Working as a collective: A Formula 1 approach to picking a winning managed fund

In a recent edition of Schroders’ The Value Perspective podcast, Tom Slater, the co-manager of Baillie Gifford’s highly successful Scottish Mortgage Investment Trust, spoke about the vital role of culture in delivering superior long-term investment returns. That included the importance of factors such as collaboration, lack of finger-pointing, and encouraging risk-taking.

Investment culture is like Formula 1 racing. F1 is a precision sport, with 80,000 separate components working together in each vehicle to achieve one end: getting the car around the track as fast as possible. These components are only functional as a collective whole.

Investment managers are the same. The manager has one objective: to produce attractive returns for clients. To achieve this aim, the manager’s assets are its people. Culture is the glue that holds the entire operation together and enables exceptional investment outcomes. As management guru Peter Drucker says, “culture eats strategy for breakfast.”

But many investors undervalue the importance of an investment firm’s culture because it is intangible, seemingly opaque, and often difficult to judge as an outsider. Yet failing to judge culture, particularly in today’s complex market environment, can lead investors to pick the wrong fund and damage their chances of reaching their financial goals.

The two levels of successful culture

Social anthropologists originally coined the term ‘culture’ to describe the qualities of specific human groups that cascade from one generation to the next. Culture, in this sense, is intangible, fluid, and capable of transcending the individuals from whom it originated.

cul·ture Merriam-Webster Definition

the set of shared attitudes, values, goals, and practices that characterises an institution or organisation

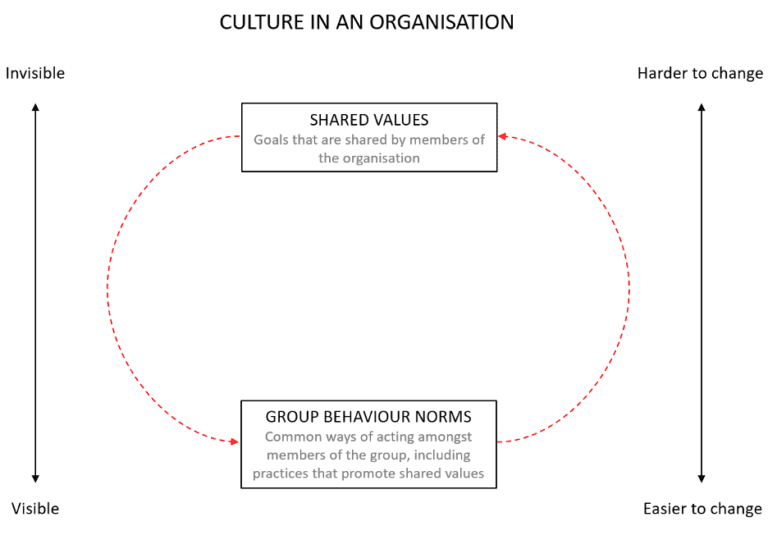

In their book Corporate Culture and Performance, Harvard Business School’s John Kotter and James Heskett described two levels of organisational culture. At the deeper, less visible level are the shared values of the firm that tend to persist even when the members of a group change. At the more visible level are the group behaviour norms of an organisation, which are common practices found in the group. The shared values are the goals and ideals of the organisation, and the group behaviour norms are the processes within the firm that are designed to achieve those goals.

For the shared values of a fund manager, they distil into one overriding objective: to make money for clients. The group’s behavioural norms must all align to reach this objective.

When it comes to processes, to generate excellent returns, an investment firm needs to excel across four categories: analysis, communication, execution and reflection.

1. Differentiated analysis

To succeed in the market, investors need a differentiated view that is proven correct over time. But that ‘variant perception’ requires deep, rigorous analysis to either uncover data that other investors have missed, or to form differentiated insights from the same data about a business’s future.

Quality analysis also allows an investor to hold stocks through times of volatility, an inescapable reality of the stock market, with conviction. Without conviction built on solid analytical foundations, the siren song to sell at an inopportune moment might cause the less prepared to abandon their investment.

Panic selling is far from a hallmark of successful investing. A good fund manager should strive to base portfolio management decisions on data points and insight, rather than emotion.

2. Open communication

Managers that deliver superior long-term returns also need a culture that fosters open communication between team members. Open communication is critical because it allows insights to be disseminated, and the cross-pollination of ideas, within the team.

Open communication also reinforces the shared values and culture of a team. If everyone is siloed and team members don’t communicate – a not implausible scenario in a work-from-home environment – then the culture of the firm withers.

Open, positive, and respectful communication amongst team members is the lifeblood of a firm’s culture, and without it the value of all other processes is diminished. With an F1 car, a 0.1% reduction in accuracy of some components will result in up to 80 components failing to work, which can lead to catastrophic failure of the whole machine. Culture is similarly fragile and must constantly be invested in.

Collaboration amongst team members is particularly critical. The alternative is to have one person present an investment idea. But then no one else knows enough about the business to properly criticise the investment thesis. When investors have a collaborative research approach, they have an inbuilt defence against poorly scrutinised investments.

3. Superior execution

It is not enough to have good ideas. A superior investment culture then needs to successfully implement those ideas. A culture of smart risk-taking smart allows investment firms to maximise the dollar gains from a portfolio of ideas.

That requires acknowledging that some ideas won’t work out and could either lose money in absolute terms or produce subpar returns. But those losses will be more than offset by winners that go up 5 to 10 times in value.

During The Value Perspective podcast, Baillie Gifford’s Tom Slater mentioned how vital it is in a successful investment firm not to have a ‘blame culture’ where team members are castigated if an idea doesn’t work out.

A blame culture risks sapping the courage of investment team members and stifling sensible risk taking.

4. Honest reflection

The final element of a superior investment firm’s processes is relentless reflection at the individual and group level to continually optimise the investment process. Analysts must be intellectually honest and rub their noses in errors (everyone will make mistakes at some point). The best cultures embrace this. When an investment fails, they carry out a post-mortem as a group so everyone can benefit from the lessons learned from investment mistakes.

The underrated factor

In F1, it is the mechanical, electrical, and digital connections that tie the 80,000 components together into a high-performance machine. The tolerances of an F1 engine are so exact that you cannot start the engine while it is cold; warm oil and water must first be pumped around the engine to allow the metal to expand. While F1 engineering is certainly impressive, these components are only functional as a collective whole.

Similarly, it is culture that provides the necessary cohesion to a team of investment professionals tasked with growing the wealth of their clients.

Given its opacity and difficulty to understand from an outsider’s perspective, culture is often underrated within investment firms. But we believe culture is one of the most vital components in delivering superior long-term investment returns.

This wire was written by George Hadjia, Research Analyst with Montaka Global Investments

Compound your wealth over the long-term

Montaka Global Investments provides investors with the opportunity to compound wealth over the long term through disciplined global investment strategies and a sophisticated approach to risk management. Get in touch with us through the 'CONTACT' button below.

1 topic