An undervalued Aussie small cap

In our piece titled ‘Is this the Next Credit Corp?’ in May 2017, we made the case for why we considered PNC to be the standout amongst emerging companies on our radar. At the time the share price was trading at $2.13, but it has since increased by around 50%. Investors may be wondering if the current price still provides an attractive entry point or whether it now represents fair value?

Clearly the share price appreciation indicates that the wider investment community is beginning to understand PNC’s investment merits including sector dynamics, business model, management team and growth potential. But in our view, the current share price still significantly under-values the existing business and the growth opportunities that the management team have outlined.

In the current market where GASP (Growth At a Stupid Price) is running rife, PNC is a rarity in that it offers strong growth but at a price below the valuations of even some value stocks.

Based on management guidance and consensus analyst forecasts, PNC is expected to grow earnings per share (EPS) by 14.7% in the current financial year, 21.2% in 2020 and 20.6% in 2021. Across the 3 years, this averages out at 18.8% per annum. Genuine double-digit earnings growth is a rarity, but growth bordering on 20% per annum places PNC in the top sphere of stocks.

Yet surprisingly, PNC is trading on a historical PER of 11.7x, or an even more modest 10.4x if we move to the current financial year. This produces an average price to earnings growth (PEG) ratio of ~0.5x over the coming 3 years, which makes me GASP when I look at some of the momentum stocks trading on PEGs of 2-4 times and higher.

But perhaps the most surprising aspect of PNC’s valuation, is that we now have sufficient baseline data as a listed entity to a) understand and b) have confidence that management will be able to meet earnings targets. When PNC first listed in May 2014, there was a limited public record of performance. Investors could be forgiven for taking a cautious or even sceptical approach. But including the prospectus, we now have 5 full years of data on which to base our analysis.

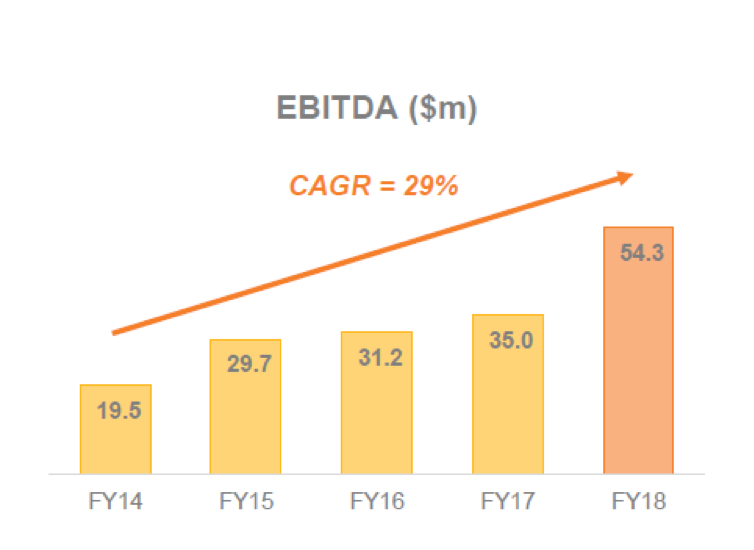

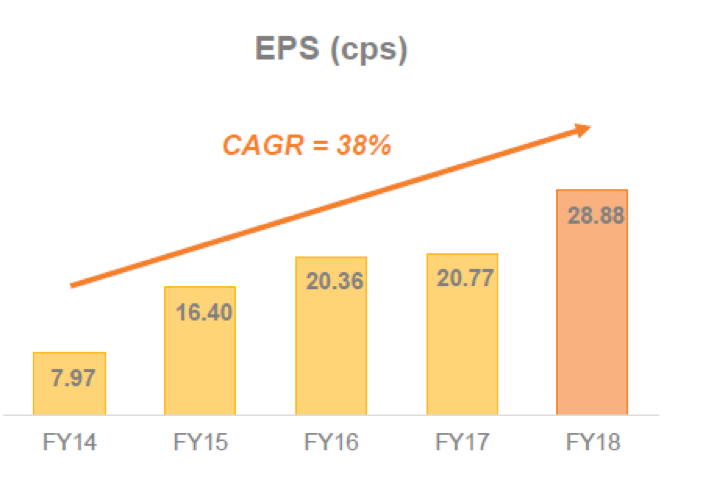

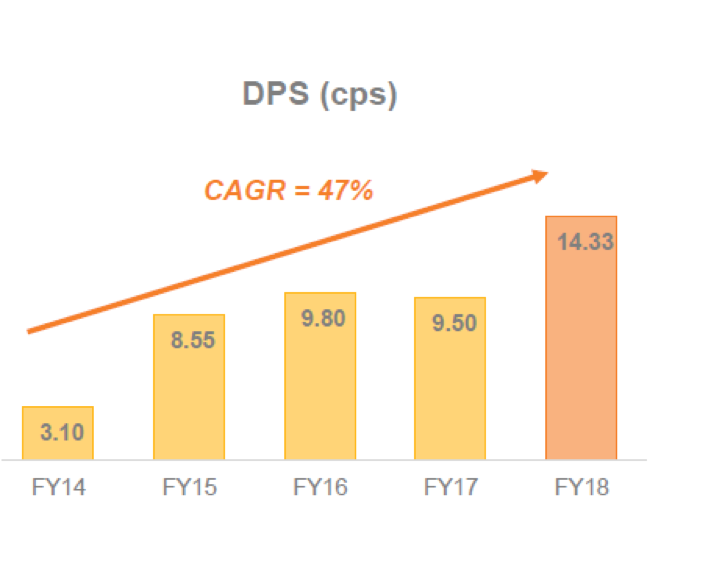

And 3 charts from the company’s latest results presentation should convince investors that this is a management team with a track record worth backing:

In short, PNC has been able to grow EPS at an average of 38% per annum since listing, resulting in dividends growing at 47% per annum. And net cashflow from operating activities has been similarly strong, increasing 82% to a record $48.5m.

So in summary, we have a company with a strong track record, a strong definable growth profile and trading on multiples well below the current market let alone an array of high growth peers. PNC remains firmly in our portfolio and I wouldn’t expect to see it leave our Top 10 Holdings for years to come.

1 topic

1 stock mentioned

.jpg)

.jpg)