ASX 200 dips on CSL trial miss, but tech, discretionary earnings bullish

Today in Review

Markets

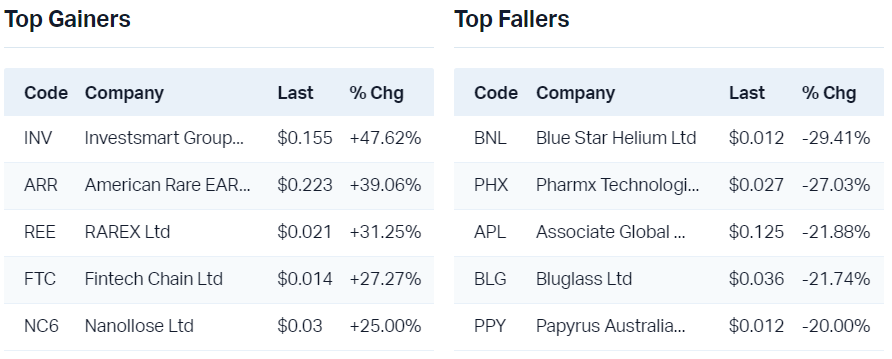

The S&P/ASX200 (XJO) finished 29.9 points lower at 7,614.9, 0.39% from its session high and just 0.07% from its low. In the broader-based S&P/ASX 300 (XKO), advancers lagged decliners by 116 to 161.

For the third session running, Information Technology (XIJ) (+1.0%) was the best performing sector, likely in response to another big jump in the tech-laden Nasdaq Composite index in the USA on Friday, but also due to a big jump in Audinate Group (AD8) (+20.6%) which released better than expected first half FY24 results today.

Health Care (XHJ) (-3.2%) was the worst performing of the major ASX sectors today, mainly due to a 4.8% fall in the sector's largest stock, CSL. CSL announced today its AEGIS-II trial which was aiming to evaluate the efficacy and safety of CSL112 for prevention of major adverse cardiovascular events did not meet the primary efficacy endpoint.

CSL's disappointing news ensured the Energy (XEJ) (-1.0%) sector didn't make it four in a row for worst performing sector today, but it was still pretty lousy! Uranium stocks were again generally softer, but it was Woodside Energy's (WDS) 2.1% fall which really hurt. I note WDS's technicals are at a bit of a crossroad as a result of this move, so check out my analysis in ChartWatch below.

ChartWatch

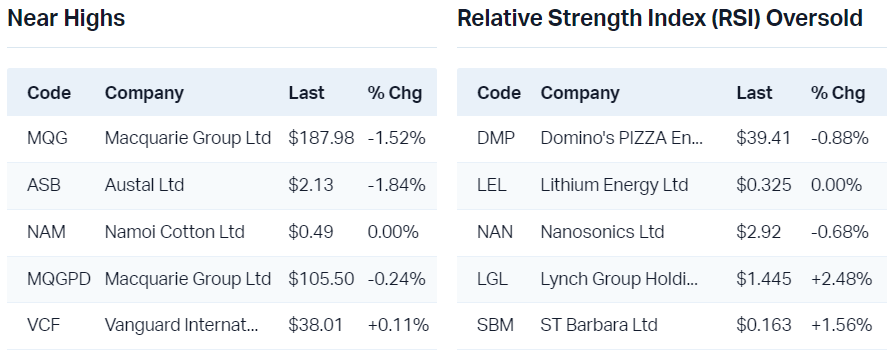

Audinate Group Ltd (ASX: AD8)

.png)

When in addition to the above the stock in question closes at a new all-time high, like Audinate did today, it tells you there's a wall of cash trying to get in – completely unphased by the current price. On the other side of the fence, supply is gripping their shares as tightly as possible.

JB Hi-Fi Ltd (ASX: JBH)

I really could just go "ditto" for JB Hi-fi, and I won't labour the point... But, this is another spectacular demonstration of excess demand. Trend followers love to bet on a strong trend perpetuating itself, and this certainly looks like a very strong trend after today's massive gap-and-run higher.

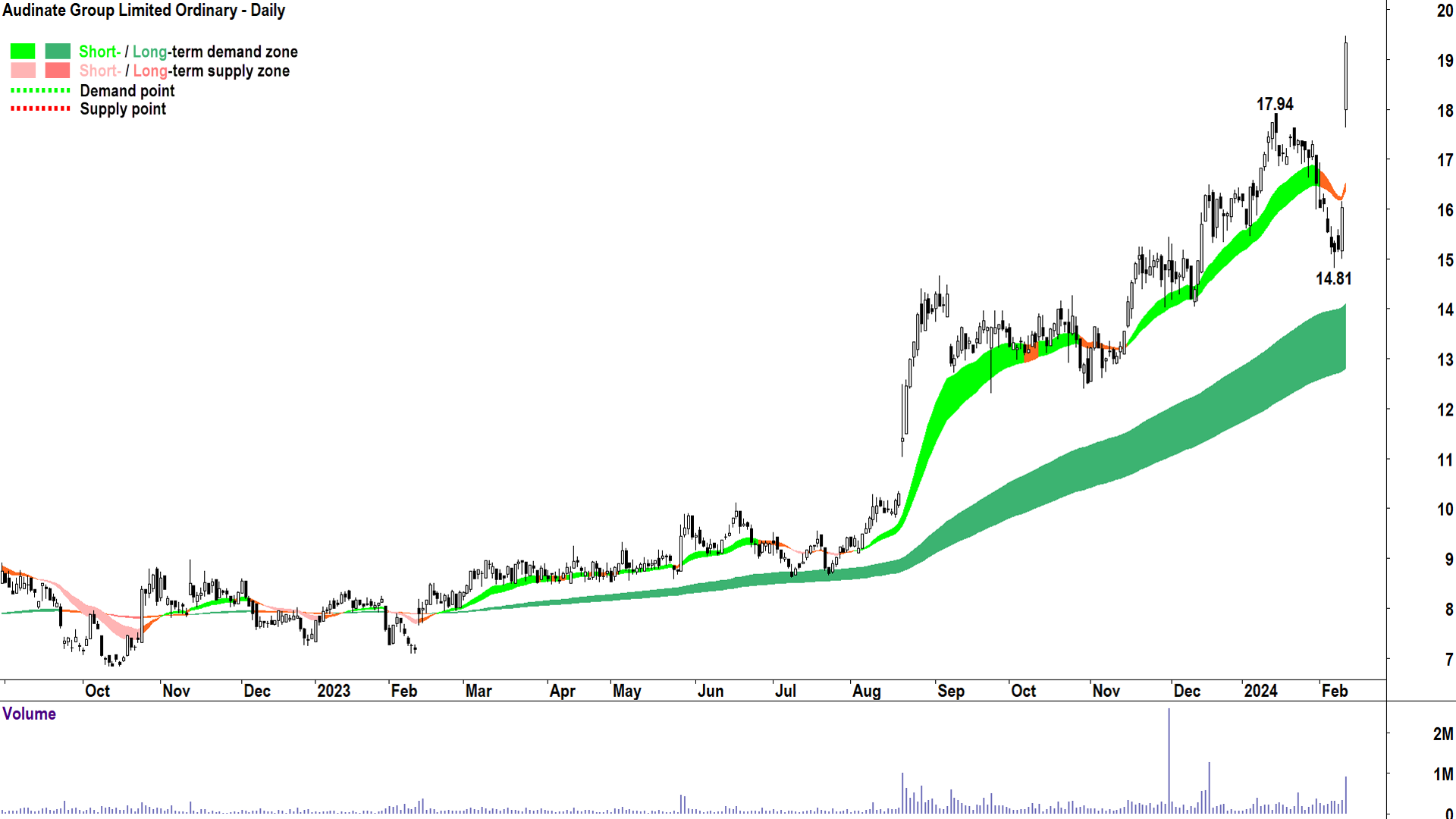

Woodside Energy Group Ltd (ASX: WDS)

What a great way to finish ChartWatch today, with such a contrast from our first two charts! If Audinate and JB Hi-fi are pictures of excess demand, of total confidence in the outlook for a company's earnings, then what does the above chart say about Woodside?

To be fair, it wasn't looking all that bad until the 7 February "shooting star" candle which coincided with news Woodside had walked away from the proposed merger with Santos. Since then, the aforementioned bearish candle, as well as the failure to close above the long term downtrend ribbon, plus subsequent supply-side candles, are all signals the supply-side has grappled control of the Woodside price.

I suggest the supply-side remains in control until Woodside can dispense with the dynamic supply laden long term downtrend ribbon (i.e. a close above at least $33.08). On the other hand, a close below $30.29 could pave the way for a test of lower static support at $31.04.

Economy

Today

No major economic data releases today!

Later this week

Tuesday

10:30 AU Westpac Consumer Sentiment: -1.3% previous

11:30 AU NAB Business Confidence: -1.0 previous

Wednesday

00:30 USA Core Consumer Price Index (CPI): forecast +0.3% in Jan to 3.7% p.a. vs +0.3% in Dec to 3.9% p.a.

Thursday

11:30 AU Employment change and unemployment rate: forecast +20,700 in Jan vs -65,100 in Dec & forecast 4.0% in Jan vs 3.9% in Dec

Friday

00:30 US Core Retail Sales: +0.1% in Jan vs +0.4% in Dec

Saturday

00:30 USA Core Producer Price Index (CPI): forecast +0.1% in Jan to 1.4% p.a. vs +0.0% in Dec to 1.0% p.a.

04:10 USA Preliminary University of Michigan Consumer Sentiment: 79.9 in Feb vs 79. in Jan

Latest News

Latest data on China lithium: Demand increasing, supply falling

The 10 most oversold ASX 200 stocks – Week 7

Which is Goldman's pick of the health insurers: nib Holdings or Medibank?

Rudi: The biggest mistake investors could make in 2024

ASX 200 stocks hitting fresh 52-week highs and lows – Week 7

CSL tumbles as key heart attack drug fails trial, why the market is so disappointed

Don't miss an ASX announcement this reporting season, check out our comprehensive H1 FY24 Earnings Season Calendar and set up and receive announcements direct to your inbox on Market Index: Create Alert Now

Interesting Movers

Trading higher

+20.6% Audinate Group (AD8) - Audinate delivers record revenue & EBITDA in 1H24, rise is consistent with prevailing long term uptrend

+15.6% Brainchip Holdings (BRN) - No news, but has logged three large white candles on significant volume over last five trading sessions, possibly short covering, possibly strategic bottom fishing!

+7.1% JB HI-FI (JBH) - Company Announcement - 2024 Half Year Results, rise is consistent with prevailing long term uptrend, bounced off long term uptrend ribbon

+5.9% BSP Financial Group (BFL) - No news, rise is consistent with prevailing short and long term uptrends

+5.4% Alpha HPA (A4N) - No news 🤔

+5.0% Bravura Solutions (BVS) - No news, rise is consistent with prevailing short and long term uptrends

+4.9% Infomedia (IFM) - No news 🤔

+4.8% Lovisa Holdings (LOV) - No news, stronger consumer discretionary sector today, possible positioning ahead of first half results due 22 Feb, rise is consistent with prevailing short and long term uptrends

+4.7% Calix (CXL) - Calix Investor Presentation February 2024

+4.7% Accent Group (AX1) - No news, stronger consumer discretionary sector today, possible positioning ahead of first half results due 22 Feb, rise is consistent with prevailing short and long term uptrends

+4.6% Beacon Lighting Group (BLX) - No news, stronger consumer discretionary sector today, possible positioning ahead of first half results due 22 Feb, rise is consistent with prevailing short and long term uptrends

+4.3% Pro Medicus (PME) - No news, initiated outperform at Macquarie with a price target of $120.00, rise is consistent with prevailing short and long term uptrends

Trading lower

-8.1% Liontown Resources (LTR) - No news, gave up most of Friday's Gina Rinehart-fuelled takevoer gains, fall is consistent with prevailing short and long term downtrends

-6.1% Fletcher Building (FBU) - Earnings guidance warning / trading halt in advance of

-5.2% Vulcan Energy Resources (VUL) - No news, fall is consistent with prevailing short and long term downtrends

-5.0% Alliance Aviation Services (AQZ) - Continued negative reaction to 7 Jan: HY24 Results Release. Fall is consistent with prevailing short and long term downtrends

-4.8% CSL (CSL) - Top-line Results from the Phase 3 AEGIS-II Trial

-4.8% Chalice Mining (CHN) - No news, fall is consistent with prevailing short and long term downtrends

-4.1% Imdex (IMD) - No news, fall is consistent with prevailing short and long term downtrends

-4.0% Weebit Nano (WBT) - No news, fall is consistent with prevailing short and long term downtrends

Broker Notes

4DMEDICAL (4DX) retained at buy at Bell Potter; Price Target: $1.25 from $1.25

Alligator Energy (AGE) retained at buy at Bell Potter; Price Target: $0.10

Bendigo and Adelaide Bank (BEN) retained at overweight at Morgan Stanley; Price Target: $10.40 from $9.80

-

Boral (BLD)

Upgraded to outperform from underperform at CLSA; Price Target: $6.40 from $5.30

Downgraded to neutral from overweight at Jarden; Price Target: $5.80 from $5.35

Retained at sell at Citi; Price Target: $5.60 from $4.60

Retained at hold at Bell Potter; Price Target: $6.30 from $5.15

Retained at outperform at Macquarie; Price Target: $6.40 from $6.00

Retained at underperform at Morgan Stanley; Price Target: $4.30 from $3.90

Boss Energy (BOE) retained at hold at Bell Potter; Price Target: $6.41

COG Financial Services (COG) retained at buy at Bell Potter; Price Target: $1.83 from $1.81

-

CSL (CSL)

Retained at buy at Citi; Price Target: $325.00

Retained at overweight at Morgan Stanley; Price Target: $318.00

Dicker Data (DDR) retained at overweight at Morgan Stanley; Price Target: $13.00

Deep Yellow (DYL) retained at buy at Bell Potter; Price Target: $1.81

Ikegps Group (IKE) upgraded to buy from hold at Bell Potter; Price Target: $0.63

Macquarie Group (MQG) retained at neutral at Citi; Price Target: $161.00

Paladin Energy (PDN) retained at buy at Bell Potter; Price Target: $1.60

Pro Medicus (PME) initiated outperform at Macquarie; Price Target: $120.00

Stockland (SGP) retained at buy at Citi; Price Target: $5.00 from $5.10

Service Stream (SSM) retained at buy at Citi; Price Target: $1.15

Syrah Resources (SYR) retained at buy at Shaw and Partners; Price Target: $1.30

Scans

This article first appeared on Market Index on 12 February 2024.

5 topics

10 stocks mentioned