As dividends across the world get cut, where to for income?

In the UK Barclays, RBS, Lloyds, HSBC, Standard Chartered all cut their 2020 dividends entirely. Companies in Europe, the USA and Australia are largely following suit, where last week the NAB reported a 64% cut to its 2020 interim dividend, while the ANZ and now Westpac have deferred all of theirs.

In Australia the major banks make up around a quarter of the ASX 200’s dividends alone.

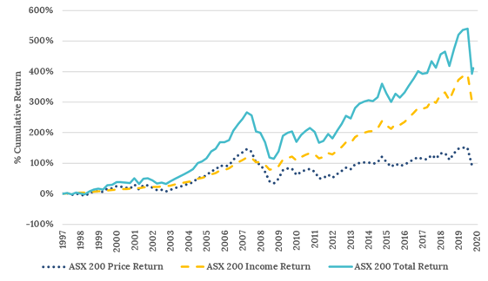

While valuations have come down and some previously overvalued stocks are now looking more attractive, this won't help those looking for yield in the short to medium term. In fact, looking back over the last 22 odd years the ASX 200 has seen very little capital growth; with the contribution to total shareholder return – surely the most important measure of company success - coming largely from reinvested dividends.

ASX 200 1997 - 2020

Source: Bloomberg

During this period investors have received a 7.4% p.a. total however the overwhelming contribution to this total return stemmed from income, not capital gain.

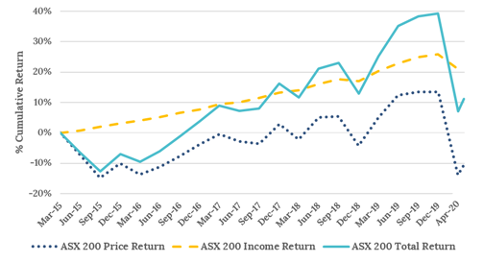

Even more striking is the chart below that shows that over the last 5 years the price return is negative, which is only just offset by income for a very modest overall gain - and this is before dividends are being cut!

ASX 200 2015 - 2020

Source: Bloomberg

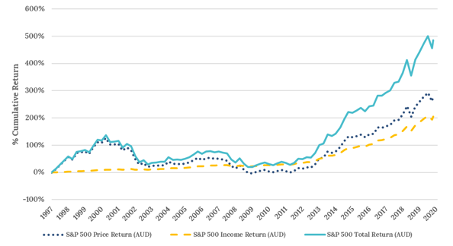

While the ASX has historically been a strong dividend payer, the same trends can be seen in other equity markets. With the S&P 500, while it has seen stronger capital improvement, the gap between price and total return over the same period is still notable.

S&P 500 1997-2020

Source: Bloomberg

The Dividend Swap Market, which suggests the scale of dividend cuts for this year but more importantly further into the future, shows that a further decline is being priced for 2021. In the US and Europe, dividend cuts of 35% to over 50% respectively are anticipated.

So, with reduced or even no income for the foreseeable outlook, investors will need to look elsewhere to generate it.

A solution lies not in the stocks themselves, but in the process of buying them. Selling put options to enter stock positions generates a premium for the potential buyer, regardless of whether the stock is ultimately bought or not. It creates:

a downside buffer to first loss,

more consistent income,

reduces portfolio volatility, and

diversifies the sources of return.

This means that in periods such as now, investors have somewhere else to go for income. Further, as option premium increases with volatility, an uncertain environment in most cases increases income from this source.

There are still some pundits forecasting a ‘v’ shaped recovery, but with earnings declines and possible depression style conditions, it will take time for dividends to return to more normal levels. More likely is this cut to dividends will continue at least into 2021 with a recovery to prior levels taking 3-4 years creating greater uncertainty for investors, and retirees in particular.

Fortunately, there is an alternative.

5 topics