6 leading investors share the charts to watch right now

.png)

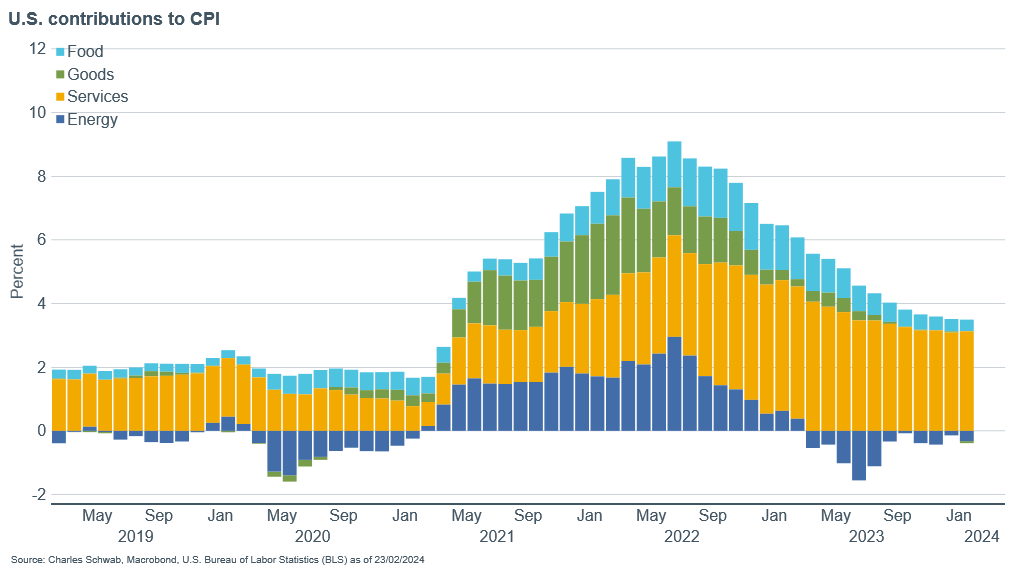

Contrasting inflation dynamics: US stagnation vs. European decline

From Jeffrey Kleintop, Charles Schwab.

In recent months, the inflation landscape has shown a stark contrast between the US and Europe. Since June 2023, the US Consumer Price Index (CPI) has stagnated, hovering just above the 3% mark, in notable contrast to Europe, where CPI has sharply decreased to below 3% over the same period.

The main driver of this disparity is the US's persistent service sector inflation, especially in housing, which is nearly double that of Europe.

Conversely, in Europe, inflation across all major categories is on a downward trend, signaling a promising reduction in CPI. This decrease is likely to converge with the central bank’s 2% target at a faster rate than in the US. This may increase market confidence in the ECB’s capacity for earlier or more aggressive rate cuts.

This divergence in inflation dynamics highlights the differing economic challenges and policy responses across the Atlantic, with Europe appearing to be on a quicker path to meeting its inflation targets than the US.

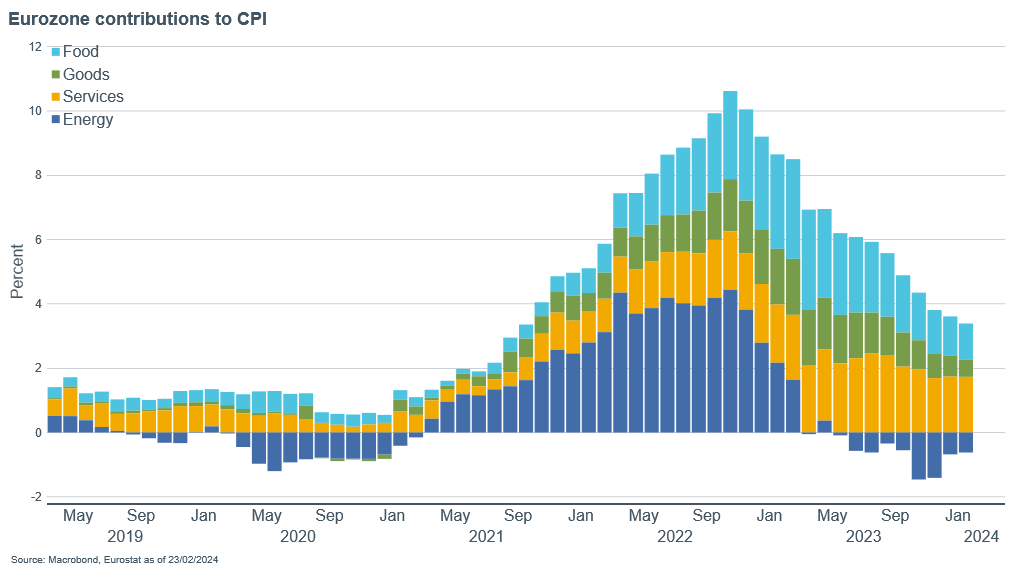

How broad-based are price pressures in the UK?

From Investec Economics.

Between Brexit, the pandemic and the war in Ukraine, it’s been a turbulent few years for the UK economy. Contrary to initial expectations, the inflationary surge has persisted.

The Bank of England initiated aggressive monetary tightening in December 2021 to mitigate excessive price pressures. This chart assesses the progress made towards achieving the 2% CPI inflation target by analyzing trends across 39 inflation sub-categories.

The Monetary Policy Committee is now in a period of pause as it assesses the impact of past hikes. The BoE has estimated that about a third of the impact of tighter policy is still to come.

As Investec’s chart shows, most of the components continue to record inflation rates above 2% (indicated by red bars), suggesting further efforts are needed before policy can be eased. Relatively few categories (indicated by blue bars) fall below the CPI target. CPI inflation itself is charted in light brown.

To date, a significant portion of the drop in inflation can be attributed to falling wholesale energy prices. While that should eventually feed through to other sectors, the BoE will likely want to see price pressures easing across the board, especially in services, before it can declare victory and begin to cut rates.

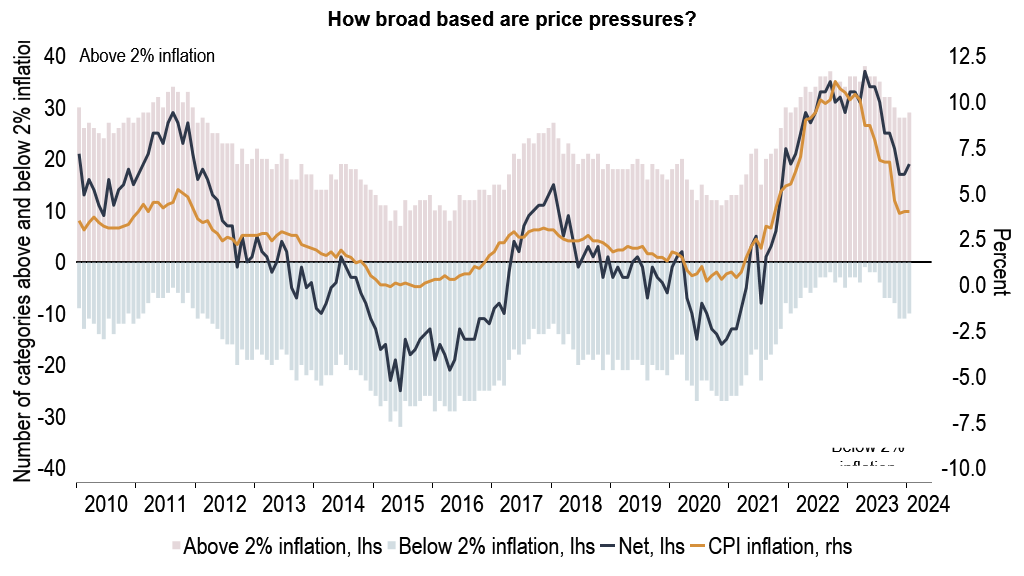

Deflation in China: global implications

From Dr. Tariq Chaudhry and Norman Liebke, Hamburg Commercial Bank.

Weak Chinese inflation has both cyclical and structural roots, driven by three primary factors: 1) declining pork prices due to oversupply; 2) weak energy prices, notably oil, despite geopolitical tensions and OPEC cuts; and 3) the spread of deflation from goods to services, exacerbating labour market weakness.

This chart breaks down components of the CPI, showing their contributions to the overall deflationary trend, with a specific focus on the plunge in pork prices presented in a separate panel. It’s notable that despite overall deflation, core inflation remains positive, indicating that volatile food and energy prices are the principal drivers of deflationary pressures.

Deflation in China poses economic risks both domestically and internationally. Domestically, consumers and businesses may delay spending or investments, potentially triggering a vicious cycle of further economic slowdown.

Internationally, China’s economic softness could accelerate interest rate cuts in emerging markets reliant on Chinese goods and could provoke concerns in the West about competitive disadvantages stemming from more affordable Chinese exports.

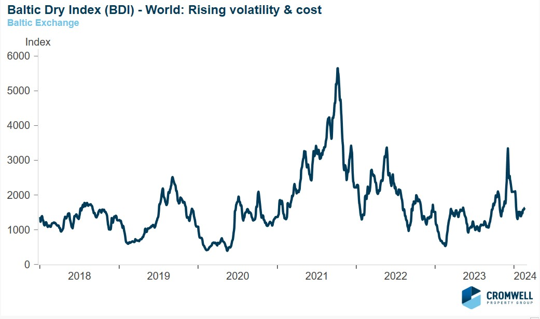

Trouble in the Panama Canal and Red Sea: The Baltic Dry Index and knock-ons for inflation

From Tom Duncan, Cromwell Property Group.

The Baltic Dry Index tracks the cost of shipping raw materials around the world, including coal and metals.

“We monitor the BDI to take the temperature on global trade and supply-chain risk,” Tom writes. “Since December it has risen significantly and shown greater volatility, reflective of the drought impacting the Panama Canal, attacks on Red Sea shipping and heightened geopolitical uncertainty.”

“We expect the BDI to continue to rise, with knock-on implications for the availability and cost of goods, inflation and a focus by businesses on supply chain resilience through nearshoring and reshoring.”

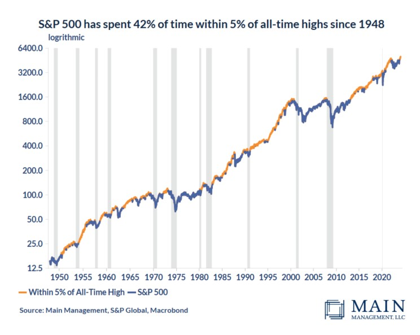

Watching the S&P 500: What happens after record highs?

From James Maxwell and Alex Varner, Main Management.

Our authors chart the US benchmark, highlighting periods where it was within 5 percent of a record. “The S&P 500 hit a new all-time high in mid-January, breaching the high-water mark set at the beginning of 2022,” James and Alex write. “That two-year period is right in the middle of how much time it has historically taken bear markets to reach new all-time highs, at #6 out of the 11 most recent bear markets.”

As the chart shows, the 2020 pandemic crash took just six months to reach new all-time highs, whereas the 2007 global financial crisis and 2000 dot-com bubble took 5.5 and 7.2 years, respectively.

“New market highs often raise questions about whether stocks are overvalued and if returns going forward will be lower as a result. However, if we look at the previously observed bear markets and what happens after record highs are hit, the momentum typically continues to bring the market even higher. In fact, the S&P 500 has spent nearly half the time (42%) within 5% of its all-time high since 1948.”

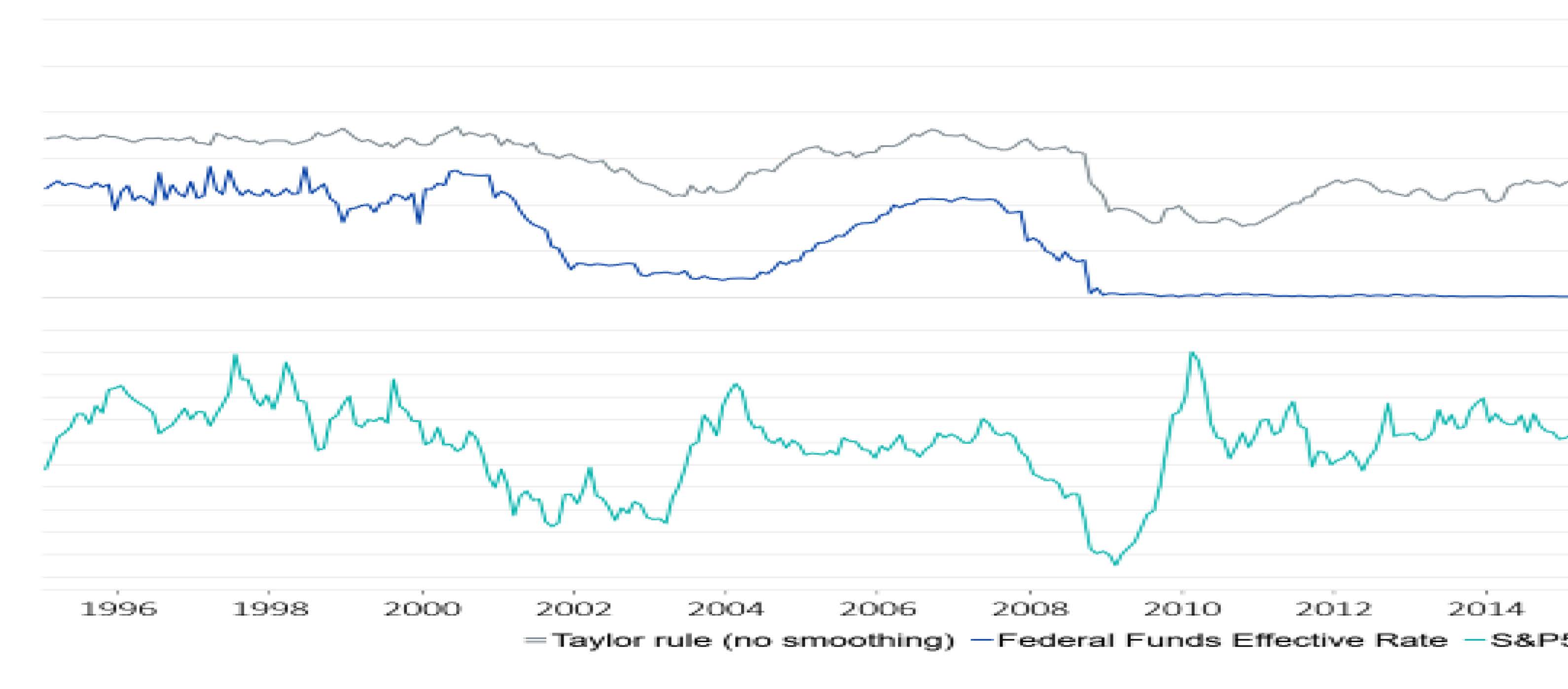

Applying the Taylor Rule to Fed policy

From Sebastien McMahon, iA Global Asset Management

The Taylor Rule is often seen as a rough guideline for assessing the appropriateness of central bank policy. This chart compares the Taylor Rule with the Fed’s key policy rate and the performance of equities.

“Effective monetary policy in 2024 requires a gradual transition towards neutral interest rates while ensuring clear communication to avoid detrimental market volatility,” Sebastien writes. “Investors remain vigilant in monitoring the Taylor Rule recommendations to anticipate changes in policy and improvements in unemployment and inflation. The peak of the Taylor Rule forecast in September 2023 coincided with a market rally, fueling a positive outlook on the economy's stabilization.”

“The current scenario is unique because the policy rate reduction could arise from an authentic soft landing that coincides with normalizing inflation instead of past instances when central banks felt compelled to ease rates due to a looming recession,” he continues. “Hence, the Fed might be able to sustain economic growth and limit the harmful effects of inflation with limited stimulation of growth. If central bankers start moving aggressively with cuts, then it’s highly unlikely that it’s because inflation has normalized without any significant economic damage.”

3 topics

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

Expertise

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

.png)