An update on interest rate markets

After the most recent FOMC meeting, we have seen numerous changes to forward probabilities within the fixed income market.

This article aims to provide investors with an update on what changes have happened in the fixed income market, and how fixed income markets are viewing the next 9 months of this interest rate cycle.

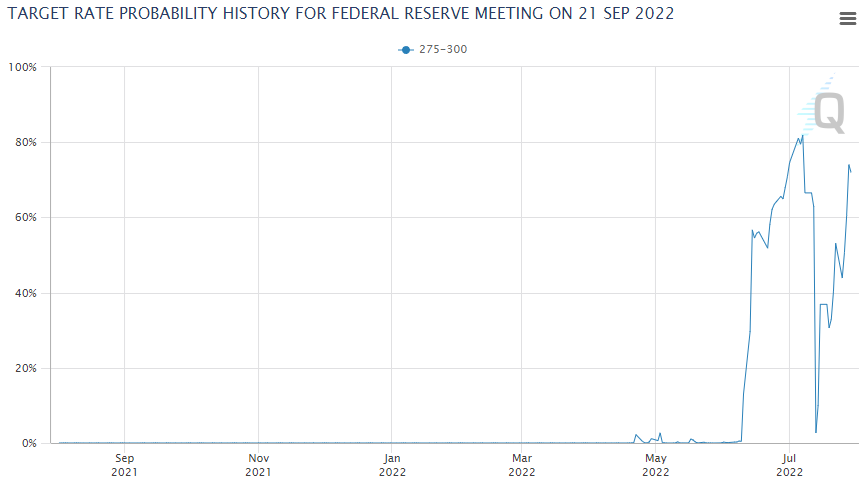

At the September meeting, expectations for a 50bps increase is unchanged

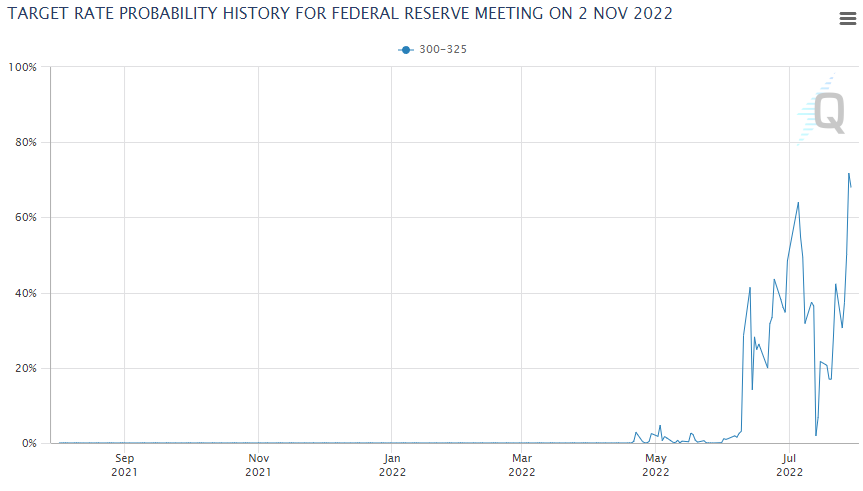

For the November meeting, another 25bps increase has 68% odds of happening, this would bring the target range to 3.00% - 3.25% - no real change here

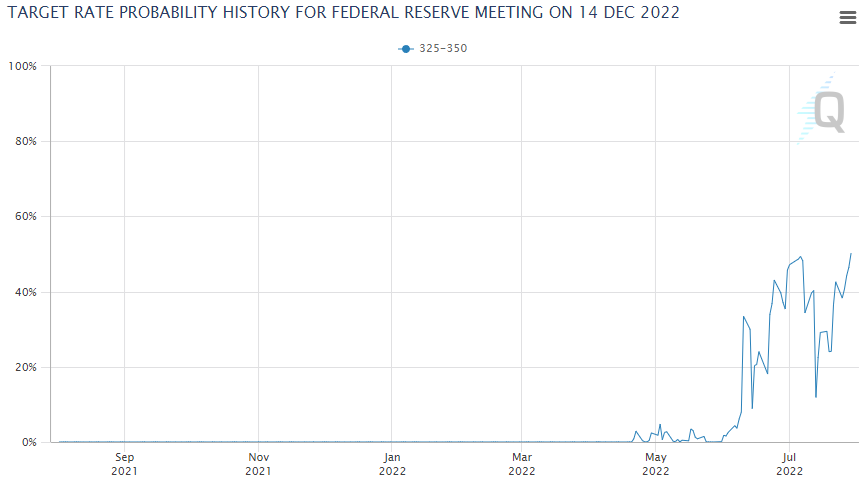

For the December meeting, another 25bps increase has 50.15% odds of happening, this would bring the target range to 3.25% - 3.50% - an increase here

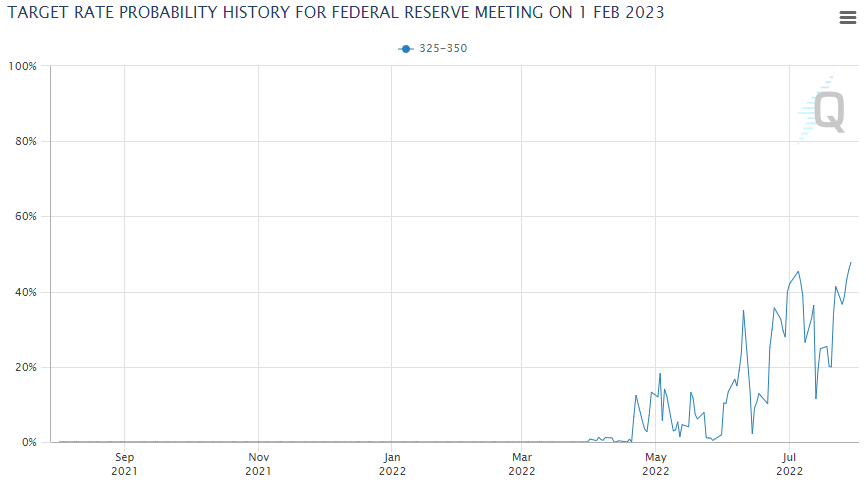

When we look at the February meeting, the odds of a hold are currently at 47.8%

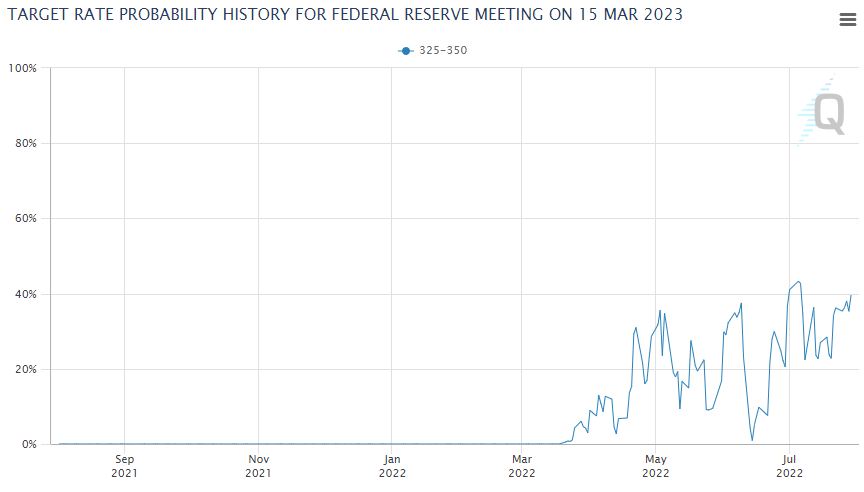

When we look to March 2023, meeting expectations are for a hold to rates once again

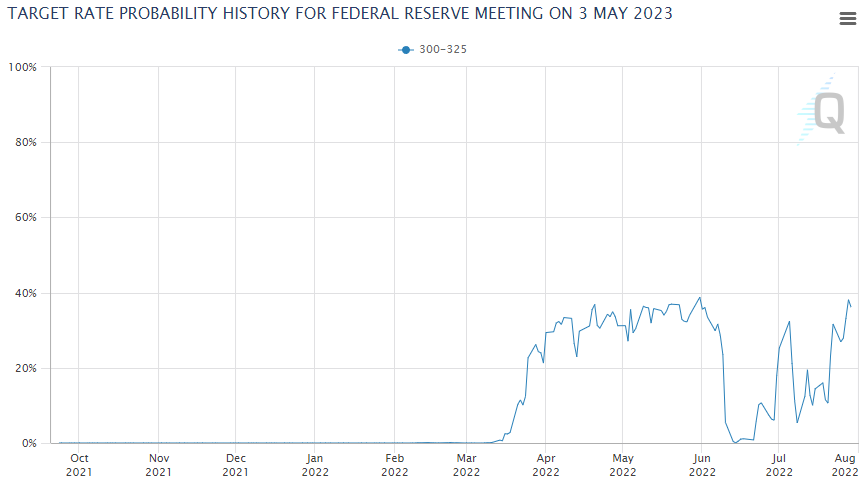

But then when we look to May, it shows that the market thinks there is a 36% chance of a cut of 0.25%

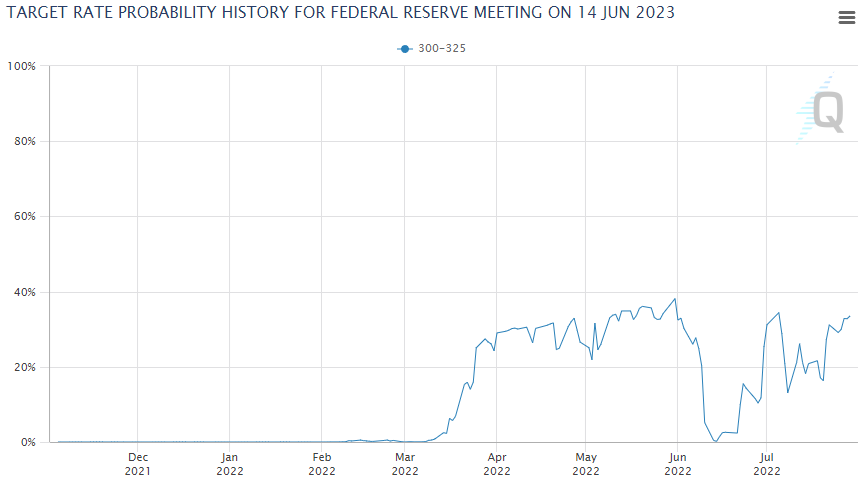

Looking forward to June 2023, markets are pricing that there will be a hold on rates once again

Ultimately the interest rate market is saying that the US Federal Reserve is going to continue to increase rates over the next three meetings. After this, and into next year, the market is currently pricing that rates will either be held or will cut.

What does this mean for portfolio positioning?

We view these changes to the forward pricing of interest rates markets as a direct indication that investors are anticipating that US growth is going to slow later this year and into early next year, and that in response to this slowing growth, the US Federal Reserve is going to reduce interest rates.

This is the same game plan that the US Federal Reserve has used since the GFC. The problem with this game plan is that if inflation continues to stay at elevated levels over the next 6 months, and does not revert to its targeted 2% level, this market pricing is off.

Summary

By looking at this information, we are able to understand why equity markets rallied last month. Participants seem to be viewing where we are currently, as getting close to the top of this interest rate cycle. Because equity markets are forward-looking, participants have looked into the future and see the end of this cycle, and that the Fed is starting to move in the other direction.

* Information as at 02.08.2022

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

5 topics