A rare buying opportunity

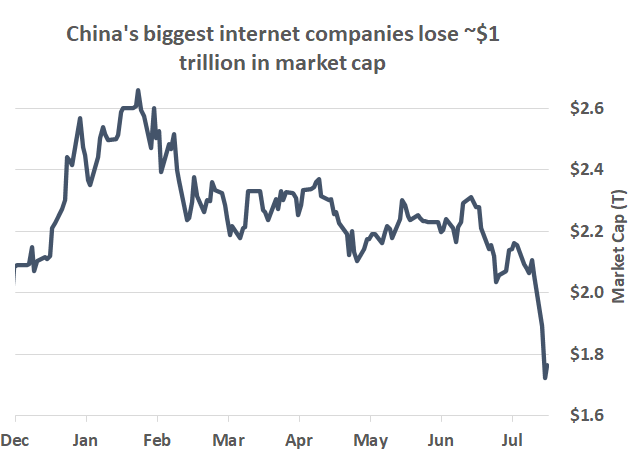

For those unaware there was a market storm in China over the last week or so which brought the usual mix of challenges and opportunities in what was the steepest sell-off for these names since September 2008.

A regulatory crackdown that began with the chastening of Jack Ma and the cancellation of Ant Financial's IPO broadened to include many of the technology companies favoured by international investors.

Alibaba and Tencent will need to open up their closed ecosystems to both each other and competitors. Didi (Chinese Uber) had its app pulled from app stores shortly after IPO, landing major shareholder Softbank and its new US investors an immediate bloody nose. Internet monopolies are under attack across the board, and on-demand/delivery/ride-sharing firms will have to provide minimum wages, working conditions and social security.

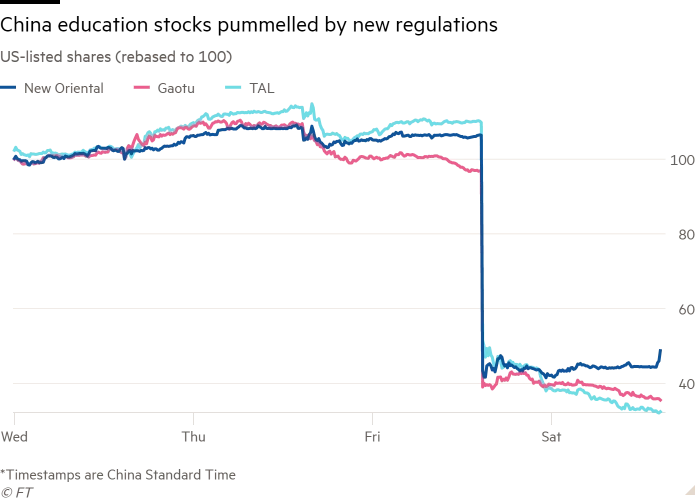

Most dramatically, Chinese tutoring companies will henceforth be non-profit, which came as something of a shock to shareholders (though not to management, who was briefed well in advance).

One US-listed company has gone from $38 billion value to <$1b in equity value in the space of a few months, quite a shift in fortune.

The US has announced a freeze on Chinese IPOs and capital raisings until risk disclosure improves, which means venture capital sunk into China relying on such an exit is now effectively frozen.

Amidst the chaos, confusion, and changing rule-book, we believe last Wednesday marked something of a bottom in these stocks and presented a rare buying opportunity.

We always like to buy into panics, and startling though these moves are, there’s a certain kind of social logic which suggests they’re not nearly as scary as they seem at first.

Tutoring

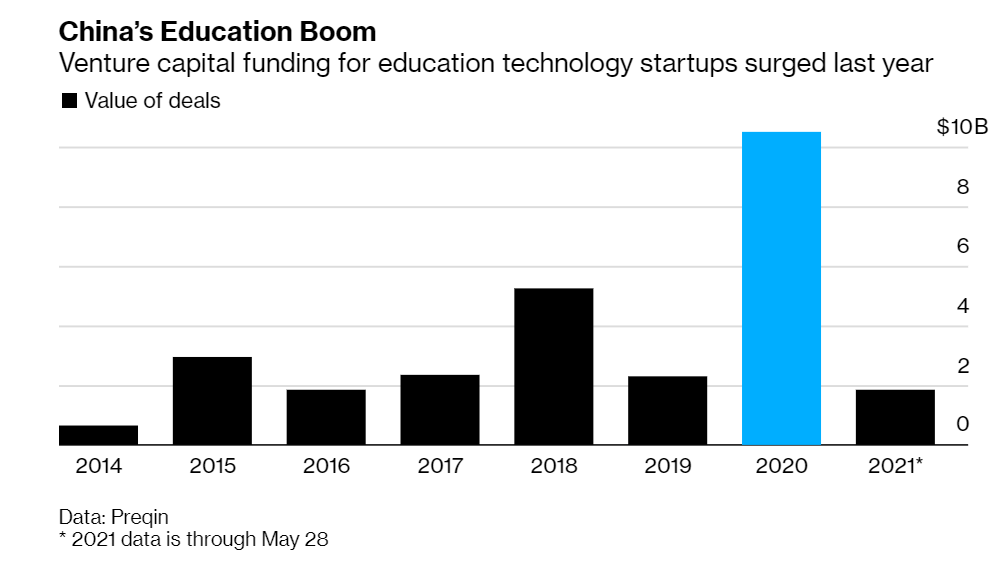

Let’s take tutoring first. This was one of the hottest sectors in global venture capital, with valuations topping $100 billion in aggregate with over $10 billion committed in the last year:

This is a large amount, even by modern VC standards.

The tutoring companies focused on the Gaokao, the end of school examinations offering a small percentage of students access to the country’s leading universities - a merit-based tradition going back millennia.

In a country where most children are only children, this puts immense pressure on children... and their parents, a situation ripe for advertising, which apparently is ubiquitous in Beijing and is a major social issue.

Foreign investors profiting from the situation clearly did not sit well with Chinese officials hoping to increase the birth rate. And so Xi struck back.

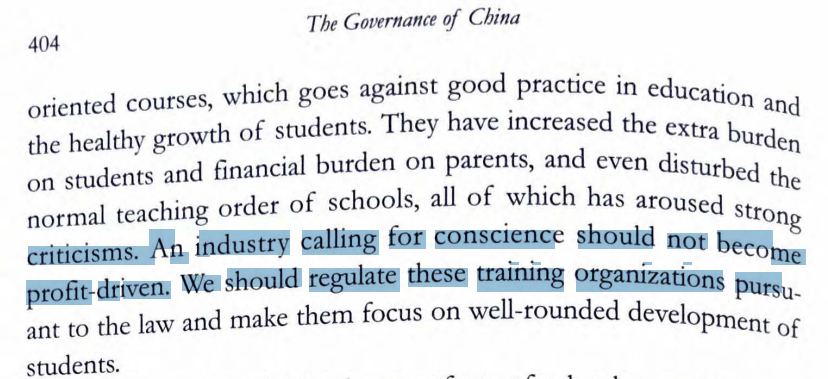

As it turns out, all these moves were flagged well in advance in President Xi Jinping’s own speeches, though it’s a lot easier with the benefit of hindsight to see the signal amongst the noise (we missed this):

From a speech by Xi Jinping

My guess is this won’t change the real issue causing so much angst, namely, an ultra-competitive academic system that rests on one deterministic set of exams. But this kind of system is as much a strength as a weakness as anyone who’s competed against the Chinese academically can attest.

The boldness of converting an industry into non-profit is impressive, but I do have a certain kind of sympathy for the idea that society shouldn’t outsource a major component of what should be social welfare to the corporate sector.

Antitrust

A second issue is antitrust, for reasons highlighted in state media:

Existing valuation models have indeed been refashioned!

This is actually quite reasonable stuff.

Alibaba and Tencent operate separate ecosystems and, with some exceptions, lock out both each other and any non-aligned startups, who are typically forced to choose between one or the other. This will now end, and both firms, as well as new ones, will be able to compete on each other’s platforms.

Alibaba was also in the habit of forcing manufacturers to sign exclusive agreements, blocking them from selling on competing platforms. No more.

These changes represent a significant opportunity for both, but a more competitive environment will clearly be less profitable in total, certainly compared to the current duopoly. In the long term, the benefits of increased competition and innovation will likely create more value, though not necessarily for the same companies.

Coincidentally, Australian industry structures often end in duopolies though for different reasons, namely we have a small market that can only support so many large businesses (let me know if you have a better explanation). Think Woolworths and Coles, Qantas and Virgin, Rio and BHP, etc.

The crackdown on monopolistic behaviour is broad, and also targets companies running at losses to gain monopolies, only to turn around and abuse that power, which is the modus operandi of much of the venture capital industry: win the market first then raise prices later.

Again, it's hard not to have a certain amount of sympathy for these regulatory moves.

The winners from breaking up the dual monopoly structure of Tencent and Alibaba are consumers and the broader ecosystem.

VC is taking the brunt of the hit, firstly by direct losses in education and firms like Didi, and secondly for the likely freeze in capital markets. But long term, this will create more, not less, opportunity for the kinds of startups they like to back.

There are plenty in the West that think Google should split from YouTube, Amazon from AWS, and Facebook should be forced to open up its social graph to new competitors which would foster a new round of startups and innovation and leave us all better off.

The power of China is that when they say they will do something, they can just, like, do it. In the West, there are strict legal limits on how far regulators can go (for very good reason).

Without going deeper along that tangent, it’s clear that when you dig into these changes, they are surprisingly reasonable.

Didi

The attack on Didi right after its IPO seemed outrageous. But as the facts came out, the real surprising thing is that the IPO went ahead at all.

Didi is particularly guilty of that monopolistic behaviour, and has seriously irked Chinese consumers by charging higher rates to the elderly. As far as I know, even Uber hasn’t stooped that low.

Curiously, Didi’s Chinese shareholders, Alibaba and Tencent, reportedly warned Didi not to list, which suggests the pressure came from Softbank and Masayoshi Son, who has sunk $12 billion into the business and lost maybe five.

And what a strange investor he is, amassing an immense fortune by being ultra and unwaveringly bullish about technology, so much so that he gets away with mistake after mistake. One can only imagine what he would have achieved if his boldness and optimism were matched by other talents…

Despite nearly 90% market share, Didi is still loss-making.

We generally shy away from companies that are loss-making after reaching user saturation which is why we consistently avoided investing in Spotify, which listed too late in its life cycle to be interesting to us. It is a case study in customer love, but has no explosive growth… and we need both.

A company milking an existing, locked-in customer base, is not really what we want to see.

And neither, apparently, do the Chinese regulators.

Pinduoduo

Pinduoduo does look like a loser here. Its success is one of the reasons it is now under pressure (the shorts were negative on the company for very different reasons, so those of you reading this don’t gloat!)

One of the many aspects of the story missed by offshore investors was the relationship with Tencent.

Pinduoduo used WeChat’s user graph to virally sign up hundreds of millions of customers in a few short years. But now WeChat will now be opened up to Alibaba’s copycat version of Pinduoduo, which will no doubt be a fierce - likely loss-making - competitor.

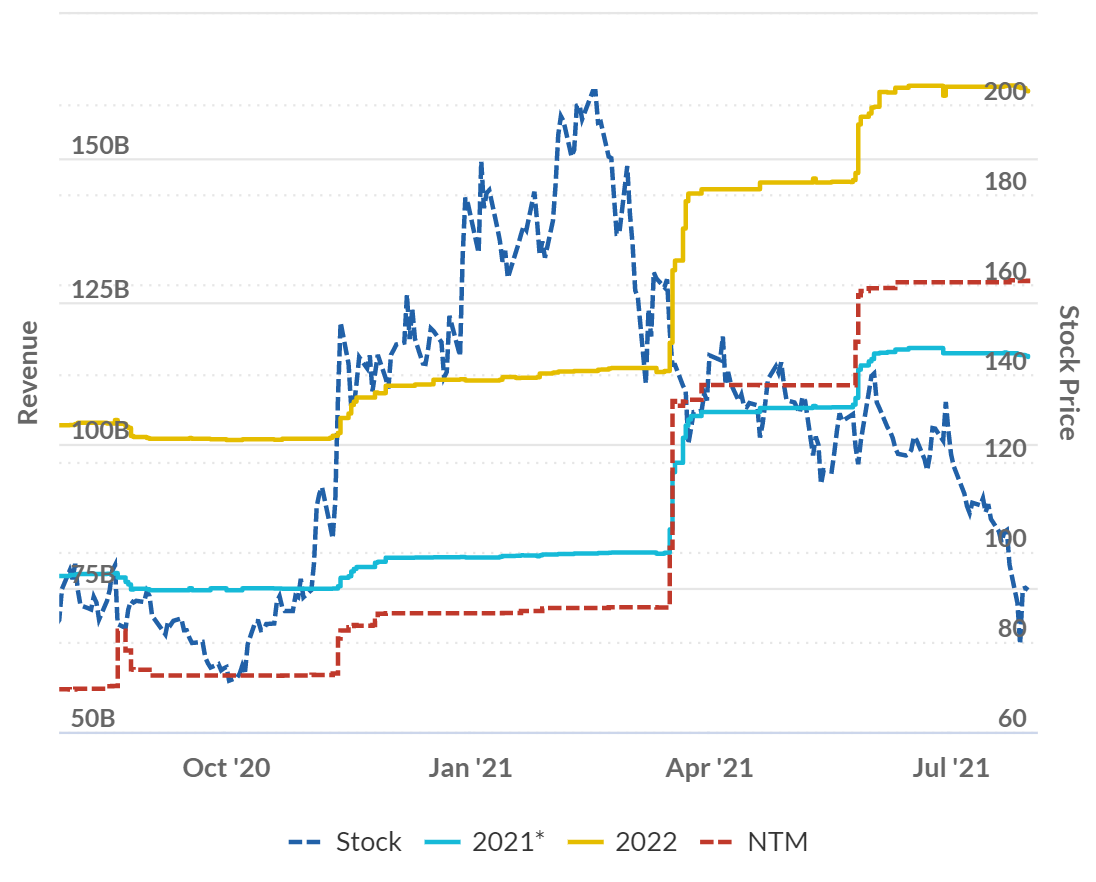

Before this, the company was going from strength to strength. Their focus on primary produce is unique and they are expanding this model to South America. The stock has repriced, but from here the risk/reward seems good. This is still, after all, a company which just posted 161% revenue growth.

Analyst estimates for Pinduoduo have been rapidly revised upwards over the last year.

Interestingly, after one of the worst periods on record for Chinese stocks, Pinduoduo is still up ~4x from when we first started buying, which shows the power of an ultra-high growth strategy: a lot can go wrong, but if you hold for 2-3 years, you can still make money.

With companies growing this fast, every day that goes by works in the fund’s favour.

So where are we now?

We increased our exposure to Chinese technology companies (they are mostly <3% positions) in the middle of last week for a few reasons.

Firstly, market sentiment reached levels in line with the panic of September 2008 and March 2020.

I’m always impressed by the market’s ability to throw up new sets of circumstances that rattle everyone, and make the ardent long-term investors panicked sellers.

This time was different and has its own set of calculations. Politics trumps markets and the Chinese regulators displayed their power to wipe out industries with no recourse. Sensible people running multibillion dollar funds have publicly questioned the very nature of equity investments in the country and whether they are investable at all. Valuations will likely carry a regulatory discount for quite some time.

Nevertheless, we will always instinctively look to buy when we see panics and steep sell-offs like this. But this alone is not enough.

Secondly, and more importantly, there are clearly articulated reasons for the crackdown, the majority of which we have a lot of sympathy for.

Extra competition and fostering innovation at the grass-roots is good. Mega tech companies can and do stifle competition and innovation. Until the details came out, it was not clear whether these moves marked a complete change of political direction.

As far as I can tell, they seem to have both public support and be in the public interest.

Tencent and Alibaba should compete, ridesharing companies should pay minimum wages and offer more to workers, and education should probably be in the hands of the state.

While there is method to the madness, we don’t seem to be as scared as everyone else.

Thirdly, market prices stabilised quickly in industries that were not targeted by the crackdown, fitting this view. Most of these firms are still largely owned by Chinese, who have early warning of trouble. Price action in tutoring companies was horrific over the last six months.

Beigene, the leading Chinese biotech company wtih a number of best-in-class cancer treatments, and electric vehicle makers like Nio and Li Auto, have traded extremely well throughout this period. These sectors are in line for more support, rather than less.

Beigene stock has been resilient in the sell-off

There is a fashionable line in Western circles that China wants less value accruing to internet platforms and more to hard-tech industries associated with manufacturing and defence.

There’s almost certainly truth to this, but some of the leading commentators we follow on the ground see this take as an oversimplification. Supporting the consumer is still a key plank of the Chinese strategy.

Another reason for optimism, taken again from market price action, is that the US announced a freeze on Chinese listings and capital raisings. Markets reacted with a shrug, and many Chinese equities rallied.

A couple of weeks ago such a move would have triggered a severe sell-off. So this marks a clear change in market reaction to bad news, one of the more reliable indicators of market turning points.

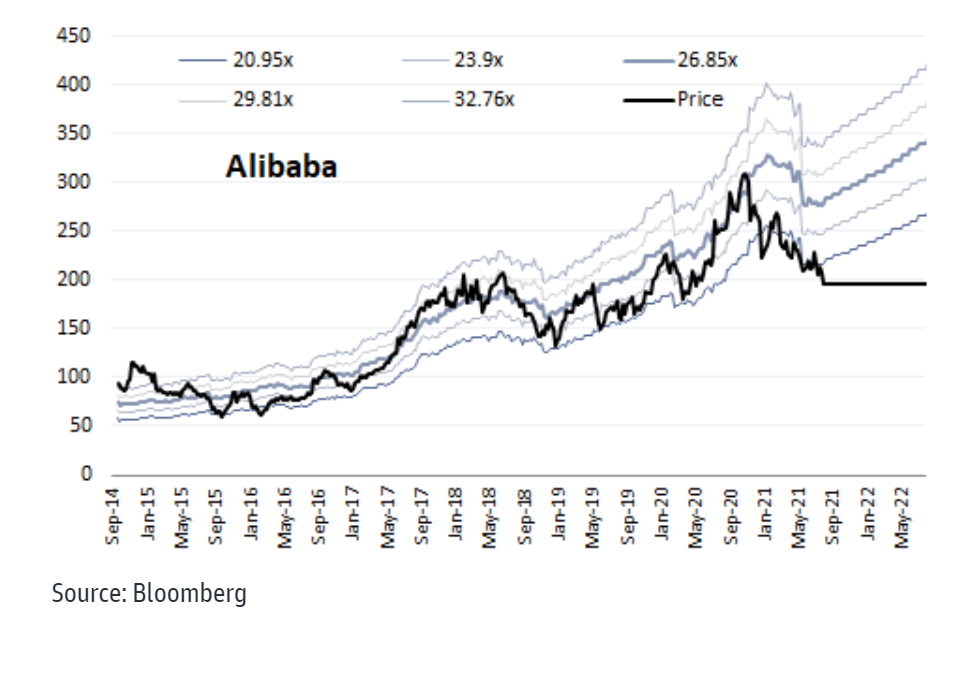

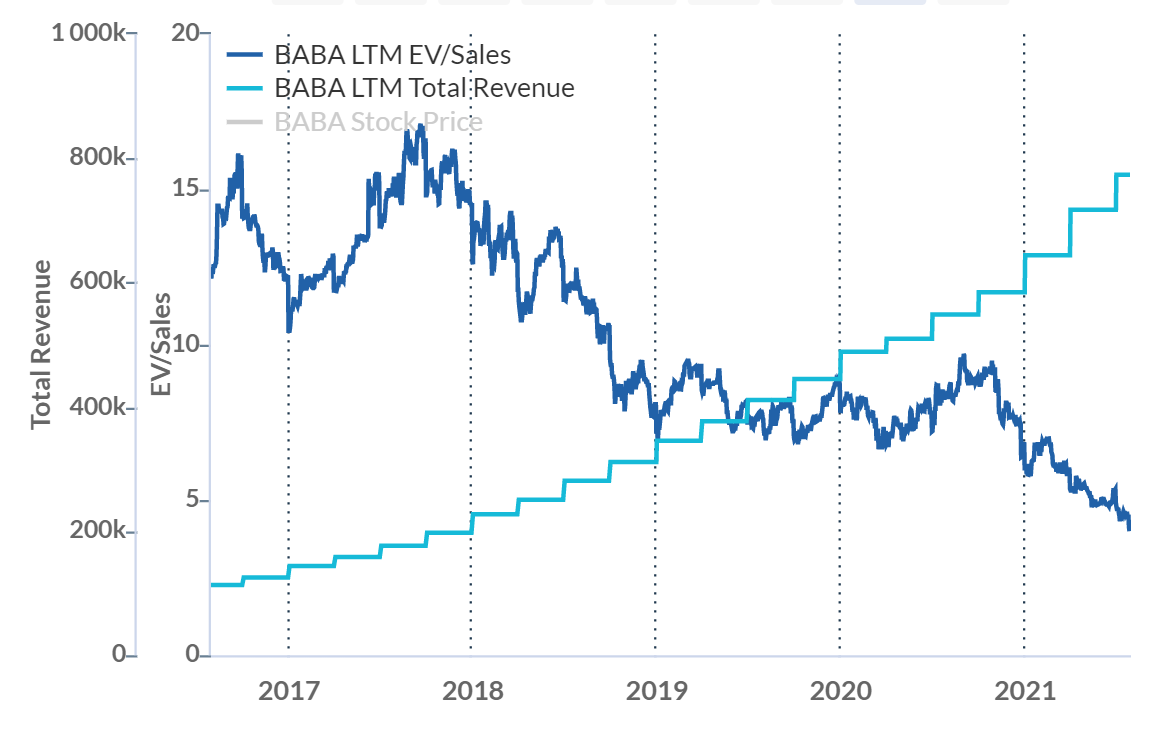

Fourthly, valuations have come right down to where they were the last time the Chinese cracked down. It’s worth noting Alibaba increased several fold from those lows in January 2016. The last five years flew, didn’t they?

This chart, put together by Goldman Sachs shows PE bands, ie what PE is indicated by certain prices. The idea is to buy at historic PE lows, and lighten up at the highs.

The multiple compression in Alibaba has been significant over a period of strong execution. At some point in our lifetimes, we suspect a similar fate for richly valued tech companies in other parts of the world:

Nevertheless, even after a dramatic sell-off returns to long term investors have been solid, even after the drawdown, which is another indication of the risk-mitigating power of a multi-year outlook:

Alibaba share price

Finally, and perhaps most importantly, on Wednesday before we added to our positions, editorials in leading state media gave strong signals of support for markets and companies that list in offshore jurisdictions.

The regulator summoned leading foreign investors to give soothing messages of support which were backed by state owned media.

As another example, as I was writing this editorial came out a few hours ago (edit: Sunday 1 August 2021) from Xinhua:

This about-turn by the regulators was the final signal we needed to increase our positions.

Political risk is not solely in the hands of the Chinese. US tech companies also come with their own set of political issues which wax and wane.

Think of the handful of social media tycoons, who abetted Trump’s rise in 2016, then more recently, silenced him, giving cause for those of all political stripes to ponder: how much power exactly should rest in the hands of our internet overlords?

The Chinese have given their answer, and also, coincidentally, a buying opportunity for foreign investors.

Learn more

Stay up to date with all our latest Livewire insights by clicking the follow button below, or fill out the contact form for more information on Frazis Capital.