7 things you need to know about the Australian property market

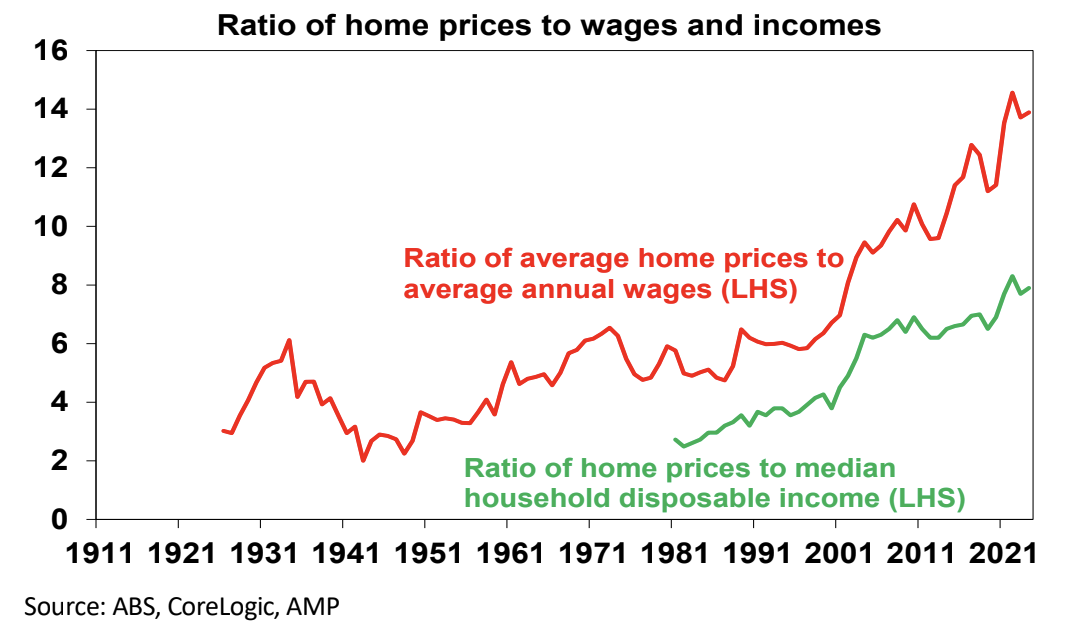

The trouble with the former is that it implies the already high ratio of home prices to incomes will double over the next 12 years! The trouble with the doomsters is that they’ve been saying that for decades.

1) It's very expensive

- House price-to-income ratios have doubled since the year 2000.

- The years taken to save a 20% deposit for an average full-time wage earner have doubled from 5 years 30 years ago to 10 years now.

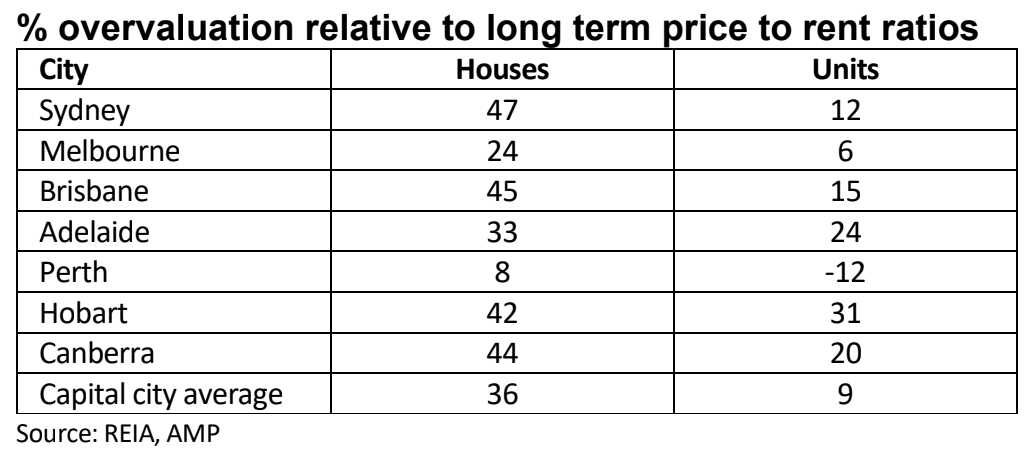

- A measure of house price valuation based on the ratio of home prices to rents (a bit like a P/E for shares) adjusted for inflation shows house prices around 36% above their long-term average price-to-rent ratio.

- It’s also expensive in global comparisons, eg, the 2023 Demographia Housing Affordability Survey shows the median multiple of house prices to income at 8.2 times versus around 5 in the US and UK.

2) It's also very diverse

This divergence partly reflects a combination of better housing affordability (with prices in Adelaide, Brisbane and Perth playing catchup after lagging pre-pandemic) and relative population growth (with Brisbane and Perth benefitting from interstate migration).

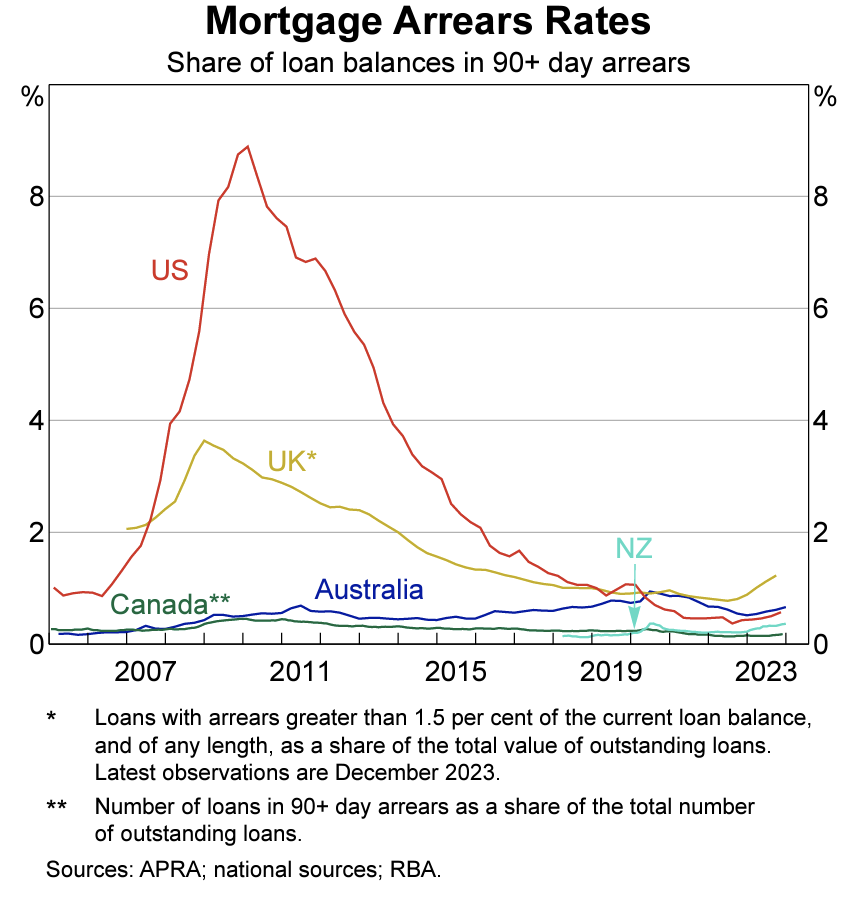

3) Mortgage arrears remain low (for now at least)

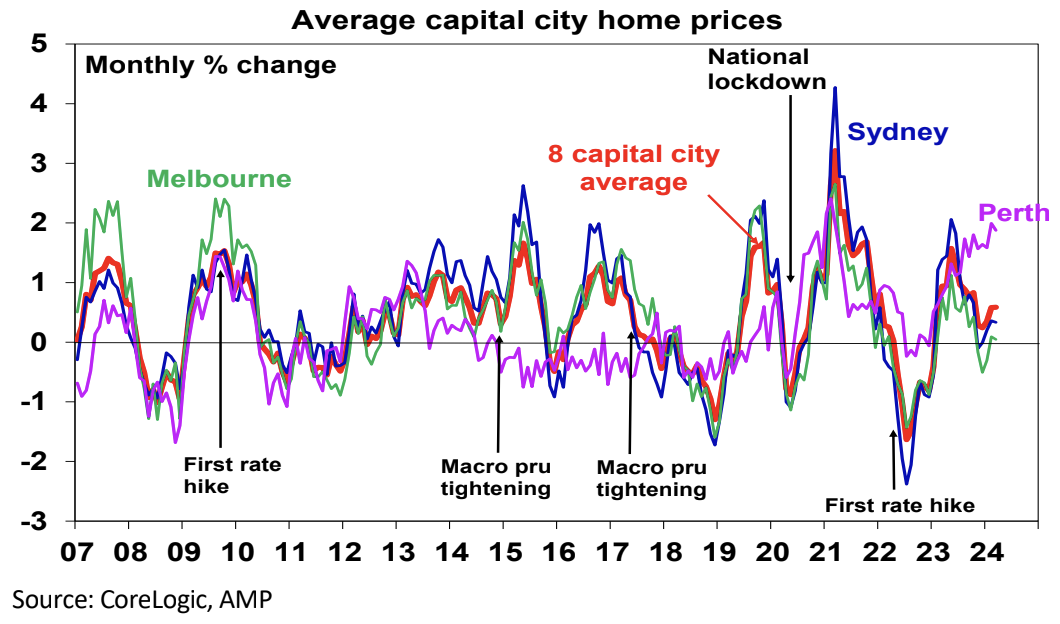

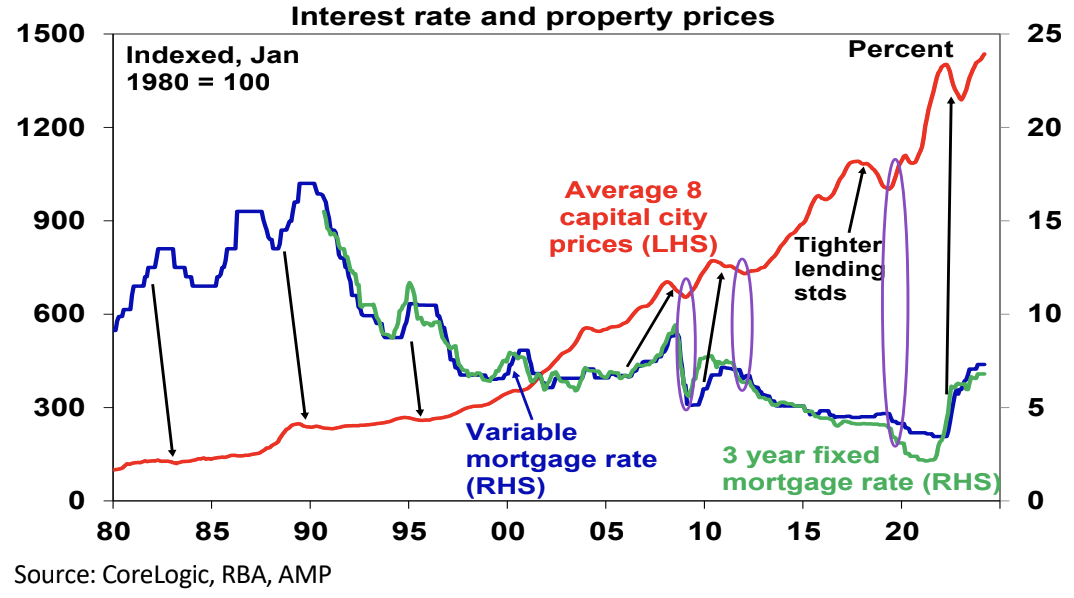

4) Interest rates still matter

But of course, the impact of interest rates can be swamped by other

factors at times, as has been the case over the last year.

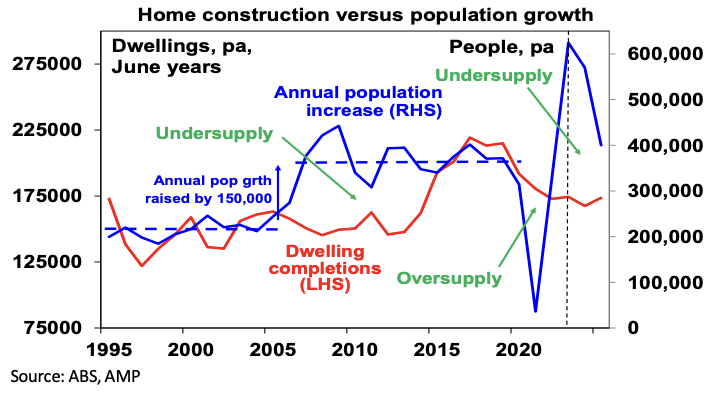

5) It’s chronically undersupplied

This has been the case since the mid-2000s when immigration levels, and hence population growth, surged and the supply of new homes did not keep up. The pandemic’s freeze on immigration provided a brief relief but this was offset by a fall in the number of people per household and the problem has worsened with reopening leading to record immigration levels (of 548,800 people over the year to September resulting in population growth of nearly 660,000).

This has pushed underlying housing demand to around 250,000 dwellings per annum at a time when home completions are around 170,000 dwellings a year. So, the shortfall of homes is getting worse (and likely to reach 200,000 dwellings by June) and this explains the surprising strength in home prices over the last year.

6) Forecasting swings in home prices is hard

Failed property crash calls have been a dime a dozen over the last two decades and forecasting property swings has been hard. For example, RBA Governor Michele Bullock noted last month that “I wouldn’t like to predict housing prices…every time we tried…we seem to get it wrong…” So be humble and sceptical when it comes to house price forecasts.

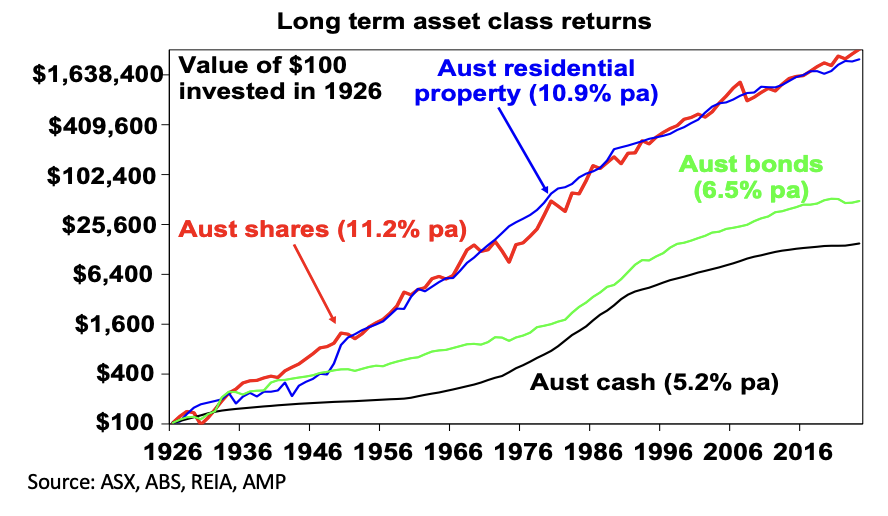

7) It has similar long-term returns to shares

This can be seen in the next chart which shows the value of $100 invested in 1926 in Australian cash, bonds, shares and residential property with interest, dividends and rent (after costs) reinvested along the way. Over the period, both shares and property return around 11% pa.

Property’s low correlation with shares, and lower volatility but lower liquidity makes it a good portfolio diversifier. So, there is a role for it in investors’ portfolios.

Where to now?

As we noted earlier, forecasting property prices is fraught. Particularly now with the opposing forces of a major chronic supply shortfall and high mortgage rates. Our base case is now for 5% or so home price growth this year, down from 8% last year, as still-high interest rates constrain demand and along with higher unemployment lead to some increase in distressed listings.

However, the supply shortfall should provide support and rate cuts are expected to boost price growth later this year. Delays to rate cuts and a sharp rise in unemployment would signal downside risks whereas the supply shortfall points to upside risk.

The key for savvy investors, given the pressure from high interest rates relative to still low rental yields making most property investments cash flow negative, is to look for properties offering decent rental yields.

2 topics