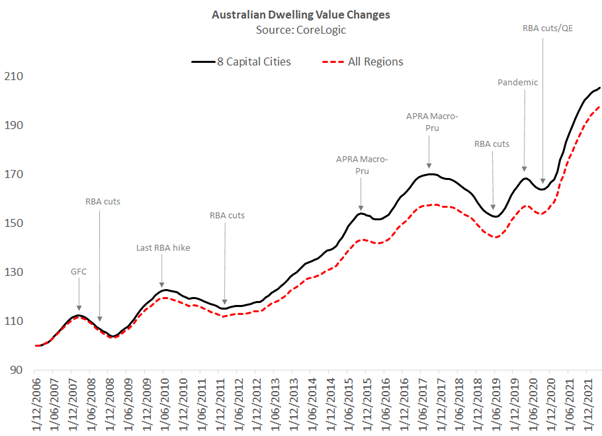

In 2013 we repeatedly warned the RBA--publicly and privately--that by slashing its cash rate it would precipitate the mother of all housing bubbles, powered by double-digit house price appreciation. Between 2011 and 2017 the RBA floored its cash rate from 4.75% to 1.50%. Over this time, national prices soared an amazing 41% based on CoreLogic's all regions index, which includes both the capital city and regional markets (or by 48% using the 8 capital city index that excludes regions).

We further advised the RBA in 2013 that they would be forced to embrace the application of macro-prudential constraints on credit creation, which it was--at the time--opposed to. By late 2014, APRA had been compelled to slowly start introducing these measures, which were progressively ramped-up in the years that followed.

Between 2015 and 2017, APRA's limits on credit creation forced lenders to materially jack-up interest rates on investment property loans. In early 2017 we argued that this would result in a 10% decline in national house prices. Between 2017 and 2019, the 8 capital city index price slumped 10.2% (the all regions index fell about 8.3%). While not much was happening in the economy, it was the biggest fall in house prices since the early 1980s.

In mid 2019 we forecast that future RBA rate cuts would drive house prices up 10% over the next 12 months, which is what we got: the 8 capital city index rose 10.3% while the all-regions index climbed 8.9%. This seemed to come as a surprise to pretty much everybody.

The real howler for the RBA--and bank economists--was their forecasts for a big house price decline during the pandemic and their inability to anticipate the stonking recovery. In March 2020, we projected a very short, and shallow, correction of 0% to 5% followed by capital gains of up to 20%, starting in September 2020.

CoreLogic's all regions price index fell 2.1% between March and September 2020 (the 8 capital city index declined by 2.8%), and thereafter started climbing quickly again.

The RBA claimed that there would not be a housing boom in response to its pandemic policies because population growth was non-existent. We countered that the profound change in purchasing power care of a huge reduction in the cost of debt coupled with robust income growth would power a sharp, 20% increase in prices.

Forecasting a record housing downturn

By October 2021, the all regions dwelling value index had indeed increased by 20% (8 capital city prices were up 19.5%). In that month, we controversially updated our forecasts to include at least another 5% of national price growth until the RBA started increasing its cash rate in the second half of 2022 (we were a couple of months off).

More importantly, we forecast that national home values would then correct by 15%-25% after the first 100 basis points (bps) of RBA cash rate increases, which would represent a record draw-down in Aussie households' most valuable asset. The RBA obliged with an initial tranche of 25bps of hikes yesterday (internally we thought a 15bps hike was most likely, although our conviction was not high either way).

Since our October 2021 forecast was released, most bank economists have subsequently embraced the proposition, typically projecting a ~10% correction in Aussie house prices over the 2022 to 2024 period.

It's worth putting this payback in context: home values across all markets have appreciated by 37% since mid 2019 when the RBA first started cutting its cash rate from 150bps down to the 10bps level that prevailed prior to yesterday's hike.

There is no precedent for the RBA hiking through a period in which house prices are falling materially. We think that the RBA might try to persist through some of the initial pay-back, but it is hard to imagine it wanting to further tighten financial conditions once they have wiped-out more than 10 percentage points off Australian households' most valuable asset. If the RBA's hikes trigger the minimum draw-down we expect, which is 15% peak-to-trough, Aussie households will have lost $1.5 trillion.

Endogeneity in the RBA's decision-making process

There are some important potential mitigants. Wage growth is expected to recover robustly. If the RBA is gradual with its rate increases--spreading them over a number of years--a nontrivial share of the correction in house prices could come via household income growth. While this might allow a smaller adjustment downwards in dwelling values, our central case--encompassing a 15%-25% national dwelling value decline--already assumes decent income growth.

Labor's proposed shared equity scheme, which is a rehash of an idea I developed for the 2003 Prime Minister's Home Ownership Task Force, might also furnish some additional housing demand. The plan I put to Prime Minister John Howard in 2003 was to be funded by the private sector. The Grattan Institute version advocates that the public sector becomes a co-owner in individuals' homes, which would be paid for by issuing at least $12 billion in new Commonwealth government debt.

Given fixed short-term housing supply, the biggest intra-cycle drivers of house prices are very simply incomes and interest rates. For better or worse, many home buyers have capitalised into house prices the assumption that rates would remain low-for-long, undoubtedly encouraged by the RBA's now discarded commitment to not raise interest rates until 2024.

The RBA has zero interest in triggering a recession or a downturn in economic growth that would deny workers their jobs and the healthy wage growth that the RBA has been trying to stimulate. It will be very closely following the world-leading daily hedonic house price indices produced by CoreLogic, which uniquely revalue the entire 10.5 million dwelling housing stock every day using 100% of the incoming sales (as reported by agents and checked using land titles data). (Disclosure, a business I co-founded created these indices.)

As house prices start rolling over in earnest later this year, we expect the RBA to modulate the pace of its monetary policy tightening process in response to clear evidence that its transmission mechanism is working.

If the RBA has learnt anything from the pandemic, it should be the importance of being data-dependent...

2 topics