8 intriguing charts in the markets today

It's a challenging time for growth investors — you only need to look at their recent results. Plenty of fund managers have posted negative returns, but I remain optimistic.

In this wire, I spell out why.

I will also walk you through some of the key metrics my team at Frazis Capital uses when looking for high-growth companies, and take you through some of the more intriguing (and revealing) charts we are analysing.

And there's more to it than just charts and numbers. We want to understand why customers love certain companies, and the factors driving explosive growth. This shows where the highest-returning opportunities in the market are likely to be.

Below I discuss the prospects of familiar tech stocks like Mercado Libre, Zoom and Coinbase and introduce a few you might not know, such as Coupang and JFrog.

Make sure you watch my discussion of Opendoor and Zillow, two disruptors that want a piece of real estate transactions. Opendoor is leading the market with innovative strategies, whereas Zillow has tried to follow along, only to be humiliated.

These two contrasting examples demonstrate why aspiring for scale, rather than high margins, can be a better idea.

This transcript has been edited for length and clarity

Hi everyone. My name is Michael Frazis. Today I'll do something slightly different and go through a few charts that I think are interesting. Some companies we're looking at, some things we've added to, some things that haven't gone so well. As always, please send through any questions and I'll answer them as best I can.

Okay. Back to the beginning. So this is us. I'm sure many of you are familiar with these slides. I thought I'd just go through a few things because it's been a pretty challenging time for growth. We're positive for the year. Certainly, there are plenty of funds in our space that are down, like Cathie Wood.

But I thought I'd give some examples of what happened and what's happened and why we're still so optimistic.

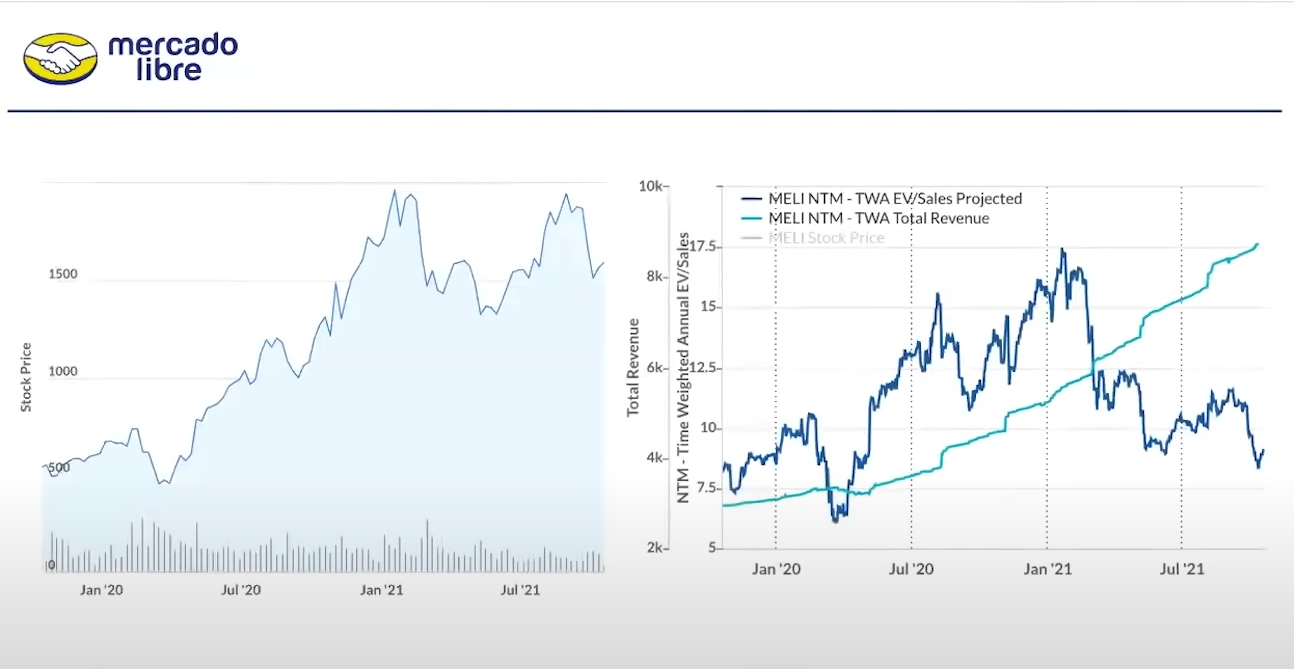

Mercado Libre is looking like a buy

So this company is Mercado Libre, which we've talked about many times. We brought this company in the 400s early last year and it's gone up three to four times. You can see that it's basically doubled to the beginning of the year, and then contracted again.

Throughout that time, revenue, which is basically this light blue line, was increasing the entire time. So this company has maintained triple-digit growth. But as of today, as of this chart, it's still well below its highs. It's 25%, 30% down.

Now what happens next? In the past, this has proved very opportunistic levels to buy, and that growth, the stock has gone sideways for a year. The company has dramatically increased its revenues by almost twice as we move into October/November.

It's like loading a spring. At some point, that fundamental growth will come through and you won't just get back the 20% or 30% that the stock is down from its highs, you'll get significantly greater value appreciation.

An interesting quote I came across recently said that the most interesting outcomes are always at the extremes of the distributions, particularly in life, particularly in investments and particularly when today's world is moving super fast.

So the fact that you can invest in something and hold it for five years, many of these companies will be in maturely different positions and be worth a huge amount. The only way we know to capture that value creation is to basically be in them the entire time.

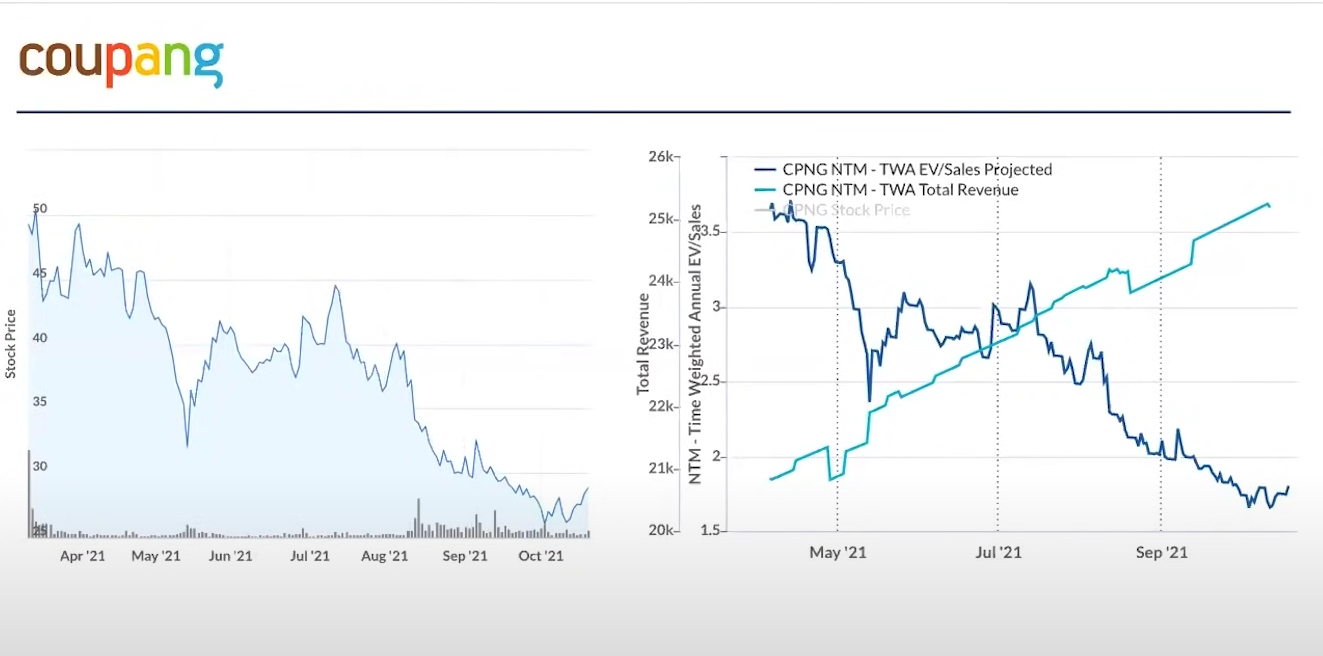

We're stocking up on Coupang

Another interesting company is Coupang. This is like the market leader in South Korea. It came on at 50; it's now almost half. We bought around 35 and we added a lot in the last few days in the mid to high 20s.

You can see, using the multiples. Again, I'm just using revenue because it's an easy, honest thing and it's consistent throughout each company through time. You can see the multiples contract from three and a half to almost one and a half, but not quite.

The multiples roughly halved over a period where the company's done exceptionally well. They've done something like 15 quarters of 50% plus organic growth. In many ways, it's one of the more interesting e-commerce companies, actually.

They're very good at delivering, so you can order things in the evening and it'll arrive in the morning. If you need, I don't know, to make sandwiches before you send a kid to school, you can order the bread and ingredients and it'll be there.

They're also very good at returns. If you want to return something, you can just leave it outside your door. I'm sure eventually we'll get that here as well. But it's a very compelling offering.

We think this is one of those periods where a company is IPOed and it's then sold off significantly. We know that SoftBank is selling, for example, I mean pretty serious size, but if you fast forward three, four, five years and the company continues to compound, you're already at those valuation lows, you're already at a sustainable valuation level.

So there's a good chance that the multiple stays the same or even increases and your return will be the organic growth plus whatever that increase is in multiple.

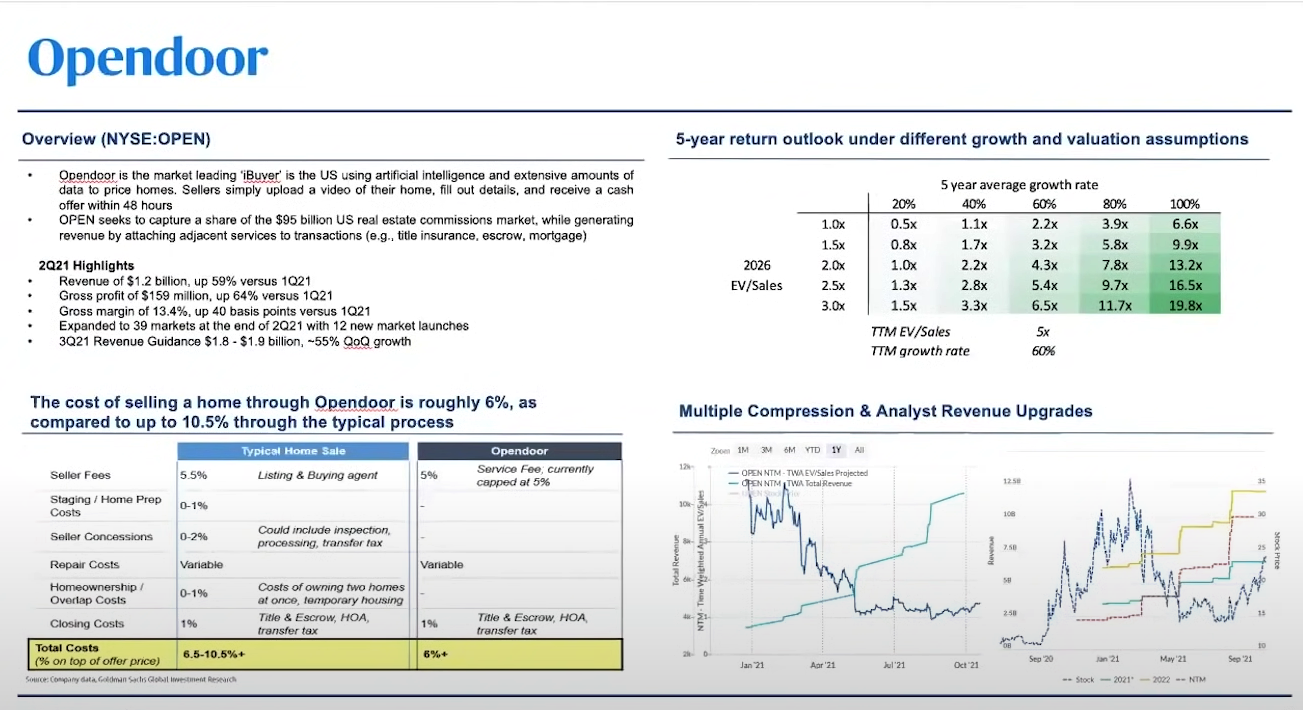

Opendoor and a tale of two disruptors

Another company that we invest in is Opendoor. It's in the United States. It offers people the ability to effectively immediately sell their homes.

Say you want to sell your home to Opendoor, they'll use their algorithm to give you a rough price. They will inspect the outside and they will ask you to potentially go through with the iPhone and camera and video the place, but broadly, within 24 to 48 hours, they'll give you a cash offer.

And they'll charge a fee to do that, at the moment it's about 5%, but that compares very favourably to the United States real estate commissions, where there's basically two sides as well. There are buyer's agents, and seller's agents.

Obviously, the real issue with selling a home is time and settlement dates, and also that uncertainty. So the fact that there's a willing buyer that's there to just happily buy houses, not quite sight unseen, but close to site unseen immediately is an extremely attractive consumer offering.

This company is growing exceptionally fast. It grew 60% in the last three months. It's hard to use multiples here, but the multiple contracted to four times, which clearly needs some level of contraction, to a bit over one times. And this is a business that should probably be able to eke out 10% margins. So that multiple now is sustainable.

There are a few holdouts in business in terms of the handful of industries that were resistant to e-commerce. E-commerce has revolutionised most of retail, but there were holdouts in luxury fashion, autos, and real estate.

Thinking about luxury fashion, we did pretty well out of Farfetch, so that is basically halved from its highs and we're out. And then Canva has gone from $5 billion to $50 billion.

So everyone's eyes are wide open to those parts of retail that were seen as impossible to put on the internet but probably will eventually be revolutionised. All kinds of people, all kinds of businesses are jumping up, trying to declare themselves the Canva of X or Y, but we think Opendoor can actually do it.

One of the similarities is, if they can make the business work on their 5% fee, they'll be able to charge ancillary revenues for mortgages, title, and escrow. They'll just be able to add in services and generate revenue that way. And that would be a key part of the value proposition as well.

It's also similar to Canva in the sense the market's just enormous. Auto is over $1 trillion dollars in the US. It's bigger than luxury fashion. The only thing bigger than it is real estate, where people spend 10, 15, 20 years of earnings to buy a home to live in.

And so the market opportunity is huge. You could reduce that market opportunity and say it's roughly equivalent to, say, the real estate commissions, but even that's $95, $100 billion a year of real estate commissions. That's another pretty significant part of the market that they can go for.

Now, Australian investors are very familiar with Zillow because the fund here took a 50% position in it, just roughly, and got a lot of local investors in. Zillow was doing the same thing. Zillow is like realestate.com.au.

From a consumer's perspective, you go on, you look at houses, you browse around, it gives you a Zestimate, lots of fun. You can see what your house is roughly worth.

Now Zillow tried to go into Opendoor's model and do these instant homes, apparently after Rich Barton, the founder, read Ben Thompson's Stratechery, which I highly recommend. If you want a good blog, Stratechery by Ben Thompson is excellent. The problem is, they're completely different businesses.

Zillow effectively advertises to estate agents. It's an estate agent model. It's a much smaller market than realestate.com.au.

Putting aside the difference between Australia and the United States, in realestate.com.au, you pay to advertise to everybody. In the US, you're basically trying to get estate agents advertising to clients to get them. So it's a small, small pool, but they do have these estimates.

So you can see why they thought why don't we do these instant offers and try and copy Opendoor's model, but they've just about a week ago, they suspended their iBuyer . So it turns out those estimates weren't good enough.

They weren't able to clear their stock profitably, and they've paused that. Now there are no guarantees in this model. There are two things that I was previously skeptical about. The first was that you're always holding inventories. When the market turns, you're going to be stuck with a bag of real estate, always.

It's actually happened last year. We got to see what would happen. Immediately Opendoor stopped buying homes and then just cleared the inventory. And then when the market turned, they were able to come back bigger, better and stronger. So it is more robust than you might think at first.

Second part was that there's a bit of game theory going on. So let's say you own a home and you know it. You know the area, you know if it's the nice side of the street, you know if it's in that.

You know where the sun light is; you know things are very obvious to people in the area. You also know the condition that you've left it in and the deep condition — how many of those little things are wrong and how many things need to be fixed.

Let's say you get given an offer. If the offer is better than what you think you can get, you'll always take it. If it's worse, you won't. That potentially leaves one of these iBuyers in a situation where they're only buying the homes that are worse than they look; worse than the algorithms would suggest. And they're never buying the ones that are higher.

I imagine that's probably what went wrong with Zillow. They would've been offering people prices. If the people who knew most about their home thought it was too low and they could get better in the market, they went to market. If not, they go over to Zillow, and Zillow was stuck with inventory they struggled to achieve. Good thing about Opendoor is, it's all they do. This is the only thing they do.

Zillow is fundamentally an internet business first and foremost, and traditionally, and culture wise, and very high revenue per employee, generally very high gross margins. Opendoor is different. They're going to live and buy by the success of algorithms. Then it's a low margin business.

They're going to have to operate the entire business in a way that reflects that reality. It's not ultimately so surprising the specialist has remained and is still buying houses while somebody who is in an adjacent industry, but not a specialist, perhaps had the consumer relationship, but didn't have the expertise in pricing and selling homes instantly, it's not so surprising that they did worse and have now exited.

So this is now a pretty big position for us, because it's already gone up a little bit. So it's a bit over 6%.

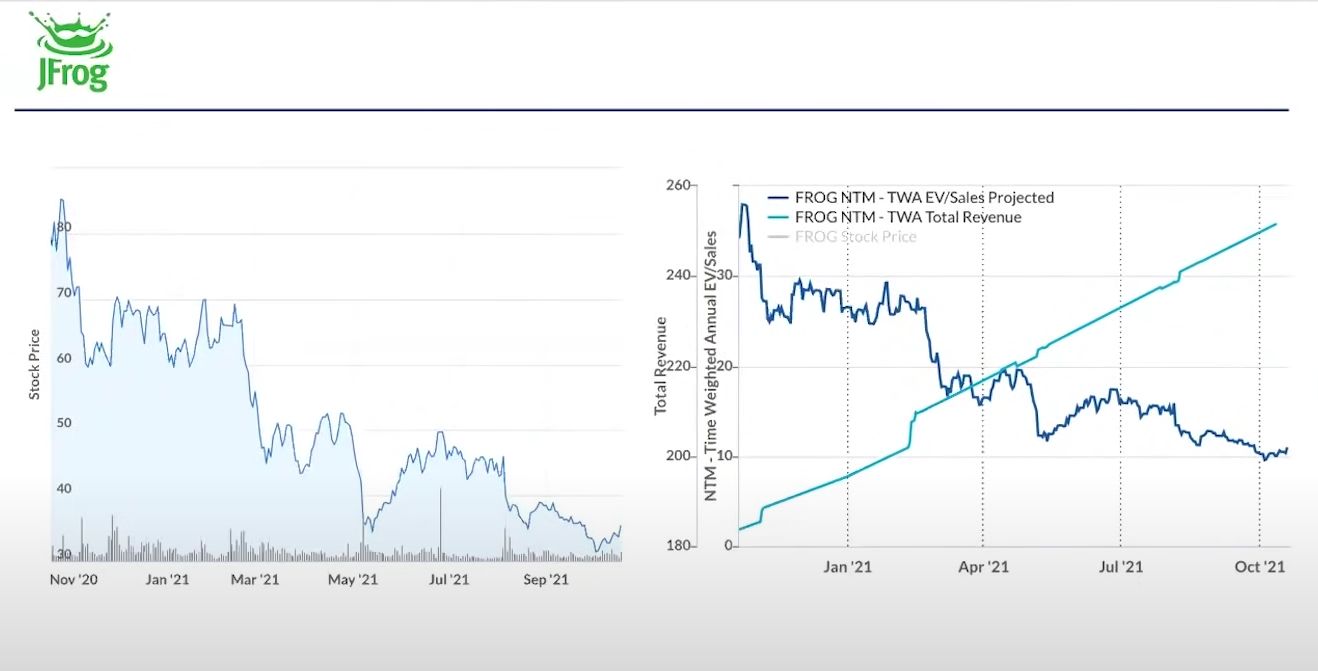

This frog looks like a prince

Another thing I thought was interesting was JFrog. There's been a tonne of IPOs and somebody just asked about Maqeta, which I'll get to. But this company came on at 35 times sales (forward sales), share price above 80.

Basically, what they do is make tools for developers. They're in package management. When you have a web application, you do generally make these packages, which are other programs that other people have made, and you need a way to download and manage those and make sure they're up to date, make sure the new updates don't include security flaws.

It's a complicated part of web development, and this is the market-leading industry tool. You can also do it for free, but this is the best industry tool. And they're trying now to use that position to go into adjacent areas.

You see what's happened — it's gone from $80 to high $30s. So more than halved, and the multiple has gone from mid 30s, actually closer to 40s, down to 10 times.

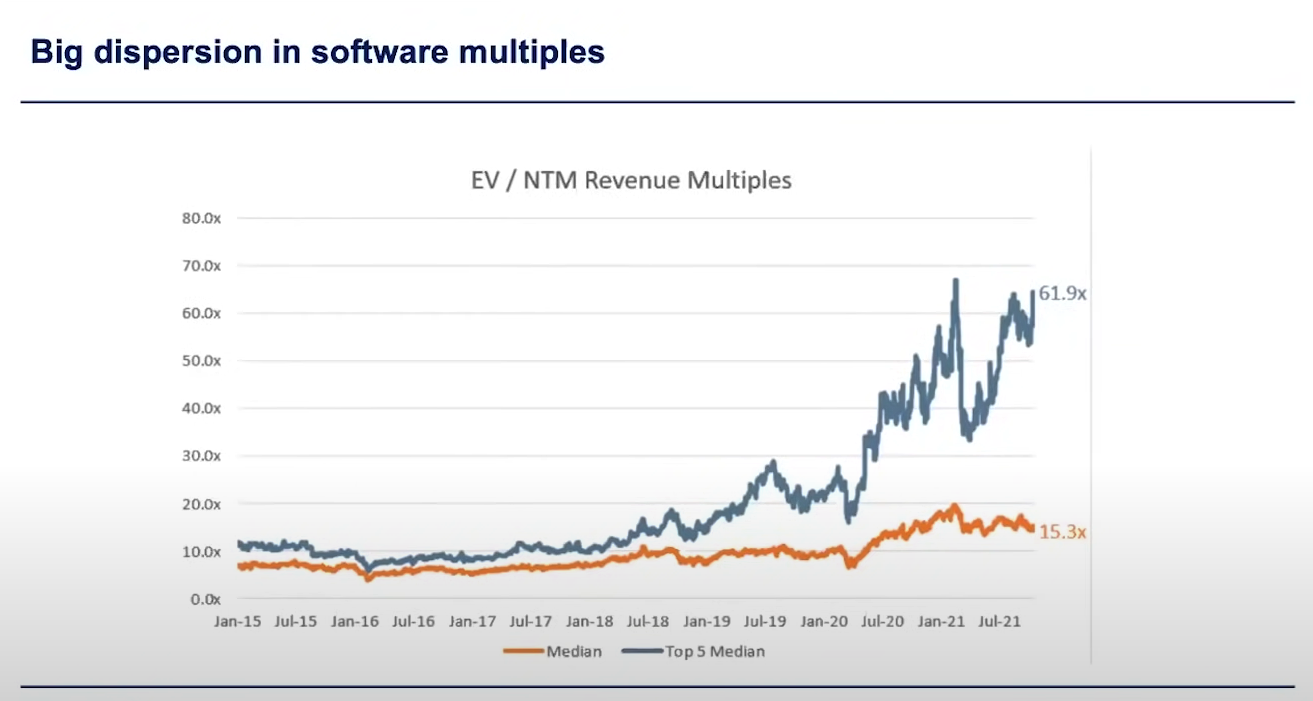

That's not a multiple; THIS is a multiple

This is where we think the opportunity is in software, because there has been this huge dispersion between the fastest-growing ones and the slowest growing. So the fastest-growing, your Snowflakes, your bill.coms, they're trading at valuation highs.

Even with the rise in interest rates, it's 62 times sales. This chart is from a guy called German Paul who's on Twitter and sends out these kinds of charts to a mailing list, if you're interested.

You can see there's been a huge decline in the median and then a massive increase in the top. You're not going to make money, I don't think, buying 62 times sales for anything.

You might do okay, particularly in the short term, because there's a tonne of momentum in these things, but over five years, that multiple has to contract, potentially 80%.

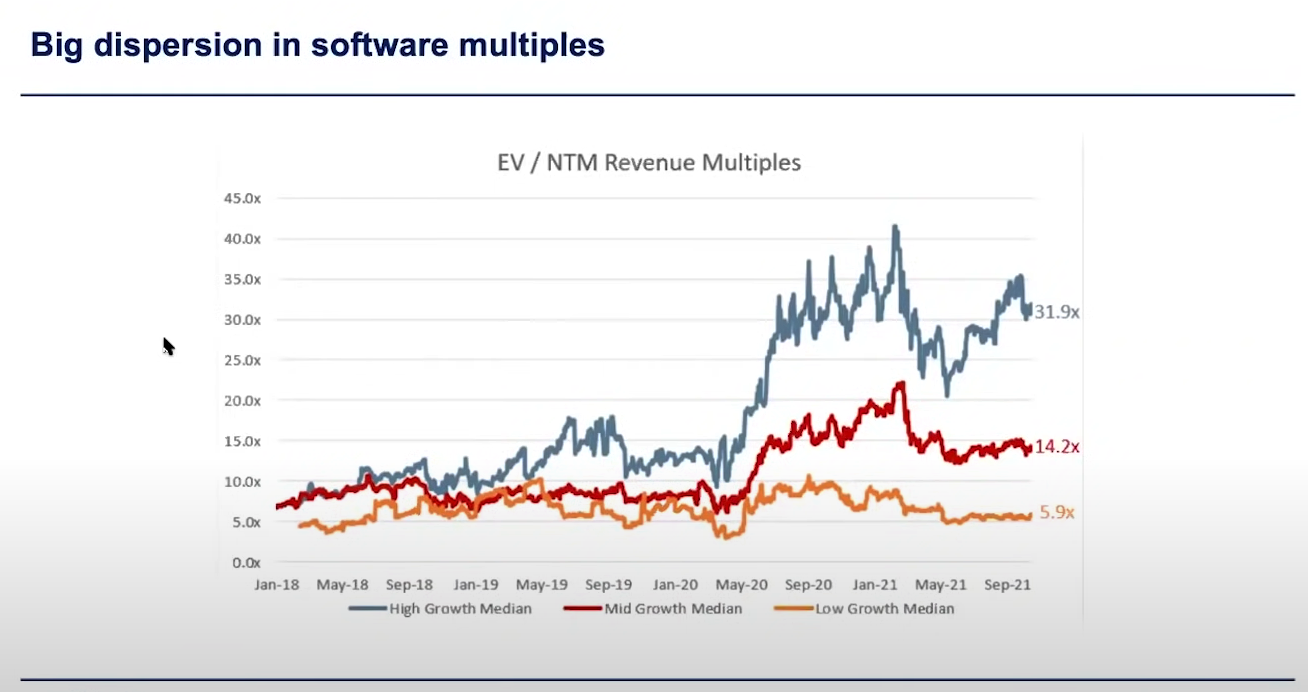

And this is another way of looking at it. He also divided software into buckets: the fastest growing, the median, and the lower growing. And again, you can see the median is actually where there seems and the lower growing software companies where there's been the most compression.

And they're almost back down to where traditionally these were very good times to buy. But the high-growth software has basically maintained that huge valuation uplift that it got earlier in the year.

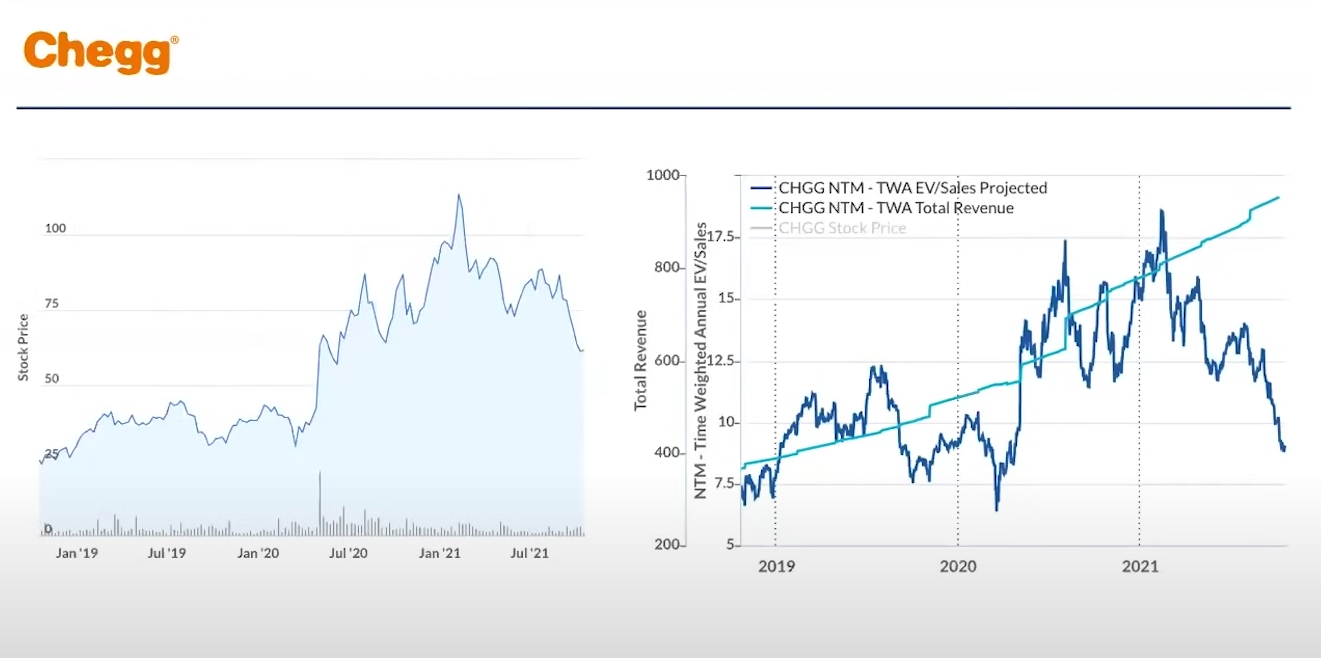

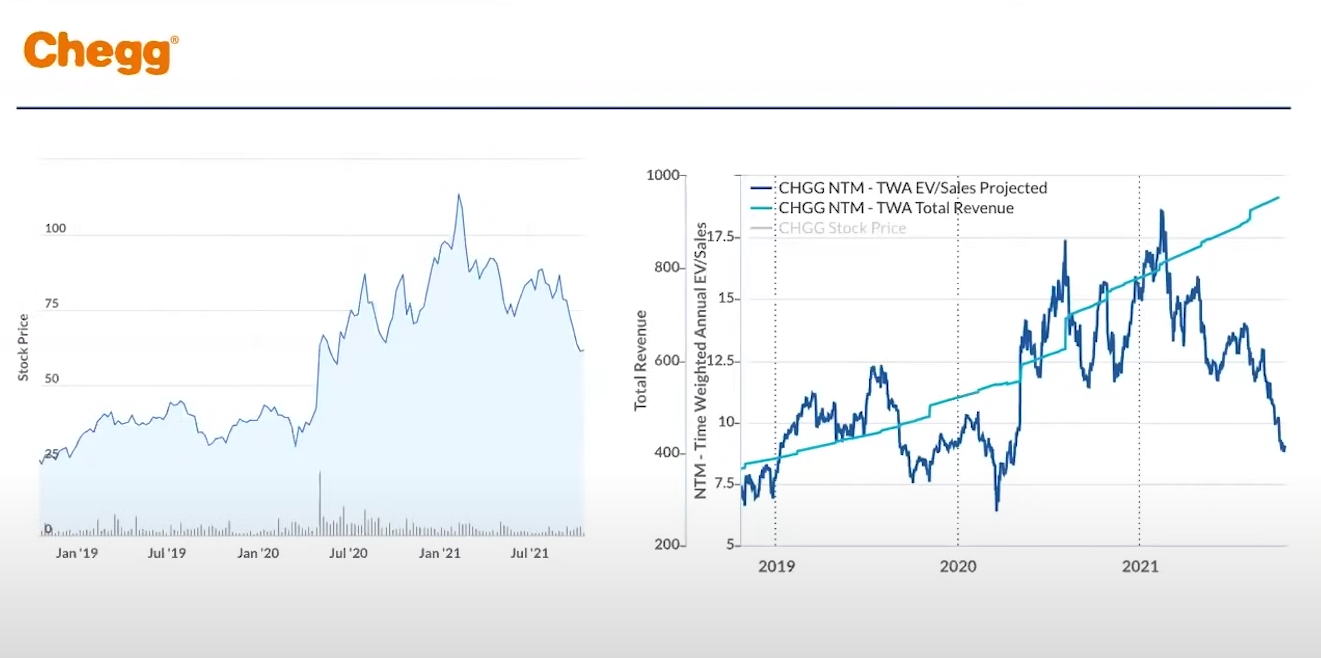

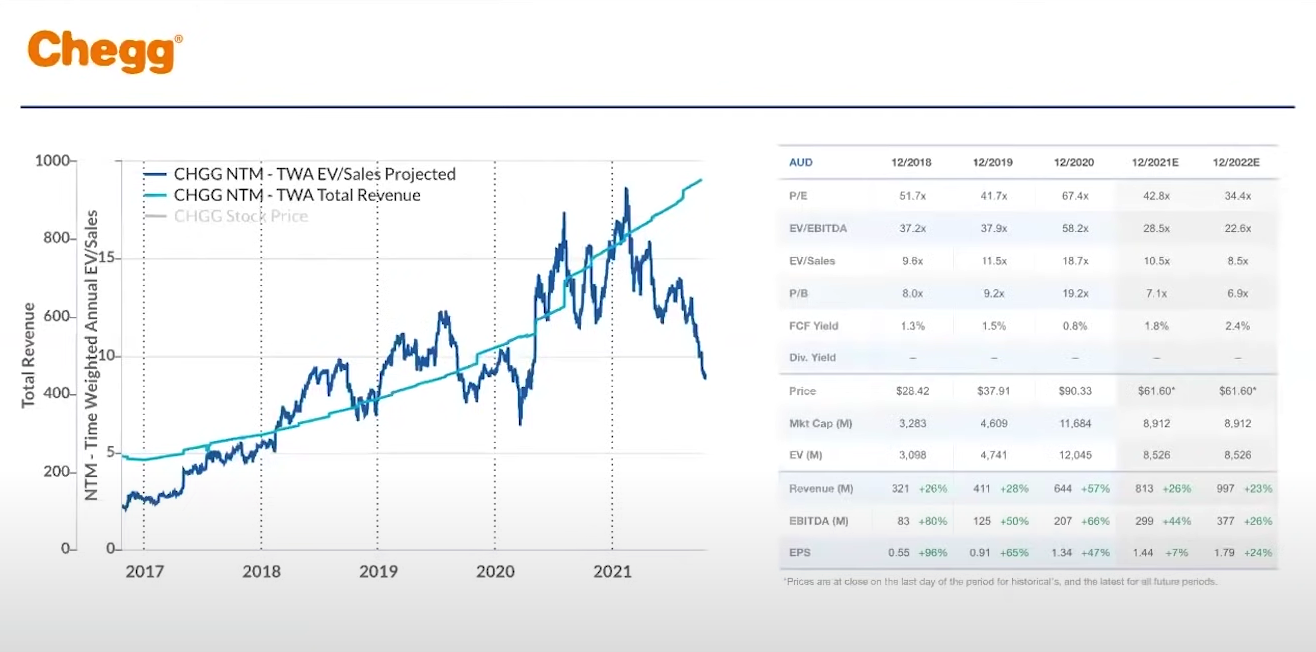

Chegg it out: Here's one we're looking over

This is another company we've been looking at: Chegg. We don't own this, but we would. I'm thinking about it very carefully.

They basically offer an extremely good platform for university-level students, often doing maths, science, engineering — difficult subjects. Lots of questions and answers, past exam papers with detailed answers — that kind of thing.

The kind of content that's very hard to create, very difficult to build from scratch, and all the interns we have absolutely love it and rave about it. It's definitely got customer love. Growth is generally 25% to 35%.

It's not crazy explosive growth, but it's still pretty solid. And the reason I think this is interesting today is that the share price is obviously up over the last two years down from its highs. I think it peaked around, I guess it was about 120 and is now down in the low 60s, but you can see the multiples come down from 18 times to eight.

So you're getting back to kind of the valuation ranges where historically returns were very good. And I thought I'd share a couple more points on this. This was kind of, what was it? Two year-, three-year chart.

This is a five-year chart. Think about that software chart, the 62 times sales. This company was trading in low single digits and went all the way to 17 and a half times, but now is trading at kind of eight times forward.

Think about what happened to the share price — it went up 10 times in five years. This is the profile you want if you want to get that.

Interestingly, revenues have grown, but we have companies that have grown revenues by this amount. I've actually got the numbers here, from 254 to 800.

We have companies that have done that in a year. It hasn't been revenue growth in this case that has done the performance, it's been this two-time sale, to 18 times, then to 10 times. So four increases in EV/sales [enterprise value/sales] and I guess two to three in revenue. That's what gets you these profiles.

You don't see any of these charts and companies that you're buying at 60 times. We are looking at this very closely.

Particularly if it gets around seven and a half times, then we'll certainly add this to our portfolio.

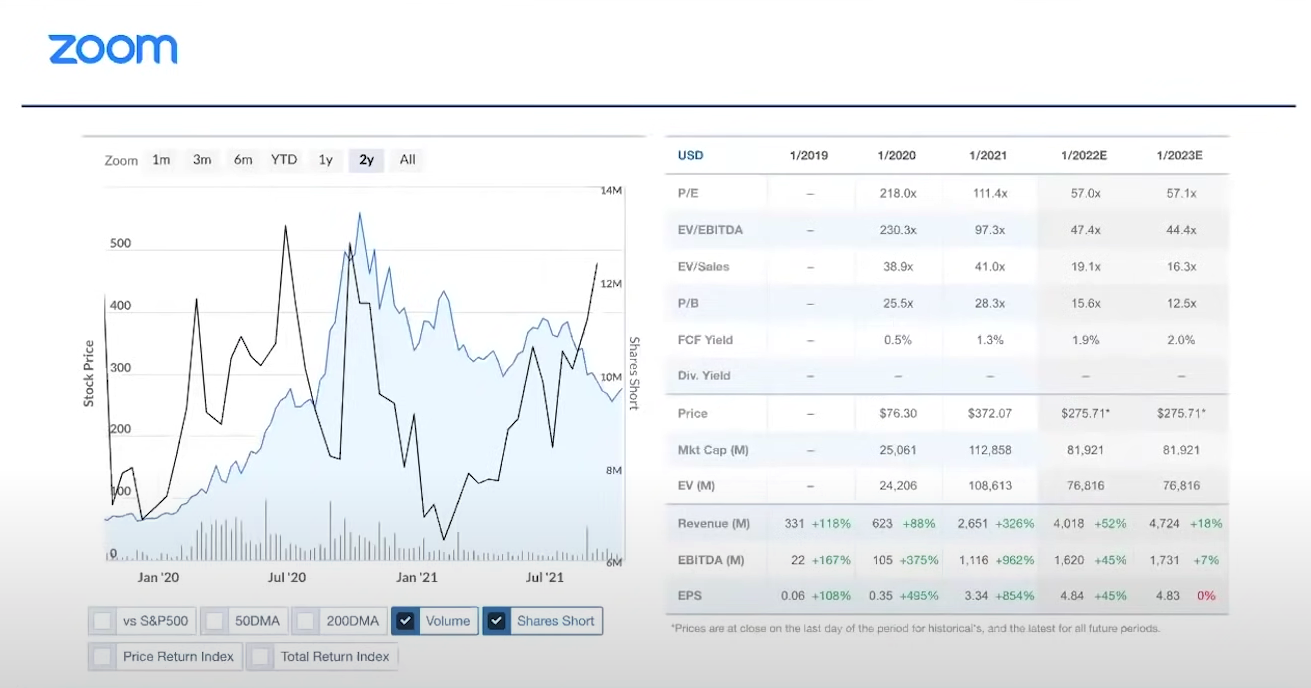

Zoom shows better is not necessarily best

Another one that's gone through a bit of a journey is Zoom. It's obviously one of the potentially big coronavirus stocks, other than perhaps Moderna. Traded all the way up to some crazy EV/sales and then has basically halved since then. So growth is largely maintained.

It's not like it's shrinking, and it's very profitable. It's not like the vast bulk of these companies that are not yet at profitability — it's printing cash and will do so for the near future. But the multiple is really contracted.

It's contracted from well over 100 times to sub 25, about 20 times forward, from memory. And that's interesting. It's interesting because there might be an opportunity there. One thing that peaked our interest always is this short interest.

You can see these spikes in short interests, generally preceded very dramatic uplifts in price, as the short sellers effectively had to close. It's always good to come in after that selling has been done, but it's a challenge.

I mean, I used Zoom religiously and now I use Teams. If you have to use Microsoft — and we have to use it because of one or two tools like Bloomberg that don't really integrate with anything else — the logic of using Teams is compelling.

First, it's free. Second, it's all in built into your Outlook. You can just press a button and call everybody you need to call. But Zoom is still, I'd say, better. Most people seem to like Zoom more. And also, a lot of people don't use Microsoft.

So taking those two things and trying to figure out how the competition plays out is not straightforward. But there's almost certainly a price at which this makes sense. And we're probably getting closer to it now.

Coinbase, bitcoin and all things blockchain

I thought it would be interesting to check in on one of these old favourites. I was asked about Coinbase. I was actually going to talk about this. We have about a 5% position and we've been buying it in the last few weeks. It has now rallied significantly.

It looks like Facebook is going to integrate with them for their own cryptocurrency plans. This is the one of the cheapest, fastest growing companies on the market, hands down. A number of the listed cryptocurrency equities are the fastest growing and cheapest companies.

It's at 3 billion of EBITDA and is trading at 64 billion. There's software companies that have a 10th of that revenue and are trading at 65 billion. This is the value mismatch. And cryptocurrency is getting very real.

It's a weird moment for cryptocurrency. On the one hand, there are people that still think it's a Ponzi scheme. And they're debating over that.

On the other hand, there's a tonne of people who've just quit everything they're doing and are just living crypto world now, and are building web 3.0, the most exciting platforms and games, and the most exciting things going on in the art world as well.

Meanwhile, every institution is realising they need to have a part of this. I know from our use, we have to transfer and receive money all the time. We have people who are investing in our fund, we're sending money out for placements, it's an absolute nightmare. When you start transacting in crypto, the fact that you just go check any transaction at any time is just so compelling.

And I'd say it's revolutionised at least three industries. The first industry is art. Just think about art over the last tens of thousands of years, the most valuable and best art.

Often the artists themselves didn't get anything for it. These were people that lived in poverty and had horrible lives, and had high rates of suicide and things like that. They never got the recognition, and even if they did get the recognition later in life, they never got financial credit for their earlier work.

Thinking about NFTs (non-fungible tokens), this is one of the first times that artists (and admittedly, it's only in a small part of the art world), but some artists are making a huge amount of money and will, because of the nature of the digital asset, the fact that you can program it and put in all kinds of features, or feature sales in the artwork, they'll also get a cut.

So you think about the evolution of what it's like to live as an artist. Now it's probably the best time ever because even if you sell an artwork, you can also sell the NFT that represents that.

And effectively, every time the artwork is sold, you get a piece. It's something that musicians can also do. They can sell an NFT of an album and again, generate revenue for bands that... it's one of those things, a handful of people make all the money and a large number of people struggle, but make ends meet, and then a lot of people don't make anything.

NFTs and crypto give people a way to develop that has clearly revolutionised the art world. And that's just a fact. Whether you like it or not, a number of artists have made more money they could possibly made otherwise.

Another element that has been completely revolutionised is gaming. And it's interesting because there was a lot of nascent crypto behaviour before crypto.

You think about World of Warcraft, which was a world — I never played it — but a world where you have a character, you build a character up. And the more you do things, the stronger you get. You need to invest a lot of time to build your character up.

In low-income parts of the world, people would set up farms where they'd basically just collect and they'd just build up characters and sell them to the West. It's very kind of crypto-like.

Now, there's games like Axie Infinity, which have grown immensely fast, in some ways probably the fastest growing game by absolute revenue dollars ever. But people can effectively build these characters out, sell them, battle them, grow them, all with this native crypto overlay.

And you think, "Okay, why do you need crypto for that if it was working for World of Warcraft?" Well, it didn't. You didn't have a wallet in World of Warcraft.

In a crypto-based game, you just sign up and you have an instant wallet that can then transact, not just within the game, but outside the game with anybody that you might want to transact with. That doesn't exist. And to the extent you try and recreate that, you are talking about cryptocurrency. Well, what if you have these wallets interact with other wallets and it's just conventional fiat currency?

Well, if there's no level of trust — you're not going to be able to do that. And then that's crypto, and in cryptocurrency, you do have that level of trust. So gaming and art from first principles have already been revolutionised. The third one is probably criminal behaviour, which is one of the ways it started.

But again, criminal behaviour is massively overdone, I think. And there's good evidence for that. And the evidence I put forward is that Bitcoin is actually really bad for criminals because it's pseudonymous. So, let's say, SilkRoad goes down, the founder is discovered and he's got a Bitcoin wallet, you can see every single person who's transacted with that Bitcoin wallet.

If you bought drugs off somebody and they got caught, they could then trace you to your transaction, to your wallet. And if you'd done anything — let's say you bought something online or there was a wallet associated with an exchange — you could immediately link it to you.

So Bitcoin is terrible for crime. But there are some cryptocurrencies that are very good for that, and they include things like Monero, which are effectively untraceable. So you think if crime was a bigger part of it, that those would be some of the biggest cryptocurrencies, and this is actually what I expected to happen, but it didn't.

The vast bulk of that $2 trillion plus of crypto wealth is not in those criminal cryptocurrencies — it's in the ones associated with gaming and the base layer currencies of Bitcoin and Ethereum.

In any case, crypto is here to stay, whether you want it or not. It has already revolutionised three industries and that's only going to continue with web 3.0.

But the idea is basically you've got to rewrite every single website to have inbuilt net crypto. Firstly, in terms of funding the website; secondly, in terms of the way that, let's say, a YouTube equivalent would reward creators.

There's a very natural way of doing that with cryptocurrency that rewards, firstly, the people that watch videos the most and the earliest; secondly, creators; and thirdly, people that just want to believe in the future of the platform and are happy to connect capital to it. Spotify, Trade Desk, advertising, all these kinds of things. There's certainly digital cryptocurrency ways of building those websites in potentially much more natural ways.

That was a few comments on why we're pumped with cryptocurrency, but we don't need to use that to invest in something like Coinbase because we can use our traditional metrics of customer love, explosive growth.

I also know there's forecasted clients in Coinbase. Already that's starting to decrease. I think that this year is a one-off and there's going to be a huge fall next year. That's what's behind these declines. At the moment Bitcoin is actually at new heights.

There's a chance that those declines are actually growth next year. And that would turn this from a $50 billion company a couple of weeks ago to a $100, $150, $200 billion company. They can maintain another year of growth. We think they probably can.

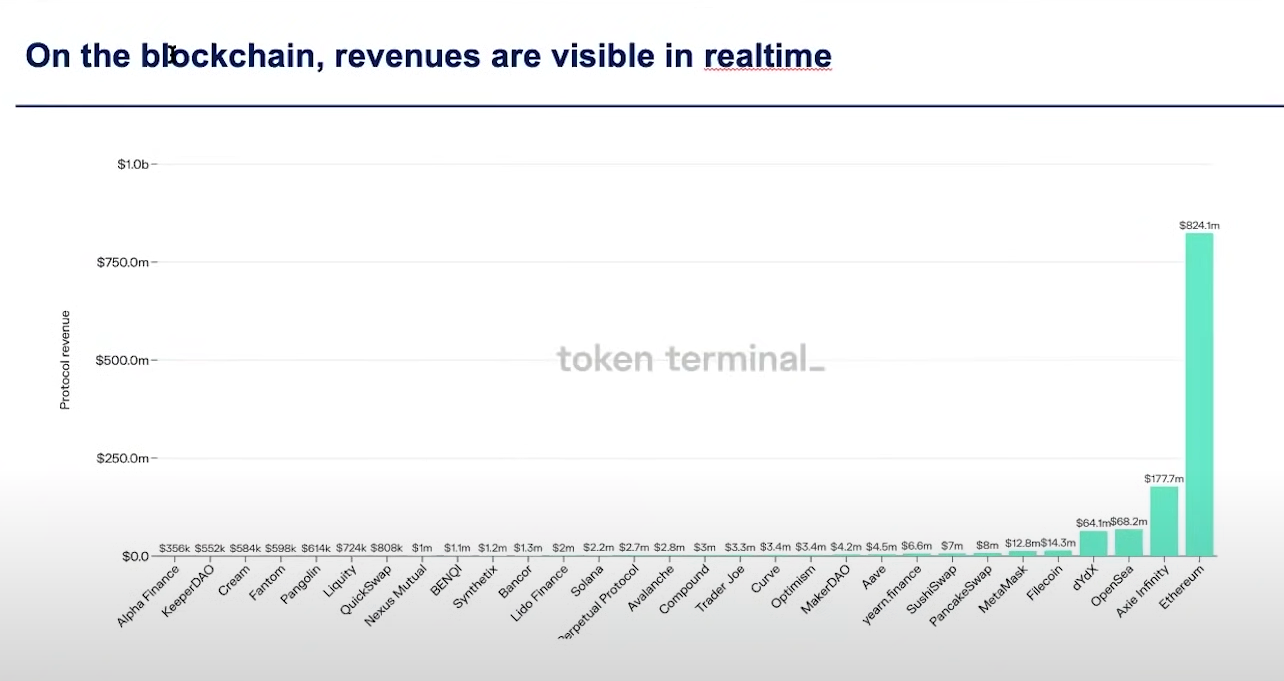

Crystal-clear visibility

The thing about Blockchain is you can see revenues of everything. I'm not sure what timeframe this is. I think this is over the last month. You can see all the revenues that have been transacted on a particular chain.

Every transaction can be summed up. There's full transparency, so it's very easy to see which ones are rising and falling. And Axie Infinity is a game that, like that World of Warcraft idea, it's huge in the Philippines.

Apparently, in the Philippines, you can get two to three times the average income by playing Axie and building up these characters. It's fascinating.

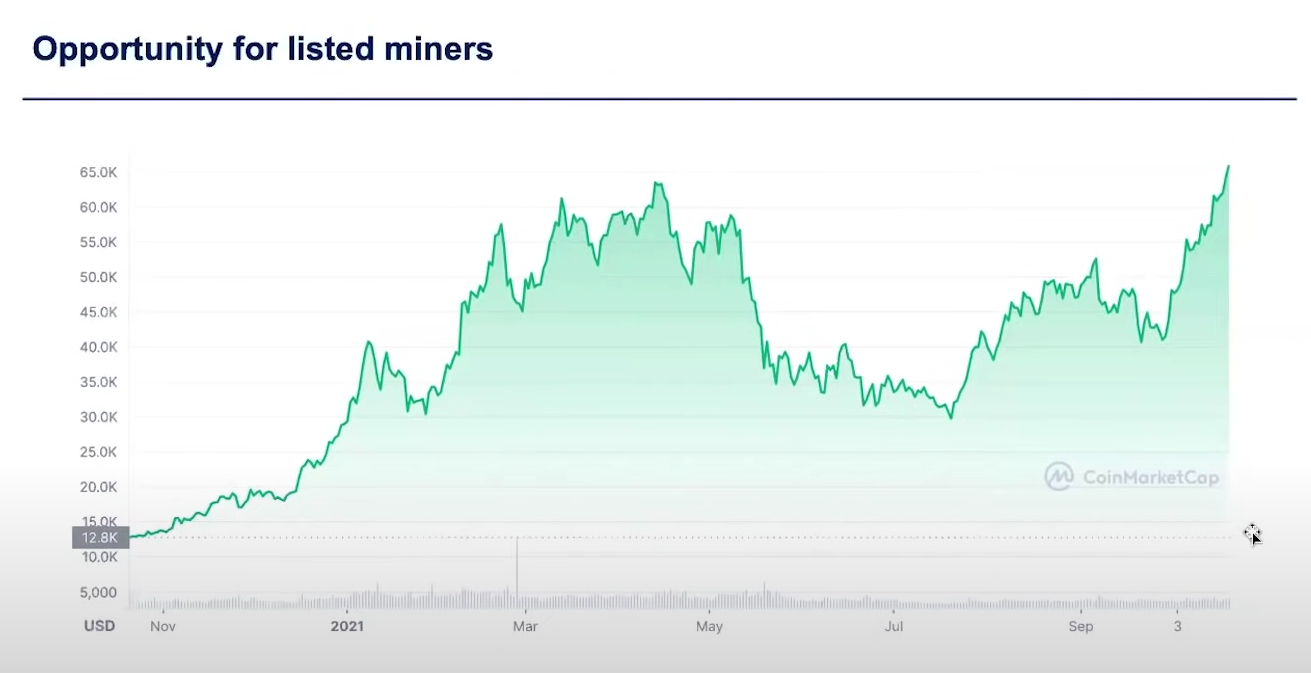

Digging into crypto miners

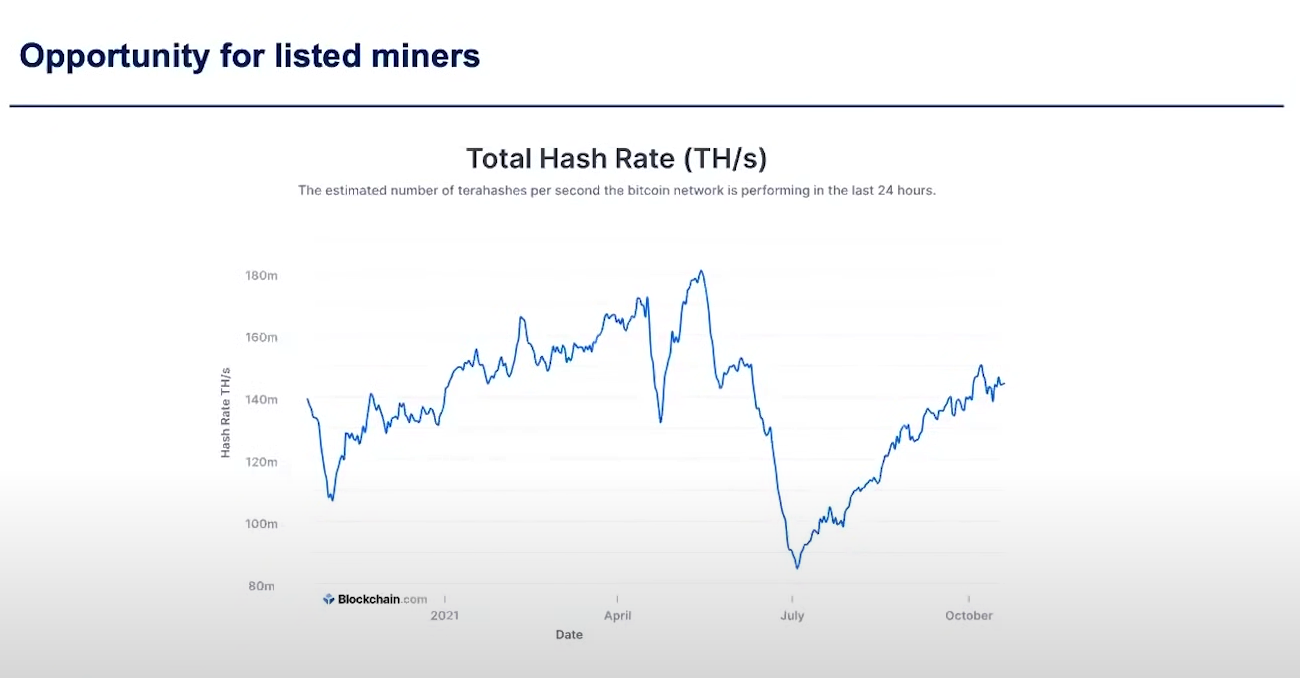

I think there's probably an opportunity to list some miners. This (above) is a chart of Bitcoin prices.

You can see there was a strong rally into the beginning of the year; a fall that we're all too familiar with. And then it's been one of the first of those growth speculative assets to reach new heights. But again, on the blockchain, everything is visible.

You can see the mining hash rate, which is equivalent to the mining, I guess, supply. And you see that hasn't reached new peaks. And the reason for that is China has basically made it illegal to mine cryptocurrency.

Now I'm sure there's Chinese people who actually use cryptocurrency. I'm sure there's plenty of Chinese people who are active in crypto markets, but there's no way you can secretly have a huge mining farm taking up valuable electricity in the middle of China.

That's one possible explanation for this disparity — the fact that Bitcoin has got to new highs, but the hash rate, which is how much the miners make, has not.

Now it turns out there's some listed miners in the US, and some Australian companies as well, that should be absolutely printing money now, because Bitcoin has gone up, the hash rate, which defines the cost to mine has stayed down, which creates an opportunity.

There's a number of those companies and they're all going through pretty extensive roll outs. So it'd be interesting for us to see what happens in this hash rate as that new capacity comes on.

Some of it has already started coming on, so I thought you'd be able to see this in the chart by now, but you haven't. But that is something I'm going to watch very, very carefully.

I thought I'd answer some questions now. Marqeta. Marqeta is pretty good. I don't have a strong enough opinion. The last time I looked, it was like 20 times sales, growing strongly. There's quite a recent IPO, it's off. I'd be interested to see if Marqeta sells off further and do more work. For high-quality companies, it's just one of those ones where you're trading off growth versus valuation.

And the sustainability of Coinbase. Crypto has been around for a while. There's that idea that the longer things have been around, the longer they'll last. Like the longer people read a book, the more likely it is they'll read it long into the future. And I think, so many years in, it's very much here to stay.

And I'd say that the rare firms like Coinbase that are very active in the space and demonstrate market leadership, which Coinbase has, they'll always accrue extra assets; they'll always have a competitive advantage.

Bitcoin has a competitive advantage to the others because it's bigger, more liquid, and has been around longer. Some of those things you can't just change. You can't just create something new that has been around longer, or has been tested so many times, attempted to hack so many times.

Similarly, Coinbase has been around the longest, so there'll be people who will have a premium on the easiest, most reliable, safest place to store my cryptocurrency, you're going to use Coinbase, which leads to sustainability.

Thoughts on Australian bioscience

Thoughts on Australian bioscience at the moment, has anything caught? All right. We're on a few things. We're on Imara. We participated pretty heavily in a couple of IPOs.

EBR, which makes these cool implantable devices in a heart like a pacemaker, that can be charged externally. That's coming to market soon. We've got quite a decent allocation to that.

And we've also got an allocation to Radio Pharm, which is developing a number of different antibodies linked to radioisotopes.

The interesting thing about radioisotopes is that there are two levels. First you get an approved image. If the image is well, which means it's going to the right spot, binding to the right thing, then it's a very good chance it's a good therapeutic.

What you do is then crank up the dose. These things are radioactive — they kill things that are close to it. So you go from an imaging product, which is easier to test for and more likely pass, and then if that works, you can extend it to a much larger market, which is therapeutics.

Telix is extremely successful in Australia doing that. Clarity Pharmaceuticals, which focuses on copper isotopes, has come to market, and Radio Pharm is using some really interesting antibodies. Maybe I'll go more into that one next time.

Okay. We'll finish there. Let me know what you think of this format: just going through a few slides and letting you know what we're thinking about certain things at certain times. Thanks so much for listening in. I look forward to doing the next one. Hope you all have a fantastic day.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

3 stocks mentioned