9 key macro insights (and why China could be our way out)

A few reasons for optimism are called out alongside the gloom in the latest edition of the VanEck ViewPoint, which I’ll mention first (though they’re further down in the full version, the PDF of which can be downloaded at the end of this page.)

The full document spans some 6,000 words across 14 pages, but I’ve captured some of the highlights in the following wire.

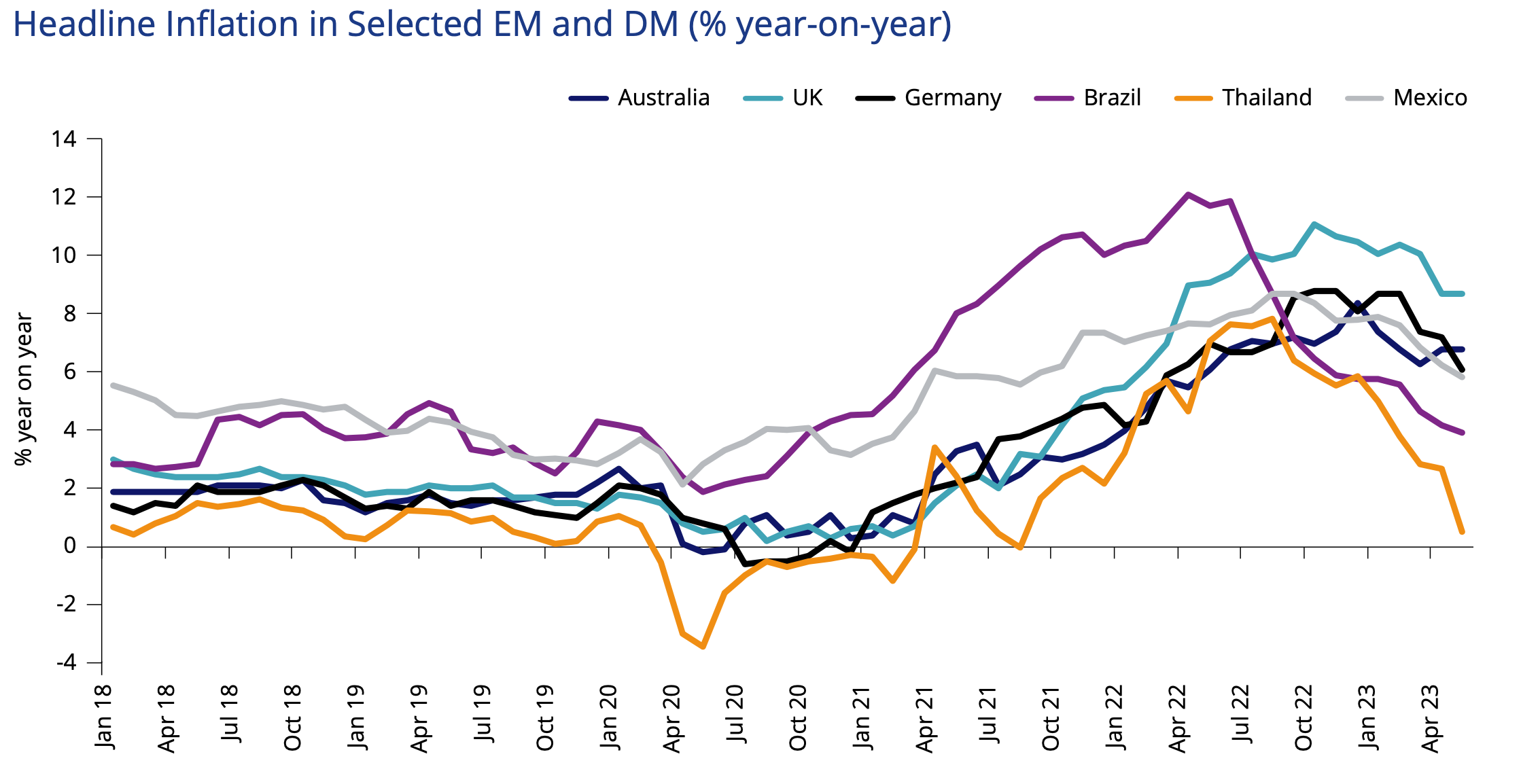

1. Emerging markets are holding their own

One of the most optimistic parts of the VanEck paper relates to emerging markets which, “acquitted themselves well during the first quarter of 2023, [and] continued to navigate the second quarter despite headwinds.”

“As we noted [in our] last quarterly, local currency is thriving in an environment characterised by a US banking crisis and global recession concerns. The ‘safe haven’ status of many EM local currency markets has moved from being a prediction to being an observation,” writes VanEck.

It suggests that, because many EMs hiked earlier and more, in real terms, than developed markets, the interest rates in these nations could rally more as a result.

“There are many investors that think we are at or near the top of the hiking cycle and many will see EM (local currency and hard currency) as ahead of the curve and the best fixed-income category through which to express this view,” writes VanEck.

Pick the emerging market

2. A contrast to the gloom

VanEck also alludes to other positive aspects in both Japan and Australia – though with serious caveats in each instance.

In the former, it says a key risk to watch is whether Japan’s Government will walk back its fiscal policy, as has happened on several occasions previously and conspired to “wreck recoveries.”

In Australia, VanEck notes the robustness of the local economy but also the “fear of missing out” that reignited in the housing market at the slightest indication of peak interest rates.

“The continuing labour market strength, rebounding housing and low productivity have forced the RBA into restarting its tightening cycle. The potential for accidents remains high,” writes VanEck.

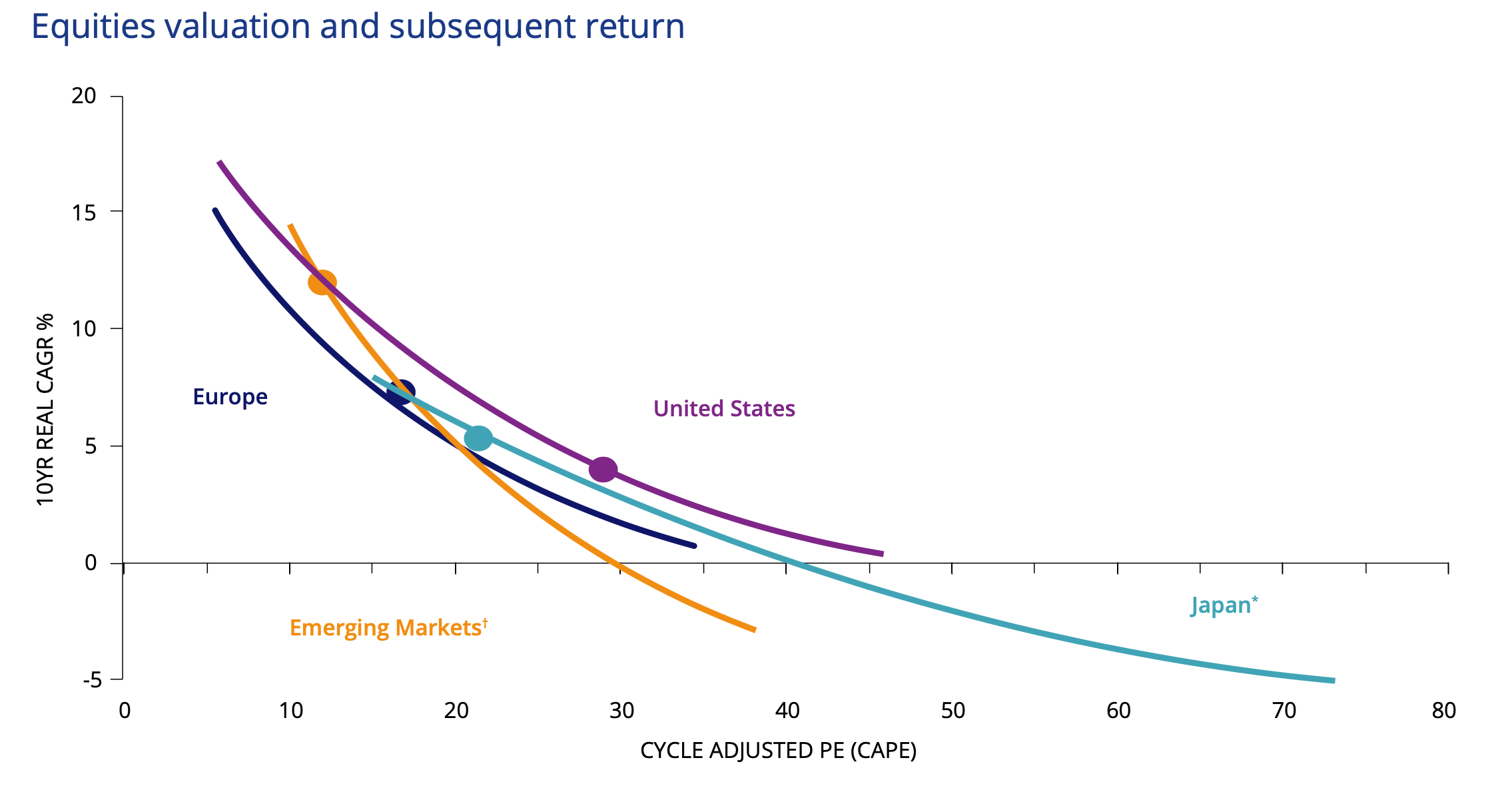

Japan equities are a potential bright spot

Source: MSCI. MSCI USA, MSCI Europe, MSCI Japan and MSCO Emerging Markets Indices used, US$ terms. EPS and price index deflated by US CPI to calculate cape. Total return is in US dollars, deflated by US CPI. Data from 1980. * Japan returns are in yen terms. † Data from 1998. Dots show the current CAPE.

3. Navigating to avoid the accidents

VanEck contends that the potential for a wage-price spiral in Australia is a genuine threat, as the nation contends with historically high immigration that is accelerating one of the leading sources of inflation: rental prices.

“Australia’s policymakers, therefore, are navigating increased pressure on rents, rising wages and rising energy prices. These, coupled with the many Australians rolling off fixed-rate mortgages and the threat of further rate rises later in the year, may mean Australia’s moniker as the ‘lucky country’, avoiding a recession for almost 30 years prior to COVID-19, may no longer apply,” the paper notes.

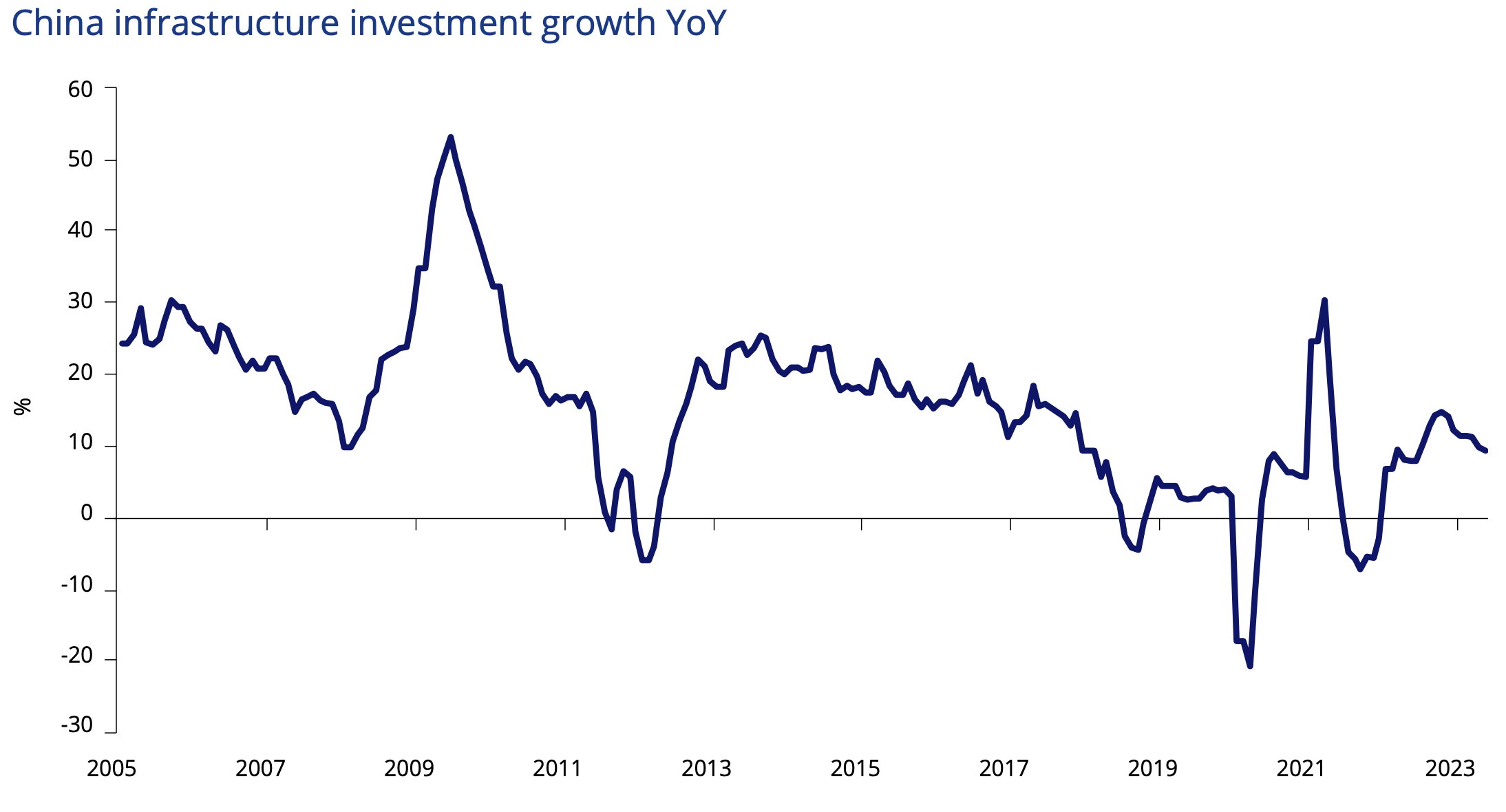

But as they have been in the past, Australian resources are “a shining light among these complications” – which means that “China could be our way out.”

China to Australia's rescue

4. US fiscal policy and artificial intelligence

The paper makes the somewhat gloomy pronouncement that VanEck expects the interest rate pauses of both the US Fed and the Reserve Bank of Australia are just that – pauses. VanEck says that, in the US, this means that the size of employment numbers and wage growth is crucial from here on – as is the potential for another market event.

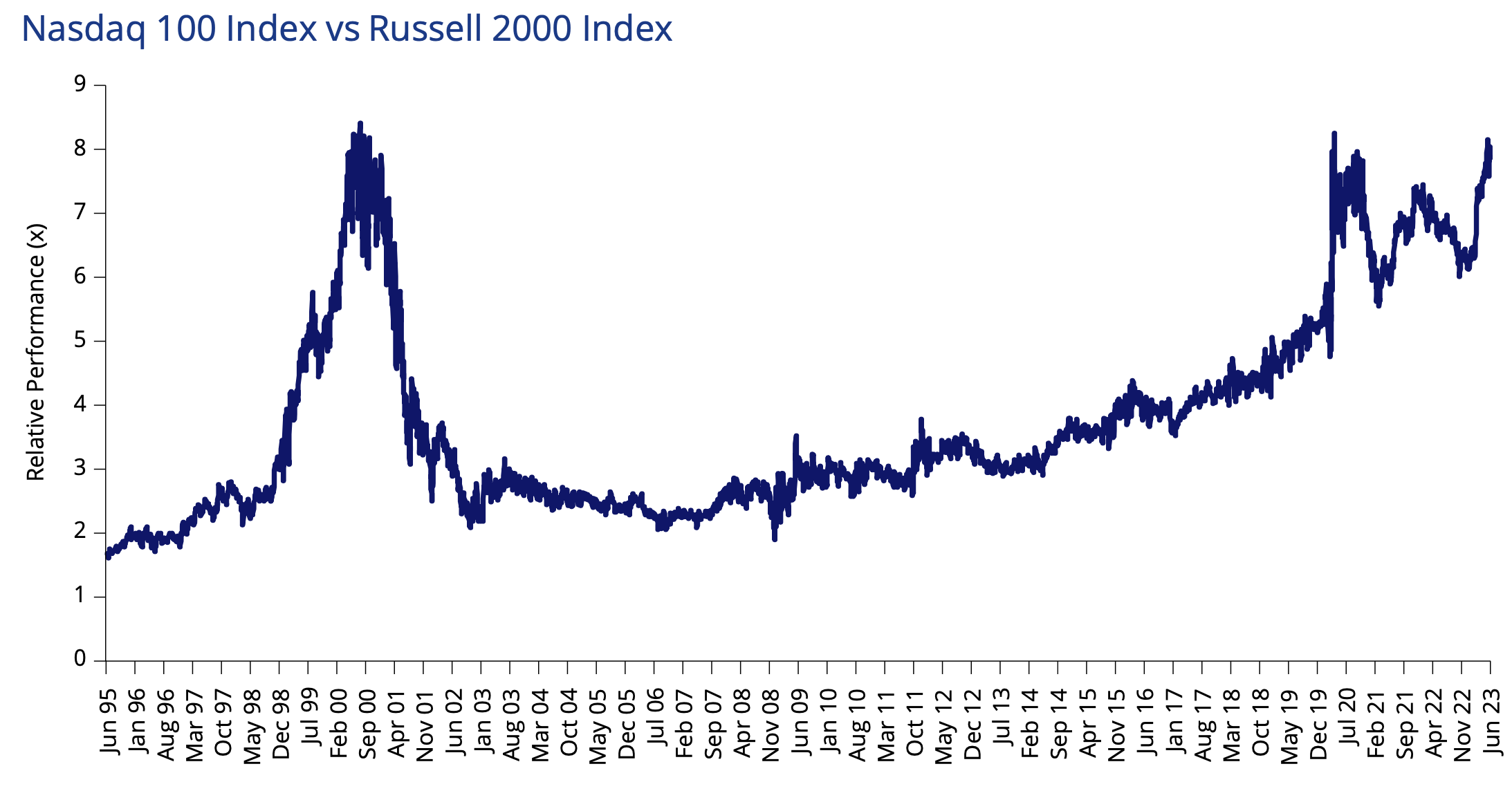

5. 2000 redux

VanEck also reflects on one of the most confounding stock market rallies of recent times, that of the S&P 500. This was driven by the cohort of mega-cap US tech firms formerly known as the FAANGs, which are now often dubbed (in some quarters, anyway) the Magnificent Seven.

This is one of the standout comments in this section of the paper: “In one day, Nvidia’s (NASDAQ: NVDA) market cap rose by more than the total market cap of 492 of the 500 members of the S&P500.”

The company’s PE ratio now exceeds 200.

VanEck suggests the second of two preconditions for a tech bubble has now been met by the buzz around Generative AI: “a potentially lucrative but difficult-to-understand product/idea.”

The paper also ponders the following question: “If monetary policy is sufficiently tight, why are we still blowing bubbles?”

The answer to this might be partly short-term, alluding to the US Treasury having stopped issuing debt, instead seeing the Fed running down the US Government bank account. This added roughly half a trillion dollars of liquidity to the US economy in the first half of calendar 2023.

Could this be another tech bubble?

6. Liquidity, the economy, and the slowdown

“With inflation softening, the optimists now are again looking for a soft landing or no landing. We still think this is a less likely outcome because we don’t believe the Fed’s inflation target is achievable without a recession,” writes VanEck.

The paper emphasises that goods price inflation has been slowing, as shown by the following three components:

- a normalisation of demand after the COVID reopening “frenzy”

- unfreezing of supply bottlenecks and,

- the usual cyclical discounting as firms try to clear inventory.

But it says that, somewhat ominously, “the best news on goods inflation is already behind us.”

7. The land of happy hopes

VanEck continues in this vein with the troubling (for central banks) observation that outside of financial markets – which it terms “the land of happy hopes” – long-term inflation expectations are heading up.

In this environment, VanEck contends the Fed looks unlikely to achieve its inflation goal in a timely manner without a recession.

“Indeed, the ominous moves in inflation expectations may already be warning the Fed is too late,” it says.

The paper suggests this might mean a recession occurs later, runs for longer – but is shallower than previously anticipated.

It also raises the prospect that commercial real estate might be a “financial accident” waiting to happen.

8. Mixed news elsewhere

In Europe, VanEck notes that the region has held up better than expected, partly due to balmier winter weather than foreseen, but still slipped into a “technical” recession.

The paper also explores the near-term economic prospects in China, where VanEck expects growth will slow in the medium term. It says two core questions on China’s potential policy responses are whether it wants to step up support; and what kind of policy stimulus will be effective.

9. Don’t forget gold

On the favoured safe-haven commodity, VanEck notes gold has been in a bull market for more than seven years.

It says a pattern has emerged where the gold price has traded in the range of US$1,700 per and the all-time high of US$2,075 per ounce.

“Gold has tested the high three times, but failed each time” – in 2020, in 2022, and again in 2023 during the COVID outbreak, the Russian invasion of Ukraine, and Silicon Valley Bank collapse respectively, writes VanEck.

It outlines three reasons why gold could again test these highs:

- An expectation geopolitical tensions will continue to escalate

- Increasing gold reserves by EM countries

- Tightening credit markets that could push the entire US economy into recession.

Learn more

The above article is an extract from VanEck's quarterly ViewPoint. You can read the full version here.

4 topics

1 stock mentioned