5 ways to access this tech megatrend

Global X ETFs

Cloud computing, which involves renting someone else’s computer power or using software on the internet, is one of the fastest-growing technologies in the world.

It is very helpful for businesses and consumers, as it spares them the "Penrose steps" of constantly buying new hardware and installing new software. While the cloud is not a new technology as such, accelerating internet speeds globally have made it far more viable in recent years.

As with any growth story, investors are wondering how they can get in. A task made more complicated by the extreme valuations of many pure-play cloud companies.

From where we sit, the best opportunity is in the FAANGs– Facebook, Amazon, Alibaba, Nvidia and Google. Not only are they the biggest cloud companies in the world, they are also more diversified and more reasonably valued than pure-plays. Below we have a look at each.

Facebook – Most famous PaaS

People rarely think of Facebook as a cloud computing company. But in reality, it is one of the first and largest cloud businesses. In business terms, Facebook is essentially a giant marketing platform delivered online – “platform as a service”, or PaaS, in the jargon. It makes money selling audiences to advertisers, where both the audience and the ads are connected by Facebook’s cloud. Businesses – large or small – are essentially renting Facebook’s platform when they buy ads.

Amazon – King of cloud

Amazon is the king of cloud computing. Its Amazon Web Services (AWS) underpins much of the internet. It runs not just Amazon’s online shop, but also Netflix, Reddit, much of the US government’s websites—and more. According to data from Statista, global cloud infrastructure service revenues were US$39 billion in Q1, and on target to surpass $150 billion this year. AWS takes a massive one-third of this revenue all by itself. Making things better, AWS has the highest profit margins of any part of Amazon.

Alibaba – Cheapest cloud company?

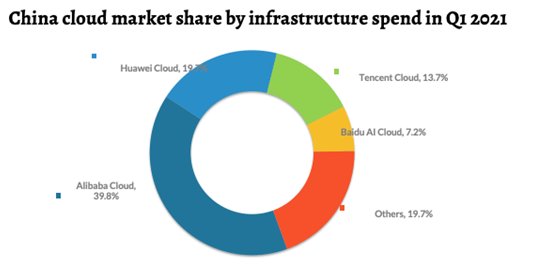

Alibaba has been in the news for all the wrong reasons this year. The bad news has helped mean its share price has fallen almost 50% from its peak. Still, Alibaba is the fourth-largest cloud company in the world and the largest in Asia. Alibaba Cloud can do almost everything: storage, artificial intelligence, big data. According to Morningstar, as of August 2021, Alibaba is on one of the lowest trailing price-to-earnings ratio that it has ever been on.

Source: China Internet Watch, as of August 2021

Nvidia – Cloud needs microchips

Microchips – sometimes called semiconductors – are crucial for cloud computing. And Nvidia designs some of the most sophisticated semiconductors in the world, which are widely used in cloud computing. Major cloud providers Amazon, Microsoft, Google all use Nvidia’s microchips to power top-end functions like machine learning and artificial intelligence. (AWS for instance uses the A100). Nvidia also runs its own cloud video gaming service called GeForce.

Google – Overlooked, underrated?

Google is the third-largest cloud provider in the world, with a suite of cloud computing services. Perhaps most famously, Google’s cloud powers Google Documents, which allow collaborative working and increasingly compete with Microsoft Office. Google’s cloud platform uses the same infrastructure as Search, Gmail, and YouTube. It also provides advanced services like machine learning, management tools and identity and security services.

Pure plays: growth fully priced?

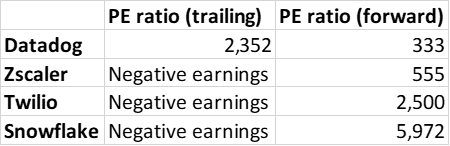

A lot of investors interested in cloud computing immediately turn to pure-plays. These include companies like Zscaler, Twilio, Datadog and Snowflake. There’s certainly something appealing about this approach. After all, pure plays allow investors to focus directly on a growth theme and screen out the noise.

Source: Morningstar, data as of 6 August 2021

However, the valuations that some pure-play cloud computing companies are trading on are truly a sight to behold. These include forward PE ratios in the several thousands... With such sky-high valuations, investors must answer the important questions. These include: how much future growth is already priced in? How long can PE ratios expand? Is there any chance that interest rates will rise which may negatively affect their valuations? What happens if growth slows?

By accessing cloud computing through the FAANGs, investors will not only buy the world’s biggest cloud computing companies. But also buy cloud companies at a reasonable price.

Access a range of opportunities

ETF Securities offer a range of ETFs across asset classes, regions, sectors and themes for your investment portfolio. Click the 'CONTACT' button below to get in touch with us.

5 topics

Expertise