A global recession is coming and why Australia won't be as lucky this time

Inflation will remain above target all year and corporate earnings still don't reflect a recession that is inevitable. That's the top-line takeaway from TD Securities' 2023 outlook white paper. And I hate to break it to you, but there's not much for the bulls to celebrate if all these predictions come to fruition.

The team is not only predicting a global recession, but they are also predicting another tough year for gold, stocks, and most of all, central banks in their fight to bring down surging prices.

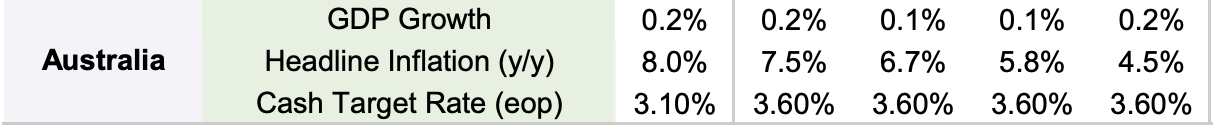

Even Australia won't escape with the economics team projecting inflation to still hover around 4.5% this time next year.

So what opportunities are there in the rubble - and is there any optimism to be had in 2023? This wire will attempt to answer those questions, as our digest of the professionals' outlook papers continues.

The big picture isn't pretty

After a year dominated by interest rate hikes, 2023 is shaping up to be the year of watching the effects of those rate hikes play out. And in their view, there haven't been enough of those rate hikes to quell the "R" word from rearing its head next year.

"Signs of the scale and timing of the recessions to come in 2023 are firming, but inflation - even the more important 3-6 month trends - is still exceptionally high almost everywhere," writes James Rossiter, TD's head of global macro strategy.

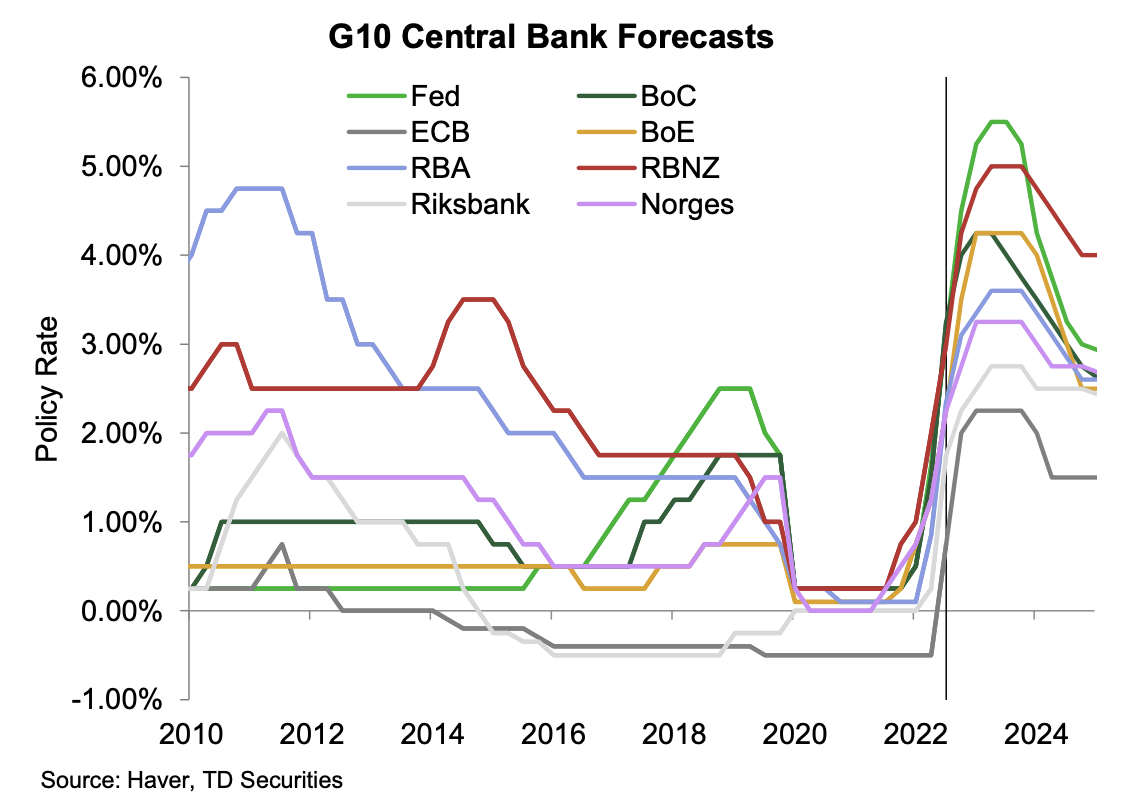

And as a result, interest rates will have to move even higher - perhaps even higher than what markets are pricing in at the moment. Case in point, TD Securities has one of the highest terminal rate forecasts on Wall Street at 5.5%.

In their view, the ultimate reason for the recession is an extremely hot labour market and the lag effect from those high energy prices seen earlier this year. And the sooner each country started hiking rates initially, the sooner they will be out of the recession woods.

The "corporate correction" hasn't started yet

2022 has also been a strange year in equities. Corporate earnings have continued to remain resilient while share prices have been anything but bulletproof. TD's team argue markets are still too richly priced for a soft landing - and they also believe that more bad news is on the way.

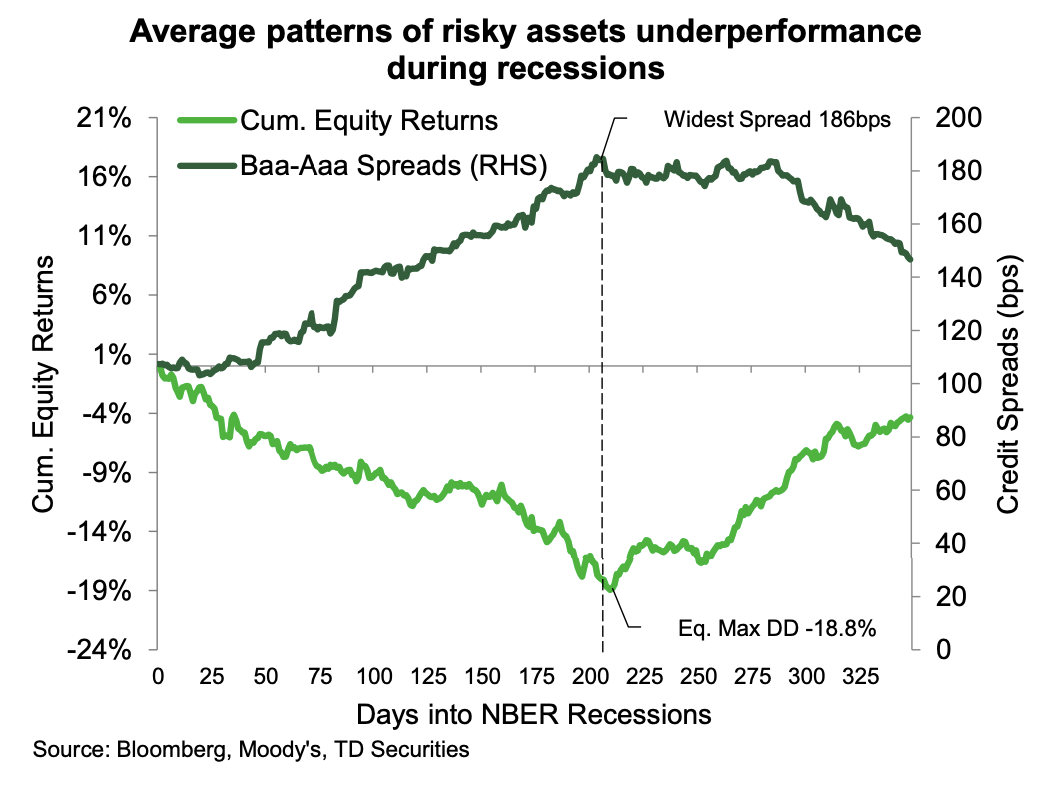

"If our base case scenario of a recession pans out, historical patterns indicate that valuations should continue to adjust downward next year. Likewise, corporate earnings, which have increased in 2022, should reverse the trend and decline in 2023," analysts led by Cristian Maggio write.

And if history is any guide, it could be a while before we see the rebound materialise:

The good news and the bad news about "terminal"

They also have a contrarian view of market pricing. TD's team believes rates traders have still underpriced the extent to which the Fed will have to hike interest rates. But there is a silver lining for Australian investors.

"The market has significantly repriced terminal rates higher. We expect the RBA to be the first central bank to reach its terminal rate and the Fed to raise rates to at least 5.5%. We expect rate cuts from the BoE [Bank of England], ECB, RBA, and RBNZ in 2024, but they will be less than the Fed and BoC [Bank of Canada]," the team writes.

All this suggests bond yields may not have peaked yet in the US.

The Australian situation looks more promising

In keeping with the theme, the TD team believe the Reserve Bank will be forced to hike rates higher into the new year. They have a terminal rate forecast of 3.6%, but senior rates strategist Prashant Newnaha says he wouldn't be surprised if the cash rate goes even higher than that.

"The RBA doesn't expect inflation to return below its 2-3% target band before end-2024 and chances are that inflation expectations may become quickly un-anchored. As such, we think the risk to our terminal rate call of 3.60% by the end of March is skewed to the upside," Newnaha writes.

Forecasting gloom (note: Q4 2022 to Q4 2023 shown here)

There is one bright spot in their outlook for the Australian economy - they predict the Australian dollar could rebound against most of its major trading partners, even if China's reopening is delayed or doesn't occur in 2023.

Finally - a note on commodities

After two downbeat years for gold, TD's commodities team believe 2023 will not be a comeback year initially. As we've already mentioned, the team's forecast for where the Federal Reserve will stop hiking rates will likely drive where nominal and real yields will peak. As a result, they believe gold bugs won't get their just desserts until real yields have peaked (their prediction is the second half of 2023).

In the energy markets, oil and gas are set to have another bumper year. And if you thought Bank of America's $100/barrel call was hot, you're going to love TD's $120/barrel call for Brent crude futures.

Among some of their other calls, they believe zinc will outperform copper while platinum is a buy-the-dip opportunity.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best strategists, economists, and fixed-income fund managers. If you have questions of your own, flick us an email: content@livewiremarkets.com

3 topics