~$1.4bn in capital destroyed - and now it's a high-conviction buy

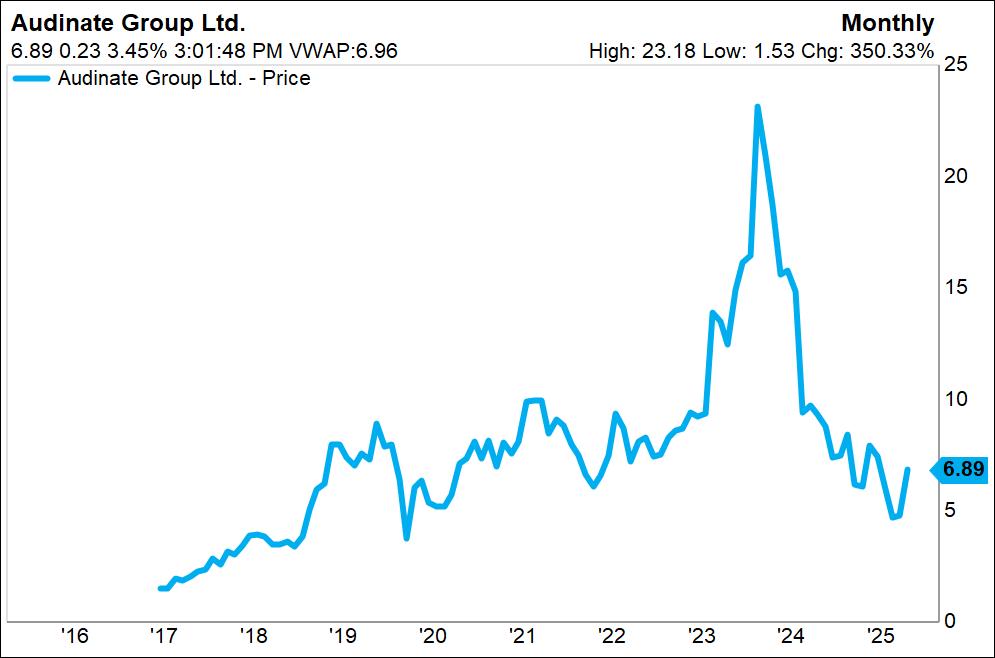

In March 2024, we called Audinate (ASX: AD8) a sell at $23.31. We doubled down on that view at ~$16.50 a few months later. Fast-forward 18 months, the stock has collapsed 70%, sentiment has evaporated, and analysts are still slashing forecasts.

"The combination of recent Director selling, index-inclusion momentum, and a non-specific (and seemingly unnecessary) September 2023 capital raise reinforces our caution."

Seneca Financial Solutions on Livewire, March 2024

But here’s the thing: nothing lasts forever—not euphoria, not despair. Today, we see an industry leader trading at its cheapest multiple since IPO, with a balance sheet ready to fuel growth and a product ecosystem more entrenched than ever.

A quick recap: what does the company do?

Audinate develops advanced audio networking technology that replaces traditional analogue cabling with digital transmission over standard computer networks. Its flagship platform, Dante, enables multiple high-quality audio (and now video) channels to travel via standard Ethernet cables with ultra-low latency.

This innovation modernises the way sound and video systems are built, allowing devices to connect and communicate seamlessly across networks. It eliminates the need for bulky analogue cabling, simplifies setup, and greatly improves scalability and control.

Dante is widely used in professional audiovisual environments such as stadiums, theatres, recording studios, universities, and broadcast facilities, where reliability and performance are critical. Here is a good video explaining a stadium case study.

Audinate licenses its technology to leading manufacturers including Yamaha, Shure, and Bose, which integrate Dante into their products. The company earns revenue through hardware sales (such as chips and modules), software products, and licensing fees.

Its growing focus on software represents a strategic shift toward higher-margin, recurring revenue streams and an expanded addressable market. Originally focused on audio, Audinate has successfully extended Dante’s capabilities to video networking, broadening its relevance across the entire audio-visual ecosystem.

Why have shares sold off so much?

The AD8 share price has been on a rollercoaster ride. A confluence of factors caused the stock to run hard in early 2024, and it traded at exuberant levels. At its 1H24 result, Audinate beat revenue expectations, doubled EBITDA, and made a meaningful net profit for the first time in its history.

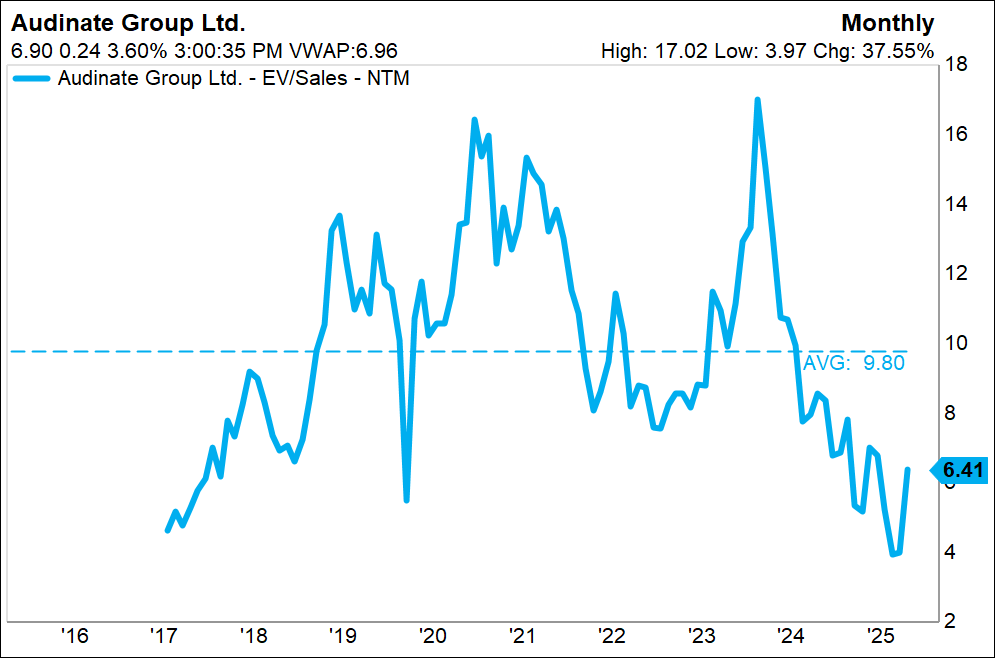

This was all exacerbated by a cyclical 'restocking' effect as the company emerged from a chip shortage in FY23 with a healthy backlog. The icing on the cake was inclusion into the ASX200 index, the most prominent Australian equities benchmark, which, on the back of the subsequent index-fund buying, propelled shares even higher post result. The stock ran to a peak of 17x EV/Sales, implying heroic, straight-line growth assumptions.

In August 2024, Audinate confessed that its revenue outlook for FY25 faced "a combination of headwinds," most notably the rebalancing of inventory holdings across the industry, which would result in lower gross profit than FY24. This persisted into 1QFY25, when "slower clearance of raw material inventories by our manufacturing customers and softer than expected demand from end-users" further dented confidence.

At its 1H25 result, Audinate reported gross profit of US$16 million, down 29% on the prior period, albeit on higher gross margins, indicating lower industry-level activity and a cyclical downturn was brewing. FY25 remained a "transitional year".

In August, Audinate reported an FY25 result largely in line with expectations. The company reported that the worst of industry-wide destocking was over. However, shares sold off again, with analysts focusing on the guidance for higher-than-expected cost growth.

As the expression goes, downgrades often come in threes.

Why We’ve Changed Our Minds

The ability to pivot when the facts change is vital in investing. At the time of our sell call, we flagged nosebleed valuations (100x EV/EBITDA), frothy sentiment, and index-driven momentum. Those risks have now violently washed out (to the tune of a ~$1.4bn in market value eroded).

You often hear fund managers say, "If this stock were 30% cheaper, I'd buy it". In reality, even when the share price falls, they rarely actually buy. The reason is that the stock is usually 30% cheaper for a reason, and it probably looks less attractive than it did before.

However, on occasion, those reasons are overblown, temporary, cyclical, and often momentum-based. At Seneca, we try to make a habit of identifying those occasions. We think Audinate might just be a prime example.

The stock has fallen 70% and trades at an all-time low valuation. But a cheap valuation alone isn't enough to change our minds. Here's what's happening 'under the hood', in the business:

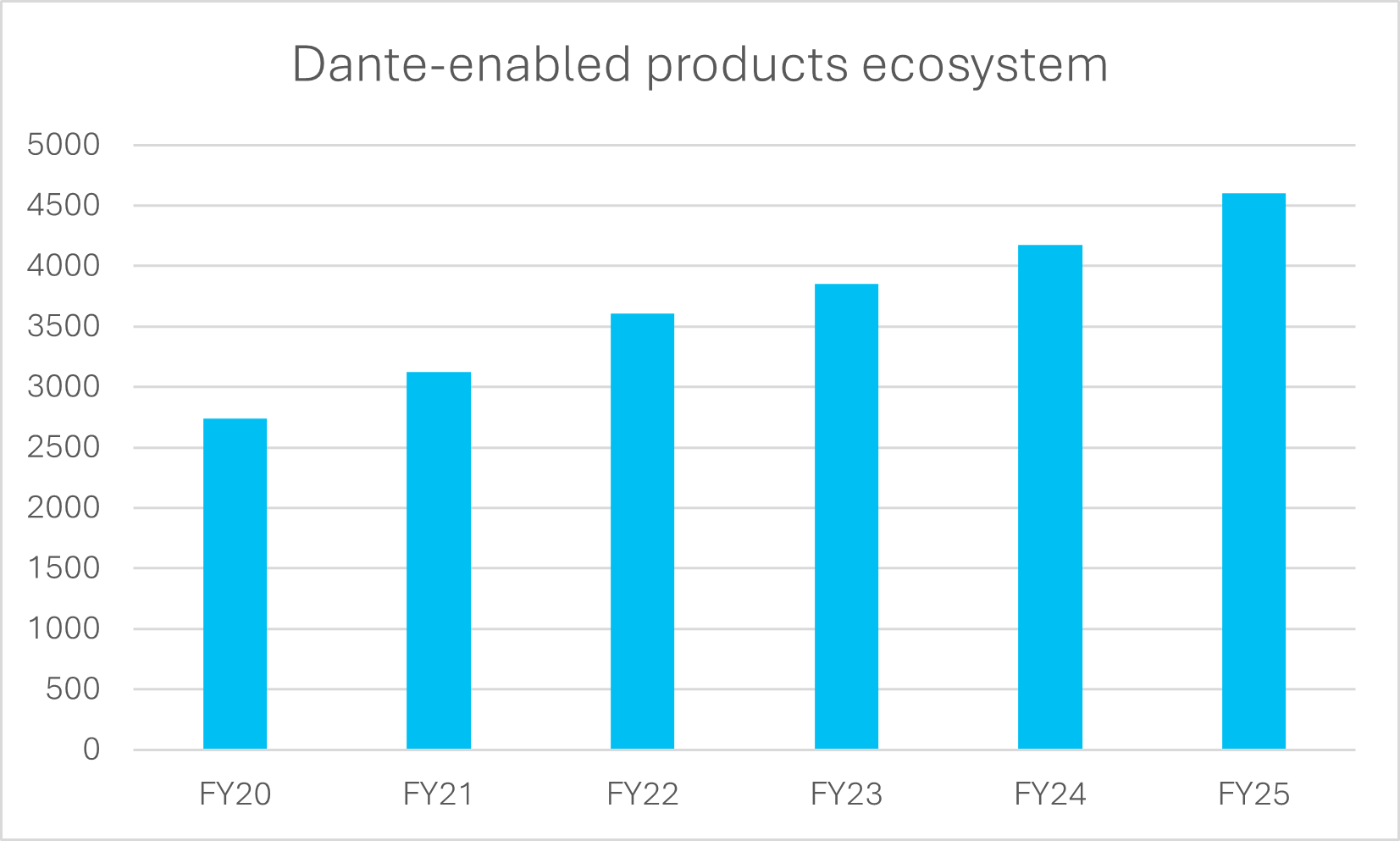

- Industry-wide destocking abating: With such a strong market share position, Audinate’s fortunes naturally follow broader industry trends. Management believes the worst of the inventory destocking cycle has passed, with distributors in the industry reporting improving sales as channel inventories normalise. Early signs of renewed activity, including a 12% increase in new design wins in FY25, suggest ordering patterns are stabilising and set the stage for growth to reaccelerate into FY26 and beyond.

- The business continues to be in excellent health: Audinate remains the best-in-class product offering embedded within the AV ecosystem. In FY25, Dante adoption increased to 14x the nearest competitor, up from 12x. With a strong balance sheet, the company doesn't need to raise equity at low prices. In fact, management has the option to pursue faster organic growth, inorganic growth, or capital management.

- Improving revenue quality while nobody is paying attention: Embedded software revenue rose 15% in FY25, underscoring Audinate’s steady shift toward higher margin, recurring revenue. While hardware softened, the mix improvement positions gross profit to rebound and drive a valuation re-rate.

- Momentum in video is also building: with OEM licences up 19% and the Iris Studio product launch due in December, setting up potential upside to FY26 expectations.

- Incentives: We believe management’s August guidance was potentially conservative. Given the timing of long-term incentive calculations, incentives appear aligned for a more upbeat tone at the upcoming AGM trading update. While past share sales have drawn criticism, the founder still holds a substantial stake worth around $13 million, and recent director buying post-results signals renewed confidence. Overall, management remains meaningfully aligned with shareholders and well positioned to benefit from a recovery in sentiment.

Valuation

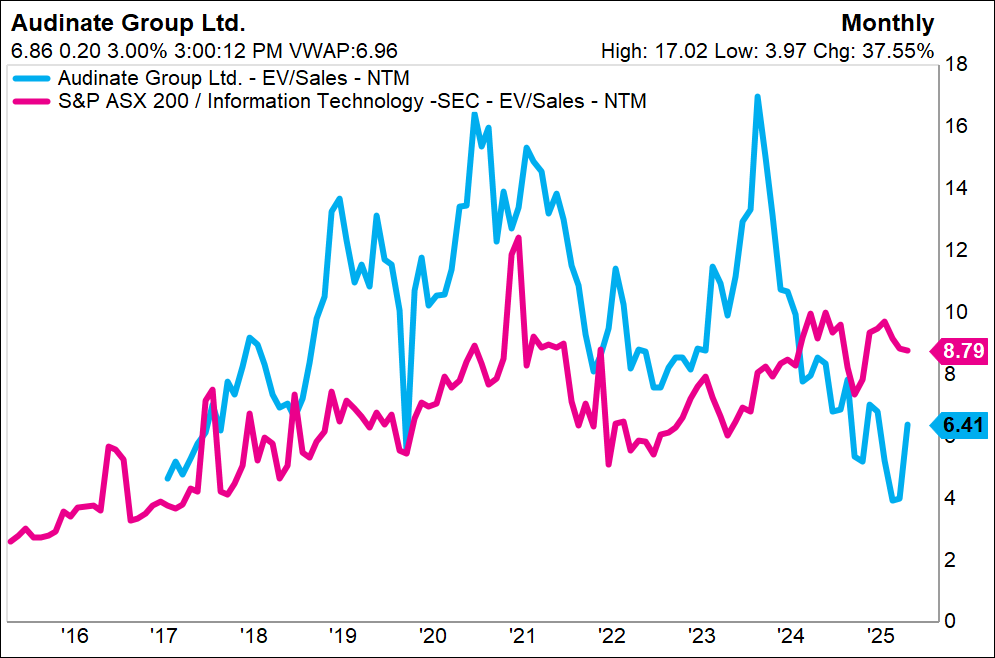

Since IPO in 2017, AD8 has traded on an average forward EV/Sales multiple of 10x. The stock currently trades on 6.4x, which is near its all-time low.

Audinate has historically traded at a premium to the ASX tech sector but now trades at a 27% discount.

On a three-year view, we see Audinate re-rating to 8-10x EV/Sales as growth normalises and margins expand toward 15-20%. With expectations reset and the company past its heavy investment phase, even moderate execution should support a move toward our $11.00 target, representing around 60% upside from current levels.

Sentiment toward Audinate is in the doldrums. Fund managers have been burned extrapolating temporary tailwinds, pundits have turned negative, and even previously bullish voices are capitulating. It’s a familiar pattern: when optimism fades, everyone crowds to one side of the boat, and price targets chase share prices lower. When the stock disappears from Livewire discussions and retail forums fall silent, that’s when we put it on the watchlist, do the work, build conviction in what needs to happen for it to recover, and determine the right price to act.

We think this pessimism has gone too far. Guidance looks conservative, and the market is likely overestimating the downturn just as it underestimated the upcycle. In our view, this is classic capitulation driven by career risk and crowd psychology. On balance, we expect sentiment to improve from here.

Catalysts - what happens next?

Audinate typically provides a trading update at its AGM in late October, and we expect a 1QFY26 update around then. Given the current negative sentiment, even modest sequential growth could be enough to trigger a meaningful re-rating. Short interest in AD8 has halved since February.

With $72.8 million in cash post-Iris acquisition and no debt, the balance sheet offers scope for capital management, including a potential buyback if conditions remain favourable. That financial strength also gives Audinate the flexibility to accelerate growth or fund small acquisitions without diluting shareholders.

At current levels, we believe investors have downside protection. If the stock remains below $6 for long, takeover interest becomes increasingly likely. Yamaha, which owns 7.5% and integrates Dante into its global audio systems, is a logical acquirer - mirroring Caterpillar (NYSE: CAT)’s recent bid for our portfolio holding, RPMGlobal (ASX: RUL), to internalise critical software.

We were too early

We started buying shares just prior to Audinate's FY25 result in August, around the $6.00 mark. We gained confidence that the worst of the destocking was over, and inventory was selling through once again. We thought the stock was a candidate to re-rate on the first confirmation that the growth trajectory of the business was back on track. Hence, we took a small 'starter' position. We were likely the first institutional investor to re-enter the stock.

But we also came into the result with our eyes wide open. Reporting season is often volatile, and the market tends to latch onto specific data points and price in extreme outcomes, extrapolating these into the future. In the case of Audinate, management's guidance for gross profit growth of 13-15% was overshadowed by a forecast operating cost increase of 25%, sending shares below the $5.00 mark.

As it turned out, we were a little early; it’s never easy to pick the exact bottom. But when positions are sized appropriately and backed by a margin of safety, that’s a risk worth taking. We increased our position to a more meaningful weight, confident that the investment case remains intact and very compelling. On a medium-term view, we think the stock can double.

From here, the key is patience: wait for the catalysts to play out, stay disciplined, and resist the temptation to chase momentum in either direction.

As always, time will tell if we are on the money with Audinate, and the market is an unforgiving beast. We might well be "too early" again on Audinate, but this is just one example of ~40 companies currently in the portfolio, which we think can add significant value for our clients.

Why can we keep identifying these outperformance opportunities?

One of the advantages of working at Seneca is the freedom to stay flexible. We don’t operate within rigid rules or bureaucratic constraints; instead, we challenge each other’s assumptions and constantly refine our thinking. In this business, if you’re not improving, you’re falling behind.

Career risk isn’t something we worry about here. As a co-portfolio manager alongside Luke Laretive, I’m empowered to make bold, conviction-driven calls rather than play it safe. That culture of flexibility, patience, and courage to act decisively is what we believe drives the best outcomes for our clients and for ourselves as fellow unitholders.

A key driver of outperformance

A key driver of our small cap fund's 39.16% return over the past year has been backing quality growth businesses when sentiment is at its worst. Stock markets, like the people who participate in them, are often irrational and powered by emotion-fuelled thinking.

This results in wild swings in sentiment that often incorrectly extrapolate the recent past into the future (recency or availability bias). We aim to exploit these sorts of market inefficiencies and have successfully done so with the likes of Catapult (ASX: CAT), Energy One (ASX: EOL), and Megaport (ASX: MP1), over the last 12 months. Audinate is one of our more recent ideas that fits this playbook.

We continue to find examples on the ASX where history doesn't repeat itself, but does rhyme.

The Seneca Australian Small Companies fund is open to qualified sophisticated, professional, and wholesale investors. Minimum initial application is $100,000 via the fund administrator's website (linked here). We accept applications monthly.

If you'd like to receive our regular updates, you can sign up for our distribution list here.

5 topics

6 stocks mentioned

1 contributor mentioned