3 sectors where ETF investors are eyeing opportunities in 2024

Despite volatility dominating many portfolios in 2023, VanEck’s latest annual investor survey has revealed Australian investors are eyeing up opportunities in the first half of 2024, with almost 60% of investors either planning on increasing their allocation to ETFs or making their first investment in ETFs in the next 6 months. One in two investors are planning on increasing their allocation to ETFs within their SMSF portfolio.

According to the survey conducted in November 2023, 65% of respondents are planning to invest in Australian shares next year, while 50% are planning to invest in international shares. Only 14% said they do not plan on investing at all next year. These results are almost identical to how investors planned their portfolios the previous year, showing appetite has not waned despite continued uncertainty across markets.

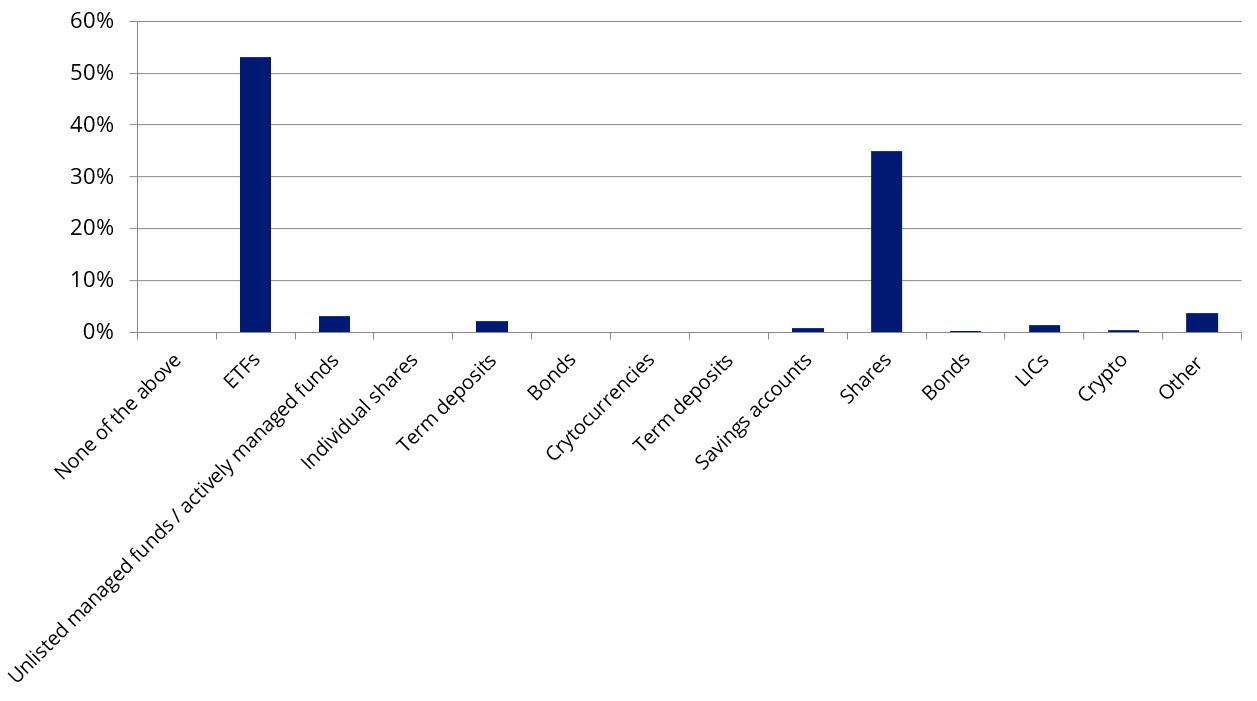

The 2023 VanEck Australian Investor Survey also showed that ETFs are by far the most popular investment vehicle, with the lion’s share of investors preferring ETFs. Only 3% of investors selected unlisted/actively managed funds and less than 2% selected LICs as their favourite. 84% of investors said they would recommend ETFs to other investors.

What is your favourite type of investment product?

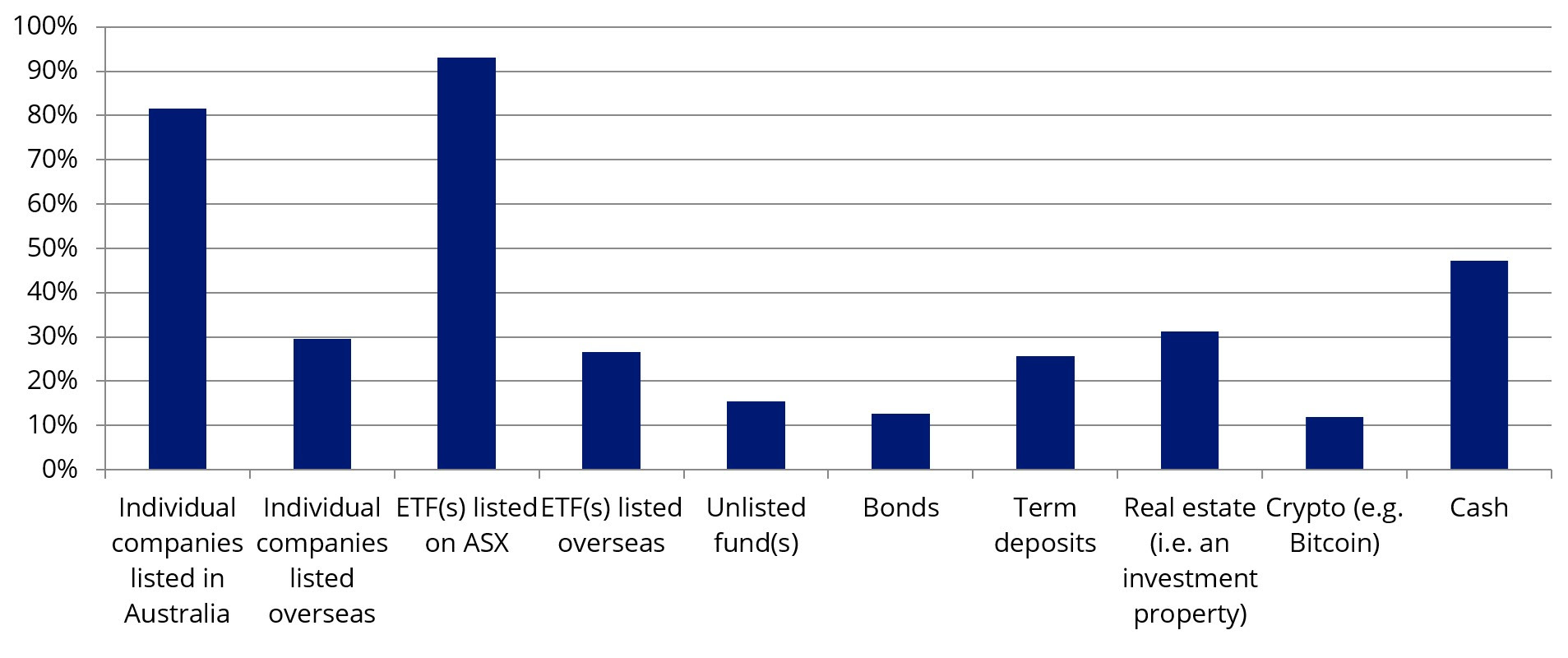

Similarly, ETFs rank as the most popular investment vehicle in investors’ current portfolios, with over 90% of respondents invested in at least one ETF.

What are you currently invested in?

Technology and healthcare are tipped to be the winning sectors for 2024, according to surveyed investors. Almost 50% of respondents said they were considering investing in the tech sector next year, and almost 40% are considering investing in healthcare companies.

Across all age groups except Baby Boomers (those 60 years and older), technology was the most popular, followed by healthcare and then resources. Conversely, resources were the most favoured sector among boomers, followed by healthcare, and technology a close third.

The vast majority (74%) of respondents said they would not be looking to invest in ESG funds in 2024.

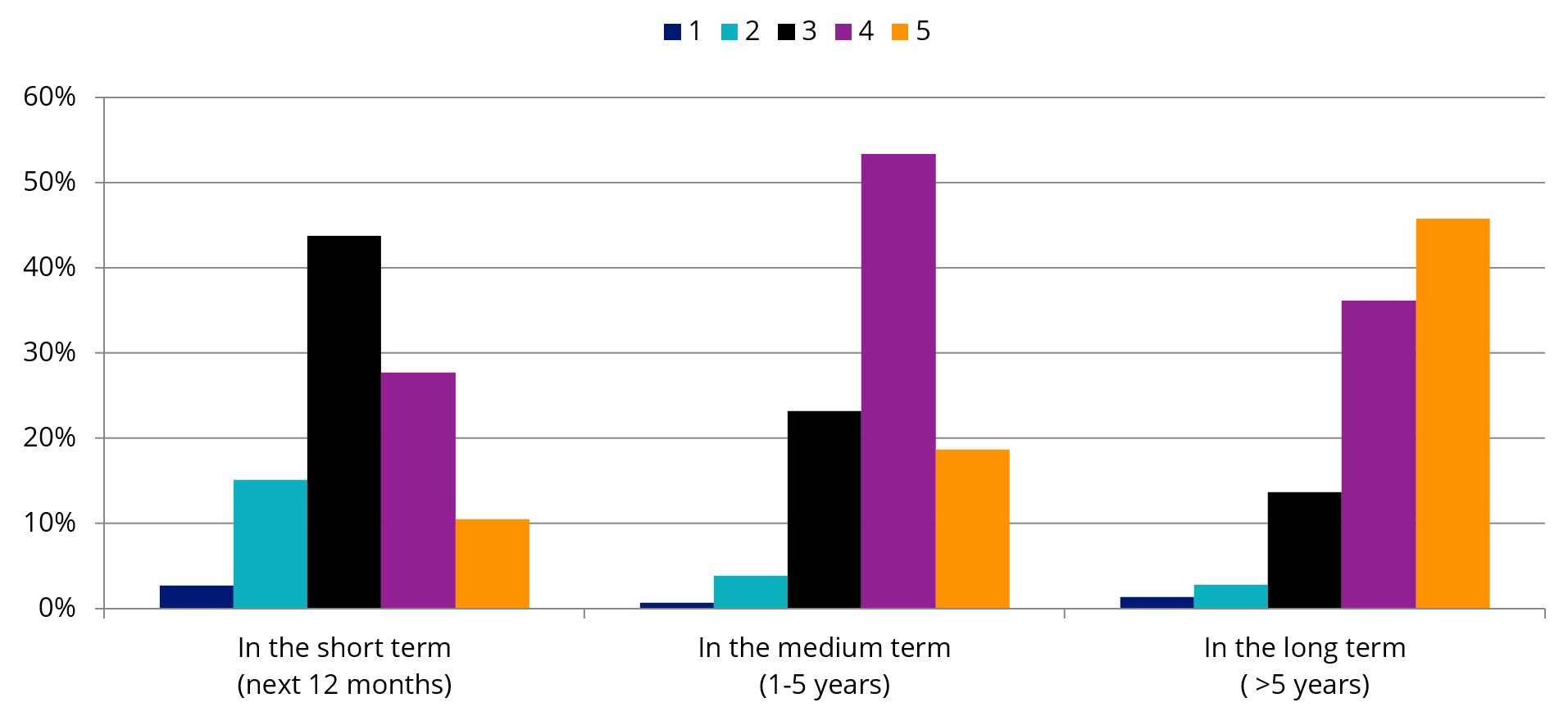

On a scale of 1 (not confident) to 5 (very confident), how do you feel about your current investment portfolio?

Investor confidence is also improving significantly over the 1- to 5-year horizon. More than 60% of respondents said they are feeling confident about their portfolios over the medium term.

Confidence increased further when considering a long-term outlook with more than 80% of investors feeling confident about their portfolios on a 5+ years basis.

2 topics