A REIT royal property opportunity

The majority of Australian listed companies report their financial results in February and August. It is common during these ‘reporting seasons’ for trends to emerge as the results are released, particularly in the Australian property sector.

Some of these trends are foreseeable, such as the ongoing demand for Australian property assets, particularly industrial properties. Another foreseeable trend was the optimistic outlook for the 2022 calendar year, with expectations of normalised cash flows post-pandemic.

One trend that took some market participants by surprise was an increased focus on expanding active businesses, in particular funds management businesses. In this article, we look at why many companies are closely examining this opportunity.

The mathematics that makes it work

Whilst lower capitalisation rates have the benefit of increasing the value of property, by mathematical necessity they also mean lower forward-looking returns. Let us look at an example that is indicative of some transactions taking place.

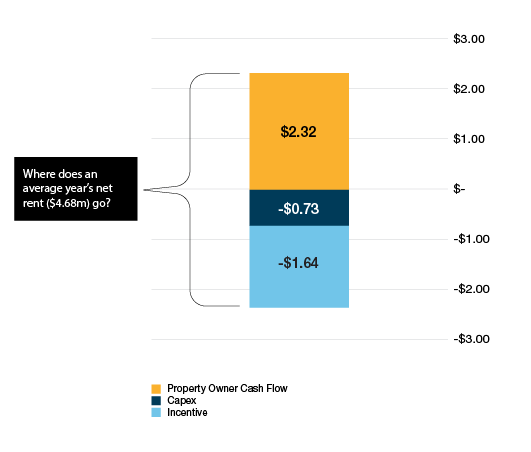

In this case, let’s think of a $100 million Sydney CBD office asset with a capitalisation rate of 4.5%, leased to a government tenant for 5 years, with 2% annual rental increments. The starting rent is $4.5 million per annum, and the ending rent is $4.87 million per annum, averaging out to $4.68 million per annum. Of this income, how much do we really capture?

Sadly for owners, tenants are often provided with an incentive to sign a lease. Right now, in Sydney, a not-unrealistic 35% incentive means that just over a third of the rental income is given back to the tenant over the life of the lease. This works for the landlord if, at the end of the lease, the landlord can retain the tenant without further incentives. However, such an outcome is unlikely. In any case, for our example, this takes $1.64 million per annum out of our income.

A further real cost to the owner is the requirement to maintain the building and services to meet the requirements of the lease. While there are different accounting treatments of these items, it really is ‘cash out the door’ and is reflected in our example by $730,000 per annum. In reality, it is likely to be lumpier than this, but the figure is realistic for prime office assets. Below is a chart outlining the average yearly cash flows of the example property across the five-year lease.

Based on these assumptions, our 4.5% capitalisation rate office asset only provides a cash flow yield of 2.32% per annum to the property owner over the life of the lease. While this is significantly better than the 0.78% yield on 5-year Australian government bonds, (at quarter-end), it is by no means a very high return and relies on further capital growth to provide a reasonable total return.

In order to enhance returns, many A-REIT management teams are trying to create new earnings streams from the same property. One way to achieve this is by earning a fee stream from the property.

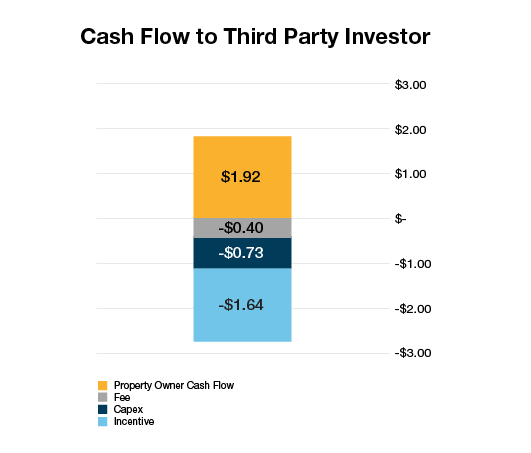

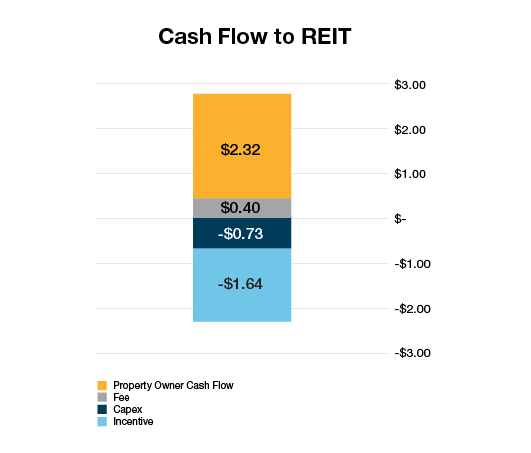

Building on the example above, let’s assume there is a $200 million property with the exact same characteristics as above. In this example, the real estate investment trust (REIT) sells 50% of the property ($100 million) to a third party and keeps 50% for itself, such that it still owns $100 million worth of property, but manages $200 million.

In this example, the REIT earns a funds management fee of 0.4% per annum on the 50% share it manages on behalf of the third party (For the sake of simplicity, we have assumed there are no incremental costs associated with this management fee stream). The charts below show the new cash flow profile.

In this example, the third-party investor gets access to $100 million worth of investment property and likely gets a say in how the property is managed. It also receives a yield significantly greater than that provided by Australian Government bonds. The REIT still collects its 2.32% property yield on its co-investment stake, but now also receives 0.4% per annum management fees. This may not sound like much, but it enhances property returns by more than 17%, a very strong boost in anyone’s language.

Funds

management is becoming increasingly popular

Recognising the benefits of creating a funds management business, many REITs within the Australian property universe have operated funds businesses for some time. For companies such as Charter Hall Group (ASX:CHC) and Goodman Group (ASX:GMG), funds management is the core of their operations, with direct property ownership supporting the capital light business. For businesses in this category, little changed through reporting season, other than ongoing demand supporting assets under management growth into the near future.

Others in the sector have had small funds management businesses for some time. Commonly, these have provided a small boost to earnings, in some cases effectively paying for some, or all of the corporate costs of the broader business. Examples of REITs in this category include GPT Group (ASX:GPT) and Dexus (ASX:DXS). Many in this category made strong statements regarding the expansion of their fund management businesses. Dexus, in particular, focused much of their earnings call on the potential of a larger funds business. In September, Dexus completed its acquisition of APN Property Group, expanding into externally managed REITs and retail funds management, adding to their existing institutional business. They also discussed the possibility of externally managed assets becoming three times larger than those managed on balance sheet, supported by a $14.6 billion development pipeline.

GPT Group has long managed a shopping centre fund and an office fund, but now has established the GPT Quadreal Logistics Trust, managing industrial assets, for itself alongside its Canadian partner. Vicinity Centre’s (ASX:VCX) asset management business has been shrinking in recent periods, however in a revised strategy, it was highlighted as a key growth pillar alongside other adjacencies such as mixed-use development. Mirvac Group (ASX:MGR) has used capital partnerships with wholesale funds for many years, predominantly aimed at enhancing the velocity of capital for its development activities. At the full year results announcement, Mirvac Group stressed the importance of its funds management activities to drive future growth.

Finally, there are those REITs who generate all, or almost all, of their earnings from owning properties on their own balance sheet. Aventus Group (ASX:AVN) owns large format retail property and currently manages one small property syndicate. In its results presentation, Aventus Group discussed growing their funds management platform to ‘diversify our income and expand our capital sources.’

Growthpoint Properties Australia (ASX:GOZ) manages its entire office and industrial portfolio for its own balance sheet, but it too is looking to create a funds business. As it stated in its results presentation ‘we are exploring opportunities to diversify our income stream by entering into funds management.’ Following on from this comment Growthpoint Properties Australia said, ‘by leveraging our expertise, we believe we can generate higher returns on capital employed for shareholders.’ So, committed to creating this business, Growthpoint Properties Australia have publicly stated they would buy existing funds management businesses and have been known underbidders on a recent platform transaction.

Stockland’s (ASX:SGP) new Chief Executive Officer, Tarun Gupta, is used to the concept of managing external capital given his past experience as Chief Financial Officer of Lendlease Group (LLC). Stockland will complete a full strategic review by the end of the year, however funds management has already been flagged as a likely feature of that review.

Execution is the key

So why hasn’t everyone been doing this for years? Some have. Charter Hall Group and Goodman Group have funds management in their DNA and have delivered very strong performance figures for their investors over many years. The values of these funds management platforms are reflected in their share prices.

The key hurdles that need to be overcome are the extra staffing, compliance, marketing and relationship management functions that come with such a business, and the need to establish a solid track record in fund performance. While there is an argument that the skills required to own and manage your own assets can be transferred to a funds management business, we still believe it takes time to transition to managing money on behalf of others, so the rewards of successful execution are never going to be immediate.

The ability of REITs to adjust to different market conditions, as highlighted by increased focus on returns through funds management, is a key advantage of investing in listed property. Some will do this successfully, whilst others may struggle. A focus on governance in particular, along with other ESG considerations, is crucial.

Never miss an insight

Click here to find more information about Cromwell Phoenix Property Securities Fund or fill in the contact form below.

Did you enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with the latest content from me by hitting the ‘follow’ button below.

4 topics

11 stocks mentioned

1 fund mentioned