A fast-growing digital infrastructure small-cap at a bargain price...

Over the past six months, the manic-depressive side of Mr. Market has come to the fore, especially in the technology sector. Anything even remotely related to the technology space has seen indiscriminate selling, with the NASDAQ-100 down 31.5% year to date. Just like how a rising tide lifts all boats, the falling tide has taken all the ships with it. At Tectonic, where we are constantly on the lookout for “hidden gems”, this provides the perfect setting to spot high quality companies that have been caught in the selloff and are trading at a bargain valuation.

We believe we have found one such opportunity in Webcentral Group (ASX:WCG) – a leading provider of domain names, hosting and IT services – and have been building a meaningful position in the Company over the past few weeks.

Company overview

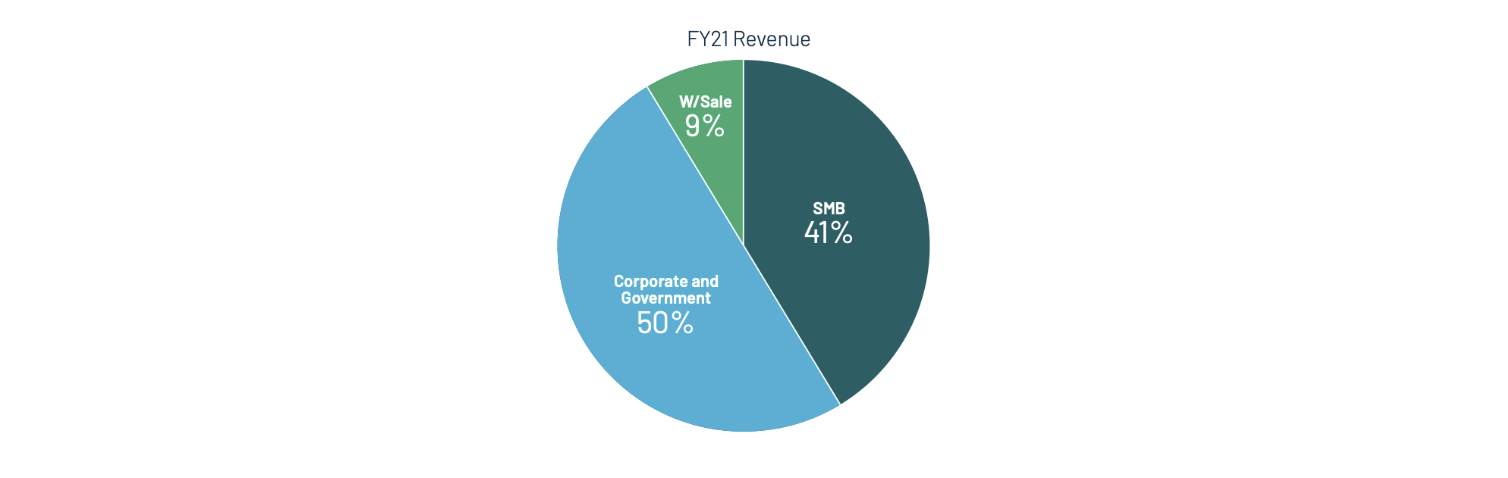

Webcentral started as Melbourne IT Group in 1996, focused on the domains and hosting market in the early days of the Internet. It listed on the ASX in 1999 and over the next couple of decades grew through acquisitions including domain registrar Netregistry, digital marketing agency WME, New Zealand-based domain registrar Domainz to become one of Australia’s top 3 domains registry businesses. Today, the Company is primarily focused on small and medium businesses (“SMB”) in Australia and New Zealand.

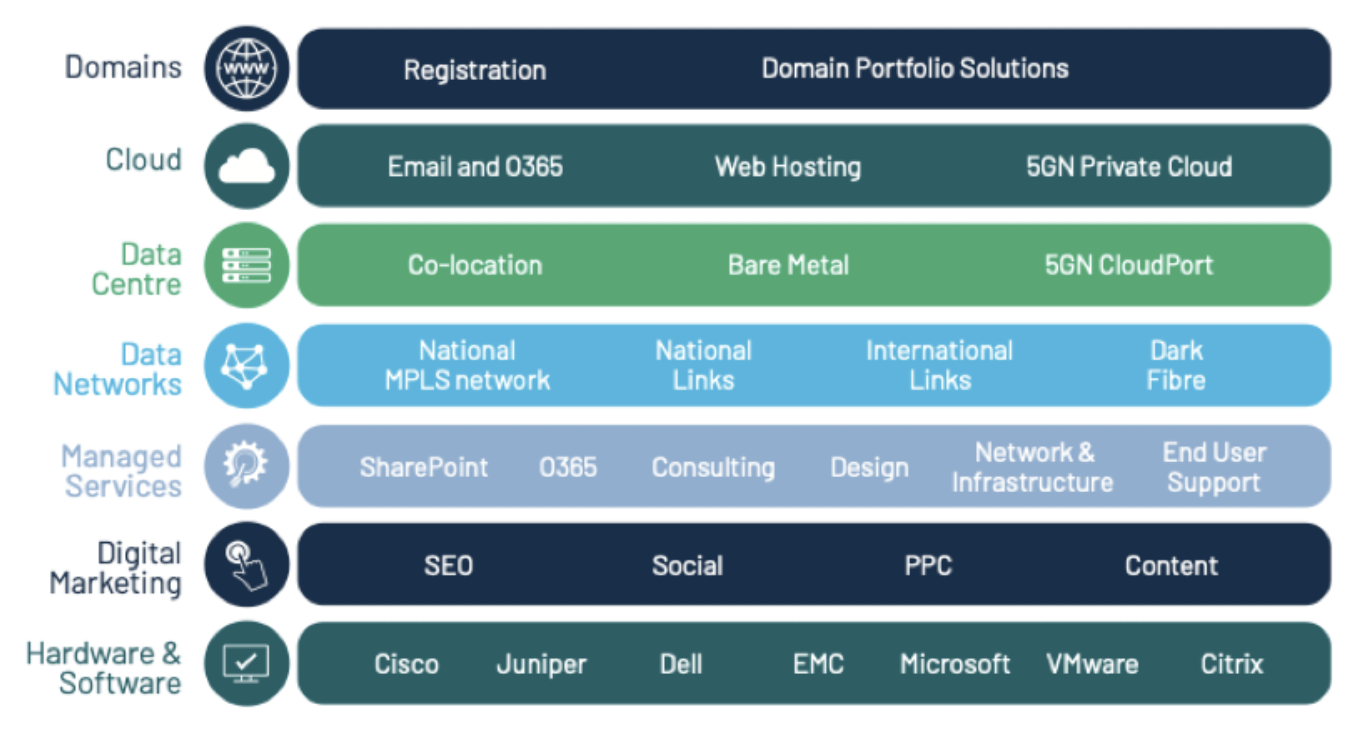

In 2021, following a bidding war between US-based Web.com and 5G Networks (“5GN”), Webcentral merged with 5GN, a telecommunications company focused on data networks and managed services. As part of the merger, Webcentral acquired 100% of the shares in 5GN, with the telecommunications carrier becoming a wholly owned subsidiary of Webcentral. The combined entity, trading under the Webcentral name, has become an integrated telecommunications, data, cloud and digital services company with an existing strong client base, a robust balance sheet and a wide array of complementary service offerings.

Why we like Webcentral:

Top 3 domain providers in Australia

Webcentral has been a market leader in Australian domain names, hosting and digital marketing services for over 20 years. It manages over 500,000 domain registrations and provides hosting services for 35,000 websites across 330,000 SMB customers.

In March 2022, the Australian Domain Administration (“auDA”) released the new ‘.au’ domains. Webcentral had been pre-selling the .au domain names and will be able to start recognising revenue from April 2022. auDA has provided a six-month exclusivity window for owners of ‘.com.au’ domains to acquire the corresponding ‘.au’ domains. We believe that a significant majority of the ‘.com.au’ domain owners will acquire the corresponding ‘.au‘ domains given the relatively insignificant cost (c. $15 p.a.) compared to the risks involved. For instance, Webcentral ((VIEW LINK)) would want to own the ((VIEW LINK)) so as not to potentially confuse customers or lose prospective customers to competition. The Company has also mentioned that owning the ‘.au’ domain improves search ranking on Google, which is very important to the SMB businesses that Webcentral has as its customers.

In its Q3FY22 update, Webcentral had stated that it had sold over 18,000 ‘.au’ domain registrations, which is a strong start. Given the Company manages over 410,000 ‘.net.au’ or ‘.com.au’ domain registrations that are eligible to secure the new ‘.au’ domain, the opportunity to generate additional recurring revenue is sizeable.

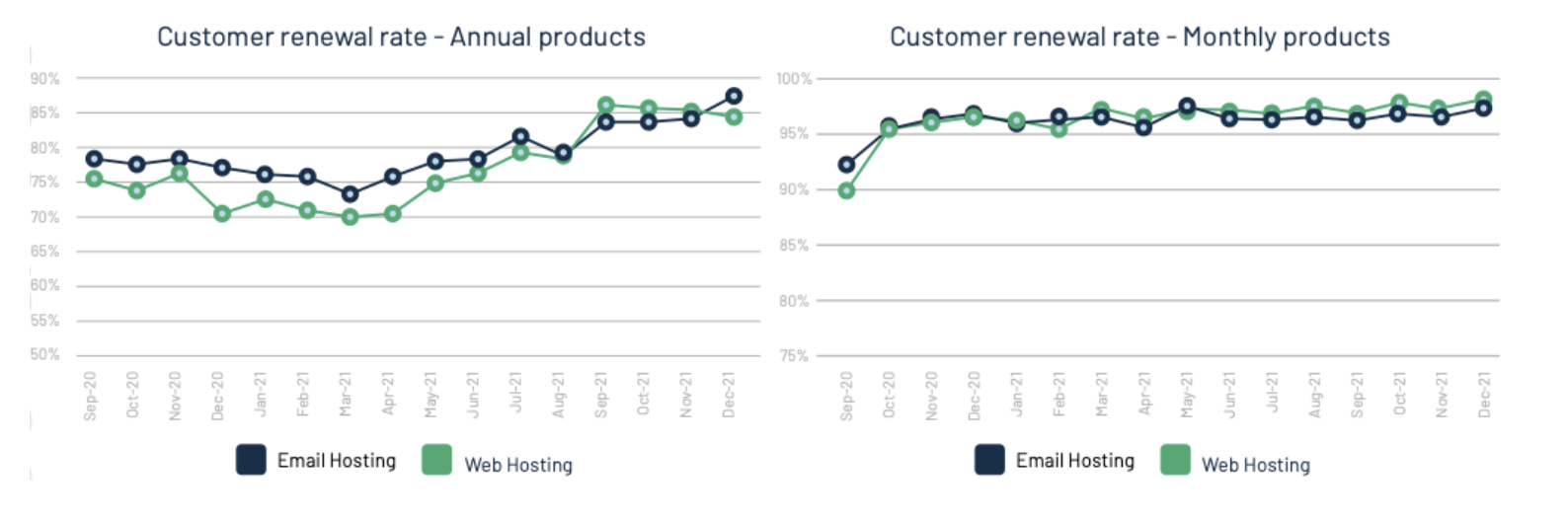

Webcentral also provides web hosting services to 35,000 websites. Over the past 12-18 months since the new management took control, the Company has invested considerable resources to improve customer service, systems and billing processes. This has had a significant improvement in customer retention rates in the web hosting space. Annual product renewal rate has increased from 75% in 2020 to 87% in 2021 and the monthly renewal rate has increased from 90% in 2020 to 98% in 2021.

Strong existing customer base

Webcentral, through its core domain registry and web hosting business, has a network of 330,000 SMB customers across Australia and New Zealand. Following the merger with 5GN, the Company also has an existing client network of 2,500 corporate and government entities.

The completion of the Webcentral and 5GN merger provides the group with significant organic growth opportunities. The Company will be able to leverage its 330,000 SMB customers through its online sales channel and offer 5GN's suite of cloud, network and managed services.

In H1FY22, 5GN had already secured $2m in total contract value (“TCV”) of new sales across cloud, data centre, networks and managed IT services. The Company had sold 70 data centre racks, representing $100k per month in new revenue. This is in addition to existing customer renewals of $12m in TCV. We believe that in FY23 and beyond, the Company will be able to leverage Webcentral’s SMB customer network and grow its digital infrastructure book.

Integrated telecommunications, IT & data infrastructure Company post-merger

Perhaps the single biggest driver of our conviction in Webcentral is the merger of the Company with 5GN. The combined entity is an integrated telecommunications, IT and data infrastructure company. Prior to founding Tectonic, we spent more than a decade investing in the private infrastructure space for a multi-billion dollar global private equity firm (Partners Group) so are well placed to assess an infrastructure-like asset when we see one. Our preferred investments were asset-heavy ‘real’ businesses, with predictable future cash flows in the form of recurring revenues backed by long term contracts, and that provide an essential service. Arguably Webcentral checks all of these requirements!

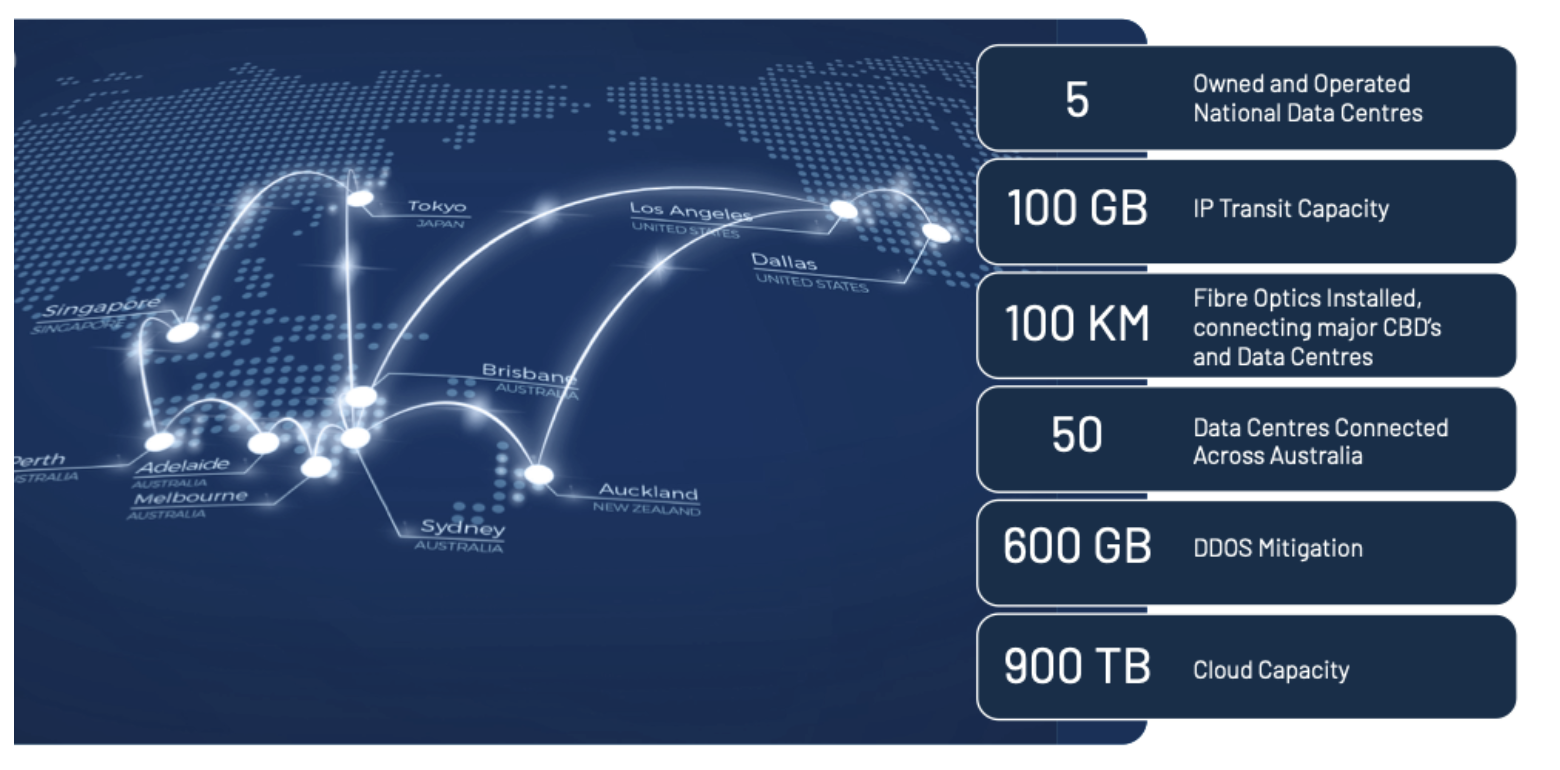

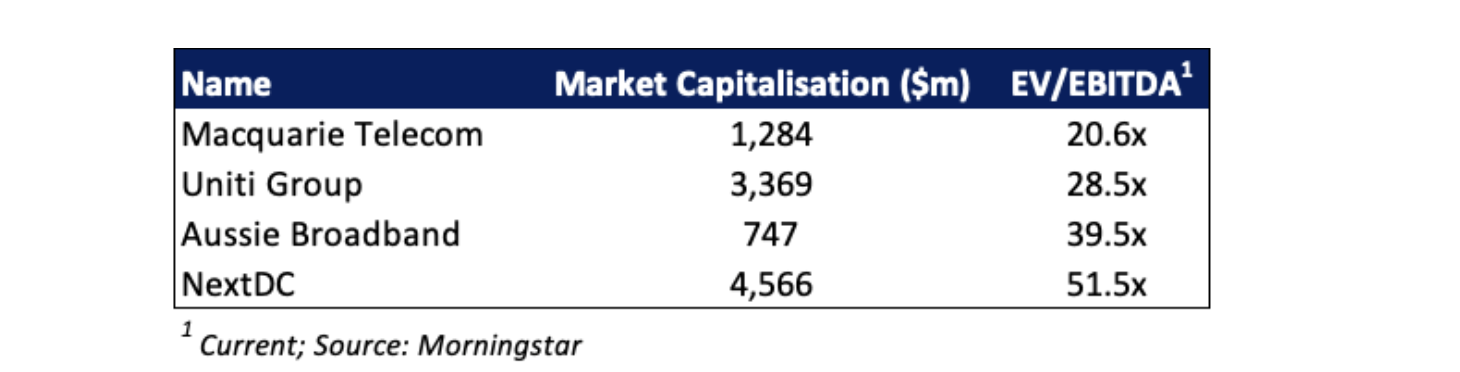

Webcentral owns and operates 5 data centres (2 in Sydney and 1 each in Melbourne, Brisbane and Adelaide). It has installed over 100km of fibre optics connecting 50 data centres across Australia and has 900 TB (1TB equals 1,000GB) of cloud capacity. This catapults Webcentral from an IT services Company to a digital infrastructure company, not dissimilar to Macquarie Telecom (ASX:MAQ), which owns 5 data centres and provides telecommunication, cloud computing, cybersecurity and data centre services to corporate and government customers within Australia. Macquarie Telecom is a more established operator, with revenues 3x that of Webcentral today. However, it trades at a market capitalisation of $1.3bn, almost 19x Webcentral’s market capitalisation of $69.5m. (It is also worth noting that Webcentral’s Chief Operating Officer is ex-Macquarie Telecom).

Unlike larger data centre owners and operators like NextDC (ASX:NXT), AirTrunk (majority owned by Macquarie Infrastructure and Real Assets) or Equinix (NASDAQ:EQIX) that target hyperscale customers such as Amazon AWS and Microsoft Azure, Webcentral targets predominantly smaller Australian enterprises. Exactly the reason we believe Webcentral’s 330,000 strong SMB customer network will provide a strong foundation for organic growth.

Strong financial position

Following the Webcentral/5GN merger in November 2021, the consolidated financial position of the Company has become much stronger. Webcentral’s borrowings of $27m in the form of a loan from 5GN was cancelled, and as of 31 December 2021, the Company’s consolidated debt stood at a manageable level of $23m. In May 2022, Webcentral announced that it had refinanced its debt with Commonwealth Bank of Australia (ASX:CBA), extending the maturity date to July 2025 while also achieving a 1% reduction in the average applicable interest rate margin. In addition, the Company has $10.5m in a standby facility available for a potential acquisition.

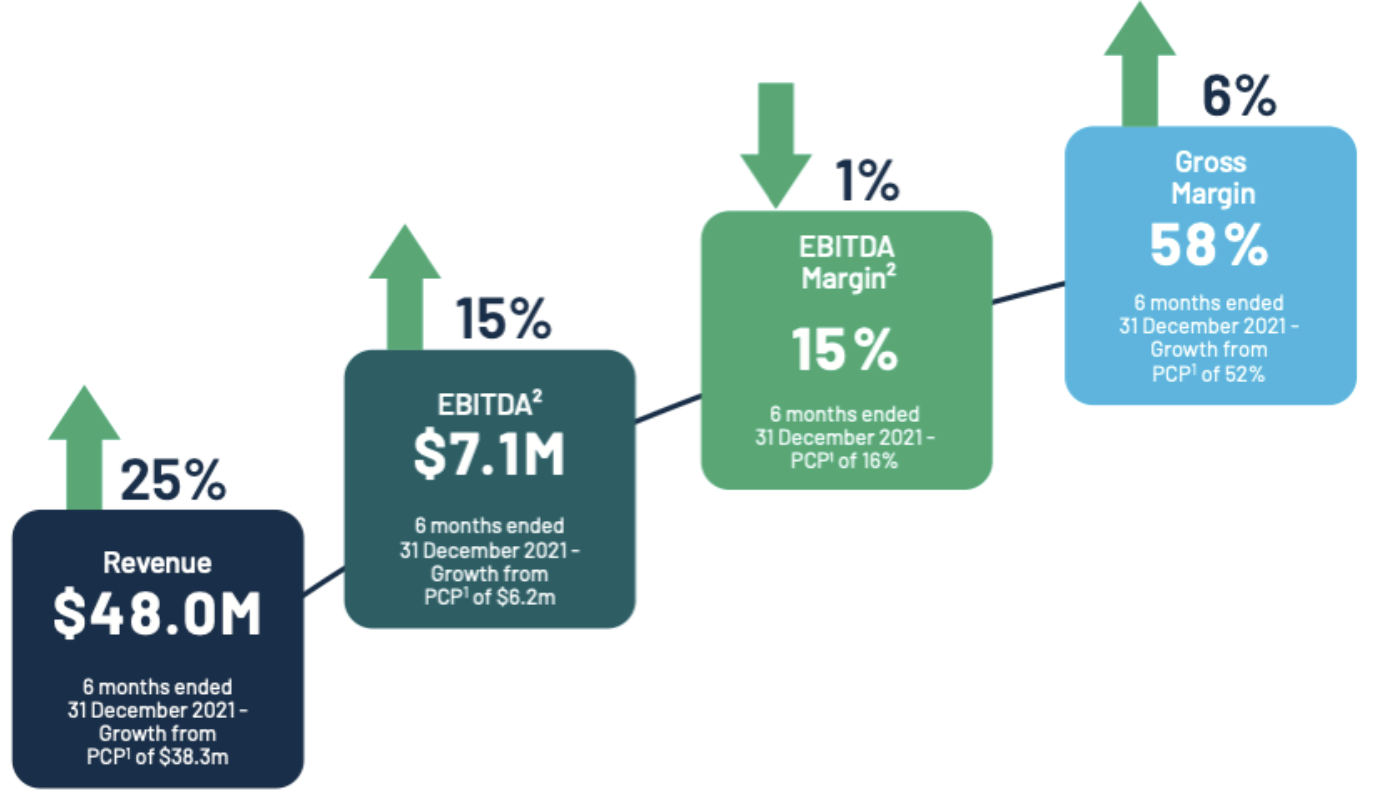

As of 31 December 2021, Webcentral had $5m cash on the balance sheet, which the Company has projected will increase to $14m by June 2022 and subsequently $53m by June 2023 (excluding cash used in any potential future acquisition). For the 6-month period ended 31 December 2021, the Company reported revenue of $48m and EBITDA of $7.1m, which represented an increase of 25% and 15% respectively compared to prior corresponding period. In addition, the Company has confirmed its guidance of full year revenue of between $98-102m and EBITDA of $17-18.5m.

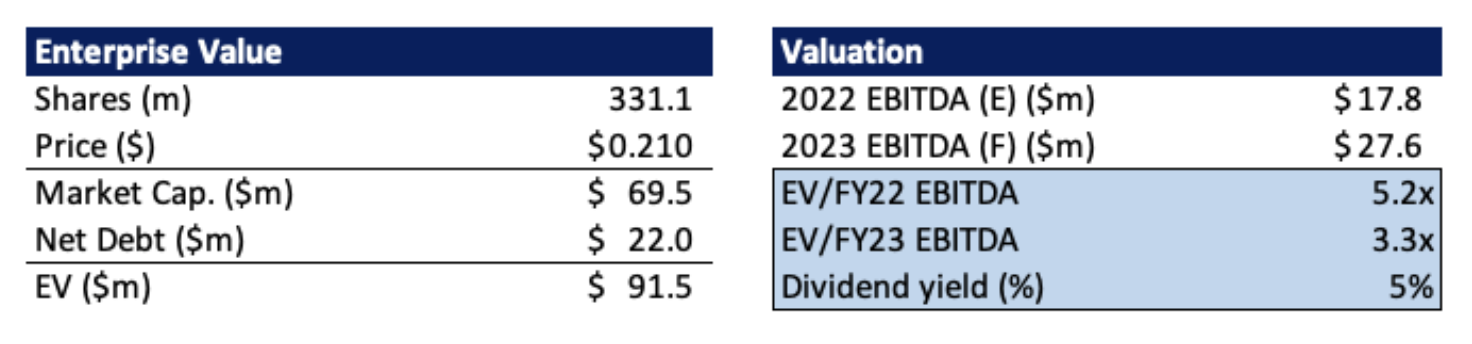

In April 2022, Webcentral completed a share sale facility for unmarketable parcels, and bought back 4.7m shares held by 5,152 shareholders representing 1.4% of Webcentral shares on issue. Following the buyback, Webcentral has c. 331m shares outstanding and a market capitalisation of only $69.5m based on its current 21c share price.

The Company has already completed its capex cycle in FY22, spending c. $8m to build out its cloud capacity and installation of its fibre network. Going forward, we should see a marked reduction in capex as the management focuses on filling up its existing capacity through its customer network. This should have a significant positive impact on the cashflow from FY23 onwards.

In May, the Company announced that the Webcentral Board is reviewing the Company’s capital management policy and assessing a range of potential capital management strategies including a share buyback facility and dividend policy. The Company has stated that it expects to be in a position to declare a dividend in respect of the financial year ending June 2022. At current share price, a $0.01/share dividend will imply a dividend yield of nearly 5%.

Aligned management

Charlie Munger once said, “Show me the incentive, I’ll show you the outcome.” At Tectonic we are strong believers that incentives drive outcomes and we like to see a strong alignment in the incentives of the management and the shareholders. Webcentral’s Managing Director Joe Demase is the single largest shareholder in the Company with a stake of over 16%. With close to 3 decades of experience under his belt, including 20 years in the telecommunications sector in Australia and the UK, Joe is a very capable operator. In his 18 months with the Company, Joe has overseen the merger and the subsequent integration of both businesses.

In addition to being the largest shareholder, Joe has been consistently buying shares on the market, including in December, March and June. In early June, Joe made his latest purchase of over 1m shares for c. $250k when the share price was close to its 52-week lows. It gives us a lot of confidence when management, who are arguably the best judge of the progress the business is making, consider their share price to be undervalued and make on-market purchases in large quantities.

As part of the Annual General Meeting in 2021, the directors (other than the MD) were assigned a total of 4.5m options. The exercise price of the options is set at $0.45, which is more than 2x the current share price. In addition, the MD has been incentivised with 15m performance rights that have an exercise price of $0.45 per share. These performance rights will only vest if the Company is included in the S&P ASX 300 Index, the index of 300 largest companies by market capitalisation on the Australian Stock Exchange. The current S&P ASX 300 cut-off market capitalisation is around $600m - $700m. Based on Webcentral’s current market capitalisation of c. $70m, the vesting of these performance rights is subject to a high bar. The most likely way the Company gets there is through some combination of M&A (with potential dilution) and share price gains.

Overall, we believe that the management is sufficiently incentivised to ensure the business continues to execute on its goals in order for the share price to eventually reflect the true value of the business.

Valuation

As of 15 June 2022, Webcentral had 331.1m shares outstanding and a share price of $0.21 per share, giving it a market capitalisation of $69.5m. With a net debt balance of c. $22m, this translates to an enterprise value of $91.5m.

In its March 2022 market update, the Company has provided FY22 revenue guidance of between $89-$102m and EBITDA guidance of $17-$18.5m. For our valuation purposes, we will take the mid-point of this guidance and assume the FY22 EBITDA will be $17.8m. Further, the Company’s Strategic Plan forecasts the FY23 revenue of over $120m with an EBITDA margin of over 23%. This gives us a forecast EBITDA for FY23 of $27.6m.

Based on these numbers, Webcentral is trading at an EV/EBITDA (FY22) multiple of 5.2x and a forward EBITDA multiple (FY23) of 3.3x. Webcentral is also reviewing a dividend policy for the year ending June 2022. Even a $0.01/share dividend (Tectonic estimate) will translate to a dividend yield of almost 5%.

Looking at comparable companies listed on the ASX (admittedly larger than Webcentral today) paints a completely different picture and highlights how undervalued Webcentral is on a comparable basis.

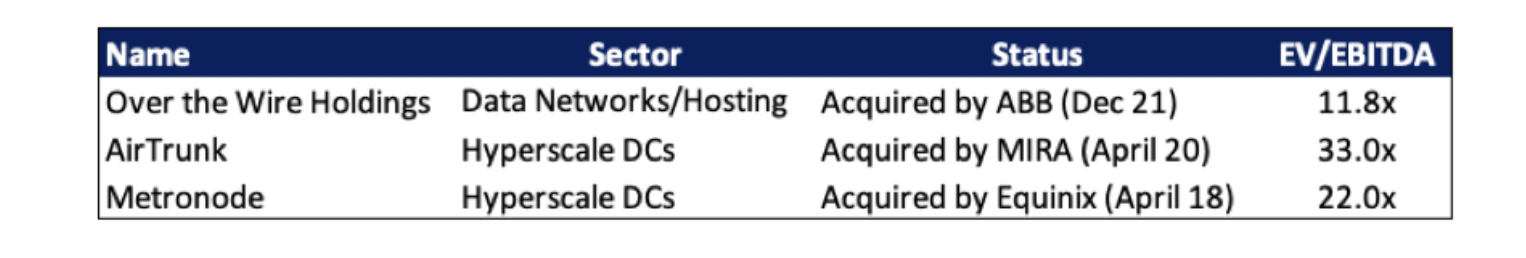

The private markets have also seen a number of transactions in the data centre space, typically in the larger hyperscale data centres. Similar to public markets, the valuations make Webcentral a deep value play.

Even with our traditional infrastructure lens, this translates to a very attractive valuation. It is important to note that Webcentral operates in a sector (data), which is among the fastest growing sectors of all. In our opinion, the current valuation of the Company provides a huge margin of safety. Once the dust settles and the Company continues to execute on its strategic plan, the market will eventually wake up to the value of the Company and the share price will follow.

Looking ahead

Webcentral has been through a challenging environment with corporate activity coming to a halt during the pandemic, affecting its digital marketing business. This was followed by the merger with 5GN in 2021 and the subsequent integration of the businesses. We believe that the challenges are squarely behind them and the management’s focus on execution will start showing results in the coming quarters. We believe the share price pressure over the past few months has been due to a combination of 5GN shareholders selling (who received WCG shares following the merger) as well as a general shift in sentiment towards the tech sector and the broad selloff globally.

As Benjamin Graham said in his book ‘The Intelligent Investor’, the market is a pendulum that forever swings between unsustainable optimism (which makes stocks too expensive) and unjustified pessimism (which makes them too cheap). At the moment, we believe that the pendulum is in the unjustified pessimism territory, especially when it comes to our assessment of Webcentral. While long duration assets (companies that have a long road ahead to becoming profitable) are not very attractive in an environment with rising interest rates and increasing cost of capital, we would not consider WCG to be in that bucket. Furthermore at these levels, Webcentral would likely be on the radar of a number of private equity / infrastructure funds as well as established players in the sector such as Equinix (NASDAQ:EQIX) given the flurry of investment activity that has happened in this sector at very lofty valuations.

This selloff has provided our Fund the opportunity to buy shares in Webcentral at an absolute bargain price and we have built a meaningful position over the past few weeks. Now we just need to sit back, be patient and wait for the market to discover this hidden gem!

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

5 stocks mentioned