A recession proof, property proof, ASX portfolio

The ASX presents us with a conundrum. A few conundrums in fact. There are three main groups of stocks: hammered but structurally challenged, seemingly cheap but cyclical headwinds, and the expensive defensives.

The structurally challenged are those where the share price has been hammered but the business model is under threat. Think Retail Food Group, iSentia and AMP, down 88%, 80%, and 53% respectively over the last 12 months.

Our seemingly cheap group contains the banks, consumer discretionary stocks and anything property related. They look cheap on the basis of historical earnings, but those historical earnings are likely to fall.

And the final group contain those whose businesses look fine but the stock prices expensive. And herein lies the conundrum. Which of these three groups are going to give us the best returns?

My advice, as we head into 2019, is to channel your inner Braveheart and hold tight on your defences. Don’t be suckered into the structurally challenged. If they are struggling in this economy, how are they going to fare in a recession? And don’t be fooled by low multiples on cyclical businesses. I learned this lesson the hard way: you make money on cyclical businesses by paying high multiples of low earnings, not the other way around. We will get opportunities, but the housing downturn has only just started and the wider economic effects are yet to be felt.

So, for now at least, we’re stuck with the expensive defensives. From the ASX top 50, I have picked 12 that I think can serve you well.

First, some notable omissions. It will be no surprise that my portfolio doesn’t contain any banks, property developers or consumer discretionary stocks. But there might be a few surprising omissions. I’ve consciously left Wesfarmers out of the portfolio. It has historically been a defensive stock, but today’s Wesfarmers is mostly Bunnings. It’s a great business, but probably suffers in a tough property market. I don’t want to own any of the property trusts. Those exposed to retail spending will be front and centre of a slowdown, while office property is probably a second derivative. They also trade at historically low yields - I just don’t want to be there.

And there are a few other stocks that have historically been defensive that I don’t want to get caught in. Transurban is a good example. I’m not convinced that toll road traffic is going to be as resilient as is commonly assumed. It’s an expensive exercise driving around Sydney or Melbourne these days, and if consumers are unemployed or feeling the pinch they might just think twice about it.

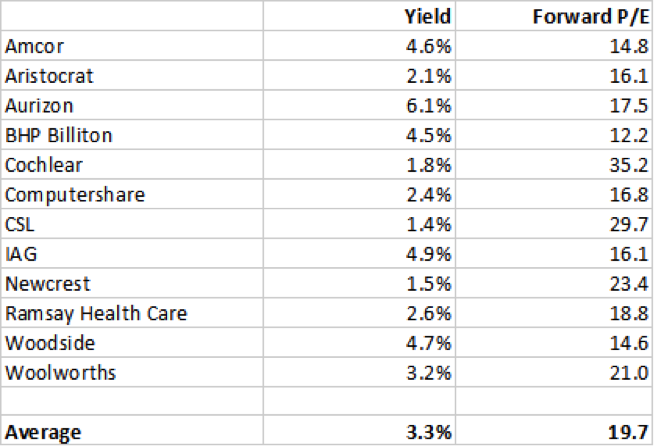

Cutting those I definitely don’t want to own leaves me with 33 stocks to choose from in the ASX 50. Here is my portfolio of 12:

Woolworths and Ramsay Health Care are predominantly domestic, but both should be defensive. BHP Billiton and Aurizon are exposed to the global economy and especially China. I’m not particularly comfortable with that, but both are reasonably priced and yielding north of 4%. BHP is also set to release a bonanza of franking credits over the next 6 months.

I want some Woodside. It’s reasonably priced as is, but I think there is a decent chance of a higher oil price over the next few years. And Newcrest is my inflation protection. The gold price has hardly budged in the past decade, but there are growing signs of global inflation and it’s worth a bit of protection insurance.

CSL and Cochlear are world-class health stocks that just happen to be listed on the ASX. Neither are cheap enough for my liking, but recent pullbacks have made them slightly more palatable. They give some nice diversification to the portfolio and are wonderful businesses.

Both Amcor and Aristocrat generate most of their sales overseas, so would benefit from a weak Australian dollar. They are both cyclical businesses, but the cycle should be largely uncorrelated with Australian housing.

Finally, I’ve thrown IAG into the mix. Insurance has its own cycles, but they too should be uncorrelated. QBE is an option, with a healthy portion of foreign earnings, but I worry about its mortgage insurance business. So IAG, with its fully franked dividends and sensible price gets the nod.

This portfolio is nothing to get excited about. Weighted evenly, it trades at roughly 20 times 2019 earnings and yields a bit more than 3%. Throw in some franking credits and expected growth and I would expect it to generate 7-8% over a long period of time.

It should do it, though, in a way that lets you sleep at night.

For 2019, I’m tipping that will be no mean feat.

Want to learn more?

If you are interested in receiving the Forager monthly and quarterly reports, please register here.

--

Note: Forager doesn’t own any of the stocks mentioned. Our portfolio is mostly small caps and we look for higher returns that those currently on offer in the ASX 50. Our current positioning has a similar tilt, though. We’re holding lots of cash and avoiding businesses exposed to the domestic economy.

7 stocks mentioned

.jpg)

.jpg)