4 market implications of yet another new PM

Yet another PM in Australia, with Scott Morrison defeating Peter Dutton who had brought on a challenge to replace Malcolm Turnbull. All of the last four elected PMs have now been deposed by their own party. This is the 6th PM this decade, so we have now caught up with Italy.

The turmoil is not great for Australia, and it has also seen investment markets start to get nervous about the coming Federal election. Of course, it’s dangerous to overstate the impact of the periodic bouts of leadership instability in Canberra seen this decade on the economy.

It seems that as the “Lucky Country”, the economy still manages to muddle along despite the mess in Canberra, and I doubt that the latest leadership turmoil will change things that much.

However, Australia should be able to do much better and the lack of durable leadership along with the problems in the Senate are making it harder to undertake serious productivity enhancing economic reforms. It is also contributing to policy uncertainty, most notably around energy policy which has led to world-beating electricity prices.

Four market implications of the latest change in leadership

First, Scott Morrison winning the vote is a reasonably good outcome from an economic and investment perspective. He did not bring on the challenge so can’t be blamed for the instability. More importantly he is seen as a reasonably sensible policy maker, is respected by investment markets in his role as Treasurer and is seen as a centrist giving the Liberals perhaps a better chance of victory in the coming Federal election. This probably explains why the share market and the $A had a bounce on the news that he will be the new PM.

Second, while he will probably continue with the Government’s existing budgetary strategy, the abandonment of the policy to cut the tax rate for large companies along with the budget coming in a better than expected does provide scope for earlier and bigger tax cuts for low to middle-income earners which could help economic growth.

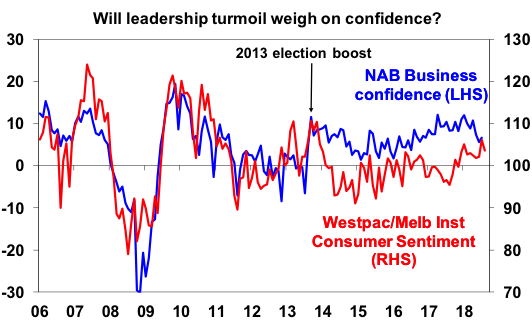

Third, the latest leadership turmoil and Scott Morrison’s relatively low margin of victory (of 45 to 40) still poses the risk that there may still be more turmoil ahead, all of which could weigh on consumer and business confidence just as it did under the last Labor Government. The LNP victory in September 2013 provided a confidence boost as Australians’ looked forward to relative stability after the leadership turmoil of the Rudd/Gillard/Rudd years, but with instability clearly continuing confidence risks being eroded again. Business confidence is most at risk given the abandonment of the policy to cut the large company tax rate.

Source: Westpac/MI, NAB, AMP Capital

Finally, the leadership turmoil and Labor’s lead in opinion polls has focussed attention on the next Federal election and the likelihood of a change in Government and this has weighed on the share market and the Australian dollar over the last week.

To keep Senate and House of Representative elections in alignment the election needs to be no later than May but if the new PM sees a bounce in poll support it could come before the end of the year.

Labor’s main policies are:

- Increased public spending in areas Iike health and education,

- Lower taxes for low to middle earners, but higher taxes for high income earners, halving the capital gains tax discount and

- Restricting negative gearing for residential property going forward to new properties

- Possibly a tougher regulatory stance in relation to the banks, energy supply and industrial relations.

The tax cuts would provide a boost to consumer spending, but the risk is that business confidence may dip which could hit business investment, and the housing market could take a hit from the negative gearing and capital gains tax changes at a time when it is already down.

The latter, particularly if combined with cuts to immigration, risks resulting in a sharper top to bottom fall in home prices than we are assuming (a 15% decline for Sydney and Melbourne and 5% nationwide) which would be negative for banks and consumer spending.

As evident over the last week, political instability and more specifically uncertainty around a change of government is likely to weigh on bank, consumer and energy shares and possibly also the Australian dollar as it risks adding to the forces already keeping interest rates down.

4 topics