Are rates barking or biting?

In calendar 2020, the US Treasury issued US$4.4 trillion of new debt to both undertake and fund its “rescue and recovery” plan for the US economy.

Of the bonds that were issued, only 5.2% (US$200 billion) is reported to have been bought by traditional non-US (foreign) buyers. Meanwhile, the US Federal Reserve bought US$2.4 trillion (54%) or an average of US$197 billion per month as it reignited a new and sustained QE program.

For calendar 2021, the Fed has indicated an intention to buy bonds at a rate of US$80 billion per month. But the market is suggesting this rate of buying is too low. This is particularly so given the passing through the US Congress/Senate of the US$1.9 trillion Biden “rescue” program and perhaps up to another US$3 trillion of “recovery” or infrastructure building fiscal stimulation that is being proposed for later in the year.

Put together with the Trump Administration rescue program, this probably amounts to the world’s largest-ever sustained fiscal stimulus. Consequently, it will now require the support of the largest QE of all time – and this is what is weighing on the long-dated US bond markets. Should the Fed not introduce a program of higher and more sustained QE along the yield curve (even past 10-year duration), then long bond yields will probably rise further.

While inflation is flagged as a risk for bond yields, it isn’t currently the primary issue, with an excess supply of both labour and energy dampening inflation. Rather, it is primarily the excessive supply of bonds to fund extraordinary fiscal expenditure that is driving long-dated yields higher.

The supply of bonds will remain excessive whenever QE is not used to match it out.

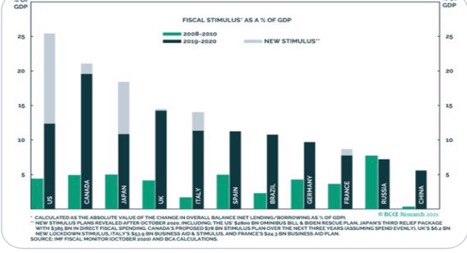

The immense size of fiscal stimulation is illustrated below, dwarfing the closest comparison of the GFC period during 2008-2009.

The massive fiscal stimulation in the US has led to upgrades in the forecasts of growth in 2021. Recently some major US economists have forecast that gross (or pre-inflation) GDP growth will be 7% in the US. This forecast begs the question: How significant will inflation be in this gross GDP outcome? Our view is not much – maybe 1.5% - but we also doubt that 7% growth can be achieved. The complete COVID vaccine rollout will take at least 4-6 months to occur and the infrastructure investment is really a 2022 story and beyond. The US will surely recover but not as quick as many suggest.

The rolling US fiscal program seems based on Modern Monetary Theory. As I’ve discussed previously, MMT argues that governments create new money by using fiscal policy and that the primary risk once the economy reaches full employment is inflation, which can be addressed by gathering taxes to reduce the spending capacity of the private sector. The Biden Administration firmly believes that with unemployment still very high, there are few bounds to fiscal stimulation and that (importantly) the Fed will maintain QE at a sustained rate.

This point is seemingly and totally lost in the political debate across the world.

Indeed, consider Australia and observe the current monetary and fiscal policy settings in Australia. Then try and find the views of politicians regarding QE and fiscal policy (there are none) to clearly show the disconnection between the policymakers (Treasury and the RBA) and the politicians.

To this point, consider the recent Royal Commission declaration that Australia’s aged care system is broken. The response from the Government in a period of massive fiscal stimulation, growing debt and its funding through QE was staggering. The Government (through Prime Minister Morrison) suggested that we must increase expenditure in aged care, and it may be best to fund it with an income tax surcharge.

That begs the obvious but uncomfortable question: Why not just increase Commonwealth borrowings and fund aged care investment inside an infrastructure investment policy (fiscal) funded by a QE program (monetary)?

The average Australian may soon question why QE that funds “Job Seeker” or “Job Keeper” is fine, but substantial investment in either aged care, healthcare, education or public infrastructure is not and requires a tax surcharge?

What is justifiable fiscal policy funded by QE and what is not justifiable?

This is a confronting issue because Australia (like the rest of the world) has embarked on a QE program without any real plan. So, how can we measure the success of QE?

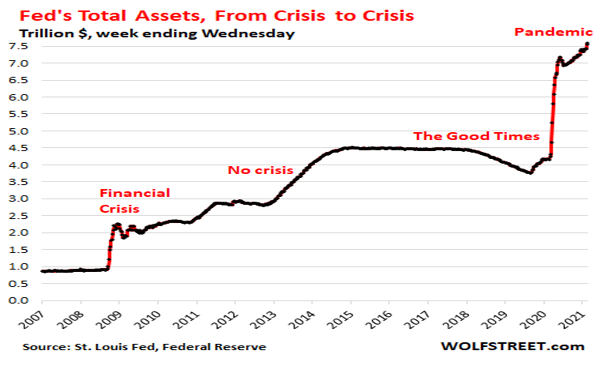

Looking again at the US, we observe the explosion of the Fed balance sheet as it lifted from about US$3.5 trillion in assets (pre-COVID) to more than US$7.5 trillion last week. Based on my earlier projections, it may well reach US$10 trillion by year’s end (or about 40% of US GDP). At that point, the Fed would own about 35% of all US bonds on issue.

Based on observing the rolling QE programs of Japan, it now seems that the world’s central banks are adopting policies to acquire most of their government-issued debt. They will buy bonds using QE for as long as it takes to force foreign creditors out of their bond markets and thereby control the cost of government debt.

That is what has happened in Japan and seems to be the path now being followed in countries around the world, including Australia.

How else can anyone explain the occurrence, in several countries, of bond yields that are either negative or well below inflation?

How can anyone explain why a target of 0.1% for a 3-year bond makes sense when the RBA is targeting an inflation rate of more than 2%?

And then, how can anyone explain how short-term interest rates will rise to meet the level of inflation at some future point?

The effect of sustained QE is well observed. Bond yields are held down and the rates that would exist in a “free market” – where central bank interference does not occur – are absent. A free market would see bond yields affected or influenced by economic activity, inflation expectations and the credit quality of the issuing government as measured by its fiscal responsibility.

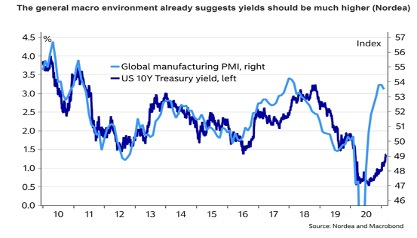

The graph below compares global manufacturing activity (Purchasing Managers Index or PMI) to US bonds and shows that bond yields are particularly low on this measure. Since the GFC it has been a good tracker, but during COVID the relationship has broken down with the massive US QE program artificially suppressing yields.

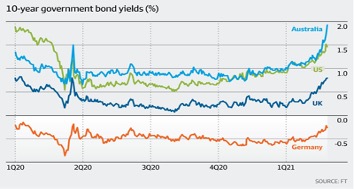

In any case, while bond yields have risen lately across the world, long yields are merely rising back to where they were prior to the COVID crisis and that was a period also full of QE manipulation. The fact that long yields are rising (but still below inflation) is to be expected. But far from being alarming, it is logical. How much higher will the central banks allow long yields to rise? And are central banks merely allowing long rates to lift to allow large pension funds to gather some yield out and along a depressed yield curve?

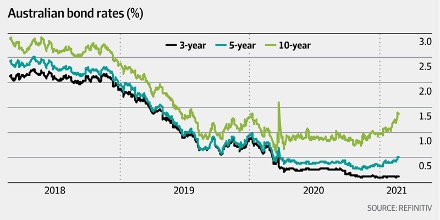

The above chart shows that Australian 10 -ear bonds have moved above their pre-COVID levels despite the RBA introducing QE. This is because the RBA program is focused on the short end. When originally introduced in March 2020, it targeted 3-year bonds at 0.25%, until November 2020 when it reduced the target for 3-year bonds to the same as the official cash rate, namely 0.10%.

It is likely that the RBA will at some point expand its QE program into the 10-year bond market. It is truly perverse that Australian 10-year bonds yield 2% more than German bonds – which are still trading with a negative yield!

The next chart takes a slightly longer look at Australian bond yields. In early 2018, 3-year bond yields were more than 2% and therefore substantially higher than today’s 10-year bond yield. The compression of the 3-year bond yields to slightly more than the 0.10% target by the RBA is a major reason why investible cash will continue to flow towards the Australian listed yield market.

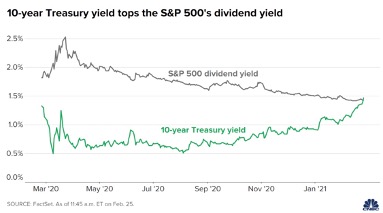

The next chart shows that US 10-year bond yields have now moved above the S&P 500 dividend yield. So is this a problem for markets? Our view is “No” because the dividends that will flow from the US economic (and world) recovery will grow, and will be far superior to the static and controlled yields of the bond market. We regard the chart as interesting but not persuasive.

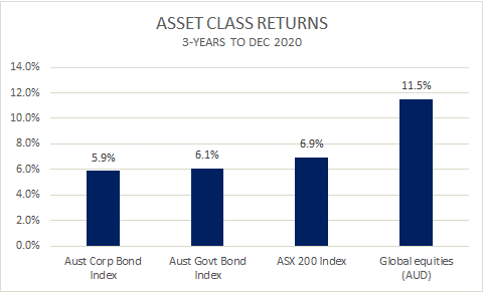

The sustained decline in bond yields driven by QE programs had an outsized effect on returns generated by all bond indices. The return for Australian asset classes is shown below, indicating that Australian bonds delivered an extraordinary return compared to Australian shares. The return on so-called low-risk assets (bonds) should not be the same as the return on risk assets (equities).

(Source: Wheelhouse)

Based on historical data the chart above, in our view, suggests a relatively strong outlook for Australian equities compared to both Australian bonds and international equities.

Excess performance over a short term (say three years) is often reversed over a longer period. Markets typically “overshoot” and certainly when the relative out-performance is created by QE across the world.

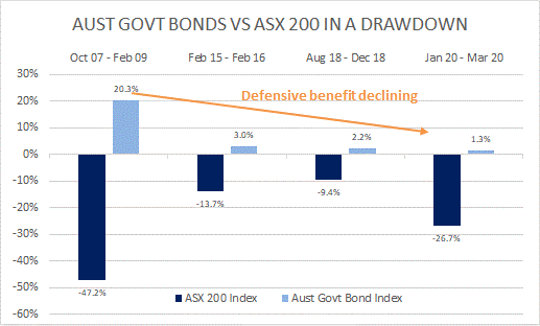

With Australia having now joined the crowd and embarked on QE, our view is that our market will benefit from this policy – just as international markets have. But a sobering observation is the forward-looking benefit of having a balanced portfolio that has an allocation to bonds. The following chart shows the “defensive” benefit of bonds as a risk-and-return offset to the volatility in equities has been, and is, declining.

(Source: Wheelhouse)

The lift in long-term bond yields is predictable. A consequence is that while the outlook for equities is positive, the ability to manage portfolio volatility has become harder. The “so-called” defensive characteristics of bonds have wilted away.

For self-directed pension funds, this suggests that an increased allocation to direct property, credit and yield assets should be considered because the bond asset class promises poor returns for the next few years as QE is used unrelentingly.

Stay up to date

I frequently provide insights and commentary on multi-asset investing and macroeconomic topics. If you enjoyed this article click 'like' and hit the 'follow' button below to read my upcoming articles on Livewire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics